NicoElNino

My Collegium Pharmaceutical (NASDAQ:COLL) position has been dormant for most of 2022 due to the ticker trading between my Buy and Sell Targets. This might change in the coming weeks as I adjust my Buy and Sell Targets following the company’s Q3 earnings report that revealed a beat on EPS and revenue thanks to synergies from their BDSI acquisition. I believe Collegium is poised to continue to report respectable growth in the coming years, which ought to translate into the share price. As a result, COLL will remain in my Compounding Healthcare “Bioreactor” growth portfolio for the foreseeable future.

I intend to provide some background on Collegium and their new portfolio products. In addition, I will review the company’s Q3 earnings and will discuss my views on the quarter. Then, I will point out a couple of downside risks that investors should consider when they are managing their COLL position. Finally, I will reset my game plan for reactivating my COLL position.

Background on the New Collegium Pharmaceutical

Collegium Pharmaceutical is dedicated to the development and commercialization of pain management and migraine medication. The majority of the company’s products address chronic pain management, which impacts around 40M adults in the U.S. each year, with at least 14M having “high-impact chronic pain” that affects their daily life. Prescription opioids are still the go-to option for the treatment of acute and chronic pain when other treatment options have failed. Unfortunately, prescription opioids have contributed to the opioid crisis due to misuse and abuse. Collegium is dedicated to promoting responsible pain management with Xtampza ER, along with the Nucynta franchise, BELBUCA, and SYMPROIC.

Collegium is also taking on migraines, which are one of the most predominant illnesses with nearly 40M people dealing with it in the United States. Collegium’s recent acquisition of BioDelivery Sciences International “BDSI”, has broadened their portfolio of products to include a migraine product, ELYXYB.

Q3 Performance

The third quarter was another strong quarter for Collegium with record revenue and record adjusted EBITDA leveraged. In addition, the company’s strong cash flows were able to pay down debt while also performing share repurchases.

Collegium Pharmaceutical Q3 Highlights (Collegium Pharmaceutical)

Total product revenue was a record $127M, up 61% from the Q3 of 202. BELBUCA’s net revenue came in at $38.8M, while Xtampza ER was able to match at $38.8M. The Nucynta franchise was able to report $44.4M in net revenue. SYMPROIC contributed $3.6M for the third quarter.

The company’s performance led to a net income of $0.5M with a GAAP EPS of $0.01. Collegium’s non-GAAP adjusted EPS was $1.10, up from $0.65 in the Q3 of 2021. The company also promoted a record non-GAAP adjusted EBITDA of $74.9M, up from $37.3M in Q3 of 2021.

In terms of finances, the company’s cash balance increased to $134.1M in Q3. In addition, Collegium paid off $25M in debt during the quarter.

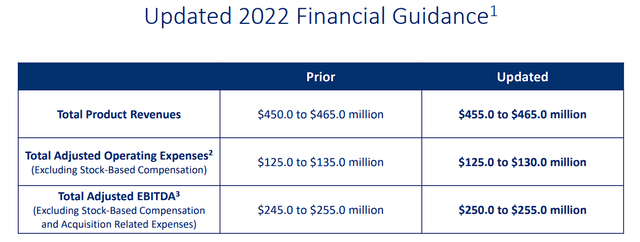

The company’s Q3 performance encouraged them to update their 2022 financial guidance for product revenue, adjusted operating expenses, and adjusted EBITDA. Collegium now expects total product revenues to be between $455M and $465M. Adjusted OpEx to come in around $125M-$130M and total adjusted EBITDA in the range of $250M to $255M.

Collegium Pharmaceutical Updated 2022 Financial Guidance (Collegium Pharmaceutical)

Collegium also highlighted some key developments and updates. First, the company expects the BDSI acquisition to hit run-rate synergies of around $85M, which is up from the $75M estimate from they announced the transaction. The company also announced that they have finalized Xtampza ER contract renegotiations which will make sure it will produce a gross-to-net below 65%, starting on January 1st, 2023. Collegium also announced that “BELBUCA Xtampza ER and Nucynta ER, have a combined 50% share of the branded ER market.”

Unfortunately not every update was positive… BELBUCA and Xtampza ER’s prescription volume was flat compared to Q3 of 2021. What is more, ELYXYB still hasn’t launched after sitting on the sidelines for a couple of quarters now.

My Thoughts on Q3

If I had to give you one takeaway from Collegium’s third-quarter earnings, it would be that the company is able to execute and make progress in every facet of their business. The earnings revealed that their business development efforts have been outstanding. The BDSI deal has been a seamless integration. The addition of the BDSI products helped deliver record net revenue and adjusted EBITDA. The company mentioned they will continue to evaluate additional assets that are “commercial stage opportunities with peak sales potential of over $150M” and are “differentiated with exclusivity that runs into the 2030s.”

On the commercial side, the renegotiation of Xtampza ER contracts will improve the gross-to-net of 54% of their prescription starting in January 2023, which should instantaneously speed up top-line growth. Next year they will renegotiate with plans that constitute an additional 30% of all prescriptions, so there is room for improvement in the future.

On the financial front, the company’s strong financial position is bolstered by hearty cash generation that has allowed them to promptly pay down debt. In fact, Collegium anticipates paying down $100M in debt by March of next year and will fully pay off the Pharmakon loan by March 2026. Into the bargain, the company is returning value to their shareholders with a $100M share repurchase program.

Overall, I believe Collegium’s Q3 earnings show that Collegium has once again made progress to hit their strategic, operational, and financial goals to ensure long-term growth.

Some Risks to Consider

Although the company has reduced or eliminated some of their longstanding downside risks, Collegium still has some risks/concerns that could hurt its future growth. First, Collegium has to deal with the eroding oxycodone ER market and its impact on Xtampza ER’s growth. The company could secure additional payer wins, which will help with script growth and market share. Xtampza has about a 35% share of its market, so there’s plenty of room to grow in the near term. However, we have to concede that an eroding market will probably have a negative impact on Xtampza ER’s peak sales.

Another issue is ELYXYB and the company’s endeavor into neurology. As I mentioned above, the company has yet to launch ELYXYB into the migraine market. We don’t know if Collegium’s commercial team can handle the expansion into another market and if it would be worth expanding the team for just one product. I have to expect the market will react harshly if the company decides to press ahead into CNS with only one product to push, but with an increase in commercial headcount.

Maybe the company will look to acquire additional CNS assets to justify the potential expansion?

Admittedly I don’t know what the company is going to do about ELYXYB, but the fact the company has not mentioned anything about their next steps with the asset in two quarters has me suspecting they might not know either.

Considering these risks, I am assigning COLL a conviction rating of 3 out of 5.

My Plan

In my previous Collegium article, I discussed my strategy of adding on dips while the company’s forward price-to-sales remained under 5x in 2021, and was eyeing the $18.75-19.75 area for a potential buy opportunity. Well, I only pulled the trigger once in December and subsequently booked some profit in February. Those were my last COLL transactions due to the ticker trading between my Buy and Sell Targets.

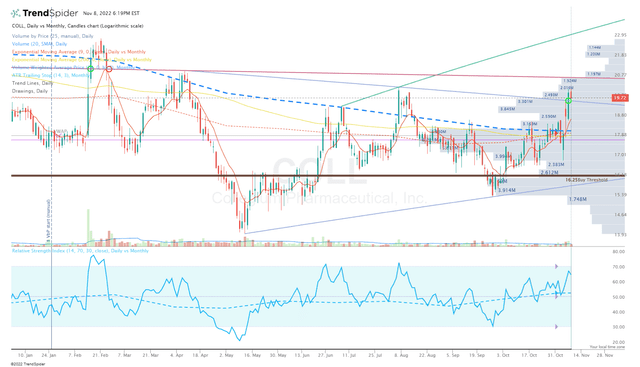

Now, I am adjusting my Buy Threshold to around $16.00 per share and my Sell Target to $52 per share. These adjustments should allow me to restart my accumulation of COLL, while still sticking to my strategy of trading COLL to quickly get the position into a “House Money” status. This will allow me to maintain a position for a long-term investment but on the market’s dime.

COLL Daily Chart (TrendSpider)

Unfortunately, COLL is still trading between my Buy Threshold and my Sell Targets, so I am going to have to remain patient for the time being.

For the long term, I am still sticking to my plan to maintain a COLL position in my Compounding Healthcare “Bioreactor” growth portfolio for at least five more years in anticipation the company will continue to maximize the value of their portfolio while investing in long-term growth. If the company fails to report growth for four consecutive quarters, I will downgrade the ticker into my “Bio Boom” speculative portfolio until the company can regain its growth trends.

Be the first to comment