ipopba/iStock via Getty Images

Investment Thesis

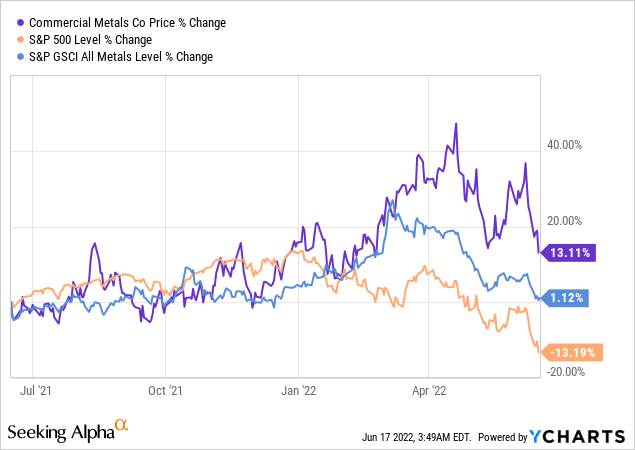

Commercial Metals Company (NYSE:CMC) has consistently outperformed the market in the previous 1-year, 3-year, 5-year, 10-year, and YTD marks. The company has published great financial results in the previous quarter on the back of rising steel prices.

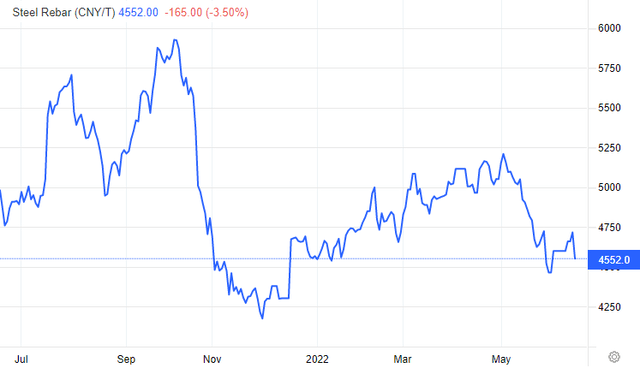

However, the prices have plummeted since the start of the current quarter, and without a rebound, the negative effects of this might reverberate in CMC’s financial statements throughout the year.

In a bullish market, the stock is indeed a good investment, but because of serious downside risks faced by the economy as a whole and steel’s propensity to nosedive in times of economic crisis, I am neutral on the stock until the situation is clarified.

The Company

CMC is a vertically integrated manufacturer, recycler, and fabricator of steel and metal products, operating in North America and Europe. It also provides related materials and services, including electric arc furnace mini and micro mills, a rerolling mill, steel fabrication, processing plants, construction-related product warehouses, and metal recycling facilities in the United States and Poland.

Its products are segregated into 3 categories: raw materials, including ferrous and nonferrous scrap; steel products, including rebar, merchant, and other steel products; and downstream products, including fabricated rebar and steel fence posts.

Improving Profitability

The company posted over $ 2.5 billion in net sales in the MRQ, reporting an over 36% YoY growth, primarily attributable to rising selling prices across the board. The average YoY selling price per ton increase for steel products was 40% in North America and 45.6% in Europe. In comparison, the cost of scrap utilized rose by 28% in North America and 41% in Europe, resulting in a YoY margin increase of $213 per ton or 50% in North America and $149 or 52% in Europe.

Consequently, the company’s gross margin reached 22.2% compared to 17% a year ago. Down the line, its operating margin grew from 9.8% to 16.7%, and the net margin grew from 7% to 12.4% YoY. The normalized net margin of 10% is also almost double the 5.7% from a year ago.

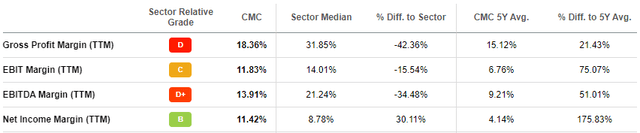

Even though the margins are improving and are higher than the company’s 5-year average, they are still underwhelming compared to the industry medians.

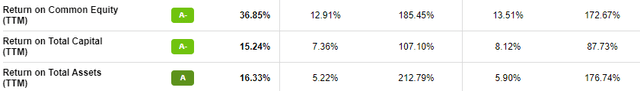

Its topline performance is already resulting in more than double the industry median management effectiveness ratios, with an ROE of 36.85%, an ROTC of 15.24%, and a ROTA of 16.33%; CMC needs to control its costs and achieve organic growth to improve its profitability.

The company’s earnings presentation states that controllable costs per ton of finished steel were flat from the previous quarter but increased YoY because of higher purchase costs per unit for freight, alloys, and energy. Since the profitability and topline growth metrics are heavily reliant on the high steel prices, the company risks losing this growth and profitability if the sale prices plummet, which is already being seen in the market.

The Bull Case

In a previous article, I explained how the average copper selling prices increased in response to strong demand from the construction market. Being a cyclical stock, steel follows a somewhat similar pattern. The prices have slid down in Q2 because of a slowed-down activity caused by high inflation and a probable recession.

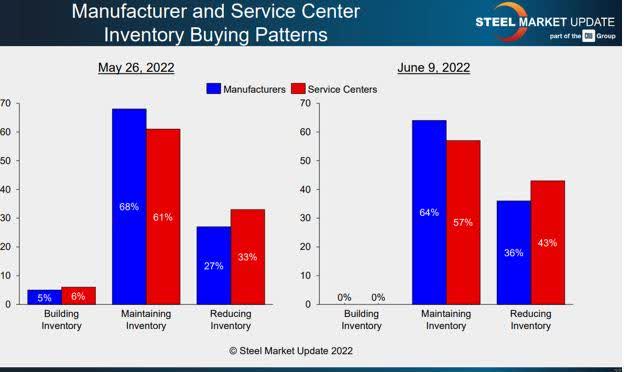

Still, the recent trends suggest a strong demand with growing order backlogs in the manufacturing sectors, with most manufacturers maintaining their inventory levels. Accordingly, CMC’s inventory has grown almost 18% QoQ.

Fabricator.com

According to S&P Global, after a 2.7% rise in steel demand in 2021, the World Steel Association has forecasted a 0.4% growth in 2022 to 1.84 billion metric tonnes and a 2.2% growth in 2023 to 1.88 billion mt. In April, chairman of the world steel Economics Committee Maxino Vedoya stated the following:

We expect growth to start coming in 2023, and this is on the presumption that the war in Ukraine will come to a conclusion sometime this year, and at least the end of this year, we will begin to see a recovery in the steel used in those markets, but throughout our forecasts, we have assumed that steel used in Russia and Ukraine is going to be way down from previous years and that the impact will flow over.

Since the Bipartisan Infrastructure Law was passed 6 months ago, the White House has divulged over $110 billion to fund projects throughout the United States over the next 5 years, including over 4,300 specific projects comprising road, bridges, port, and airport modernization, and water infrastructure. This will also heavily support the future demand for the company’s product line.

The Bear Case

With the threats of an upcoming recession, there remains a risk that steel prices will steeply spiral toward unanticipated lows such as those reached in 2008. Being a cyclical commodity, steel stocks are prone to serious disruptions during an economic crisis, and the backlogs may deplete overnight.

Considering that the steel rebar is currently trading below its 52-week prior rates, it is likely that the downward spiral in response to the recession has already started, and the industry has seen its operational peak in the previous quarters. Given that the prices plummeted in the previous month, the company is likely to post underwhelming Q3 financial reports in the absence of a rebound.

The company has a strong balance sheet with an Altman Z score of 3.99, a debt to equity ratio of 55.6%, a current ratio of 4.23, and a book value per share of $25.91, so it is more than likely to endure through the economic downturn. Still, the systemic risks posed by unfavorable commodity pricing to the company are concerningly high.

Attractive Valuation

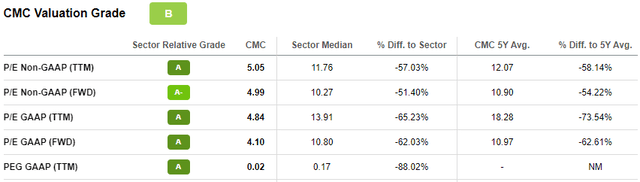

The overall market price decline in 2022 has been favorable to the company’s valuation metrics because its price ratios have failed to deteriorate despite the higher financial performance. The company is trading at much better relative valuation metrics than its peers and is trading at a discount to its 5-year averages.

Its current price is at 4.84x earnings and 0.55x of sales, 65% and 58% lower than the industry medians of 13.91x and 1.31x. The average of its forward GAAP and non-GAAP P/E, EV/Sales, EV/EBITDA, EV/EBIT, P/S, P/B, and P/CF gives us a price tag of $74 per share, whereas the average of all these ratios with the TTM based metrics as well results in a target price of $64 per share.

However, it should be noted that these ratios assume that the current circumstances will persist throughout the fiscal period. In the case of any drastic downward changes in macroeconomic factors, for example, a recession, these forecasts will be adversely affected and vice versa in uplifted circumstances, such as robust growth in the housing market.

Conclusion

Commercial Metals Company stock is currently undervalued and this would indeed be a great time for investment in normal circumstances. However, given the systemic risks faced by the steel industry, the risks are too high compared to the rewards. Only the more risk-taking investors should be looking to invest in such stocks right now.

For conservative investors, the downside risks of owning a cyclical stock at the precipice of an impending recession might not be a desirable decision. Still, CMC offers a good position for risk-taking investors, who are either looking for a long-term steel investment or believe that the upside risk outweigh the risk of a tanking economy.

Be the first to comment