Olga Tsareva/iStock via Getty Images

Internally managed cannabis REIT Innovative Industrial Properties (NYSE:IIPR) has not been immune to the general disruption and consolidation 2022 has brought to the US cannabis industry with its common shares down 55% year-to-date. Indeed, the largest cannabis-focused ETF, AdvisorShares Pure US Cannabis ETF (MSOS) is also down a similar 55% YTD as the number of cannabis companies under material financial stress and facing going concern risk rises materially from the year-ago period.

The pandemic saw a broad return of hope to a sector that has come to be defined by capital destruction and lost dreams as hype met onerous government regulation and still persistent black market sales. Initial TAMs for MSOs were overestimated and the licensing environment has been too fragmented for the type of operational gearing that supports sustained profitability for a large number of operators. This somewhat bleak backdrop is where Innovative Industrial operates and has thrived.

Innovative Industrial Properties

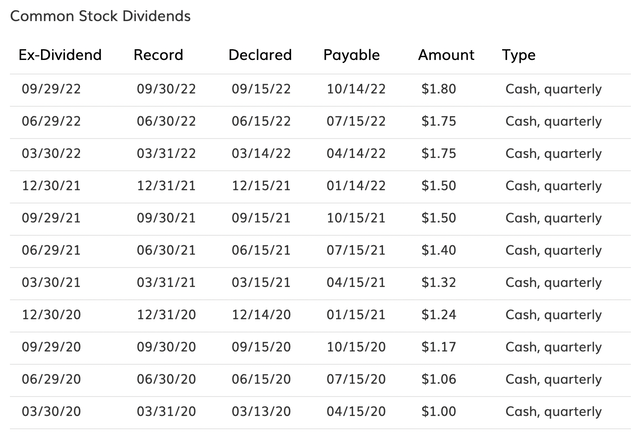

The company has been a gift to dividend growth investors with its per share quarterly dividend cash payout growing from $0.15 when it went public to $1.80. The most recent payout was raised by 2.9% with historical growth from IPO far in excess of inflation over the same time period and with two raises this year alone.

Innovative Industrial was the first publicly traded company to provide real estate capital to the regulated US cannabis industry and remains the only company of its type on the NYSE due to going public during a now-closed loophole period. This has formed a moat with subsequent players in its space shut out from Innovative Industrial’s large investor base.

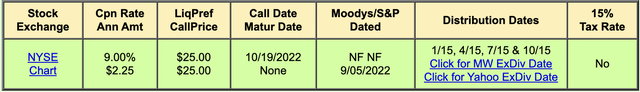

The company’s 9.00% Series A Cumulative Red Preferred Stock (NYSE:IIPR.PA) provides a level of stability with fixed quarterly coupon payments and a redemption price of $25 per share. This creates a floor against what could be more pain ahead as the cannabis industry goes through a period of consolidation. Whilst the preferred is down 21% year-to-date, this was due to what was previously an extremely odd per-share premium that grew as large as $12 over the call price. This has now declined to $1.05, a 4.2% premium over call.

Who are the preferred for? Income investors who are willing to sacrifice future albeit potentially slower dividend growth and potential capital gains for an 8.6% yield at the current price. But the preferred are trading past their call date and new owners would instantly be faced with a loss if the company chooses to redeem them before year-end. This alone makes the preferred an unattractive investment and not a security prospective investors should consider.

Rental Revenue And FFO Growth Driven By A Now Consolidating Cannabis Space

Innovative Industrial’s business acquires freestanding industrial and retail properties and leases them to state-licensed cannabis operators. This is under long-term and triple-net lease agreements. The company’s sale-leaseback program to state-licensed companies offers them a source of capital against what remains quite limited access to traditional finance with cannabis still being classified as a Schedule I substance under the Controlled Substances Act of 1970.

The business faces two core existential threats. The first threat is that of federal legalization which would bring a high level of traditional banking finance to the sector. Whilst this is likely years into the future, it would dampen the company’s historically strong rental revenue viscosity with licensed operators faced with more funding choices than the current landscape.

The second threat is from the ongoing consolidation in the sector as cumulative losses and cash burn finally take their toll on an industry that has somewhat struggled to consistently turn a profit since state legalization reached critical mass.

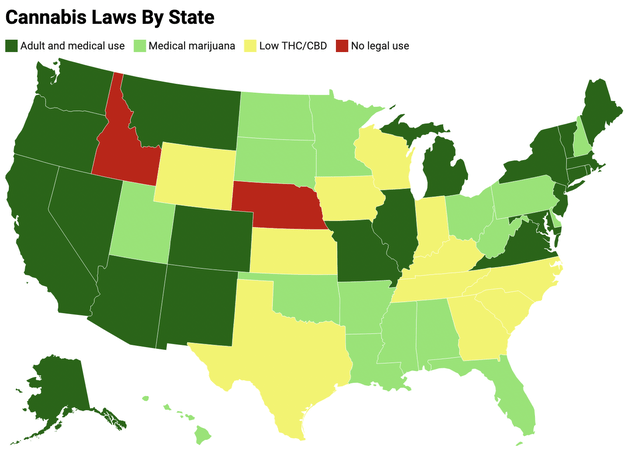

This comes as recreational adult use of cannabis is now legal in 21 states with Maryland and Missouri most recently joining the list. US cannabis sales are forecasted to grow to over $45.9 billion by 2025 as more states pass legalization initiatives.

Hence, the longer-term macro backdrop still looks favourable. Innovative Industrial faces the difficult task of maintaining and building out a tenant portfolio that overlaps heavily with the companies that will be successful as cannabis enters a new phase of growth.

Headwinds Ahead But Financials Look Great

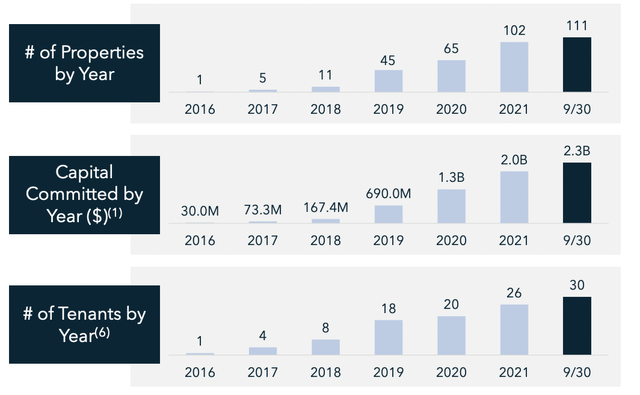

Innovative Industrial last reported earnings for its fiscal 2022 third quarter saw revenue of $70.9 million, above consensus for $68.4 million and grew by 31.5% over the year-ago quarter. This growth came on the back of investment which drove an increase in the total number of properties to 111 at the end of the third quarter.

Innovative Industrial Properties

$368.6 Million of new investments have been made over the last nine months with the company gearing up for growth against what is set to be a difficult economic backdrop in 2023. Cannabis is likely to enjoy some level of demand inelasticity in a recession which places the company’s tenants in a good position as the broader macroeconomic context worsens.

Adjusted third quarter FFO per share of $2.13 exceeded consensus and was an increase from $1.71 in the year-ago comp. This supported a larger dividend payout on the common of $1.80 per share to bring the company’s annual dividend yield to 6.4% at its current share price. These results were very strong considering the company didn’t collect rent from two tenants. Still being able to grow the dividend is a strong vote of confidence in management’s investment strategy and long-term plan for value creation. Against this, Innovative Industrial’s preferred stock makes little sense. Its common shares could provide a good upside if the company navigates the coming environment without any more defaults on rents. Further, the current price to forward FFO of 14.56x is fair for a company that is still set for double-digit growth as cannabis consolidates. I’m set to be a buyer at this level.

Be the first to comment