Cindy Ord/Getty Images Entertainment

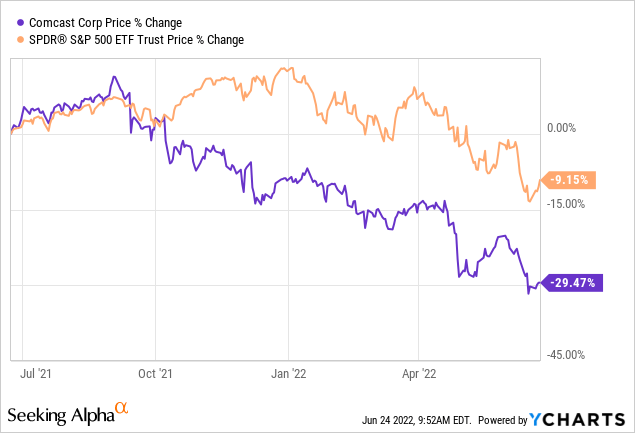

Comcast’s (NASDAQ:CMCSA) stock price has fallen almost 30% during the last twelve months, performing significantly worse than the overall market. In our opinion, this sell off was not justified based on the strong fundamentals of the firm. On the other hand, the declining consumer confidence could have a negative impact on the business in the near term. We believe that Comcast’s stock could be an attractive investment option at the current price levels for someone with a longer term investment horizon.

In this article, first we will take a look at Comcast’s business and its performance in the first quarter of 2022, to understand what segments are the main value generators. Then, we will asses the current valuation of the firm and discuss how CMCSA’s stock could perform during times of low consumer confidence.

Financials and business model

In the first quarter of 2022, Comcast has reported great results. The firm’s revenue grew by 14% year over year, while the adjusted EBITDA and adjusted EPS increased by 8.8% and 13.2%, respectively. Let us take a look what was actually driving this growth.

Cable communications

The cable communications segment grew by 6.5% year over year, driven primarily by the strong residential broadband, business services and wireless. The firm managed to add more than 250k new customers in the first quarter.

Four out of five services have contributed to this growth. Broadband grew by 8%, business services grew by 10.6%, wireless grew by 32% and advertising increased by 8.6%. Only the video series have seen a decline of 1.5%.

In our opinion, this segment of the business is relatively inflation proof and is likely to be less influenced by the ongoing supply chain disruptions and the geopolitical conflicts. Further, we believe this segment can provide stability to the overall business to a certain extent, as more than 50% of the revenue are generated by the cable communications. On the other hand, we need to keep in mind that in case the economic situation in the U.S. deteriorates, consumers may choose cheaper subscription packages or switch to cheaper/ free alternatives.

NBCUniversal

In this segment, revenue has increased almost by 47% compared to the year ago quarter. A strong influencer was the theme parks business, in which the demand has been exceptional. The Universal Orlando theme park has generated record adjusted EBITDA in Q1. Media and Studios have also contributed significantly to revenue growth, however difficulties have been seen with increased programming and production costs, related to the Winter Olympics and Super Bowl, and also higher marketing costs. These headwinds have been driving the adjusted EBITDA lower in Q1.

Although the theme parks business has done exceptionally well, we believe this segment is the most vulnerable to future Covid-19 outbreaks and potential lockdowns. Also, the macroeconomic headwinds, including declining consumer confidence in the U.S. could also have negative impacts in the near term.

Sky

This segment has had the worst performance in the first quarter. There has been a 2.2% decline in total customer relationships year-over-year. Revenue has also declined by a minimal 0.5%. On the other hand, adjusted EBITDA has significantly grown, due to the lower sports programming costs.

All in all, we believe that Comcast’s relatively diverse business and their diversified cash flow streams may provide some stability in a volatile environment. In our view, the current macroeconomic headwinds are not likely to severely impact the firm’s operations.

Value

By looking at the traditional price multiples, we believe Comcast appears to be undervalued at the current price levels.

Comcast’s price-to-earnings ratio is 12.3x compared to the sector median of 17.4x, representing an almost 30% discount. The EV/EBITDA is also almost 10% below the sector median. In terms of price-to-cashflow the discount is approximately 30% as well. When comparing the current price multiples with CMCSA’s own 5 year historic average, we also see a discount across all metrics.

In our opinion these discounts are not justified as the firm has a well working business model and stable growth. Both revenue growth and EPS growth have been higher than the sector median. Further, analysts estimate the growth to continue in the near future. Forecasted EPS for 2022 is $3.59, while for 2023 it is $4.03. We believe these growth estimates are reasonable due to the strong growth in the cable communications segment, however potential headwinds across NBCUniversal must be kept in mind.

To sum up, we believe CMCSA could be a good choice from a valuation point of view, with an upside of 15% – 20% according to price multiples.

Dividends

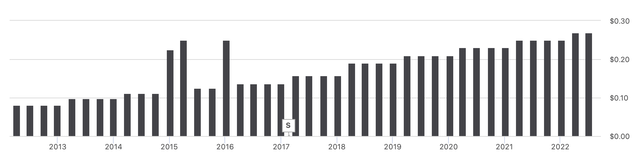

Comcast has been paying dividends since 2008, showing a strong commitment to return value to its shareholders. Although not always consistently, but CMCSA has also been increasing its dividend payments over the years.

Dividend history (Seekingalpha.com)

In January 2022, the dividend has been raised once again, by $0.08, reaching $1.08 on an annual basis. The stock currently has a dividend yield slightly below 2.5%.

In our opinion, Comcast could be an ideal candidate for investors looking for safe and growing dividend payments. As the payout ratio is approximately 30%, we believe that the dividend is safe and sustainable, especially considering the strong cash flow generation and the forecasted earnings growth in the upcoming quarters.

Share buybacks

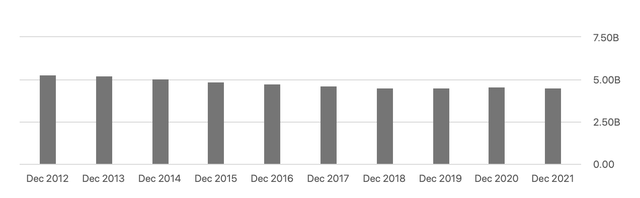

Comcast has also stayed committed to return value to its shareholders by consistently purchasing back their shares. In the last decade, CMCSA has reduced its number of shares outstanding by about 15%.

Shares outstanding (Seekingalpha.com)

In Q1 2022 alone, the firm repurchased shares for $3 billion as a part of their repurchase program which resumed in 2021.

In our opinion, the strong share buyback track record is another reason to consider investing in Comcast.

Historic stock performance during times of low consumer confidence

In this section we will take a look at four time periods, when consumer confidence was low in the United States.

Why is consumer confidence important?

Consumer confidence is often treated as a leading economic indicator, which can signal potential changes in the consumer spending in the near term. As the U.S. consumer confidence has been steadily declining over the last months, reaching its lowest reading in 10 years, and even approaching levels seen in 2008-2009, we believe that the change of the spending behavior of consumers in the near term is inevitable.

Let us take a look how Comcast’s stock has performed during times of low consumer confidence in the last 30 years.

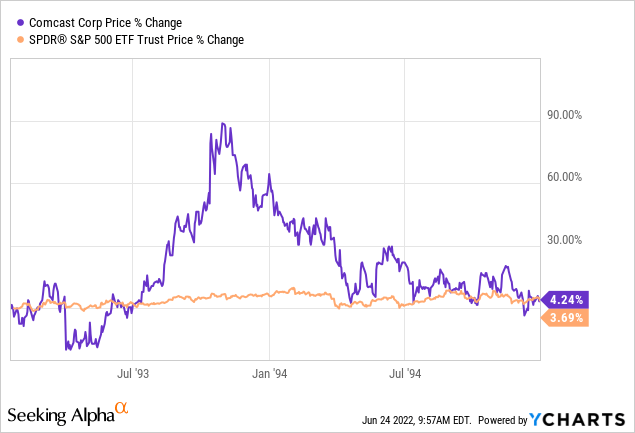

1990-1995:

Despite the extremely good performance in 1993, almost doubling in price, CMCSA has eventually almost given up all of the gain at the end of the 5 year period. In this time frame, eventually CMCSA performed in-line with the broader market, although had a much higher volatility.

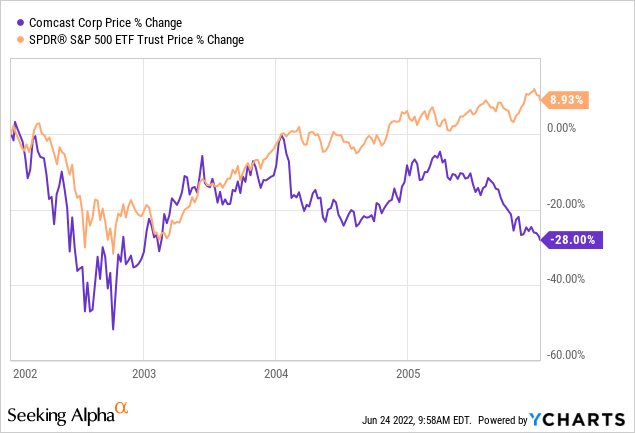

2002-2006:

While between 2002 and 2006 the broader market had a positive return, CMCSA lost 28% of its market value.

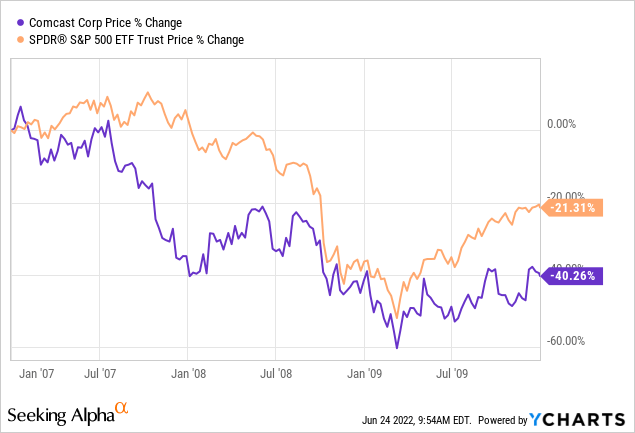

2007-2010:

In the period of the financial crisis, both the broader market and CMCSA have performed poorly, however Comcast lost more than 40% of its market value, compared to the 21% decline of the S&P500.

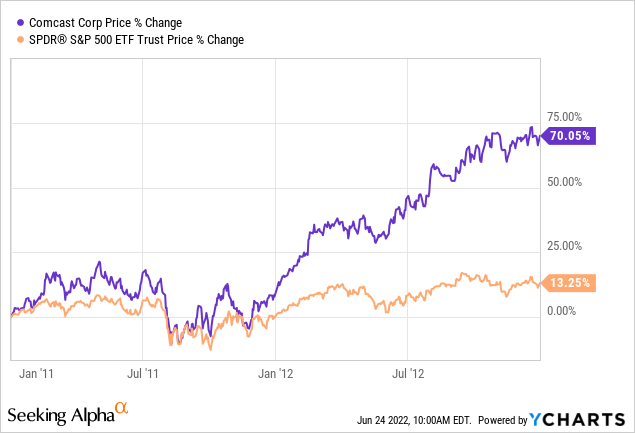

2011-2013:

The picture looks completely different between 2011 – 2013. While the S&P500 gained 13% in this timeframe, Comcast’s stock price was up by as much as 70%.

All in all, we can see that CMCSA has underperformed the broader market only 2 out of 4 times, during periods low consumer confidence, which is not a strong evidence that it would underperform again. However, we believe that there are certain parts of the business now, which are more susceptible to the negative impacts of declining consumer confidence, mainly the NBCUniversal segment. Also, we believe that competition in the sector became more fierce. And during periods of low consumer confidence, people are likely to cut costs eventually on services as well. Cost cuts are not necessarily equivalent to not purchasing certain items or services at all. Often consumers are looking to save by switching to lower cost alternatives.

Competition

Before concluding, we have to highlight the risk of competition associated with Comcast’s business.

The competition in the communication services sector is very intense. Comcast has to compete not only with other broadband and wireless providers, but also with streaming platforms providing a range of different contents, including Netflix (NFLX), Disney (DIS) and Apple (AAPL), just to mention a few.

We believe that the cost of changing between the different platforms is low, therefore user retention is a significant challenge, which not only CMCSA, but all of its peers face. The changing consumer behavior and the dynamically changing demand for certain services can negatively impact CMCSA’s business.

A comprehensive list of risks can be found in the firm’s annual report.

Key takeaways

After the almost 30% decline in price over the last 12 months period, we believe the current price level could be an attractive entry point.

The diversified business could provide protection against inflation to a certain extent. Theme parks have performed extremely well in the first quarter, however they may be influenced the most by increasing inflation and declining consumer confidence in the United States.

A more than 2% safe and sustainable dividend yield, combined with share buyback programs, are also attractive.

Be the first to comment