Alexander_Volkov/iStock via Getty Images

Investment Thesis

Compass Pathways (NASDAQ:CMPS) is a UK-based biotech pioneering a new combination therapy for treatment resistant depression (“TRD”) that involves administration of the psychedelic drug psilocybin – named COMP360 – accompanied by psychological support.

I last covered the company for Seeking Alpha back in September 2021 when Compass’ share price traded at $32.6 and its market cap was ~$1.4bn, and despite arguably making some significant progress since then, today Compass stock trades at a value of $10.6, and its market cap valuation is $440m at the time of writing.

The fall in value is in keeping with the devastating biotech bear market that has driven the average drug developers’ stock price down by more than half across the past 12 months.

Compass remains well funded, reporting $244m of cash and equivalents as of Q122, and made a loss of just $21.2m in the quarter, so there seems little danger of investors being diluted by an at-the-market fundraising – unless it was on the back of a strong data readout, or to fund a marketing push, in which case shareholders would ultimately be rewarded by a rising share price.

Compass has also now completed a Phase 2b safety and efficacy trial of psilocybin plus psychotherapy in 233 patients across 22 sites in the EU, US and Canada, and announced results in December last year, which showed that:

… a single 25mg dose of COMP360 demonstrated a highly statistically significant and clinically relevant reduction in depressive symptom severity after three weeks, with a rapid and durable treatment response

The 25mg group vs the 1mg group showed a -6.6 difference on the MADRS* depression scale at week 3 (p<0.001). In the 25mg group, 36.7% (29 patients) showed response* at week 3 and 29.1% (23 patients) were in remission* at week 3. Furthermore, at the end of the trial at week 12, 24.1% (19 patients) were sustained responders. Additional analyses of primary and secondary endpoints have supported these results

Compass has held an end of Phase 2 meeting with the FDA and is finalizing its Phase 3 trial which is expected to launch in the second half of this year. The company has secured 10 patents covering composition, formulation and method of use, and overall, Compass has become a torch bearer for the use of psychedelic drugs to treat depressive diseases.

COMP360 was awarded Breakthrough Therapy Designation by the FDA in 2018, and besides TRD, it’s being evaluated in post-traumatic stress disorder (“PTSD”), and in partnership with Universities and “Centres of Excellence,” such as the Sheppard Pratt centre for psychiatric care, is being evaluated as a therapy for Major Depressive Disorder (“MDD”), Chronic cluster headaches, Bipolar Disorder, Anorexia Nervosa, Suicidal Ideation, Autism, Body Dysmorphic disorder and MDD in cancer patients.

With such a wide variety of indications being addressed, and armed with its positive Phase 2 data and with a pivotal trial to follow, investors may feel that Compass is a victim of a savage bear market, rather than a cause of it, and that even if a return to former highs of $58, in December 2020, and $49, in November 2021, is not possible, that nevertheless, 50-100% upside could be achievable for this company given its target markets, its supporters, and its data.

In the rest of this post, I will present several arguments for and against this view, beginning with the legal issues surrounding the use of psilocybin in medicine, which is perhaps the biggest hurdle facing Compass as it attempts to commercialize its novel approach to treating complex central nervous system (“CNS”) depressive disorders.

The Schedule 1 Question

When chasing approval for its combination of psilocybin and accompanying therapy, Compass must persuade not just the FDA, but the Drug Enforcement Agency (“DEA”) to change its stance on the drug.

In the US, psilocybin is categorized as a Schedule 1 drug – which means, according to a statement taken from the risks section of Compass’ 2021 10K Submission to the SEC:

Schedule 1 substances by definition have a high potential for abuse, have no currently “accepted medical use” in the United States, lack accepted safety for use under medical supervision, and may not be prescribed, marketed or sold in the United States.

If the FDA were to approve psilocybin, then the “accepted medical use” argument changes, and in theory, the DEA would then have to adjust its categorization to Schedule II – V, but this could take some considerable time, if it were to ever happen. This is the same problem that afflicts the approval and use of medical marijuana and both the DEA and FDA have resisted almost all attempts to argue that cannabis has an accepted medical use.

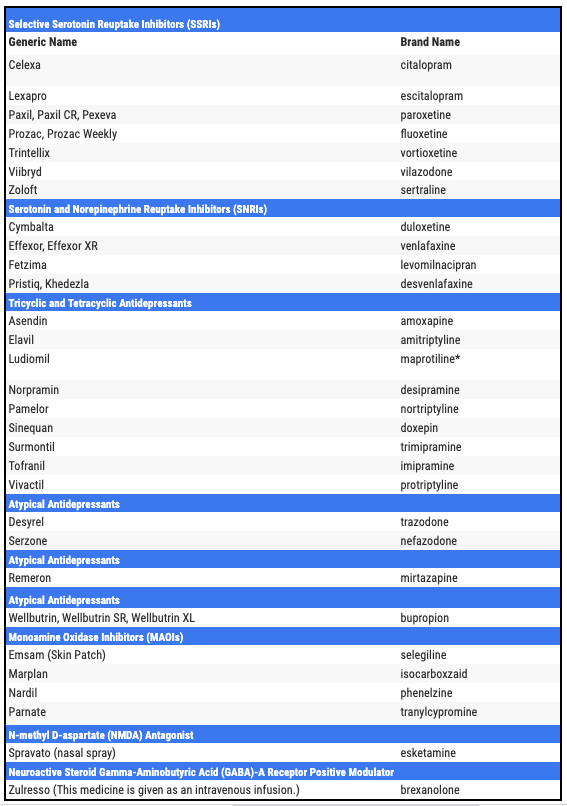

As such, I suspect that Compass’ Phase 3 trial data would have to be overwhelmingly good to persuade either agency to consider its approval. Although depressive disorders are an area of major unmet need, there are quite a few different approved therapies on the market, as per the table below.

table sourced online

As we can see, patients are not short of treatment options, although Compass points out that there are ~320m patients using first line Major Depressive Disorder therapies, and ~200m using second line, and the relapse rate is respectively 60-70% and 50-75%, whilst the relapse rate in third line – a 100m patient population – is 80-90%.

Perhaps there’s a need for a new approach, then, and Compass has also conducted a survey of physicians which it says suggests that at least 50% would prescribe psilocybin therapy, if approved. I would take that survey with a slight pinch of salt, because I suspect physicians would be more hesitant to vote yes if Psilocybin were actually authorised, because there are some safety issues associated with the drug.

Safety and Costs Potentially Make COMP360 Impracticable

In its Phase 2b trial, headache, nausea and fatigue were the most commonly reported adverse safety events while there were 27 reported cases of suicidal ideation, suicidal behavior, and intentional self-injury in 17 patients, seven of whom were in the 25mg group, six in the 10mg group, and four in the 1 mg group. Compass Chief Medical Officer commented:

More detailed analysis of the safety data supports our conclusion that there is no evidence to date to suggest a causal relationship between the serious adverse events of suicidal ideation, suicidal behavior and self-injury, and administration of COMP360 psilocybin therapy. Unfortunately, these events occur unpredictably and are to be expected in this patient population.

That certainly seems a reasonable explanation, although arguably there’s a slight correlation between dose size and cases of severe adverse events (“SAEs”). An issue related to this is that, for the trial, patients were encouraged to stop using their prescription antidepressants for a couple of weeks before and after the trial, but how would this work in a real-world setting? How many sessions (which last 6-8 hours) are required before a patient can be said to be “cured” or their conditions improving? Do patients subsequently return to their prescription anti-depressants?

Of course, all of these issues could potentially be resolved if the body of evidence supporting psilocybin use was overwhelming, but that’s not the case – yet – and given the time commitment – both from the patient and therapist – it’s difficult at present to see psilocybin becoming a mainstream product, and if it’s to be a niche one, it will likely come at a high cost. After paying physician/psychotherapy fees and guiding patients through weeks of preparation and recovery, what would Compass’ margins look like?

Looking Ahead – What’s Next For Compass?

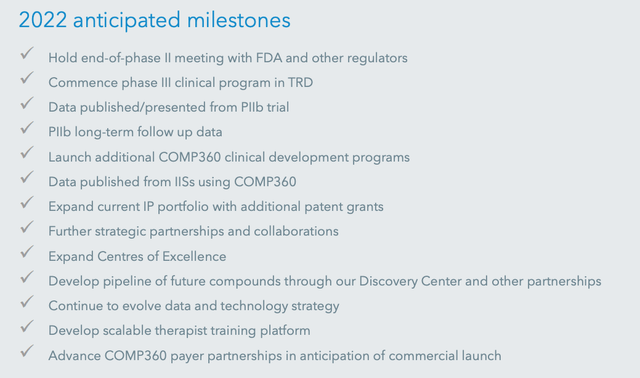

In its latest corporate presentation, Compass outlines its goals for 2022.

2022 anticipated milestones (corporate presentation)

Although there’s a lot of exciting work to be done across the rest of 2022, Compass looks a little short on share price needle-moving catalysts, with no new data upcoming – the Phase 2b follow-up data has already been released, which concluded:

A post-hoc analysis of the 19 sustained responders in the 25mg group found that changes in quality of life, self-reported depression severity, and functioning, were clinically meaningful, with mean scores for these patients returning to “normal” levels and maintained to 12 weeks, the end of the trial.

There will potentially be more data from a one-year follow-up, but it’s the Phase 3 that represents Compass’ best chance of moving toward being a commercial-stage, revenue-generating company.

In the meantime, the collaborations which are happening globally will help to keep Compass in the news, build a larger body of evidence to support its drug and its approach to administration, and keep the company front and center of any discussion on the value of adding psychedelic drugs to the depressive conditions treatment mix.

Compass also says it has audio and visual recordings from some of its sessions and is using machine learning techniques to try to gain more understanding of patients’ experiences and how the process may benefit them.

Management was cagey on the Q122 earnings call about what precisely was discussed with the FDA after its post-study meeting, and as well as the FDA, and the DEA, Compass needs to satisfy payers and providers that there’s a proven link between psilocybin, psychotherapy and outcomes in order to secure reimbursement for its drug, if approved. As company CEO George Goldsmith commented in response to an analysts’ question on the earnings call:

I think our focus is really to start providing a greater connection based on evidence and training and we’re aiming to do that in all of our work, so that we can deliver a more standardized approach that actually links to the data to improve outcomes.

Conclusion – Is Compass Investable?

Compass is a first-mover and a frontrunner in a complex area of CNS treatment and as such is facing a number of problems.

- Persuading the FDA and DEA to alter their stance on its core product.

- Generating evidence from studies without their being a near-term prospect of commercialization given the timeframes involved and reviews that would have to take place.

- Finding ways to display a clear link between sessions, and proving patient improvement in depressive conditions that can be highly personalized and subjective.

- Ensuring the therapy can be safe for all patients, not just some.

It’s a long list and we can add funding concerns to it – in 12-18 months the company will be looking to raise perhaps $200 – $500m to continue its work, which will be tough if the FDA and DEA are not on board by then. There’s also the threat that psilocybin will simply go out of fashion as a treatment option.

Johnson & Johnson (JNJ), for example, recently released their ketamine based product, Spravato, which is now being pegged for $450m of sales, significantly below analysts’ original forecasts of ~$3bn due to the FDA’s insistence on the drug being administered in a controlled environment. Meanwhile, Atai Life Sciences (ATAI) recently IPOd, raising $225m to develop psychedelic drug therapies, and it represents a significant rival to Compass, although its market valuation has already sunk from $3.2bn post IPO, to ~$600m.

It feels a little as though Compass is trying to circumnavigate the FDA and DEA’s objection to using psilocybin as a medicinal drug by providing additional features such as a psychotherapist on hand, audio and visual stimulation, language interpretation, etc. but that ultimately the company may face a roadblock that is too entrenched to be overcome. If that’s the case, the company may go the way of so many cannabis companies and its shares may sink even further.

For what it’s worth, however, I do think there are some glimmers of hope. The Phase 2 trial was a success, despite its limitations (it’s questionable if an FDA AdComm would move to approve psilocybin based on such a trial design) the Phase 3 will (hopefully) begin shortly, there’s funding in place for another year at least, and there’s a considerable groundswell of positive opinion on the work that Compass is doing as evidenced by its collaborations – and even the number of analysts questions on the earnings call.

Goodwill alone will not grow Compass’ valuation or share price, and Compass may one day be viewed as having played an essential role in the commercialization of psychedelic drugs, without having reaped the benefits itself.

Even so, at a market valuation of $440m and share price of $10.5 – down 72% in the past year, I think Compass remains an intriguing and potentially investable company. Its progress has in many ways been faultless over the past year even while its share price has tanked – it’s the product it wants to sell that’s the bigger problem.

I admire the company’s dedication and although I will stop short of a buy recommendation, due to a lack of near-term catalysts, I will be keeping a close eye on the company and hoping that some way or somehow they can find an empirical link between its product and demonstrable and durable improvement in patient’s conditions.

Be the first to comment