http://www.fotogestoeber.de

Investment thesis

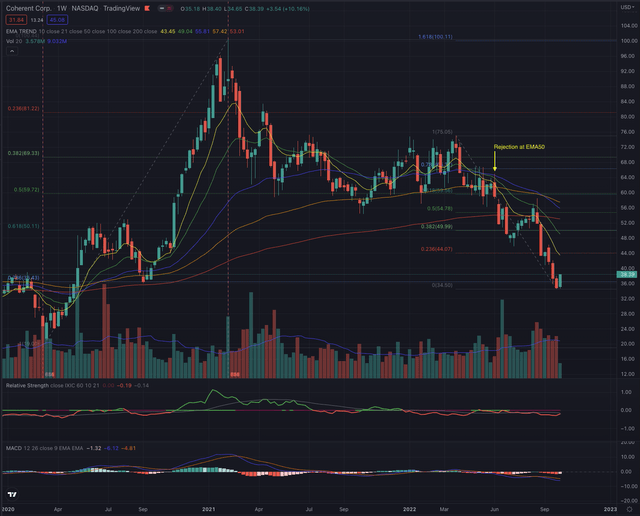

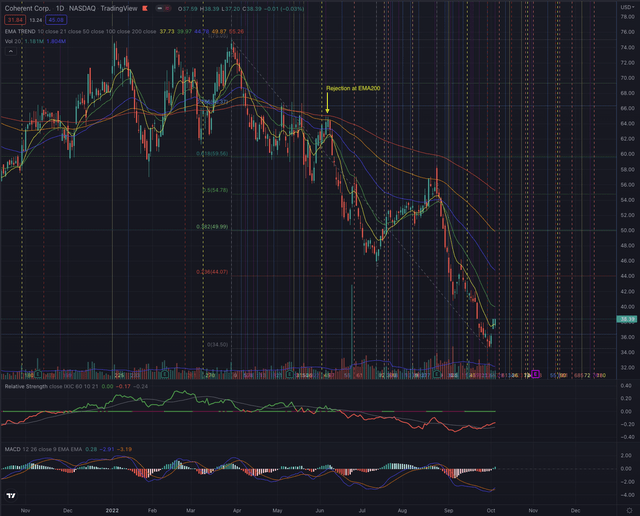

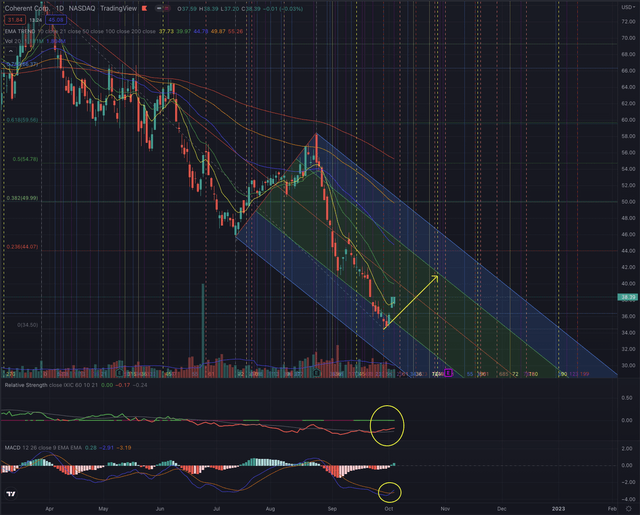

Coherent Corp. (NASDAQ:COHR) has been in a long-term downtrend since May 2022, after reporting relative strength since the beginning of the year, while the broader technology market began its decline. The company is facing significant challenges while it is digesting the recent acquisition but offers also substantial opportunities for long-term investors. The stock marked a new low on September 29, 2022, after a steep sell-off during the whole previous month, and is now likely forming a reversal, that could lead the stock to test its closest overhead resistance. As I underscored in my last article on COHR, fundamentally the company looks significantly undervalued and offers very attractive opportunities in most of its business segments. Given the technical opportunity for a rebound, I maintain my buy rating which I now confirm also in a short-term perspective. The recent price action suggests a higher likelihood for a first price target seen at $41 and if the overhead resistance can be overcome, a second target around $44. A failure of these assumptions could lead the stock to test the recent low and even fall further to its next support level seen at $31.80.

A quick look at the big picture

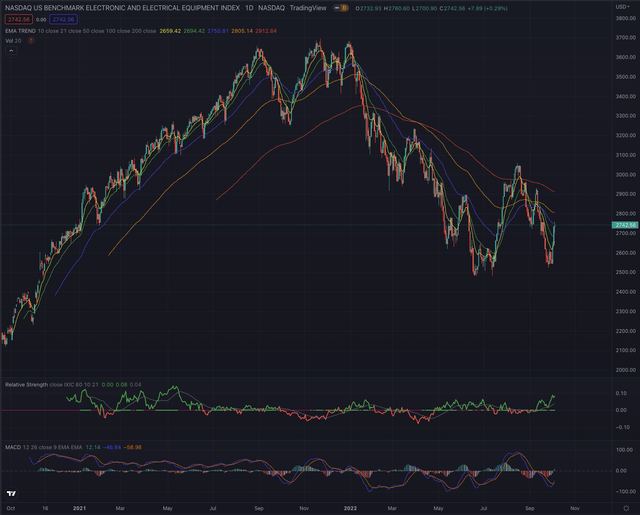

The US technology sector is among the three worst performers in the past year, after bottoming in June 2022 and rebounding significantly until mid-August, the sector has again turned out to be a loser in the last months, led by companies active in the electronics and computer distribution industry, infrastructure software providers, and semiconductor manufacturers, while companies in the solar industry, and electronic components manufacturers could perform better.

The NASDAQ US Benchmark Electronic and Electronic Equipment Index (NQUSB502020) topped at the end of December 2021 and has since severely corrected, losing 33% until July 14, 2022, before rallying 23% and now likely forming a bottom. The industry has shown sporadic relative strength since the beginning of its downtrend, which is now significantly increasing when compared to its main reference index. The benchmark looks quite extended and is likely building up positive momentum, after its significant drop during the last two months.

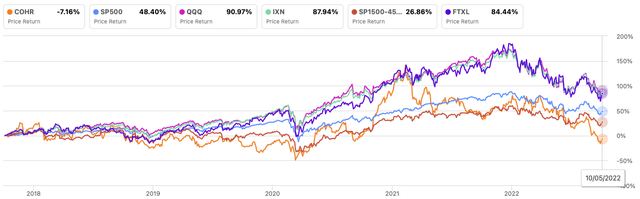

Looking back even further, Coherent mostly performed worse compared to major market indexes (SP500) and (QQQ) and the broader tech market iShares Global Tech ETF (NYSEARCA:IXN). Towards the end of 2020, the stock could show some significant relative strength, although it didn’t last long, as the technology market significantly outperformed the stock until today, resulting in -7.16% performance over the past 5 years. COHR’s performance is also significantly lower when compared to the S&P Composite 1500 Electronic Components Index Sub Industry (SP1500-45203015) and the First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL).

Author, using SeekingAlpha.com

Where are we now?

Since my last article II-VI Is A Powerful Choice In Multiple Secular Growth Trends published on June 5, where I wrote about the company’s fundamentals and gave my opinion on its undervaluation from a long-term perspective, the stock couldn’t maintain its relative strength, was rejected on its EMA200 on a daily scale, or its EMA50 on its weekly chart, and has been significantly dragged down, dropping over 45% until September 29.

While the stock is still in a long-term downtrend, some relative strength is now seemingly building up, also suggested by its crossing MACD. Despite that, it is still early to affirm that the recent bottom set at $34.50 on September 29, will hold or if the stock could face further weakness, as the sector and the most relevant industry for Coherent are both still in a strong downtrend and it will need substantial volume and conviction to build resilience and consistent relative strength.

What is coming next?

I expect the stock to continue to reduce its negative momentum and build up some relative strength, as the recent sell-off has been very intensive and quick. The stock has seemingly reached a strong support level, from which it could attempt to form a sound base, a process that would likely take some time, but the stock could now form a short-term rebound where it could try to reach its nearest resistance levels.

My estimations suggest that the most likely price targets, if the stock can overcome its closest trailing moving averages, are now situated at $41 and $44, with the ceiling of the downtrend channel seen as the most optimistic target in the near term. As the last few sessions showed a positive price action but it was not accompanied by a substantial spike in buy-side volume, the downside risk could still be substantially high in the near term, and investors should closely observe the price action if the stock approaches the recent bottom, with the next support seen around $31.80.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

As I wrote in my former article on Coherent, I consider the company to be significantly undervalued when considering its fundamentals. The company has a substantial moat in the industry and is well positioned in strong secular growth trends. Based on technical aspects, the stock is still in its long-term downtrend in stage 4 but has recently given signs of a possible short-term rebound and since this article focuses on purely technical aspects, I confirm my buy rating also in a more short-term view, but would definitely keep my stop-loss tight and set them close to the recent low or the next support level, as the downside risks are still significant and the general market is still in an unfavorable situation, facing major headwinds and high volatility.

Be the first to comment