Chris McGrath/Getty Images News

Coinbase (NASDAQ:COIN) was founded in 2012 by Brian Armstrong, as a safe and transparent way to trade cryptocurrencies, during a time that was like the “wild wild west”. Since then the company has grown into the largest crypto exchange in the U.S.A and 2nd largest crypto exchange in the world, after Binance (BNB-USD).

Coinbase benefited massively from the wild popularity of crypto and crypto trading during the pandemic. The “Illusion of Control” is a dangerous phenomenon that can occur in the mind when trading and especially with cryptocurrency. When you believe an asset will go up because it did the previous day, this can cause a dangerous cycle until it all comes crashing down like a house of cards. This is exactly what we are seeing now as we enter the depths of a harsh “Crypto Winter”, with the price of Bitcoin (BTC-USD) down 70% from its all-time highs in November 2021. The recent collapse of the exchange FTX (FTT-USD) has rocked the crypto world even more. This has resulted in the young founder Sam Bankman-Fried seeing his net worth plummet from $26 billion to a mere $991 million. There are also a series of regulatory frameworks which are currently in the pipeline for development. I personally believe some regulation is a positive sign and it will actually cement Coinbase’s leading position, as more regulation could deter new competitors from entering the market.

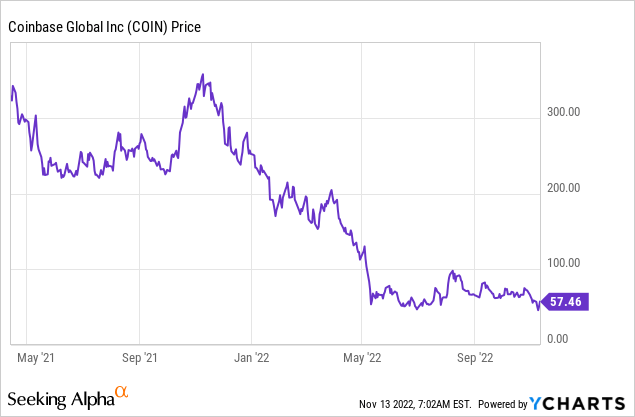

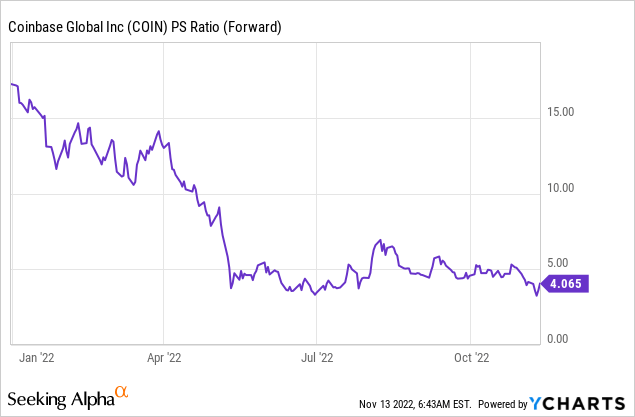

The share price of Coinbase has plummeted by over 80% from its all-time highs in November 2021, despite its Subscription and Services revenue increasing by over 40% in the quarter. Thus in this post I’m going to breakdown the company’s third-quarter results, give my thoughts on the FTX collapse, and reveal the company’s valuation, let’s dive in.

Third Quarter Results

Users and Volume

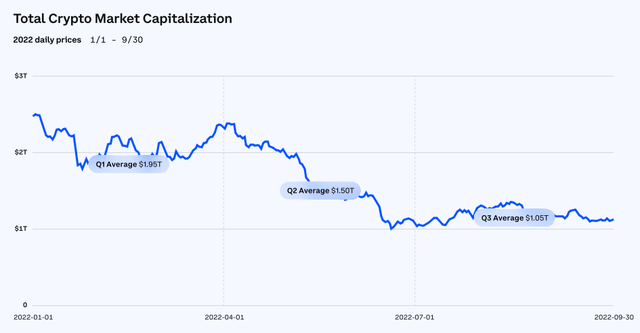

Coinbase generated mixed business and financial results for the third quarter of 2022. The company had 8.5 million Monthly Transacted Users [MTUs], which was lower than the 9 million MTUs in the second quarter of 2022. This has been driven by a prolonged “Crypto Winter”, as asset prices have been butchered and users have become more fearful. From the chart below you can see that the total crypto market capitalization was $1.95 trillion in Q1,22 and this was sliced nearly in half to just $1.05 trillion by Q3,22. As a comparison, we could see is the entire crypto ecosystem worth similar to Google (GOOG) (GOOGL), which trades at a $1.25 trillion market cap. It is difficult to say, we do know the crypto ecosystem has captured the minds of many people and excited them but crypto-assets do not create cash flow directly.

There is a silver lining in the “crypto winter”, Coinbase has noted that users are trading less, but still holding or “hodl’ing” assets on the platform (nice to see the company has kept its sense of humor). This is a similar pattern to the crypto crash of 2017, in which users saw assets crash. However, this time users can take advantage of staking savings products that didn’t exist in 2017, now users can earn up to 5.75% which isn’t bad.

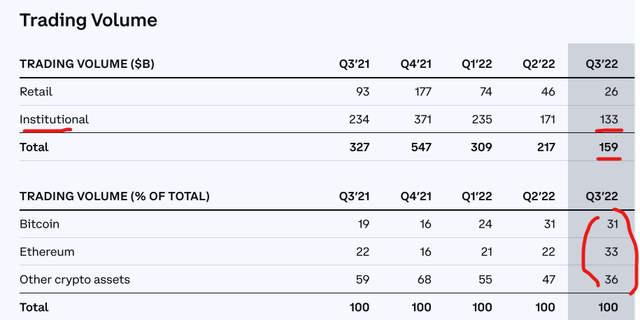

Coinbase has also grown the Institutional side of its platform as a portion of trading volume. In Q3,21, Institutional investors made up ~72% of trading volume, and by Q3,22 this figure has risen to ~84%. This has been driven by major partnerships such as the one with BlackRock the world’s largest asset manager. The BlackRock (BLK) deal was huge for Coinbase and gave a seal of approval to its technology and regulatory compliance status. In the third quarter, Coinbase built on this momentum and added popular U.K.-based brokerage platform Trading 212, The Chicago Bulls, Banque Syz (Switzerland), and Koch Disruptive Industries (KDT) to its platform.

Institutional volume is likely to be more consistent and less volatile. From my experience interviewing asset managers, I discovered many are open to carving out at least a 5% stake of their portfolio for a speculative hedge asset like Crypto. Given many institutional investors have billions of dollars in assets under management, this can add up to considerable sums. Rather than just relying on your average Joe trader to trade $500 per month.

Coinbase is well diversified across crypto asset classes with it split by approximately one-third across Bitcoin (31%), Ethereum (ETH-USD) (33%), and then Other Crypto assets at 36%.

FTX Collapse – Lehman Brothers Moment?

In Q3,22 Total Assets on the Coinbase Platform were $101 billion which surprisingly increased by 5% year over year from $96 billion in Q2,22. These surprise inflows came as crypto prices had a slight boost at the end of the quarter. However, with the collapse of rival exchange services provider FTX in mid-November, Crypto prices took a major hammering as shockwaves were sent through the market. If this is a “Lehman Brothers” moment, then it could mean a further cascade of collapses across the crypto ecosystem. Now although we aren’t seeing signs of this yet it is still early days. FTX was also hacked in a $650 million mega heist on Friday the 11th of November, as the company was on its knees.

The good news is Coinbase is a much more established firm than FTX, founded in 2012 vs 2019. It is also backed by some large institutional investors, such as Vanguard (6% of stock), BlackRock (3.33%), and Morgan Stanley (MS) (3.11%). Coinbase also has a simpler business model as a traditional crypto exchange, whereas FTX was more of a complex technology service provider exchange. Therefore those who are bullish on the long-term prospects of crypto and Coinbase could see this moment as an opportunity. This would be akin to investing into a bank like JPMorgan upon the collapse of Lehman brothers in 2008. Not every investor likes this style of “contrarian investing” and it requires a strong stomach with a long-term vision.

Revenue Review

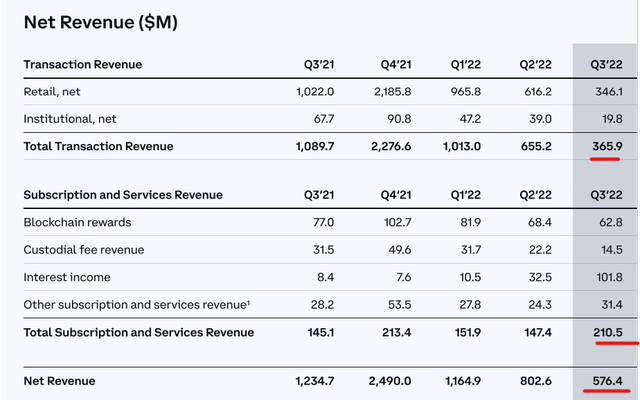

In Q3,22 Coinbase generated net revenue was $576 million, which was down an eye-watering 53% year over year. This was driven by the aforementioned slowdown in trading and the “crypto winter”. However, as mentioned prior it good to remember that the majority of users still have accounts and are holding their crypto currency. Therefore if crypto starts to rise in popularity again, Coinbase will be poised to capture economic rents. $366 million of its revenue is attributed to transaction revenue.

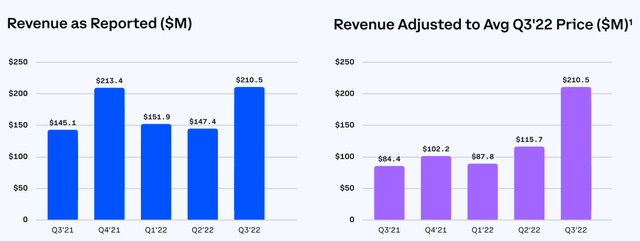

A silver lining for Coinbase was its strong boost in Subscription and Services revenue which increased by 42% quarter over quarter, to $210.5 million, which was fantastic. Adjusted for the average price in Q3, Subscription and services revenue increased by a blistering 148% year over year. This growth was driven by a 1,111% increase in Interest income. This was driven by the rising interest rate environment which benefits Coinbase in a couple of ways.

The first is because the company is part of the USD Coin [USDC] ecosystem, which is the leading US dollar stablecoin and has a market cap of ~$49 billion. The company also earns interest on its customer account money which is held in fiat currency, which equated to a staggering $6.6 billion in the third quarter of 2022. Its “Other” subscription and services revenue also increased by 29% quarter over quarter which was solid. This was driven by Coinbase One, a premium membership product, and Coinbase Cloud which could become the backbone infrastructure of Web3 and the Metaverse.

Subscription and Services Revenue (Q3,22)

Profitability and Expenses

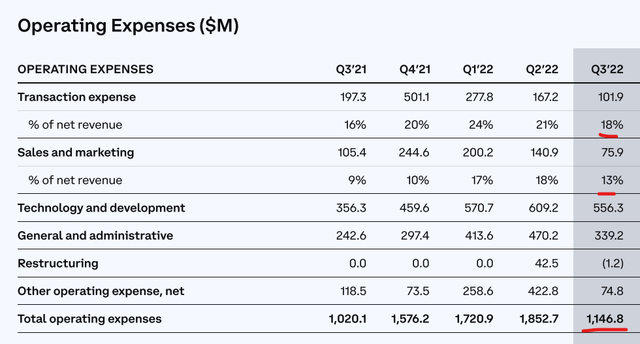

Coinbase generated earnings per share of negative $2.43 which missed analyst expectations by $0.05. Its net loss ballooned to $545 million and Adjusted EBITDA was negative $116 million. The good news is Transaction expenses actually declined by 39% Q/Q to $102 million, mainly thanks to lower trading volume. The shift in income derived from interest payments has also helped to generate operating leverage, as transaction expenses made up 18% of net revenue vs 21% in Q2,22. Sales and Marketing expenses were reduced by 46% Q/Q as Coinbase scaled back its marketing spend, as consumers will be less inclined to get involved in crypto which resulted in lower efficiency on advertising spending. Technology and Development expenses also decreased by 9% year over year to $556 million, as the company is driving greater efficiencies in its software.

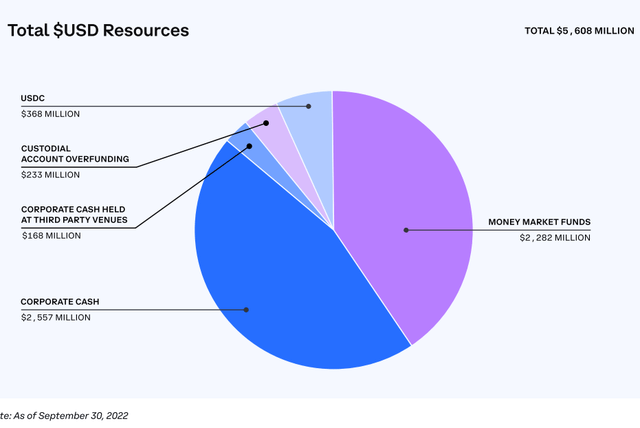

Coinbase has a solid balance sheet with $5.6 billion in U.S dollar liquidity. In addition, the company has $3.64 billion in total debt.

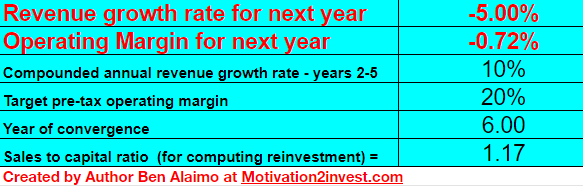

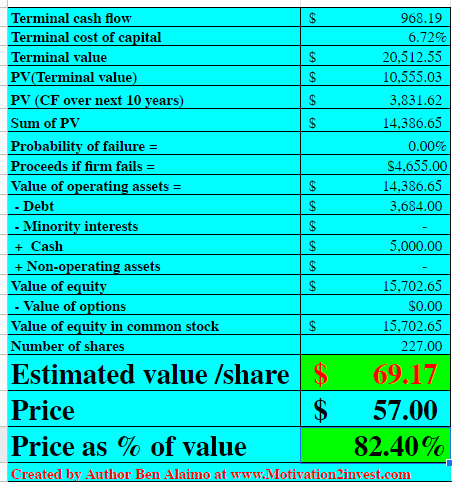

Advanced Valuation

In order to value Coinbase I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a continual decline in revenue of 5% for next year, driven by the prolonged “Crypto Winter”. However, in years 2 to 5, I have forecasted revenue growth of 10% per year. I expect this to be driven by continual growth in subscription revenue and favorable comparisons to the prior year.

Coinbase stock valuation 1 (created by author Ben at Motivation 2 Invest)

Optimistically, I am forecasting Coinbase to increase its pre-tax operating margin to 20% over the next 6 years. 23% is the average margin for the software industry, I have used this margin as the company provides a software-based finance product. The company is already managing to improve the efficiency of its platform, so I believe this is achievable if a crypto tailwind gives the stock a boost.

Coinbase stock valuation 2 (created by author Ben at Motivation 2 Invest)

As an extra datapoint Coinbase trades at a Price to Sales ratio = 4.1 which is significantly cheaper than historic levels of over 10.

Risks

Recession/Crypto Winter

Crypto prices had a huge boost in 2020, as a cash-rich consumer with plenty of time of their hands “dabbled” in crypto trading and a huge amount of speculation. But now the environment is very different, as high inflation and interest rates rate, the consumer has been squeezed and crypto has been put on hold or “Hodl” for many. Therefore I do expect short-term volatility in this market and a continued lack of trading/engagement. The collapse of FTX could be a Lehman brothers moment but also an opportunity for long term investors.

Final Thoughts

A bet on Coinbase is really a bet on the future of the cryptocurrency market. If you are a “believer” that decentralized finance will disrupt incumbents and a series of Web3 applications will take over the world, then Coinbase is the ideal way to play this trend. However, it should be noted that there is no guarantee crypto will bounce back, its future is based partly on a “killer application” and also on the excitement of the individual trader.

Be the first to comment