William_Potter

AGNC Investment, for those not familiar with it, is a REIT that invests in mortgage-backed securities (MBS) on a leveraged basis. As such, it earns interest income by managing the complex interest rate risks of mortgage investing. The credit risk of the mortgages in the MBS is absorbed by Fannie Mae and Freddie Mac. AGNC has operated since 2008.

The second quarter – good or bad?

AGNC reported its Q2 results earlier this week. The three key results were:

- It maintained its $0.36 quarterly dividend. That’s a good thing.

- It generated operating EPS of $0.83, way in excess of its dividend and its best quarterly result since 2014. That’s a great thing.

- Its tangible book value fell to $11.43 per share, a 30% decline from a year ago. That’s a pretty bad thing.

Buy the stock at this probable inflection point.

What should we think about this stock considering Q2’s big mixed messages? The company’s view, and mine as well, is that it has just managed through a major interest rate headwind that is in process of changing direction. If so, not only does AGNC’s 11% dividend yield appear safe, but I think there is a reasonable case for a dividend increase within a year or two. This article lays out my case, borrowing liberally from AGNC’s comments on its second quarter earnings conference call.

AGNC’s book value dynamics

Critical to understanding how AGNC’s book value moves is understanding how it invests and how those investments are accounted for. AGNC’s assets are almost exclusively fixed-rate MBS with expected lives (“durations”) of 3-6 years. AGNC funds the MBS with repos (short-term borrowings) and then buys interest rate swaps based on Treasury bond rates that create debt with durations close to those of the MBS. For example, at the end of Q2, the duration of AGNC’s assets was 5.4 years and of its debt, 5.0 years.

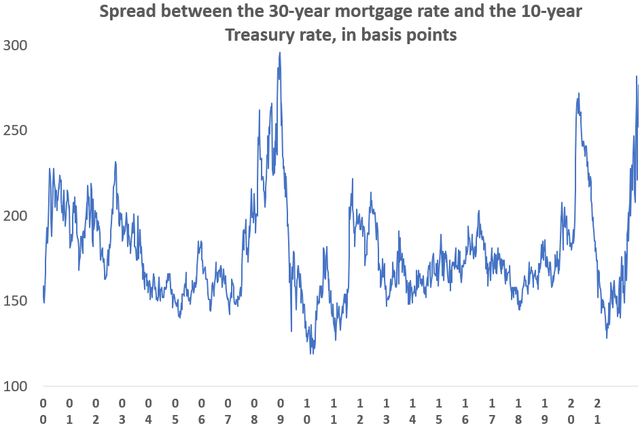

The hedging substantially reduces AGNC’s interest rate risk and stabilizes its interest income over the long run. But in the short run, valuations of AGNC’s MBS assets and its Treasury rate-based interest rate swaps can vary sharply from each other, as this chart shows:

Freddie Mac and the Federal Reserve

Sources: Freddie Mac and the Federal Reserve

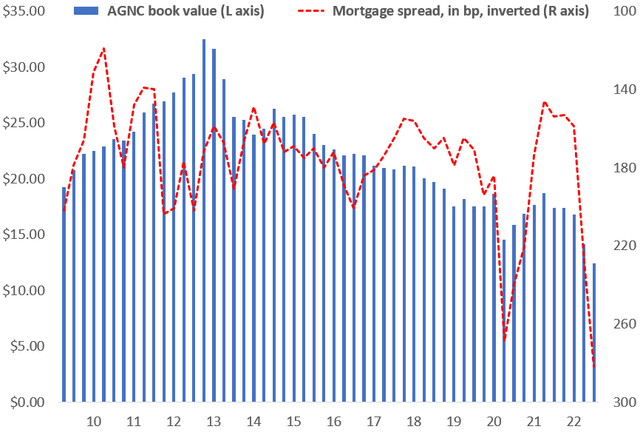

GAAP accounting requires AGNC to mark-to-market both the MBS and the swaps each quarter, so these wide swings in valuations are reflected in the company’s book value. A widening spread typically reduces the book value and a narrowing spread increases it. This chart shows the correlation over time, with the mortgage spread inverted:

Freddie Mac, the Federal Reserve, AGNC financials

Sources: Freddie Mac, Federal Reserve and company financial reports

Now you can see why AGNC’s book value got beat up this past year – because the mortgage-to-Treasury interest rate widened dramatically, to historic highs. So where is that spread going next?

AGNC’s book valuation is likely at an inflection point

AGNC management sees brighter days ahead for the spread, and I agree. There are three reasons for optimism. The first is that MBS yields are now quite attractive, as AGNC notes:

“Agency MBS spreads have widened by more than 100 basis points over the last year to end the second quarter…This yield differential rarely gets that wide or stays that wide for any meaningful period of time…At current valuation levels, Agency MBS are attractive by almost any historical measure…We believe AGNC is entering a favorable environment that will be conducive to generating strong risk-adjusted returns for our shareholders.”

Other investors are undoubtedly seeing the same thing, as evidenced by a 30 bp spread narrowing over the last few weeks.

Second, the supply of new MBS coming to the market is slowing. Again, AGNC’s comments:

“At the beginning of the year, the net supply of Agency MBS to the private sector was expected to be in the $700 billion range, which would have made it the largest issuance year on record. Today, however, with mortgage rates higher, house prices elevated and the economy slowing, the net supply of Agency MBS is now expected to be closer to $400 billion, with most of that supply having already occurred in the first half of the year.”

Less supply means higher prices for MBS, and therefore a narrower spread.

Third, AGNC believes that the Federal Reserve will not be dumping a lot of MBS on the market, avoiding a further increase supply:

“We believe the risk of asset sales by the Fed is extremely low. The Fed has made it clear through their actions and their words that their primary monetary policy tool is adjusting the federal funds rate, not balance sheet reduction.”

These three factors are already making a difference – AGNC’s CEO noted that since the end of Q2 its book value had risen by 4%.

Operating earnings dynamics

In my initial Seeking Alpha article on AGNC this past February, I described an interest margin forecasting model I created based on these three variables:

- The fed funds rate

- AGNC’s MBS repayment rate

- AGNC’s “TBA” MBS assets as a share of total assets. TBA assets are newly issued MBS, and for some reason can be far cheaper to finance than seasoned MBS.

The formula estimates AGNC’s interest margin. For you math nerds, the formula is:

1.04% – .126*(A) + .029*(B) + .009*(C)

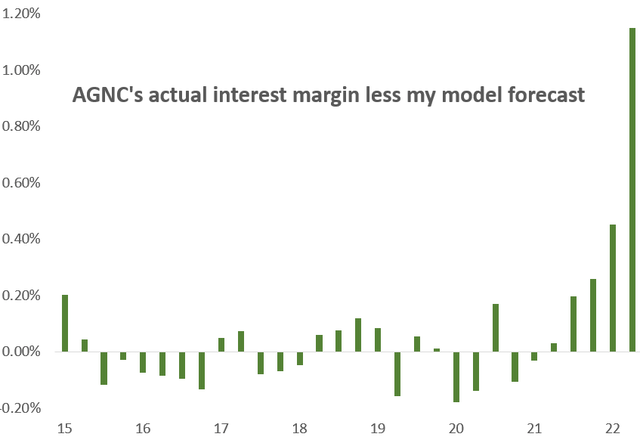

The model has done a pretty good job of forecasting AGNC’s interest margin, until recently. Here is a history of the difference between AGNC’s actual margin and my forecast:

My estimates using AGNC financial data

The positive surprise in Q2’s 2.70% interest margin was largely due to exceptional profits on those TBA assets. Nice, but the big question is “Where is AGNC’s interest margin headed now?”

The interest margin should be solid going forward

Why do I say that? After all, two of the three model variables are getting more negative:

- The Fed funds rate is surging.

- AGNC said on its conference call that TBA profits are returning towards more normal levels.

But models, like records, are made to be broken. AGNC expects three “model surprises”:

1. Less fed funds impact than expected. AGNC said that “Our net spread and dollar roll income should remain well protected against higher short-term rates that are expected over the remainder of the year as a result of our large hedge position.” AGNC currently has a record 126% of its MBS investments hedged against higher fed funds rates.

2. A higher “core” interest margin. Note in my interest margin model above the constant, equal to 1.04%. AGNC expects that in effect that it will outperform that constant because of the attractive of current MBS investments:

“Today with asset yields at around 4.4% or 4.5%…the net interest margin is something in the neighborhood of around 150 basis points. You leverage that 8x, it would give you a gross ROE of 12%. Our operating costs are still below 1%…and you get a mark-to-market return somewhere in the 14% to 16% range.”

3. More leverage. “Leverage” here means the amount of MBS AGNC holds relative to its shareholders’ capital. From 2017 into 2020 AGNC leveraged 8-10 times on its capital. But AGNC responded to the uncertainty post-COVID and into the inflation surge by reducing its leverage to 7.5 times to reduce its risk. Now AGNC sees a chance to safely increase its leverage, and thus its earnings power:

“Levered returns on Agency MBS in the current environment are as favorable as they have been at any point during AGNC’s existence. Given this improved outlook, as this period of volatility subsides, we will look for opportunities to adjust our conservative positioning, including increasing leverage.”

And AGNC very intelligently leaves open the possibility of increasing that leverage by reducing capital instead of adding more assets:

“If we were in an environment where we wanted to take leverage up, and we were trading at a discount to book value than the best transaction from a shareholder’s perspective would be to buy back stock as opposed to adding investments…It would be a way to increase leverage that was most accretive to our existing shareholders.”

The bottom line – AGNC’s going-forward dividend yield should equal or exceed 11%. That’s an attractive investment.

Fittingly, I’ll leave the final words to management:

“In an environment where we can redeploy proceeds at return levels that are significantly above our current dividend yield, we think that ultimately will lead to a strong position and better sustainability of our dividend.”

That sounds pretty bullish for a stock with an 11% yield, doesn’t it? Take a look.

Be the first to comment