karandaev

Investing to me is about a balance between investing in safety and conservative growth. Ideally, I want both – as well as a good upside. However, there are companies where the majority of the reasoning behind investing in the business is that the company offers impressive overall safety – meaning it’s unlikely to drop that far in the event of an eventual downturn.

There are plenty of examples of such investments. And one class of them that I like is qualitative companies in the consumer defensive segment – like Coca-Cola (NASDAQ:COKE), the bottler, not the brand.

Coca-Cola Consolidated – an update on the company

I looked at the company a few months back and established a thesis on the company. The business distributes beverages and soft drinks (non-alcoholic) across 14 U.S states, and it’s been around for over 100 years. Sales are not only aimed at Coca-Cola-based soft drinks, but the company also has a 17% business exposure to peers like Monster (MNST) and Dr Pepper (KDP). Coca-Cola is, in fact, not even a majority shareholder, but owns around 5% of the company. The company does have a majority shareholder in the Harrison family, which owns around 86% of the business’s voting power through a complex array of trusts and companies.

As would be suggested by the 0.2% yield, the company is to a very high degree focused on the capital appreciation and earnings growth, as opposed to dividend growth and yield. As expected, credit rating safety at investment grade is part of the company’s business, and it has a conservative debt/capital of below 45%.

In essence, the company’s lifeblood is the bottling and distribution of Coke and non-Coke beverages and everything involved in the process. The company does cans, plastic bottles, as well as post-mix products for retailers such as food chains, that allows for the fountain mixing of sodas by the addition of carbonated water with syrup. The company has the allowance of KO to distribute, promote, market, and sell KO products according to specific agreements. The company makes quarterly sub-bottling payments to Coca-Cola for this set of rights. The company has similar agreements with all of the companies for which the company bottles and distributes beverages, including KDP and MNST.

COKE distributes to five main markets with around 60 million customers from 60 distribution centers. It’s a US-only business, and unlike many businesses we look at today, it actually owns most of its PP&E. It’s a commodity-focused business, with primary inputs of plastic bottles, aluminum cans, sweeteners, carbon dioxide, and packaging materials – all of which have seen price increases over the past couple of months.

What this means is that the company has a correlation or risk to input costs from plastics, alumina, corn, sweetener, and other products.

The company’s products are sold through various distribution channels such as retail stores, supermarkets, DTC channels, club stores, convenience stores, drug stores, and direct on-location sales (such as restaurants, schools, amusement parks, etc.) as well as vending machines.

The company’s primary customers are Walmart (WMT) and Kroger (KR). When you own this sort of business and two customers make up for a full quarter of the company’s sales, the loss of such customers could have a significantly detrimental impact on the company and its earnings. However, for the time being, there are no signs whatsoever that this seems to be the case with regard to these customers.

So, the same question would be relevant as in my last article – Why COKE over KO?

The answer would be the same – returns. COKE has delivered substantially better returns than KO has on a 20-year basis. KO has given investors a 20-year RoR of just south of 200% – which is of course very nice, even if it’s slightly below market. Looking at investment performance is a binary activity – A is better than B over time. COKE has yielded returns of close to 1,400%, turning an initial investment of $10,000 into almost $140,000. Therefore, COKE is better than KO (over the past 20 years).

Will this be the same going forward?

The signals out of Charlotte, N.C are that the company’s positive trend remains unbroken. COKE delivered strong operating results, with a double-digit 11% net sales increase in the face of the overall share price decline, with physical case volume increasing by about 1%.

The obvious implication here is that the sales increase was not a result of a massively or outsized increase in demand for Coca-Cola or any of the other beverages the company bottles, but rather price increases. The company reports a respectable volume increase of around 1.8% in sparkling, with still beverages up around 0.6%. The company is clear in its communication, delivering strong sales momentum.

In the bottom line, the company managed to preserve its margins. Despite increased sales, the difference was enough to preserve gross margins but no more than that. Adjusted gross margins were up when accounting for price realization and volume growth, but the picture is clear – COKE is managing the overall headwinds of inflation and input cost increases, like most other companies.

There also remains a not-inconsiderable amount of supply chain issues affecting the company, as well as overall other cost increases. We see this with a significant SD&A cost increase of 8%, which came due to an increase in overall labor costs.

However, consumer demand remains strong for the company’s products, and COKE is pushing affordable packing solutions across the brand portfolio, believing these to be a significant part of the future for the company.

In the end, operating income was up 22% GAAP and 33% on an adjusted basis, while cash flows, which I view as somewhat more important, were down. Strong operating performance was led by top-line growth, but OCF was impacted by seasonal changes in working capital as well as the timing of payables and receivables. I refer you to my first article, where the seasonality of the company is discussed more.

Let’s look at what this relatively stable and positive quarter has done to impact the valuation of COKE.

COKE – The valuation

As mentioned in my first article on COKE, this company trades at a general premium to any normal P/E ratio. Much like KO, the multiples for KO are high – even high at times. This is owing to the company’s impressive, recent-year growth rates.

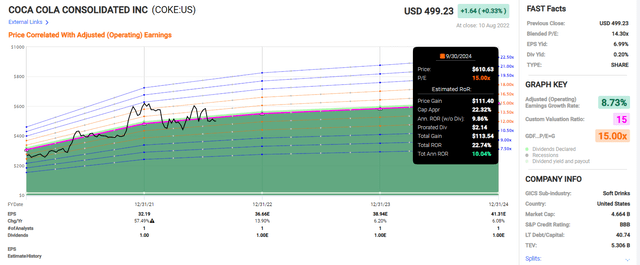

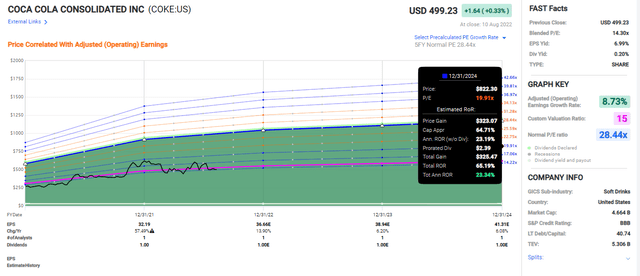

In the past 5 years, COKE has averaged and adjusted EPS growth rate of 33.27%. Going forward, it’s expected to perform much more moderately than this, with an average annual forecasted growth rate of around 8% per year until the 2024E fiscal.

This means that we probably should not put COKE at 25-30x P/E multiples, as some have been looking at.

The good news is that even in the case of only a 15x P/E multiple on an average weighted basis, the company, under current forecasts, will see an upside on an annual basis of close to double digits.

As I said – a dividend isn’t something you should be caring about here. The company has one – it’s a buck per share a year – but this dividend hasn’t been touched in over 20 years, and it’s unlikely to be bumped or shifted in the future. No one expects it – not other analysts, or myself.

The current dividend yield comes to a total of 0.2% – that’s it.

Still, upside exists, as we can see, and that upside is double digits. You can think of it like this every time someone in the company’s serving area buys a bottle of soda or still beverage that the company bottles and distributes, you get a share of the profit.

Given the ubiquitousness of the company’s products, that’s a pretty appealing thought and investment to be making. I wrote earlier that:

While I would prefer to invest in COKE at around 15X P/E, which isn’t at all impossible looking at company valuation history, the current P/E is close to 17-18X, depending on what earnings normalization you consider to be accurate here.

(Source: COKE Article)

I am unwilling to assign COKE a higher premium than a 20X P/E even at the highest end, despite the 20-year average coming to 24X. I believe there’s a bit too much of that growth exuberance baked into assumptions there, and past performance is sometimes not as indicative of future performance as we might like for it to be.

If we consider that 20x P/E premium to be in any way valid – as the market certainly does over time, the upside that we can consider for COKE balloons to more than twice the conservative level.

Remember, at least half of the argument for this company is that this company is distributing/bottling beloved soft drinks, teas, sodas, water, and energy drinks.

There’s something to be said for taking shelter from the storm in a safety enhanced by Maslow’s Hierarchy of Needs. Certainly, drinks are at a very foundational level of that pyramid. Even if you can’t argue that people “need” Coca-Cola, Dr Pepper, or some of the many other drinks that the company distributes, to survive, I will argue freely with you that these products are much more foundational than say investing in an e-automotive company, or something similar. On that basis, there is an argument to be made for investing in the company.

I have, along the line of that thinking and based on my previous statement of considering the company attractive at a 15x P/E, begun investing in COKE by buying a small number of shares (they cost nearly $500 a piece, after all, and I can’t trade fractional shares).

Also note that the company hasn’t often diluted its equity, meaning a single share of COKE actually costs almost $500/share, which may be prohibitive to some.

However, if you ask me to give you a PT for COKE, then my answer will be $590/share, a conservative ~20X P/E for 2022.

That means this company retains its “BUY”, and that’s where I maintain my position. I am now LONG COKE.

Thesis

My thesis for COKE is relatively simple:

- COKE is an advantageous soft drink/beverage investment with bottling and manufacturing capacity across 5 attractive US regions. This makes the company a guaranteed cash cow, with exposures to things like input inflation, CapEx and risks associated to companies like this – including customer concentration.

- However, the company has a superb track record of delivering value to its shareholders, almost quadrupling KO 20-year returns, and is well managed, even if its dividend leaves something to be desired.

- At a slight premium, I still view KO as a worthy “BUY” with a 20X P/E long-term target, indicating a PT of $590/share.

- Because of that, I’m going with a “BUY” here.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation but hovers within a fair value or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

COKE is currently a “BUY”, in accordance with this approach.

The company also fulfills several of my investment criteria (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company is currently “cheap” (enough).

- This company pays a well-covered dividend.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment