Scott Olson/Getty Images News

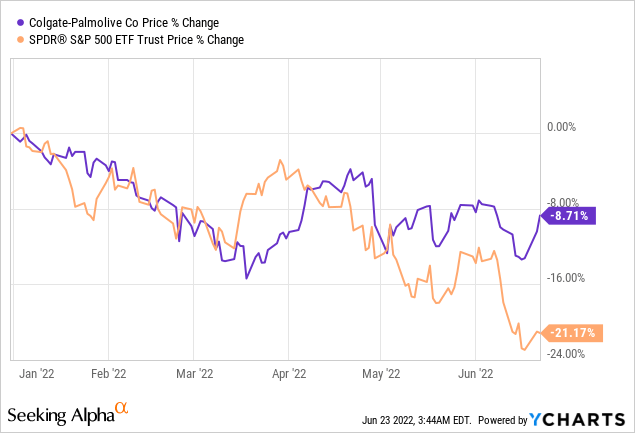

Colgate-Palmolive’s (NYSE:CL) stock price has declined year to date by about 9% outperforming the broader market, which is down by more than 20% in the same time frame.

We believe that his outperformance is likely to continue in the near future, as the U.S. consumer confidence has continued to decline in 2022.

In this article, we will take a look at how CL has historically performed in times of low consumer confidence, while we will also highlight some of the pros and cons of investing in CL now.

Performance during low consumer confidence

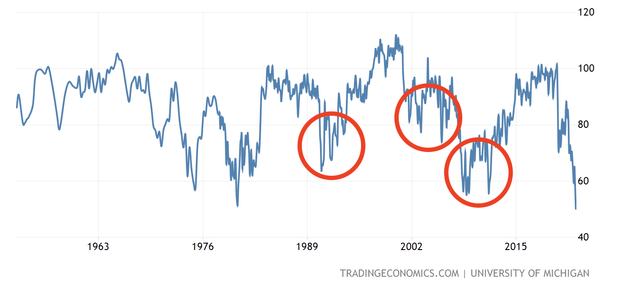

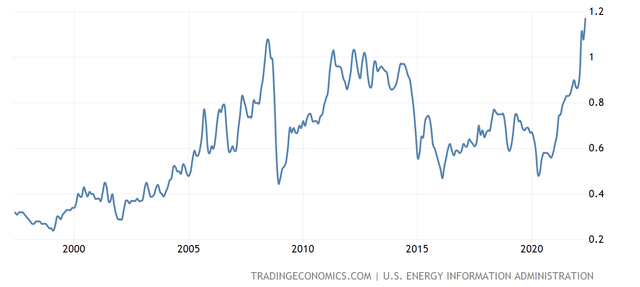

U.S. consumer confidence has been steadily declining in the last months, reaching the lowest reading in 10 years and approaching levels seen in 2008-2009.

Although consumer spending has remained high so far, the low consumer confidence is likely to result in a change of the spending behaviour of the consumers in the near term. This change is expected to impact the spending on durable goods and discretionary items the most, as consumers tend to cut or delay spendings on items, which are not necessities.

On the other hand, firms, which are in the consumer staples sector are not likely to be significantly impacted and may even be well-positioned to outperform the broader market.

Let us take a look now, how CL’s stock has performed during times of low consumer confidence in the last 30 years.

U.S. Consumer confidence (Tradingeconomics.com)

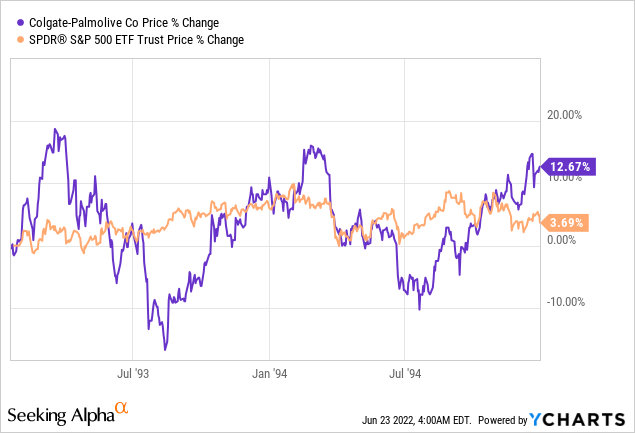

First period: 1990-1995

Although the stock price of CL stock has been much more volatile than the volatile of the broader market in the same period, at the end of this 5-year period CL has outperformed the S&P 500 (SPY), by as much as 9%.

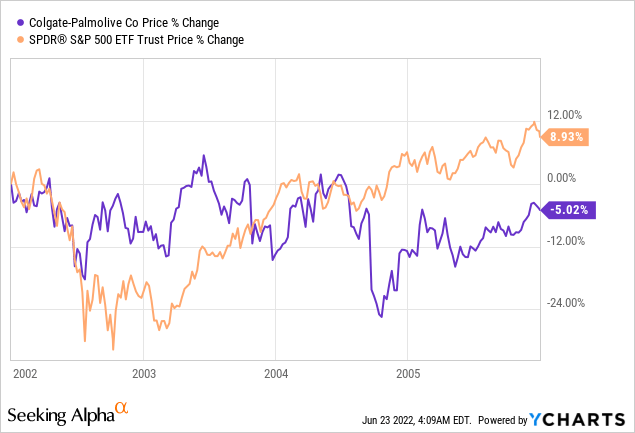

Second Period: 2002-2006

In this time period, the broader market actually outperformed Colgate-Palmolive by more than 13%. We also have to mention that in this period, consumer confidence was not as low as in the other periods highlighted here, but we decided to include it in our analysis as there was a significant decline compared to the prior years.

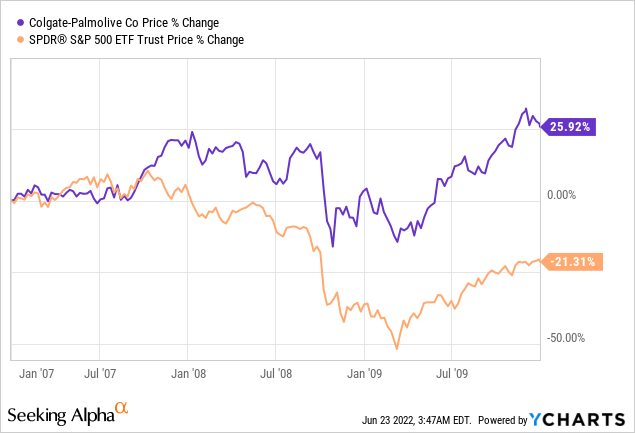

Third period: 2007-2010

Between 2007 and 2012, CL significantly outperformed the broader market. While S&P 500 was down at the end of the time period by more than 20%, CL was up by more than 25%. U.S. consumer confidence was low for an extended period, and even declined below levels seen in the 90’s.

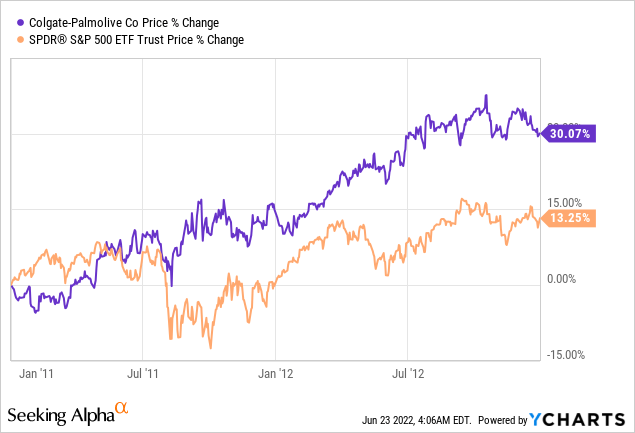

Fourth period: 2011-2013

In the last time period of low consumer confidence, CL once again substantially outperformed the broader market, by returning as much as 30% in the time frame, while the S&P 500 has returned only 13%.

All in all, we can conclude that Colgate-Palmolive has significantly outperformed the broader market in three out of the four examined period, described by low consumer confidence. Although past performance may not always be useful for predicting the future, we believe that these historic observations, combined with the firm’s strong position and market share, make the CL a potential candidate that could outperform the S&P 500 in the current market environment, as consumer confidence is approaching levels seen in 2008-2009.

Not only the historic outperformance that makes CL’s stock an attractive option now, but also its dividend payment history and share buybacks.

Dividend

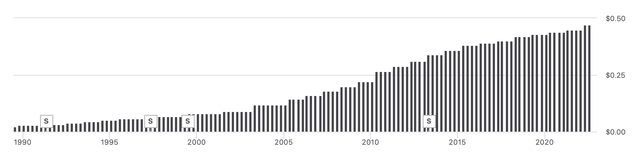

CL has a proven track record of returning value to its shareholders in the form of dividend payments, as the firm has been paying out dividends for 58 consecutive years. For the last 21 years, the company has also managed to increase its payments, consecutively.

Dividend history (Seekinglapha.com)

Although we believe that CL is likely to continue paying dividends to its shareholders, we have to point out that the firm’s Dividend Payout Ratio (TTM) (GAAP) is as much as 75%, which is higher than the consumer staples sector median of ~50% and even higher than the company’s own 5 years historic average of 60%. In our opinion, this payout ratio appears to be very high, therefore before investing in CL for its dividends and dividend growth, keep in mind the risks associated with it.

Share buybacks

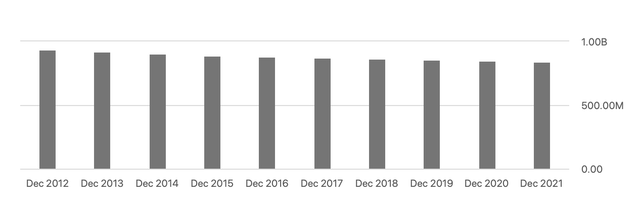

In the last decade, CL has also returned value to its shareholders by reducing their number of shares outstanding by as much as 10%.

Shares outstanding (Seekingalpha.com)

In short, we like to invest in businesses that do not dilute their shareholders by issuing equity. Therefore CL could be an ideal investment choice from this perspective as well.

Macroeconomic headwinds

In the first quarter, Colgate-Palmolive has been struggling with increased raw material and increased logistics costs, resulting in a downward pressure on the firm’s margins and earnings per share, which are now expected to be down by mid-single digits in the base business.

These increased costs are highly related to the elevated oil and gasoline prices, which have continued to sharply rise in 2022, after the beginning of the geopolitical conflict in the Eastern European region.

Gasoline prices (USD/L) (Tradingeconomics.com)

Although there have been some positive news from OPEC+’s side regarding the increasing of oil output in a larger than planned increment from July onwards, there was no significant impact on the prices. On the other hand, there are several other factors, which are negatively impacting the supply of oil and gas, including the incident in the Freeport LNG plant, and the recent reduction in Russian gas transports to Europe.

As we believe that the situation in Eastern Europe is likely to remain uncertain in the near future, we do not expect a sharp drop in energy prices in the rest of 2022. As a result, we expect that elevated raw material and logistics costs going to continue impacting CL’s margins in the near term, despite the firm’s efforts of implementing accelerated price increases in the high single digit range.

Also important to mention that due to the geopolitical tension, CL has also suspended the sale of non-essential health and hygiene products in Russia, which is likely to have a slight impact on the sales figures.

Key takeaways

Although past performance is not indicative of the future, CL’s stock has a strong track record of outperforming the broader market during times of low consumer confidence.

Cl’s stock could also be an attractive option for investors looking for dividends and dividend growth, as the company has been paying dividends consecutively for the last 58 years. Be aware that the dividend payout ratio is significantly above the sector median.

Macroeconomic headwinds are likely to keep negatively influencing CL’s margins in the near term.

Be the first to comment