Hailshadow/iStock via Getty Images

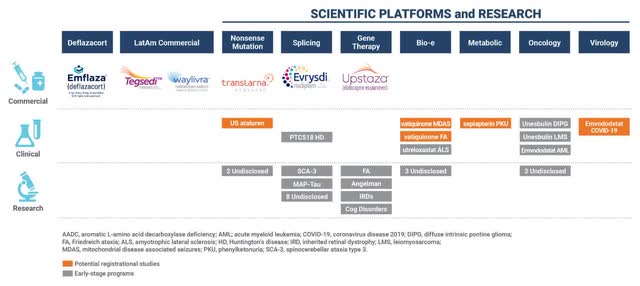

PTC Therapeutics (NASDAQ:PTCT) is a large ($2.5 billion cap) biopharmaceutical company focused on the development of medicines for rare disorders and globally commercializes 6 products (Figure 1). APHENITY is the first of 3 registration-directed trials reading out in the next 8 months or so; it is evaluating PTC923 (sepiapterin, formerly known as CNSA-001) for PKU at clinical sites in 15 countries. In 2018, the estimated total number of individuals with PKU from 321 countries was 454,580. If PTC can leverage the expected positive data into quick approvals in the respective regions, they can exceed their $3 billion revenue target (with 57% or $1.57 billion coming from 4 major pipeline candidates including PTC923) by 2026 in my view.

Figure 1. PTC Therapeutics Portfolio Pipeline

Background

PKU is also known as phenylalanine (Phe) hydroxylase (PAH) deficiency and in the U.S. has an incidence of 1 in 10,000 births and prevalence of 1 in 25,000, equating to around 13,300 currently. Newborns with untreated PKU may have increased levels of the essential amino acid Phe, which is not made by the body and must come from diet. PKU can cause permanent brain damage and other serious problems. Standard PKU classification is according to the pre-treatment blood Phe concentration, ranging from mild hyperphenylalaninemia (MHP) with concentrations of 120–600 μmol/L, to mild PKU (mPKU, 600–1,200 μmol/L), and to the severe or classical PKU (cPKU, >1,200 μmol/L). In the U.S., 14.2% were found to have MHP, 27.2% had mPKU, and 58.6% had cPKU. In May 2021, both the Food and Drug Administration (FDA) and European Commission granted Orphan Drug Designation (ODD) for PTC923 for the treatment of patients with hyperphenylalaninemia.

According to the American College of Medical Genetics and Genomics (ACMG) guidelines, treatment of mild and classical PKU is imperative. Although not all North American centers start at 360 μmol/L, European guidelines advise treatment at those Phe levels. Kuvan, from BioMarin Pharmaceutical Inc. (BMRN), and supplementation with large neutral amino acids, are the only pharmacotherapies in the ACMG and European guidelines. Kuvan (sapropterin dihydrochloride) is a synthetic form of the naturally occurring cofactor for PAH, tetrahydrobiopterin (BH4). Treatment is lifelong.

PTC923

PTC923 is a formulation of a natural precursor that is converted to BH4. The first evaluation of PTC923 in PKU subjects was a Phase 2 active-controlled crossover study in 24 adult subjects. They were randomized to three 7-day sequences of two doses of PTC923 (20 mg/kg/day and 60 mg/kg/day) and the most common dose of Kuvan, 20 mg/kg/day, separated by 7-day washout periods. The primary end point (or PEP) was mean blood Phe change from baseline, and the higher dose of PTC923 60 mg/kg was significantly more effective than Kuvan (−206.4 μmol/L vs −91.5 μmol/L; p = 0.0098). PTC923 60 mg/kg was also the only regimen that worked on 11 subjects with cPKU (−150.8 μmol/L; p = 0.0287). The trial was small and short, and the all-comers design recruited a relatively milder population than in routine clinical practice. APHENITY is a 6-week Phase 3 placebo-controlled study with the PEP of reduction in blood Phe levels. It includes a run-in phase during which potential subjects of all ages are treated with PTC923 for two weeks and only those demonstrating responses that bring Phe to <600 μmol/L are randomized.

Kuvan shows the way

If APHENITY is positive and leads to FDA approval, some insights can be gleaned from Kuvan’s past performance up to 2015, the last in which BioMarin only had exclusive rights to market Kuvan in the U.S. and Canada. Even though revenues missed expectations, Kuvan still netted $239.3 million for the year. BioMarin recognizes revenues from product sales upon delivery to specialty pharmacies or end-users, such as hospitals, which act as retailers. It included royalties earned ($2 million) from Kuvan product sold by erstwhile global partner Merck Serono (OTCPK:MKKGY) in Europe and approximates 4% of Merck’s world-wide sales ($50 million or so). Unlike with its other customers, BioMarin sold Kuvan to Merck at close to its manufacturing cost. As Kuvan gross margins were 83% for 2015, $8.5 million (17% of $50 million) and the royalty could be subtracted to yield $228.8 million as U.S. product sales.

In 2015, the Department of Veterans Affairs willingly paid $2,887.11 for a 120-count bottle of Kuvan 100 mg tablets. Medicaid’s gross spend (before rebates) per prescription (typically a 30-day supply) of Kuvan tablets was $7,540, which takes 3 bottles from a retailer’s inventory. Reasonable assumptions of a 75%/25% commercial vs Medicaid patient split and a 15% discount (dropping the cost to $6,409) to the government calculates to around 31,700 prescriptions, or an average of 7,900 scripts per quarter. Going by prevalence, there were 12,830 PKU patients in the U.S. that year, representing an estimated 62% penetration. The percentage may have gone up since then, but there is a ceiling based on the lack of effect on most cPKU patients.

Financials

PTC expects that sales of current products, together with cash and securities of $238.4 million as of September 30, plus a further $350 million in “low-cost, low-dilution capital” from a Blackstone (BX) partnership on October 27, would be sufficient to fund its operations for at least the next twelve months. Third quarter total revenues of $217.1 million represented a 56.5% year-over-year growth, while total operating expenses of $285.3 million only rose 23.1% YOY. However, non-operational expenses included a doubling of “other” expense (from $18.8 million to $38.1 million) mainly from unrealized foreign currency transaction losses. All in all, net loss before income tax expense of $127.2 million narrowed from last year and will likely continue to trend that way, supporting management’s assertions. With $650 million more in available support from the Blackstone collaboration to further PTC’s mission of delivering a new therapy every 2-3 years, there is no need to seek further financing until 2024.

Risks and takeaways

While results are anticipated by the end of Q4, some researchers think that the “estimated” primary completion date will be on February 9, 2023. Any delay is bad because it represents revenue that is forever lost. Of course, an unlikely APHENITY failure by not meeting its PEP, or a heretofore unseen safety signal could derail all the nice projections. SA rates PTCT a Hold based on bad grades on Valuation and Growth Quant factors, which probably can’t accurately take the pipeline into account. Nevertheless, biotechs are usually avoided in bear markets by investors looking for better stocks based on value/growth.

Conversely, if PTC923 is proven better than Kuvan, a conservatively similar 62% penetration of 13,300 is around 8,200 PKU patients (and monthly prescriptions). If priced the same as 2015 Kuvan, PTC would quickly realize over $60 million per quarter or a quarter of a billion annually. Obviously, those figures would be much larger if the benefit on cPKU is confirmed, as the total addressable market becomes the full spectrum of PKU. Furthermore, PTC’s options concerning the rest of the world is not included. With all its flaws, global sales of Kuvan maxed out at $463.4 million in 2019 as BioMarin went at it alone after reclaiming rights from Merck in 2016. Launched effectively, PTC923 could be a sleeper blockbuster.

Be the first to comment