Dan Totilca/iStock Editorial via Getty Images

The Goldman Sachs Group, Inc. (GS) still remains in the middle of an identity crisis.

Just what is Goldman Sachs?

It used to be the premier investment bank in the United States.

Then coming out of the Great Recession something changed.

What changed was Morgan Stanley (MS).

Morgan Stanley believed that it needed to change in order to be in tune with the current approach the Federal Reserve was taking to monetary policy and the way that the “modern” financial market was functioning.

First of all, Morgan Stanley was not the “star” that Goldman Sachs was.

And, secondly, Morgan Stanley produced results that were far more volatile than either Goldman Sachs, another investment banking company, or JPMorgan Chase & Co. (JPM), the largest of the giant financial institutions in the United States.

Morgan Stanley wanted to play in this game.

Morgan Stanley decided that it needed substantially improve its performance coming out of the Great Recession and also to change its business model, and reduce the volatility of its quarterly results.

Like an investment bank, Morgan Stanley’s business model relied upon deal-making and trading, to sources of revenue that could be highly volatile.

The plan was to smooth out the earnings of Morgan Stanley by getting more into the areas of asset management and wealth management so as to produce steadier, fee-generating businesses.

Morgan Stanley has succeeded in moving on to this model and generating higher and smoother performance metrics.

Its return on tangible equity has risen to 14.4 percent in the second quarter of 2022. Its performance over the past five years has been in excess of 11.0 percent, with numbers that have hit 14.9 percent (in the second quarter of 2021) and 12.04 percent (in the second quarter of 2018).

Goldman Sachs believed that it should move in this direction as well, especially since the monetary policy of the Federal Reserve seemed to be producing more stable, but constantly rising stock prices.

David Solomon was elevated to be Goldman’s Chief Executive Officer in 2018 with the task of changing the business model of Goldman Sachs to compete more directly with the new model that was driving Morgan Stanley.

Mr. Solomon was made Chairman of Goldman in January 2019.

New Model

Mr. Solomon moved to change the business model of Goldman Sachs.

The major objective of Mr. Solomon’s business model seemed to be to change Goldman Sachs so that it would have a less volatile performance record.

Well, here we are, more than halfway through 2022.

And, what is the big discussion going on about Goldman Sachs?

What is Goldman Sachs all about? What is its identity?

Goldman Sachs, over the past few years, has attempted to develop a consumer bank, increase transaction services, build its asset management division, and build its wealth management division.

And, what has happened?

Well, Goldman Sachs turned in some really good results in the past year and one-half.

In the second quarter of 2022, Goldman earned a 13.99 percent return on tangible equity. In 2021, the return in the second quarter was 20.25 percent.

Record profits. Last year, its share price hit a historical high.

However, according to Joshua Franklin, writing in the Financial Times:

“[T]hese milestones were largely on the back of the bank’s legacy trading and investment banking business putting up stellar numbers.”

Mr. Franklin is quite harsh when judging the performance of Mr. Solomon:

“If Solomon’s strategic goal is to convince outside investors that Goldman is a steady bet, he still has some work left to do. After almost four years in charge, his new Goldman still looks a lot like the old one.”

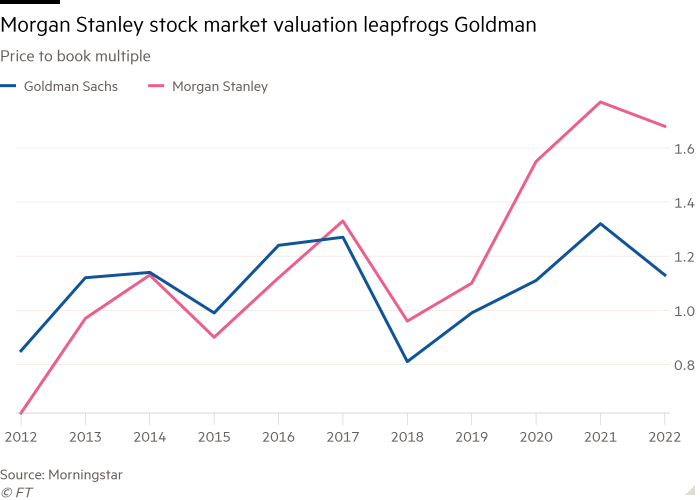

And where this comes out is in the stock price. Specifically, it comes out in the price-to-book ratio. Morgan Stanley has leaped ahead of Goldman Sachs in this measure.

Price-to-book Ratio: Morgan Stanley versus Goldman Sachs (Financial Times)

Investors seem to prefer Morgan Stanley to Goldman Sachs.

And, this is the rub.

Is Goldman Sachs on the right track?

Goldman Sachs

So, the battle goes on inside Goldman Sachs. The new model…the old model…where should the commitment be?

Here is where the answer may depend upon macro-factors and not micro-factors.

Goldman Sachs was the “role model” for the investment banking industry. Not only was its business model to be emulated, but its talent base was to be envied by its competitors. It was the top of the mountain.

The attempt to change its model is having an effect on these things. For one, Goldman, according to Mr. Franklin, “has been hit by several significant departures.”

People were hired to support one business model, and they did it well. Now, there seems to be a new business model in place, and a new management to enforce it.

Time to leave.

But, it may not be the time for Goldman to go further along with its aim to work for smoother, less volatile revenues.

Morgan Stanley changed its business model around 2009, when James Gorman became the new CEO. The timing could not have been better.

Ben Bernanke was the chairman of the Federal Reserve, and he was moving to institute a new model for monetary policy. Mr. Bernanke wanted the Fed to stimulate stock prices so as to create a wealth effect that would spur on consumer spending and lead the U.S. economy into a long, extended economic recovery.

Mr. Bernanke succeeded and through the 2009-2021 period investors in the United States saw a stock market that almost continuously rose as the market hit many new historical highs.

And, asset prices, in general, rose in a relatively steady upward movement.

Mr. Gorman could not have arrived at a better time for his program to move into asset management and wealth management. With asset prices rising…constantly…the revenues at Morgan Stanley rose…constantly.

Mr. Gorman’s business plan was just the right one for the macroeconomic conditions that the Fed achieved during the 2010s.

But, will this environment carry over for Goldman Sachs?

The last two and one-half years have not been steady ones.

The stock markets hit new historical highs during this time period, the last one coming in very early January 2022, but the markets became much more volatile.

The year 2021 was incredible. Goldman Sachs earned of return of more than 20.0 percent on tangible equity.

And, these results were achieved with the same divisions of Goldman that used to produce exceptional returns…business dealing and trading.

Now, we move forward.

After the incredible returns of 2021, we are back to a 16.86 percent return on tangible equity in the first quarter of 2022 before the 13.99 percent return in the second quarter.

The word on the Street, however, is that times have changed.

I have written about this several times myself.

We may have left the time when stock (asset) prices rose in a relatively steady way. We may be entering a period when economic policy is more volatile, stock (asset) prices are more volatile, and the economy as a whole is less stable.

In such a case, Goldman Sachs may want to review its decision to build areas of the firm that produce more stable cash flows. They may want to reconsider going back to the model that stresses business deals and trading.

This may be exactly the wrong time to stress a change in how it operates.

Be the first to comment