Justin Sullivan

Investment Thesis

Colgate-Palmolive Company (NYSE:CL) is currently battling inflationary headwinds and adverse foreign exchange movements which have impacted the results for the third quarter of 2022. However, the company through its revenue growth management strategy and higher pricing was able to deliver high single-digit constant-currency organic sales growth. In the third quarter, the company also experienced capacity constraints and retail inventory reductions due to an uncertain macro environment which resulted in lower volumes and affected sales and margins. Moving forward, I believe the current macro headwinds should continue to adversely impact revenue growth and margins in the near term. However, in the medium to longer term, the company should be able to deliver revenue and margin growth through its growth strategy, effective pricing, moderating inflation, high levels of daily product usage, and reducing capacity constraints, along with various growth initiatives taken by the company. CL stock is trading in line with its historical levels. While I like the company’s long-term prospects, I prefer to be on the sidelines given its fair valuations and near-term macro headwinds. Hence, I have a neutral rating on the stock.

Revenue Analysis and Outlook

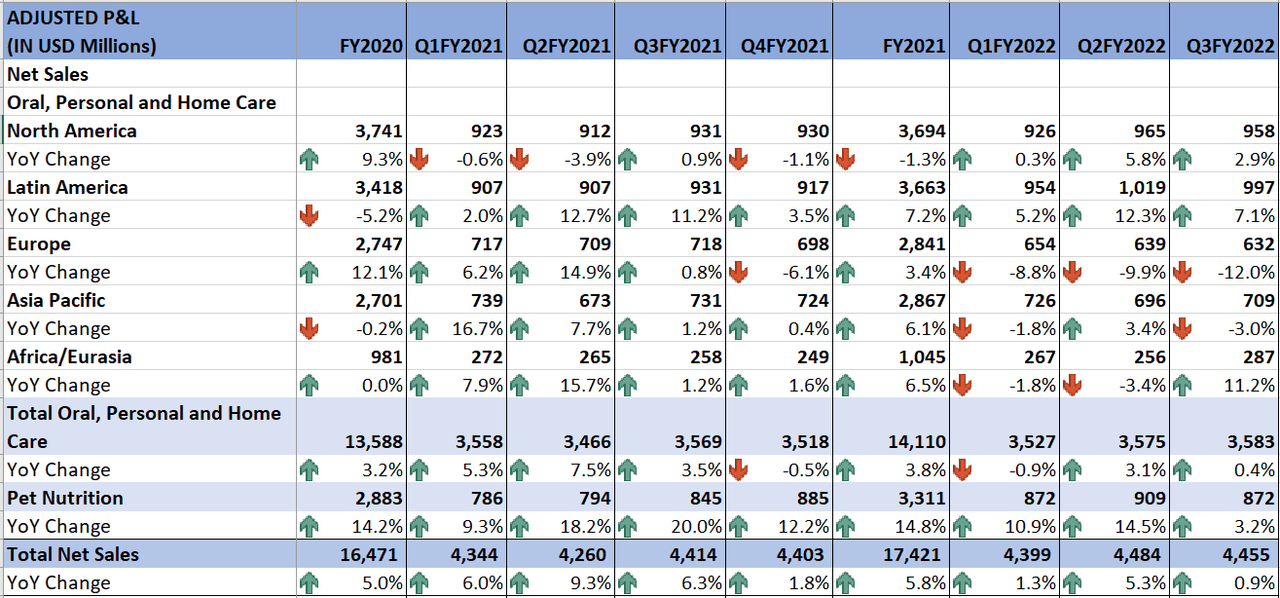

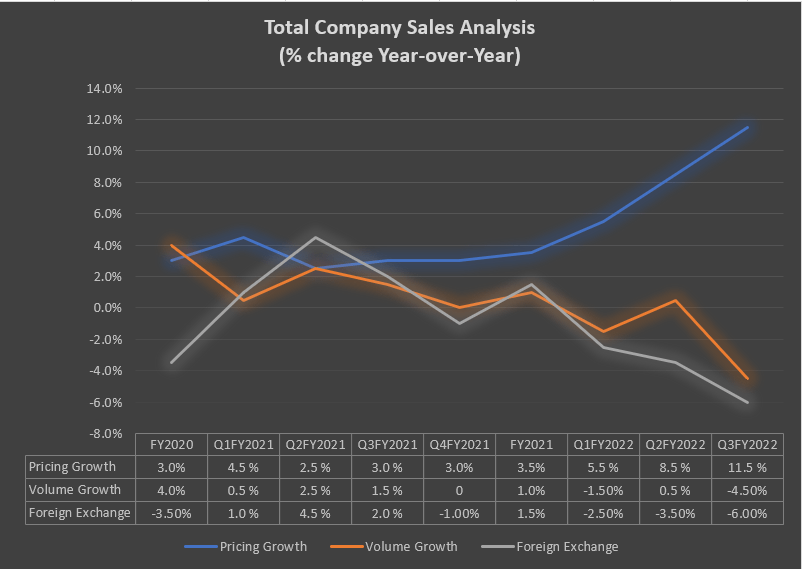

In the third quarter of 2022, Colgate-Palmolive reported net sales of $4.46 billion an increase of 1% from the year-ago quarter. The increase reflected a 7% organic sales growth, partially offset by a 6% foreign exchange headwind. The organic sales growth reflected an 11.5% pricing growth, partially offset by a volume decline of 4.5%. The decline in volume was due to inventory reductions done by retail partners particularly in North America in response to a highly uncertain macro environment. The war in Ukraine also had a negative 0.5% impact on the total company volume in the quarter along with capacity constraints at Hill’s Pet nutrition business.

CL’s Revenue (Company Data, GS Analytics)

For the Oral, Personal, and Home Care segment, geographically, in North America, net sales increased by 2.9% Y/Y or 3.5% organically to $958 million. The sales growth was attributed to the pricing growth of 9%, partially offset by a negative 5.5% volume impact and negative foreign exchange of 0.5%. The organic growth reflected strong demand for the toothpaste category in Oral Care and the liquid and bar soap category in Personal Care. In Latin America, net sales increased by 7.1% Y/Y or 11.5% organically to $997 million. The sales growth was attributed to the pricing growth of 20.0%, partially offset by a negative 8.5% volume growth and negative foreign exchange of 4.5%. The organic growth was contributed by increases in Oral Care and Personal Care organic sales along with strong demand for whitening, gum, and sensitivity offerings in the market. In Europe, net sales declined by 12% Y/Y to $632 million. The decline was a result of a 2.5% volume decline and negative foreign exchange of 14.5%, partially offset by a 5.0% price increase. On a constant-currency organic basis, sales grew by 2.5%. The organic sales growth was attributed to increased healthy market conditions in the UK, Poland, and France, partially offset by a sales decline in the Filorga business. In Asia Pacific, net sales declined by 3% Y/Y to $709 million. The decline was a result of a 1% volume decline and negative foreign exchange of 8.0%, partially offset by a 6% price increase. On a constant-currency organic basis, sales grew by 5%. The organic sales growth reflected the strong performance of the Greater China region which reported growth both in the Hawley and Hazel joint business and the base business of the company. Lastly in Africa/Eurasia, net sales increased by 11.2% Y/Y to $287 million with pricing growth of 26.5%, partially offset by a volume decline of 6.5% and negative foreign exchange of 9.0%. The constant-currency organic sales growth of 20% Y/Y reflected good demand for all three categories.

Now, for the Hills’s Pet Nutrition segment, net sales increased by 3.2% Y/Y to $872 million. The increase reflected 11% price growth and a negative 3.5% volume growth along with a foreign exchange headwind of 4.5%. The Organic sales increased 3.5% Y/Y on a constant-currency basis primarily due to growth in the wellness and therapeutic categories with increased demand in the U.S. and Europe.

CL’s Historic Net Sales Analysis (Company Data, GS Analytics)

The organic sales growth for the total company reflected the successful implementation of revenue growth management under the business strategy of Colgate. The business strategy is focused on driving top-line growth through science-driven innovations and efficient pricing realization. A good example of this growth strategy is the company’s efforts to drive growth in teeth whitening in Oral Care. In the U.S., the company launched Optic White Pro Series having 5% hydrogen peroxide in the toothpaste, which resulted in a market share gain in the country. Outside the U.S. the company is gaining market share with products like Colgate Optic White O2 in Asia Pacific and Colgate Max White Ultra in Europe. In Personal Care, the company is driving growth through science-based innovation by launching EltaMD, which is the number one dermatologist-recommended professional sunscreen in the United States and the first-ever EltaMD UV Stick, a 100% mineral sunscreen stick. In South Africa, the company is focused on driving premiumization by launching a market-leading fabric softener business.

Lastly, in Hill’s Pet Nutrition, the company developed Hill’s Prescription Diet Derm Complete. This pet food has been clinically proven to help dogs with both environmental and food sensitivities. Moreover, the company acquired operations of three dry pet food facilities from Red Collar Pet Foods on September 30. This should help the business with volume growth by limiting capacity constraints while expanding the wellness and therapeutic diets business.

Looking forward, I believe, Colgate-Palmolive can deliver on its longer-term organic growth target of 3-5%. While the near-term macro headwinds like negative FX are still there, a couple of things are improving. The company has usually been a leader in pricing, due to which its volumes got impacted by pricing elasticity as it raised prices in recent quarters. However, exiting the third quarter the company saw competitors follow up with their pricing increases. This should improve the demand elasticity of the company’s products in Q4 2022 and 2023. For volume, the management believes that capacity constraints and inventory destocking to abate as we move into the fourth quarter, which should sequentially improve the volume growth. In addition, the company is focused on revenue growth by improving its portfolio under its growth strategy. Moving forward, healthy demand, continuous pricing realizations, and the company’s growth strategy should help in delivering revenue growth in 2023 and beyond.

CL Margin Analysis and Prospects

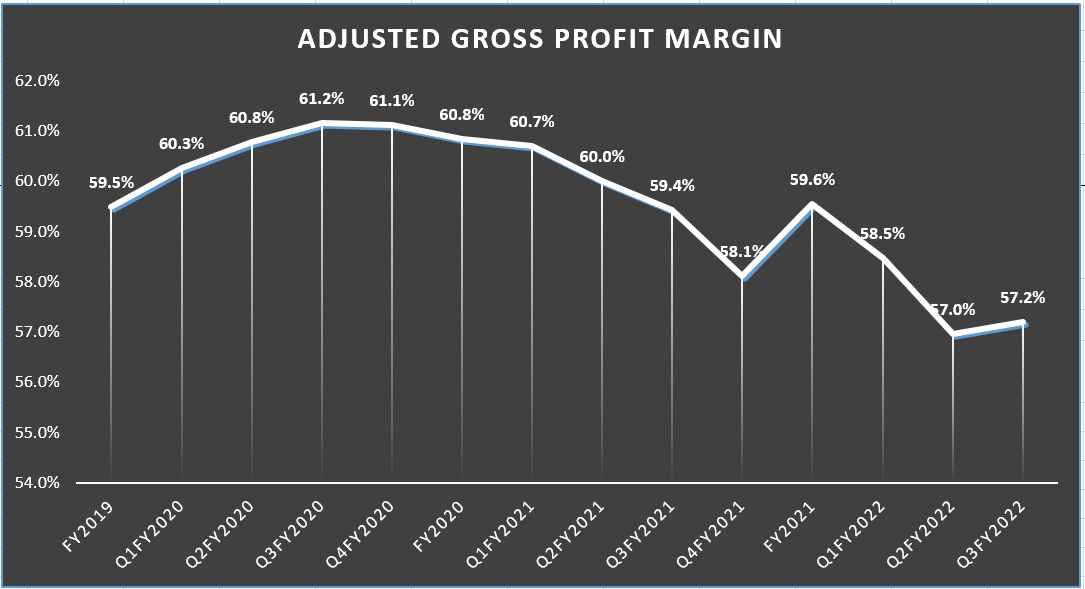

In the third quarter, the company reported an adjusted gross margin of 57.2%, down 220 bps Y/Y. The decline was a result of higher raw material and packaging material costs due to inflation. The company expects a $1.3 billion or 23% Y/Y increase in raw material costs for the full year 2022. The higher raw material costs were partially offset by pricing growth and cost savings. SG&A as a percentage of net sales, in the quarter, declined 40 bps Y/Y to 36.7%. The decline was a result of lower advertising investments.

CL’s Historic Gross Profit Margin (Company Data, GS Analytics)

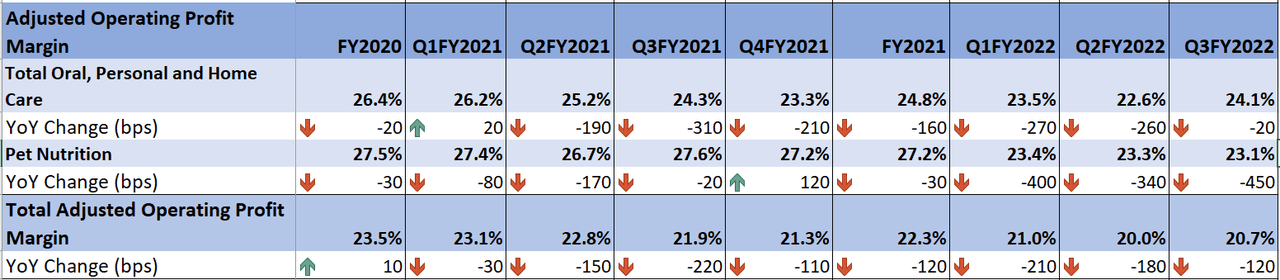

Turning to adjusted operating profit margin, the company reported a 20.7% adjusted operating margin, down 120 bps Y/Y. The decline was due to lower operating leverage as a result of volume decline, partially offset by lower SG&A expenses. In the Oral, Personal, and Home Care segment, the adjusted operating margin declined 20 bps Y/Y to 24.1%. The decline was a result of a 420 bps Y/Y and 330 bps Y/Y decline in Europe and Asia Pacific’s operating margins, respectively due to lower gross profit and lower volume generation. The decline was partially offset by an increase in North and Latin America and Africa/Eurasia operating margins, as a result of higher gross profit and sales leverage. Higher gross profit in these divisions reflected the 2022 Global Productivity Initiatives taken by the company to drive cost savings. Moving to Hill’s Pet Nutrition segment, the adjusted operating margin declined by 450 bps to 23.1%. The decline reflected lower gross profit due to higher inflationary raw material costs and volume declines due to capacity constraints in the quarter.

CL’s Historic Operating Profit Margin (Company Data, GS Analytics)

For the fourth quarter, the company expects the acquisition of Red Collar to have a negative impact on total company margins by approximately 100 bps. Looking forward, I believe margins will be negatively impacted by inflationary costs in the near term. However, in the medium to longer term, the company should be able to deliver gross and operating margin growth as inflationary headwinds moderate and the company benefits from 2022 global productivity initiatives. In the long term, margins should also benefit from cost reduction and resumption of volume growth.

Valuation and Conclusion

Colgate-Palmolive is currently trading at 24.39x 2023 consensus estimate of $3.17 which is a slight premium versus its 5-year average forward P/E of 24.15x. While FX and inflationary headwinds should continue to affect CL’s results in the near term, its medium to longer-term prospects look good and the company should be able to deliver growth through its business strategy, effective price realization, moderating inflation, and growth initiatives taken by the company. However, the company’s long-term prospects seem to be fully getting reflected in its stock price at the current valuations which leaves me on the sideline for now. Hence I have a neutral rating on the stock.

Be the first to comment