Stephen Lam

Investment thesis

The year so far has been tough for investors as all markets have been falling so far this year. We are dealing with high inflation, rate hikes by the central banks, and a serious threat of a recession in the near term. It is therefore no surprise that markets are down by double digits. But where most investors might be down over 10% this year, it is not all just negative. The current market does offer us some very interesting buying opportunities as some companies keep growing earnings and pop up as very resilient. But even these companies are down significantly. The best thing we investors can do now is to identify the stocks that are undervalued as a result of the downturn (and of course don’t panic sell your existing holdings).

Technology stocks have been the winners over the last couple of years, or actually, for the last decade or so. Covid gave another boost to growth stocks as technology services became increasingly important as people were forced to stay at home and work from home. As a result, a lot of these technology companies were massively overvalued at the end of 2021, even though a lot of these companies were not even profitable. But the environment has changed drastically, and people are not willing to pay for unprofitable companies in the way they were a little over a year ago.

One of the companies that has been growing at a rapid pace is CRM software company Salesforce (NYSE:CRM). The big difference for Salesforce, of course, is that this company is profitable. Salesforce is down over 40% this year, despite the recent rally. As a result, the stock price has only increased by 40% over the last 5 years. Meanwhile, revenue has grown from around $7 billion in FY16 to approximately $22 billion in FY22, meaning revenues have more than tripled over the last 5 years.

It is the drop in share price so far this year that caused me to start following Salesforce. I think it is a very interesting business and I like software companies in general. Generally, these companies have very high margins and are believed to be more recession and inflation-resistant. I cannot imagine businesses cutting on their CRM systems as these might even increase in importance when times get tough.

I currently do not own any shares in Salesforce. The company has always been a bit too expensive for my taste, while profits were almost non-existent. Now, as I mentioned earlier, the drop in share price so far this year for a quality business like Salesforce did attract my interest. For that reason, I will try to find out within this article whether Salesforce is a buy at current prices. This is my initial thesis on Salesforce and so I will do a company deep-dive.

Salesforce Inc.

Salesforce is an American cloud-based software company with its headquarters in San Francisco, California. Salesforce provides CRM software and applications with a focus on sales, customer service, marketing automation, and analytics. Salesforce made its IPO in 2004 and has grown to a market cap of $154 billion today. Salesforce is one of the largest cloud-based companies on the planet.

Customer 360 is the CRM software Salesforce offers to its customers and has been the #1 CRM system in the world for many years now.

Customer 360 platform (Salesforce)

Nowadays, more than 150,000 companies use Salesforce’s CRM platform and use it to grow their business and increase customer relations. What CRM does is help companies understand their customers’ needs and solve problems more effectively through an all-in-one platform that includes all information you need to serve your customers in the best way possible.

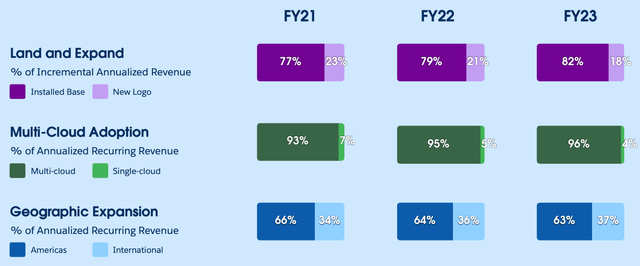

You can imagine from the introduction above that Salesforce still has a load of growth prospects. Their dominant position in CRM offers them the ability to expand their platform and upsell their customers or expand into other industries and services while using their huge existing client base to sell these products. In September Salesforce held its annual investor day and this gave us some new insights into the future potential for Salesforce.

Salesforce expects its total addressable market [TAM] to continue to grow at a 13% CAGR until 2026 and to reach a massive $290 billion.

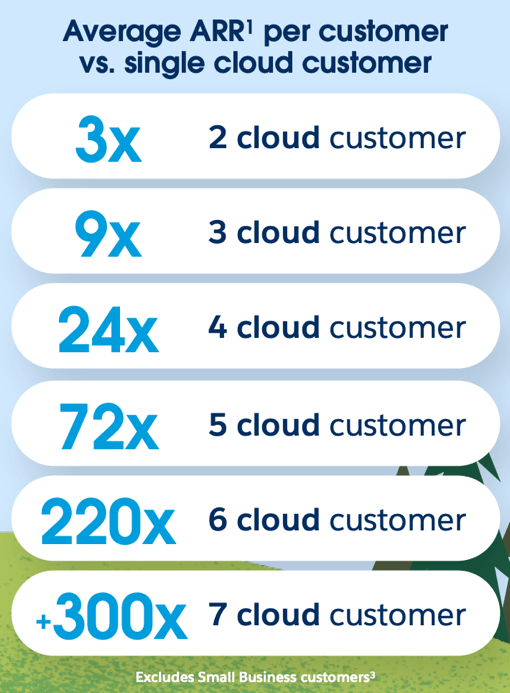

One key point regarding Salesforce’s customer 360 is the change in the cloud environment. An increasing number of businesses use multiple cloud vendors. More cloud vendors mean more annual recurring revenue [ARR] for Salesforce. Salesforce provided a nice overview of the difference in ARR per number of cloud providers and this shows the massive potential as more and more businesses shift towards multiple cloud vendors as the cloud grows in importance.

Salesforce

This is reflected in Salesforce’s financial results as 20% of customers use more than 4 cloud vendors, but these customers account for 85% of ARR. Salesforce believes it can use its land-and-expand strategy to boost ARR growth over the longer term as it plans to upsell to existing customers.

Salesforce also still sees a lot of growth potential through geographic expansion. According to Salesforce, there is still a large part of its TAM untapped, and it sees potential to drive new market opportunities. Salesforce has seen its ARR grow at a 21% CAGR in North America over the last three years, while ARR from international markets has grown at a 27% CAGR. Despite this strong growth, Salesforce remains to believe it has plenty of room to expand at a similar pace over the next couple of years. ARR is the best kind of revenue for Salesforce as it is a predictable revenue stream and less sensitive to economic problems and a potential recession. The majority of revenue is subscription revenue and therefore recurring annually.

Remaining TAM opportunity (Salesforce)

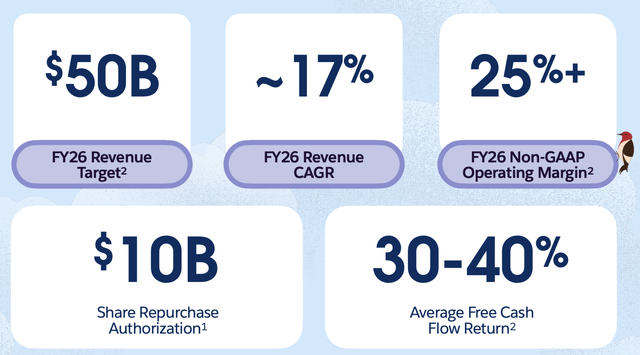

According to Salesforce, they should be able to grow their revenue to a massive $50 billion by 2026, growing revenue at a 17% CAGR and doubling revenue compared to last year. Salesforce currently projects $31 billion in revenue for FY23. I feel like the goals Salesforce is aiming for might be a bit too high. If we take into consideration the possibility of a potential recession, it seems unlikely that Salesforce is going to double its revenue by FY26. Yet, I would not say it is impossible as I feel like Salesforce has a relatively stable business that should not be hurt as much as many others.

In addition to significantly increasing revenue by FY26, Salesforce also wants to increase its margins. It believes it can do this by benefitting from its land-and-expand strategy, product innovation, an increase in brand awareness through networking, and system automation. This all should lead to a 25%+ non-GAAP operating margin by FY26.

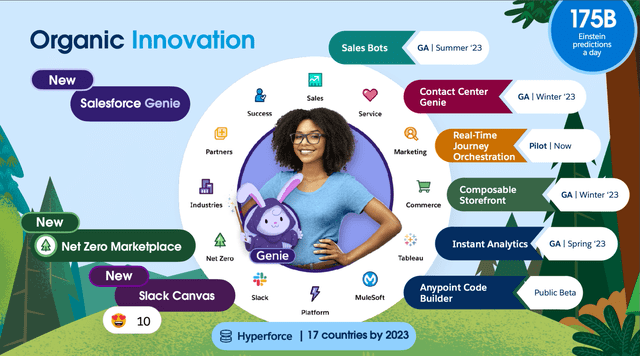

Salesforce has been a great player regarding business innovation over the years and it is not planning on stopping now. Salesforce plans on bringing a whole bunch of innovations in 2023 which should boost platform attractiveness and upsell opportunities to increase ARR.

Salesforce innovation (Salesforce)

In addition to business growth, Salesforce confirmed it will stay active in M&A when they believe it will be a significant addition to its product portfolio. Also, Salesforce announced its first-ever share repurchase program. Management authorized a $10 billion share repurchase program. This is very good news for investors, although I am not sure whether I would rather see Salesforce invest this money into the business. Yet, it does confirm that management believes the stock is currently undervalued.

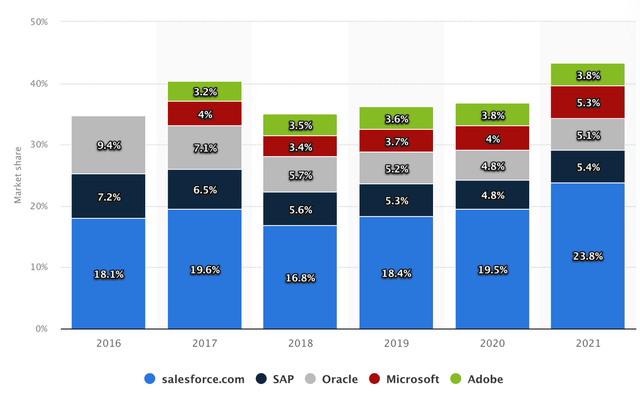

Of course, I already shared the outlook Salesforce presented regarding market growth by using their TAM. According to Allied Market Research, the CRM market is expected to grow at an 11.1% CAGR from 2020 to 2027 and will reach a market size of close to $100 billion. Since CRM is the main business for Salesforce and they are the largest player by a fair margin, as is shown by the graph below, I expect them to profit from this industry growth. Salesforce even grew its market share over the last 5 years to a massive 23.8% in FY21. This shows us Salesforce is in a great position to benefit from market growth. Now, how is this strength reflected in their recent financial results?

Financial results

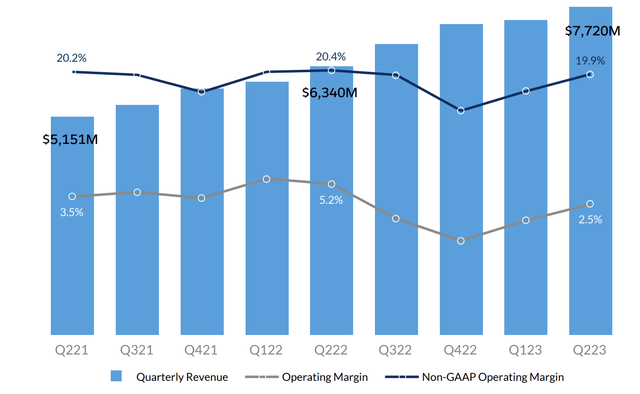

On August 24th Salesforce presented its second-quarter results. Revenue came in at $7.72 billion, showing 22% YoY growth and 26% on constant currency. Subscription revenues for the quarter were $7.14 billion and grew 21% YoY. Non-GAAP EPS was $1.19, while GAAP EPS was significantly lower at just $0.07. Management stated the following:

Our results demonstrate the strength and diversity of our product portfolio across regions, industries and segments. In this more measured buying environment, our Customer 360 portfolio is even more strategic and relevant as our customers focus on productivity, efficiency and time to value.

Management confirmed what I said earlier and that is that its Customer 360 platform will be of increasing importance to businesses as it increases efficiency and productivity in times when this is crucial. This is also part of the reason I do expect Salesforce to remain relatively stable in revenue, even if we see a severe slowdown.

The operating margin for the second quarter came in at 19.9% non-GAAP and GAAP margin of only 2.5%. In addition, operating cash flow came in at $330 million, which is a 14% decrease YoY and free cash flow was just $130 million, 24% lower YoY. This might also immediately bring on a big problem with Salesforce, its profitability. Yes, there is a profit, but cash flows are low for a business earning over $30 billion in revenue annually and existing for over 20 years.

Growth for the quarter remained very strong on the top line, but the bottom line saw a significant decrease, which was disappointing. If we look at the revenue split by region, we see that the strongest growth was visible in the EMEA region, which grew by 23% YoY and 35% YoY on constant currency. APAC saw 17% growth and 31% constant currency. Growth in the Americas was a solid 22%. This does show that growth for the international markets is growing faster, most likely because of a lower penetration of the market in these regions.

The outlook for the third quarter is also not the most positive one. Salesforce will report its third-quarter results later this week on November 30th. For this quarter Salesforce expects revenue between $7.82 – $7.83 billion, representing just 14% growth YoY and a serious slowdown compared to previous quarters. Non-GAAP EPS is expected to be between $1.20 and $1.21.

As a result, Salesforce now expects FY23 revenue (current fiscal quarter) of $31 billion on the top end, up 17% YoY. FY23 margin is expected to be 20.4% on a non-GAAP basis.

Balance sheet and valuation

Salesforce does have a solid balance sheet with total cash of $13.5 billion at the end of its 2Q23. This was an increase of 40% YoY. Total debt was $14.3 billion, meaning Salesforce has a negative net debt position of about $800 million. I really like the cash position of Salesforce as it does give the company a lot of opportunities regarding M&A, but also investing in business opportunities. I am less of a fan of the debt position, but as this is almost fully covered by its cash, this should not be a problem for now. Salesforce is not generating loads of free cash flow at the moment, so debt should not go much higher for my taste. The 40% YoY increase in its total cash position is positive as it shows the business is fully capable of generating free cash flow.

Salesforce is currently valued at a forward P/E of 31.25 and is therefore 44% undervalued compared to its 5-year average, yet it is also not particularly growing at the same rate as it did the last 5 years. Salesforce receives a C- from Seeking Alpha for its valuation as the stock is still not cheap compared to its (slowing) growth rates.

Current analyst estimates are projecting 17% growth for the current fiscal year, in line with management expectations. For FY23 (or fiscal FY24 for Salesforce) analysts project 14.4% revenue growth and 16% for the two years after that. That would mean Salesforce would reach close to $48 billion in revenue by FY26, not reaching management’s current goal of $50 billion. I am personally very curious to see whether Salesforce will be able to manage to grow the business by 14% over the next fiscal year. This will highly depend on the severity of a potential recession. I think analysts’ estimates for revenue to come in around $48 billion by 2026 seem fair. Bottom line growth is expected to grow at a faster pace closer to 20% per year until 2026.

All in all, I still think Salesforce is richly valued, but the significant decline so far this year has made the stock a lot less expensive. If Salesforce would manage to grow its top line by over 14% next year, which I doubt, I think the stock is fairly valued at prices around $150/160 per share. I do want to add to this that if growth would come in closer to 10% or lower next year, there is still significant room for downside to around $120 per share. Personally, when comparing the growth outlook and current price, I would be comfortable with opening a small position or slowly adding to an existing position.

Risks

We have discussed the upside potential for Salesforce so far, but now it is time to turn to a bit more of a negative view and look at the risks of an investment in Salesforce. Of course, one of the main risks for a growth stock with a higher valuation in the current environment is the risk of more downside. Salesforce is, as discussed above, still not cheap and if the economy would make a turn for the worse, there would still possibly be significantly more downside for Salesforce through valuation contractions. Later this week Salesforce will report its 3Q23 earnings and it will be crucial for Salesforce to report solid numbers. The outlook is already guiding for slowing growth. Also, this quarter will give us a better look at how resilient the business and growth are. In the case of a disappointing quarter, this could have a significant impact on the fiscal 2024 expectations as well.

On November 8th, CNBC reported that Salesforce reportedly laid off hundreds of employees, and job cuts could jump as high as 2500. So far, according to CNBC, less than 1000 workers lost their jobs. Salesforce did not respond to the matter so far but will probably give us some information about it when they report their earnings next week. It could already point to lower expectations for growth by management and the need to save costs. Laying off personnel is never a good sign, but it could be a good move by management to increase its top line in the case of a slowdown. It is something to keep an eye on next week.

Finally, I want to point out that cash flows remain to be low, except for the fourth and first quarters. This does not leave much room for mistakes for Salesforce. I prefer companies with more of a solid bottom line, but I expect Salesforce to significantly increase their bottom line over the next years as less money will be needed for R&D.

Conclusion

Salesforce is a great company, with strong management, a dominant market position, strong growth ahead, and a solid balance sheet. The main issue for Salesforce remains its valuation as this creates the most risk for a lower share price. A lot will depend on what Salesforce will report later this week when they report their 3Q23 earnings. Despite all near-term weaknesses and uncertainties, I do think the long-term thesis for Salesforce is strong and the current share price is not a bad one to start a position in this dominant enterprise software company. Long-term growth will be supported by growth in cloud computing, CRM industry growth, and business expansion.

I feel like the company is a hard one to judge. I think the company is right in between a buy and a hold. Yet, as I do believe in the long-term potential of the business and the valuation has come down significantly to more acceptable prices, I rate the company a buy at current prices and under current growth assumptions.

I will keep a close eye on earnings later this week and will update the thesis if necessary. For now, I rate Salesforce a buy on a strong growth outlook driven by industry growth and business expansion. I recommend being careful with buying this stock and adding or buying small bits split over time as near-term problems might cause the share price to trade lower.

Be the first to comment