Bim/E+ via Getty Images

Acadia Realty Trust (NYSE:AKR) is a retail-focused real estate investment trust (“REIT”) with an interest in over 200 properties via their core and fund portfolios.

In the core portfolio, which accounts for approximately 60% of total revenues, their wholly or partially owned properties primarily consist of street/urban retail and suburban shopping centers that are located primarily in high-barrier-to-entry markets in densely populated metropolitan areas, such as the Chicago and New York Metros. Their fund portfolio, on the other hand, serves as an investment vehicle for primarily opportunistic and value-add retail in street retail properties.

Together, the total portfolio generated nearly +$300M in revenues in 2021 and the total is on pace to increase by over 10% in 2022, based on the first half run rate.

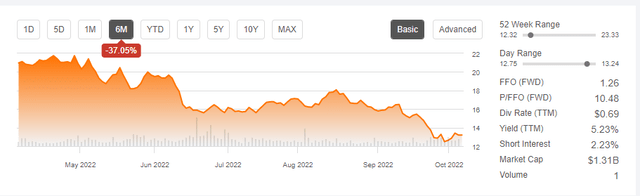

Since the last update on the stock, shares have fallen over 20% versus a decline of less than 10% in the broader S&P 500 index over the same period. Though a bit off its 52-week lows, AKR still trades nearly 40% lower than it did six months ago.

Seeking Alpha – AKR Trading Summary

With an abundance of opportunities in the overall market, it’s easy to overlook AKR, a smaller REIT in relation to a large pool of competitors in the retail property sector. In the coming periods, however, AKR is set to benefit from increasing occupancy levels and continued rental rate growth that will remain supported by contractual escalators on their growing portfolio of street retail. By ignoring the stock, prospective investors may, thus, be missing out on an attractive long-term buying opportunity at value pricing.

A Resilient Group Of Retailers Who Continue To Pay Their Bills

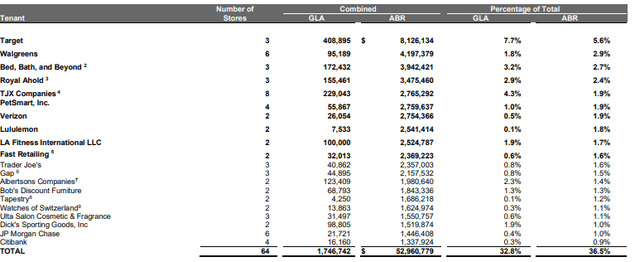

As a retail-focused REIT, one of the primary concerns for investors is the quality of AKR’s tenant base. In this regard, the core portfolio is well diversified across many well-known and time-tested retailers, such as Target (TGT), Walgreens (WBA), and The TJX Companies (TJX).

Overall, their top tenants represent just under 40% of annualized base rents (“ABR”), with no single tenant except TGT representing over 3% of total ABR.

Q2FY22 Investor Supplement – Summary Of Top Tenants By ABR

At 2.7% of total ABR and a top three tenant, exposure to Bed Bath & Beyond (BBBY) is not insignificant. While the overall health of the company is certainly a concern, the vast majority of the ABR exposure is from one store in San Francisco that has a lease term through 2028 and has historically been one of the higher productivity stores.

And over the years, AKR has tried to recapture all or a portion of BBBY’s space since their in-place rents are well below market rates. According to management, if they can get the space back, they believe they can double the current rates on the property. As such, it would work in favor for AKR if they were to lose BBBY. Sure, it would take time to backfill the property, but it’s unlikely the space will remain vacant for long.

Future Growth To Be Driven By Continued Increases In Commenced Occupancy

Further strength in the portfolio is evidenced by leased occupancy rates that remain stable from Q1 at 94.1%, but up 90 basis points (“bps”) from the end of 2021 and 170bps from Q2FY21. In addition, there is a spread of 360bps in commenced occupancy (“SNO”). As this pipeline is commenced, AKR should realize significant incremental rent growth of about 5%. Regarding the timeline, 85% of these leases are expected to commence in the second half of the year, with the majority in Q4, and the balance in 2023.

On their most recent business update at the beginning of September, management noted that due to new signings, the SNO pipeline grew over 30% to +$8.8M from +$6.7M at the end of Q2. This represents 6% of the company’s total core ABR.

AKR also noted on their update that AKR continues to achieve peak leasing volumes that are being accompanied with cash spreads in excess of 40% in certain markets, such as Soho, New York. Given the deterioration in the market outlook, this could come as a surprise to many investors. The company, however, has been consistently exceeding expectations.

A Strong Q2 Driven By Street Retail

This is evident in guidance that was again raised following their Q2 release that displayed NOI growth of 4.8%, led by their street portfolio, which grew nearly 7% during the quarter. As a result of this growth, the street/urban share of the core portfolio is now 70% versus 60% previously.

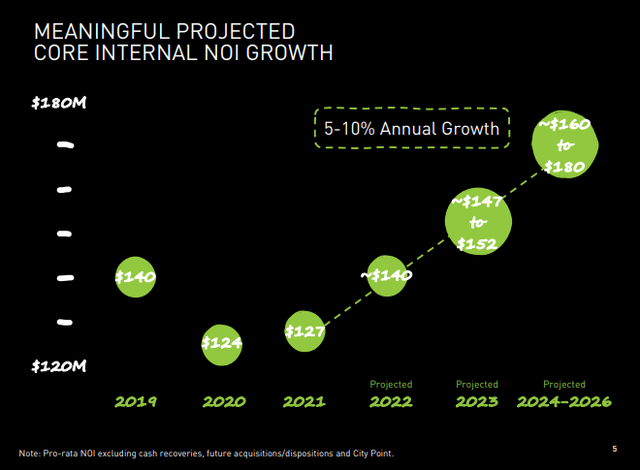

This will benefit AKR in later periods, as street retail benefits from greater contractual rate growth and a faster opportunity to achieve fair market rent resets than in their suburban assets. With rents at many of their streets at cyclical lows and a mark-to-market opportunity approaching 20% in some markets, this could yield significant gains and could result in AKR exceeding their targeted organic growth rate of 5-10% through 2026.

September 2022 Investor Presentation – Projected Organic NOI Growth Through 2026

Acadia Realty Trust’s Balance Sheet Remains Healthy

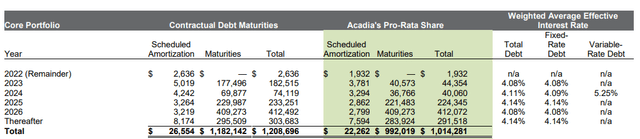

Aside from investor concerns regarding the retail landscape, which is being addressed through improving occupancy levels, stable cash collections, and continued leasing strength, another concern at the top of the list is debt-related risks resulting from rising interest rates.

In this regard, AKR is at little risk of a negative credit event, as they have manageable core debt maturities through 2026. In addition, substantially all their interest rate exposure is effectively fixed due to long-term hedging arrangements. While overall debt, including fund debt, is on the high side as a multiple of EBITDA, at 7.2x, it is still less than 50% of total capitalization.

Q2FY22 Investor Supplement – Summary Of Debt Maturities

Furthermore, AKR also has ample liquidity and maintains adequate coverage of both their fixed charges and their quarterly dividend payout. At just 70% of adjusted funds from operations (“FFO”), the current quarterly dividend is considered safe. And it appears to have sufficient room to grow further. A potential return to the pre-pandemic quarterly payout level of $0.29/share also can’t be ruled out, given the current strength in operations. For income investors, this would represent a material increase in the dividend from current levels.

A Retail-Focused REIT Not To Be Overlooked

AKR is a smaller, retail-focused REIT, but it’s not one to be overlooked. In Q2, results came in ahead of expectations, with favorable gains from commenced occupancy and rate growth in their street portfolio. In addition, at a 98% rate, cash collections are exhibiting no signs of impairment. And despite deteriorating economic conditions, full year guidance was increased.

Operating strength was further reinforced in their most recent business update in the beginning of September, where management noted that the company is continuing to achieve peak leasing volumes in their core portfolio, with cash spreads in excess of 40% in certain high growth markets, such as Soho, New York.

Though recessionary forces are one concern for investors, AKR’s portfolio has proved resilient through some of the most turbulent market conditions, including through the COVID-19 pandemic. One reason for this is due to the affluent demographic in AKR’s markets that results in a more stable sentiment index than the broader consumer population.

Further increases in commenced occupancy, in addition to rising contractual rent growth in their street portfolio is likely to drive earnings in future periods and will enable AKR to achieve their targeted organic NOI growth rate of between 5-10% through 2026. At these rates, a 10x multiple may not be appropriate, especially since shares were trading at 18x at the end of 2019 and 11.4x at the end of 2020.

Even at a 13x multiple, shares would have implied upside of nearly 25%. This would be on top of an annual dividend that is currently yielding over 5% and is still set at a payout level that is materially below the annualized amount paid at the beginning of 2020. Though there are plenty of buying opportunities in the market today, AKR is one not to be ignored.

Be the first to comment