Hispanolistic/E+ via Getty Images

It’s hardly a surprise that the housing market is cooling off quickly. A potential recession is looming, with companies laying off workers and enacting hiring freezes. Mortgage rates have approximately doubled versus the same time last year. At last, it seems like buyer demand is catching up to scarce inventory across the country.

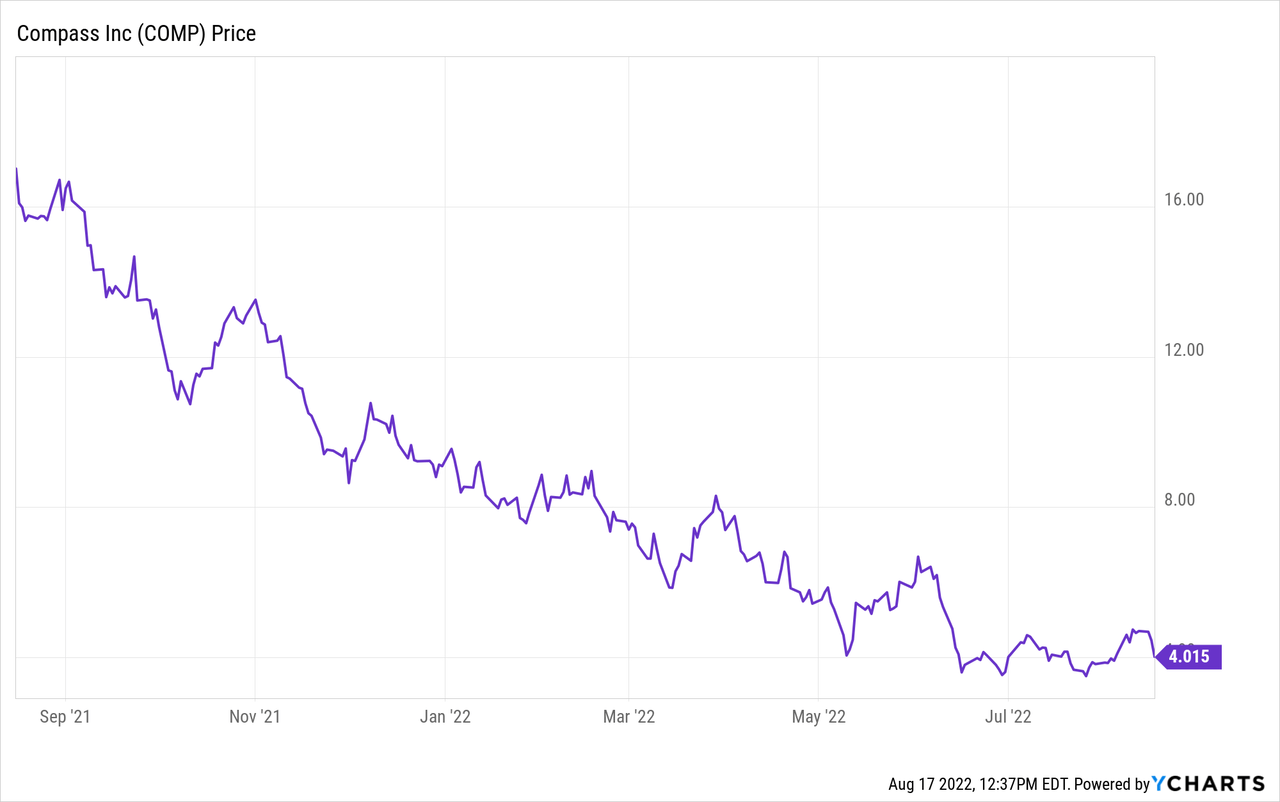

Caught in this crossfire is Compass (NYSE:COMP), the technology-enabled real estate broker that has quickly become one of the dominant high-end brokerage presences in coastal markets. Compass has lost nearly 60% of its value this year and is trading very close to all-time lows. Confidence in the stock was further shaken after it released disappointing Q2 results in mid-August.

The unfortunate news here: there are no near-term catalysts that can pull Compass out of its current doldrums. Expectations have been reset lower, but the housing market and Compass’ brokerage fees won’t restore overnight. That being said, I marvel at the speed of Compass’ decline and the cheapness of its stock. Longer-term, I still like how Compass is building market share and deploying technology to both attract buyers as well as lower operating costs. Over time, Compass will continue to gain significant advantages over traditional brokers.

I remain very bullish on Compass. You’ll need a strong stomach for this stock and will need to be able to withstand months of volatility. That being said, I think the opportunity to buy this stock at a <$1.5 billion enterprise value is incredibly attractive. It’s worth noting as well that Compass is trading at less than a quarter of where it went public in 2021 (at $18 per share).

For investors who are newer to this name, here is a rundown of the long-term bull case for Compass:

- Within a few years, Compass has become a dominant brokerage – Compass’ market share of U.S. real estate transactions is growing rapidly to ~5%. Already deeply embedded into major coastal markets, Compass is more recently pushing into new office opportunities in the Midwest. There’s still room for further expansion. Even after the new market activity this year, Compass is still penetrated into less than half of the U.S. population.

- Tertiary revenue opportunities – Recently, Compass has been opening the door to new monetization opportunities, including starting its own title company. This positioning helps Compass derive more wallet share from real estate transactions as a whole. Compass has commented that attach rates on these tertiary services are rising. Compass estimates its U.S. TAM is $240 billion, of which only $95 billion and the rest is coming from adjacent services.

- Strong branding – Compass built a brand around being a full-service, high-quality real estate brokerage, very similar in style and profile to competitors like Berkshire Hathaway Home Services or Sotheby’s. This gives the company a very strong distinguisher against other tech-first rivals like Redfin.

- Scalable platform – Compass’ primary costs lie in the R&D spend to deliver its technology platform for Compass agents, as well as the sales and marketing costs of advertising its brand to homebuyers/sellers and potential new agents. These costs are scalable: as Compass’ scale grows, and as agent productivity grows (the average Compass agent generates 19% more sales in the second year), Compass will be able to improve its profitability margins, which we have already seen in the company’s latest results.

From a valuation perspective: at current share prices near $4, Compass trades at a market cap of just $1.72 billion. After we net off the $430.5 million of cash and minor $30.4 million of debt on the company’s most recent balance sheet, its resulting enterprise value is $1.32 billion.

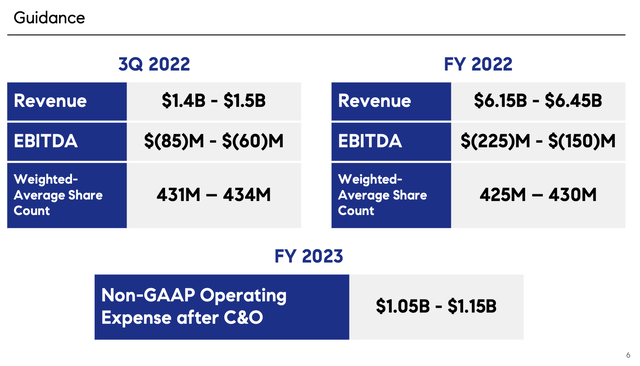

For the current fiscal year, Compass has slashed its guidance to account for the softening trends in the housing market. It’s now pointing to $6.15-$6.45 billion in revenue (representing a range of -4% decline to flat y/y) and -$225 to -$150 million in adjusted EBITDA. This compares to a prior (and much more bullish) outlook of $7.6-$8.0 billion in revenue (18-25% y/y growth), and “at least breakeven adjusted EBITDA”.

Compass outlook (Compass Q2 earnings deck)

Near-term multiples aren’t a great gauge for Compass. But do note that the company is still aiming for a long-term profitability target of 10% adjusted EBITDA margins and 8-9% FCF margins (it previously defined “long term” as a 2025 target, but it has removed specific timeframes now for that guidance). To me, as long as Compass continues to scale and pack more revenue on top of its existing technology platform, these targets can be reasonably hit. Even with this quarter’s revenue crunch, Compass still managed to eke out positive adjusted EBITDA.

The bottom line here: Compass requires a bit of bravery, but I am enthusiastic about buying one of the country’s largest and fastest-growing real estate brokerages at pennies on the dollar. Use this dip as a buying opportunity.

Q2 download

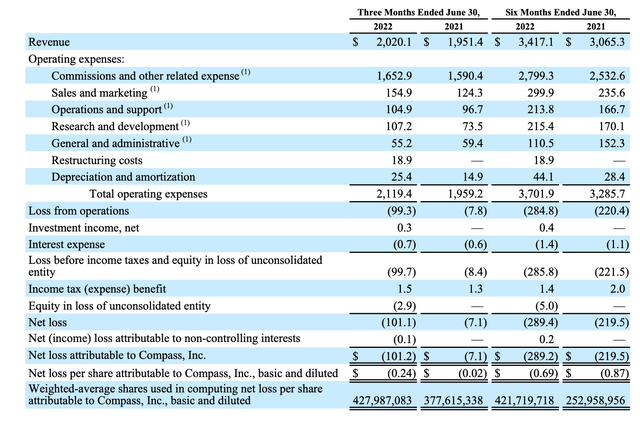

Let’s now cover Compass’ latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Compass Q2 results (Compass Q2 earnings deck)

Compass’ revenue in Q2 still grew at a 4% y/y pace to $2.02 billion. This did, however, decelerate substantially from 26% y/y growth in Q1.

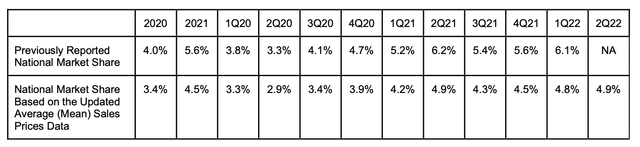

Market share gains also held. Note that the NAR (National Association of Realtors) changed its methodology for average home-sales prices, and hence Compass’ dollar-based market share calculations have changed. But we note that in Q2, the company’s market share based on this new calculation edged up slightly to 4.9% – an impressive figure for A) a very fragmented market and B) a company that is still very much a coastal force but not well-penetrated in key markets in the interior United States.

Compass market share trends (Compass Q2 earnings deck)

The net number of transactions that Compass agents executed in the quarter was up 2% y/y. Excluding California, Compass’ largest and original market, transactions grew at a much quicker 17% y/y pace.

Some additional context from CEO Robert Reffkin on what the company is seeing in the market, taken from his prepared remarks on the Q2 earnings call:

To provide context, this year, the Fed took repeated actions, which have had the direct effect of driving down our revenue. Since June, we’ve seen the fastest one-week increase in mortgage rates in the history of the United States as well as other economic headwinds growing stronger. This has created an enormous amount of uncertainty for the rest of the year, but we are all hoping for a soft landing. We are preparing for the real estate market this calendar year to be nearly 25% below where industry experts believed it would be just six months ago.

Never in my time at Compass have we seen such a big downturn in the market in such a short time.

We shared with you on our quarterly calls earlier this year, and we have already been taking steps to manage our cash and normalized expenses, so we could deliver positive free cash flow in 2023 and beyond. We are taking new additional actions to adjust to these market conditions […]

Going forward, I am focusing the company’s efforts around the following three objectives: one, generating free cash flow; two, profitably gaining market share; and three, retaining our agents and our principal agent retention continues to be above 90%, even growing quarter-over-quarter. We plan to maintain our number one industry position continue to offer the best productivity enhancing platform of tools and services to our agents. We expect to come out of this downturn an even stronger company with a more profitable and scalable business.”

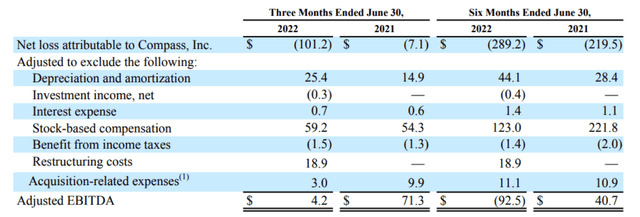

Responding to the slowdown in the housing market, Compass has taken actions to reduce 10% of its headcount, a move it announced in May. Though these initiatives are still in progress, Compass has managed to maintain positive adjusted EBITDA through Q2 (though this is expected to swing to a loss in Q3):

Compass adjusted EBITDA (Compass Q2 earnings deck)

The company’s latest cost-cutting plan aims to generate $320 million in annual run-rate savings (roughly 5% of annual revenue) while maintaining free cash flow breakeven in 2023.

Key takeaways

Yes, Compass is not in an ideal rosy situation. The company’s growth plans are being interrupted by a housing market chill – but luckily, the company is reacting by slashing costs and putting a temporary halt on its market expansion.

Real estate has always been cyclical – but don’t ignore the opportunity to buy into a fantastic industry leader just because we’re about to turn into a temporary down-cycle. Stay long here.

Be the first to comment