Marina113/iStock Editorial via Getty Images

After our Exor’s analysis, today we are back to comment on one of the most important investments in the holding. We already anticipated that CNH Industrial (NYSE:CNHI) was thinking to leave Piazza Affari (Milan’s stock exchange) as already done by its controlling company. During the Q3 Q&A call, this was announced by Scott Wine, the company’s CEO, who also confirmed that no decision has yet been taken, but at the board level, they are considering the advantages & disadvantages. After the Iveco spin-off, many Wall Street analysts are asking CNH Industrial to be more comparable and compared with its closest US peers. This was also reported in the company’s press release that announced the following: “CNH Industrial will now voluntarily file annual and quarterly reports on Forms 10-K and 10-Q, as used by US domestic filers”. This should definitely support CNH’s higher liquidity and will be able to reduce some discounts versus its competitors. The next key development would be to change its dividend polity from an annual payment to a quarterly payment (in line with its peers). In fact, after the third quarter results, the North American region is now the most important area for CNH.

Q3 Results

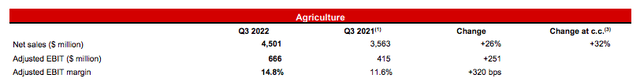

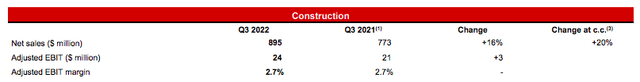

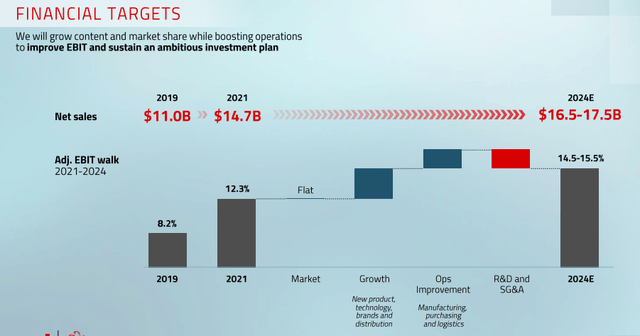

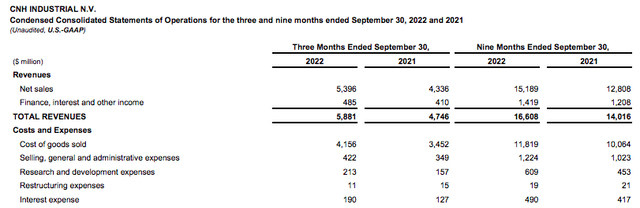

In our initiation of coverage, we positively view the company’s MACRO and MICRO upside. And the Q3 results were above our previous expectations, and for this reason, we are not surprised to see CNH’s stock price rebound. Speaking of numbers, top-line sales increased to $5.88 billion from $4.74 billion compared to the same quarter last year, with an adjusted operating profit from $420 to $670 million. In detail, the adjusted EBIT margin of the agriculture segment reached record levels close to 15% (Fig 1), while the construction division was in line with its previous year’s number and recorded the same results at 2.7% (Fig 2). What is important to report is the fact that the company is accelerating its profitability to achieve its target for the 2024 business plan (Fig 3). Indeed, thanks to supportive volume growth, a higher price development, and a better product mix, CNH was able to increase its core EBIT margin by 270 basis points, from 9.7% to 12.4%. Going down to the P&L analysis, the Italian-American company closed the third quarter net profits with a clear increase of 18% to $559 million. Consequently, EPS reached $0.41, largely beating expectations of $0.32.

Last time, we concluded our analysis with a note on interest rate development. In the first half year, the company closed its accounts with more than $20 billion in debt and we forecasted higher expenses in interest rate, suggesting that this negative development will lower CNH’s FCF evolution. This is exactly what happened (Fig 3). In Q3, the company paid $190 million in expenses compared to the $127 million recorded last year. Debt obligation also slightly increased versus the HY numbers.

Adj. EBIT Agriculture division

Fig 1

Adj. EBIT Construction division

Fig 2

CNH’s financial target 2024, Source: Capital Market Day 2022 (Agriculture Segment presentation) CNH Industrial interest expenses evolution, Source: CNH Industrial Q3 press release (Fig 3)

Conclusion and Valuation

Thanks to these surprising numbers and despite the uncertainties related to inflation and war in Ukraine, CNH raised its guidance for the full year. In detail, despite unfavorable exchange rates, revenue will grow between 16-18% compared to 2021. In addition, CNH’s FCF of industrial activities remained positive in the July-September period, confirming the goal of generating over $1 billion for 2022. The company’s order book remains robust, in the wake of high grain prices which continue to support the demand for products in the agriculture segment. If we are pricing in this better margin development, even considering higher interest expenses, we should review upwards our valuation. However, the company is in line with its historical average. Here at the Lab, we know that CNH is undervalued versus its US competitors. This is not a piece of news, it has always been. With an 11x P/E ratio, we believe this valuation is justified; however, as we previously performed in Eni, we will definitely review CNH’s target price upward after a confirmation of a few positive quarters. Deleverage is also a priority that will drive upward our rating.

Be the first to comment