NeilLockhart

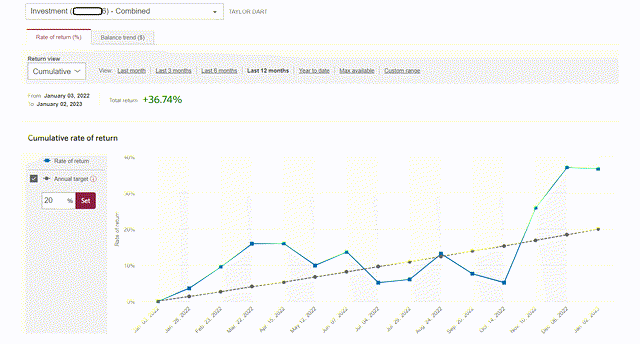

Just over five months ago, I wrote on Coeur Mining (NYSE:CDE), noting that while the stock was reasonably valued, I saw better opportunities elsewhere in the sector. Since then, some of my favorite ideas, like Agnico Eagle (AEM), and i-80 Gold (IAUX), have performed well, and while Coeur has seen a recovery in its share price, it has underperformed its silver peers. This decision to stick to the simpler stories with the best orebodies where management was executing flawlessly helped me to post a positive return in 2022. However, some investors might wonder if Coeur (CDE) is worth a second look after lagging on this rally, especially after the excellent sale of its non-core Nevada assets. Let’s dig into the stock below and its recent developments:

2022 Returns (2022 Returns, Author’s Photo & Account)

Q3 Results

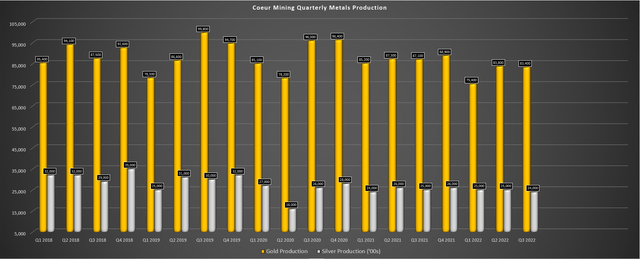

Coeur Mining released its Q3 results in November, reporting quarterly production of ~83,400 ounces of gold and ~2.4 million ounces of silver. This represented a continued trend lower in metals production, with gold and silver output down 4% year-over-year and more than 15% from pre-COVID-19 levels (Q3 2019). This can be attributed to lower grades at Palmarejo and Rochester, two of its most significant contributors, and its Silvertip Mine heading into care & maintenance. Combined with softer metals and despite the benefit of smart gold hedging, Coeur’s revenue dipped to $183.0 million in Q3, down 12% from the year-ago period. The weaker sales and higher costs resulted in an adjusted net loss of $44.7 million, a significant increase from Q3 2021 levels.

Coeur Mining – Quarterly Metals Production (Company Filings, Author’s Chart)

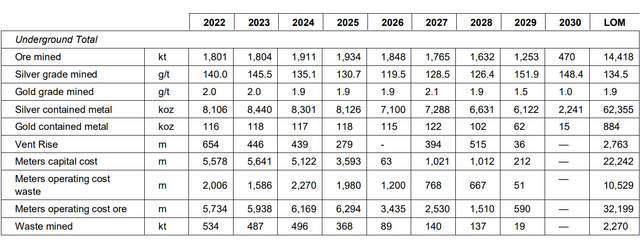

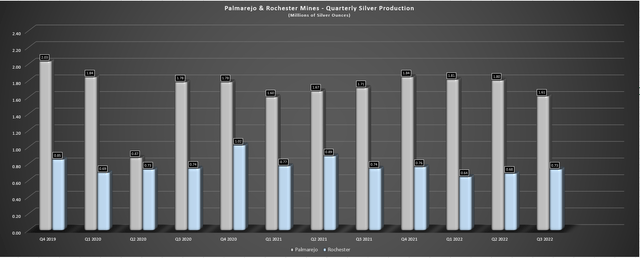

Digging into the operations a little closer, we can see that while Rochester’s silver production has remained relatively static on a three-year basis, Palmarejo’s silver production has continued to trend lower since FY2019 levels, sliding to ~1.61 million ounces in Q3 2022. This is attributed to the much lower silver grades at the mine, partially offset by improved recovery rates, with silver grades down from ~4.9 ounces per ton to ~3.5 ounces per ton in the three-year period. Unfortunately, gold grades have also fallen sharply from pre-COVID-19 levels, down from 0.09 ounces per ton to ~0.05 ounces per ton. Unfortunately, this trend isn’t expected to improve post-2023, with silver/gold grades expected to trend lower under the current mine plan.

Palmarejo Grades (Company Filings) Palmarejo/Rochester – Silver Production (Company Filings, Author’s Chart)

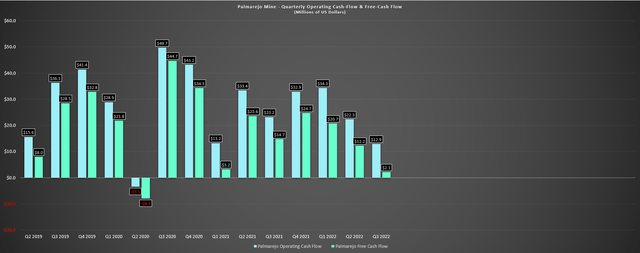

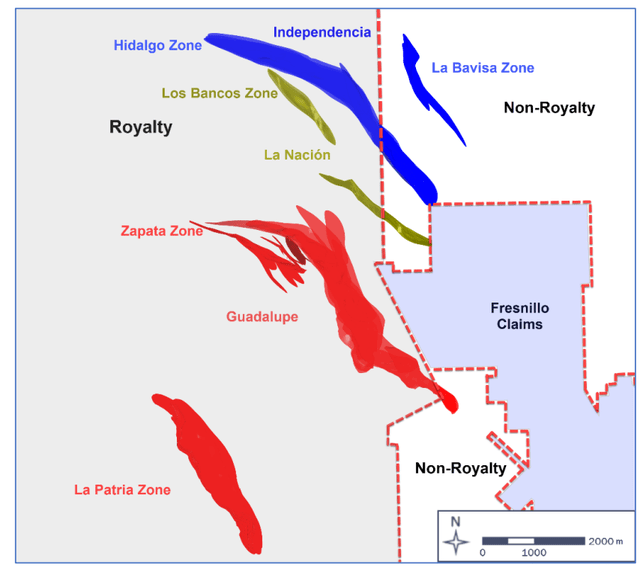

Based on the lower metals sales and the impact of inflationary pressures, cash flow dipped to just $12.9 million in Q3 2022, a nearly 50% decline vs. year-ago levels. Meanwhile, free cash flow came in at just $2.1 million, impacted by higher capital expenditures, higher operating costs, and lower silver prices. Given that Palmarejo is one of Coeur’s more consistent contributors to free cash, the sharp decline in profitability and free cash flow didn’t help its consolidated free cash flow, which is already severely impacted by elevated spending as work continues on the three-year POA 11 build at Rochester. That said, the higher silver prices we’re seeing will help out, and Coeur hopes to be able to define resources to the east of Franco’s (FNV) streaming ground longer-term (highlighted below), which would improve margins.

Palmarejo – Quarterly Operating Cash Flow & Free Cash Flow (Company Filings, Author’s Chart) Palmarejo Operations & Royalty Ground (Company Filings)

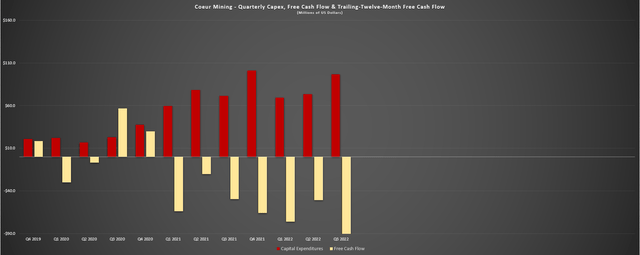

At the company’s US operations, Rochester had another high-cost quarter with a significant cash outflow as it’s in the heart of construction activities at POA 11, and while Wharf and Kensington had decent quarters, profitability was impacted by inflationary pressures on consumables. This resulted in Coeur reporting another quarter of negative free cash flow despite having one of the stronger realized gold prices in the period ($1,702/oz) among its peers due to the benefit of its hedges. While higher metals prices will help to boost sales in Q3, and it’s possible we may be seeing some easing of inflationary pressures, I would expect to see continued negative free cash flow for Coeur as Rochester nears the finish line with the project ~70% complete as of year-end with $200 million in capex planned for 2023 at this asset alone.

Coeur Mining – Quarterly Capex & Free Cash Flow (Company Filings, Author’s Chart)

To summarize, this wasn’t a great quarter for Coeur, but its hedges did help to soften the blow, and while it saw a sharp increase in costs, Coeur’s one mine in care & maintenance continues to see phenomenal exploration results, as is often the case with carbonate replacement deposits [CRDs]. Coeur noted that it is looking at a restart at the latter portion of this decade that will require a new EIA but could look at a 2,250-3,250 tonne per day operation, up to triple the current footprint. While this would significantly increase production, a re-sizing won’t be cheap, with capex likely to come in above $625 million with an expansion of tailings capacity and associated infrastructure and a larger camp. Hence, a partner will likely be needed without consistent $1,950/oz plus gold prices to bolster free cash flow.

Recent Developments & Future Outlook

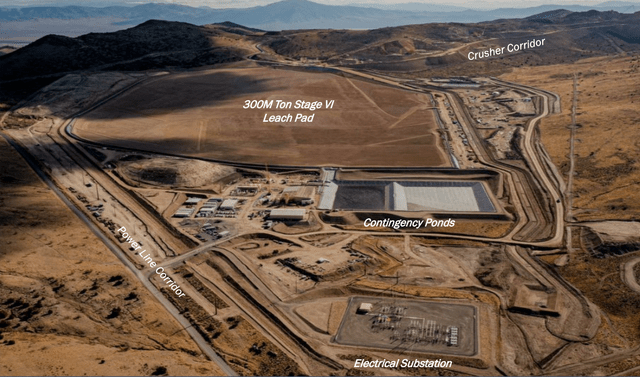

Moving over to recent developments, the Rochester Expansion is a game-changer for Coeur. This operation, which is mediocre at best from a profitability standpoint, will see a significant decline in unit costs with the benefit of economies of scale. In fact, Rochester is expected to churn out at least $80 million per year in free cash flow (first three years post-expansion) with the new ~32 million ton per annum operation. In terms of construction, the Stage VI Leach Pad is complete, and the Merrill-Crowe Process Plant and crushing circuit are expected to be completed by Q3.

Rochester Expansion Progress (Company Presentation)

Unfortunately, the updated capex estimate of ~$660 million is well above initial plans of ~$400 million, which has led to more share dilution and a weaker balance sheet than Coeur had planned when it green-lighted the operation. Hence, while we are nearing the end of this three-year build that will dramatically improve Coeur’s production profile, as shown below, the production growth per share is well below what some investors might have been hoping for, with a consistent trend higher in shares outstanding. That said, with ~$380 million in liquidity following the recent sale of its non-core Nevada assets for a great price (Sterling/Crown), investors can breathe a sigh of relief that this trend of consistent share dilution may finally be over.

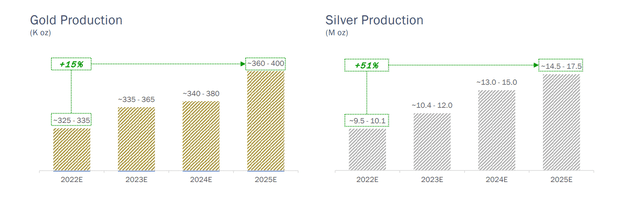

Future Production Profile (Company Presentation)

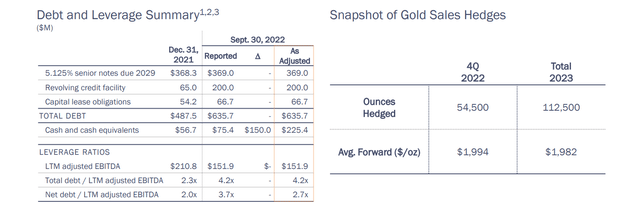

As shown in the below chart, the $150 million sale of Sterling/Crown has helped to improve Coeur’s leverage ratios and net debt position. This is evidenced by net debt of ~$410 million, down from ~$430 million heading into 2022, despite a very high capex year and a challenging operating environment (low gold prices, inflationary pressures). Meanwhile, Coeur will benefit from gold hedges above $1,980/oz (167,000 ounces), easing its cash burn over the next few quarters when combined with the recovery in the silver price. Still, Coeur has one of the weaker balance sheets sector-wide among its peers, so investors certainly can’t look forward to dividends and buybacks here like we’re seeing from Barrick (GOLD).

Coeur – Debt & Leverage (Company Presentation)

Overall, I think the sale of Coeur’s non-core assets in Nevada was a brilliant move, and the company was patient enough to find the right buyer and get a great price for these assets. This has likely back-stopped future share dilution assuming the gold price stays above $1,600/oz from now on, and investors can now look forward to the prize: a ~15% increase in gold production and ~50% increase in silver production looking out to 2025. Let’s take a look at the valuation to see whether investors are getting this growth (recovery story, to be more accurate) for a reasonable price.

Valuation & Technical Picture

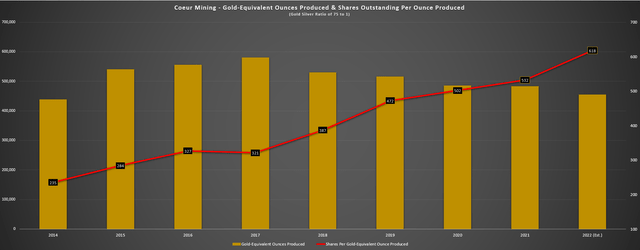

Coeur Mining has ~281 million shares and a share price of US$3.60, giving it a market cap of ~$1.01 billion and an enterprise value of ~$1.42 billion. This may seem like a very attractive valuation for a future ~600,000-ounce producer on a gold-equivalent ounce [GEO] basis, especially when Alamos Gold (AGI) is trading at a market cap of ~$4.0 billion and expected to have a similar 2026 production profile. That said, Alamos is expected to have a much more attractive cost profile (sub $950/oz consolidated AISC), and Coeur’s operations are much higher cost, though consolidated costs will improve meaningfully once unit costs drop due to economies of scale at its Rochester Mine. Plus, while Alamos has been buying back shares, Coeur has been a serial share diluter with a hideous trend in production growth per share.

Coeur Mining – Estimated Annual Production vs. Shares Per Gold-Equivalent Ounce Of Production (Company Filings, Author’s Chart & Estimates)

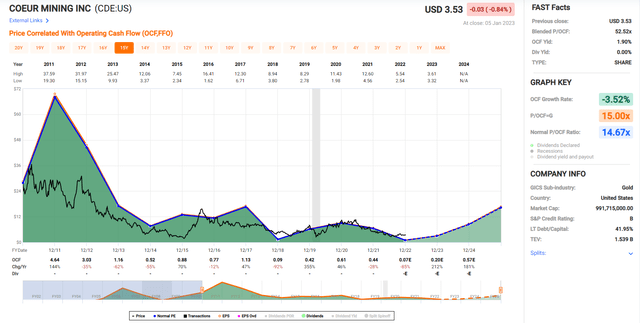

As the chart above shows, the number of shares outstanding per GEO produced increased by ~160% over the last eight years, and while this figure will drop as the Rochester Expansion ramps up, this is still one of the worst production per share trends sector-wide. So, while Coeur may appear very cheap relative to some of its peers, I believe this is somewhat justified given the very poor track record. Meanwhile, looking at the below chart, some investors might argue that CDE is significantly undervalued, trading at just a fraction of its historical cash flow multiple (14.7). While this is certainly true based on FY2024 estimates ($0.57), I don’t see any justification for Coeur to trade at a premium vs. much better-run producers with higher margins like Hecla (HL), Agnico Eagle (AEM), and others.

CDE – Historical Cash Flow Multiple & Forward Estimates (FAST Graphs)

Using what I believe to be a more conservative multiple of 6.0x cash flow estimates, I see a fair value for Coeur of US$3.42. I believe it makes sense to assign an additional $160 million [US$0.57] in value to Silvertip, one of the highest-grade CRD projects globally and a past producer. Whether this is developed independently, joint-ventured, or divested, I would argue that this fair value isn’t unreasonable for the asset, with this value being balanced against the long timeline to move it into operation. Putting it together, I see a fair value for Coeur of US$4.00 per share. While this points to an 8% upside from a current share price of US$3.70, I prefer a minimum 40% discount to fair value when buying small-cap cyclical stocks, meaning that CDE would need to dip below US$2.40 to enter a low-risk buy zone.

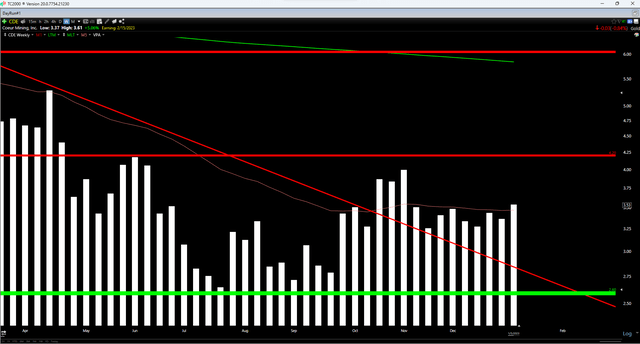

Finally, if we look at CDE’s technical picture, we can see that the stock appears to have strong support at $2.60, with no strong resistance until $4.20. With the stock currently trading at $3.60, it is sitting slightly above the mid-point of this range with a reward/risk ratio of 0.60 to 1.0. This ratio is well below the 5/1 reward/risk ratio I prefer to justify entering new positions in small-cap names. Plus, I typically pass on industry laggards altogether, given that there’s simply no need to stoop to owning the bottom half of stocks in a sector. Hence, I do not see this as a low-risk buying opportunity from a valuation or technical standpoint, and CDE would need to dip to $2.40 or lower for me to become remotely interested in the stock.

Summary

Coeur Mining has made some decent moves over the past year, including proactive hedging that paid off very nicely and the divestment of its Nevada property at a very attractive price that has helped to give it an additional cash buffer and improve its leverage ratios. Meanwhile, the company is on the eve of a major expansion that will transform its flagship operation, translating to a significant improvement in free cash flow post-2023. Still, I believe there’s an elevated risk of buying industry laggards after a sector has already made a significant move off its lows, and CDE is the definition of a laggard, even if it is in the turnaround phase. For this reason, I see Coeur as an Avoid, and I continue to focus on more attractive names elsewhere in the sector.

Be the first to comment