Robert Way

E-commerce giant Alibaba Group Holding Limited (NYSE:BABA) finally submitted its earnings sheet for the September quarter – its fiscal Q2 2023 – on Thursday. Earnings were better than expected. However, it can’t be denied that Alibaba faces numerous and serious challenges in the short term, including the after-effects of COVID-19 lockdowns and generally slowing top line growth in an increasingly competitive market. I believe Alibaba is set for a longer period of moderating top-line growth, but the shares remain attractive due to their irrationally low valuation factor. Two segments especially have emerged as growth drivers for Alibaba!

Alibaba beat earnings for the September quarter

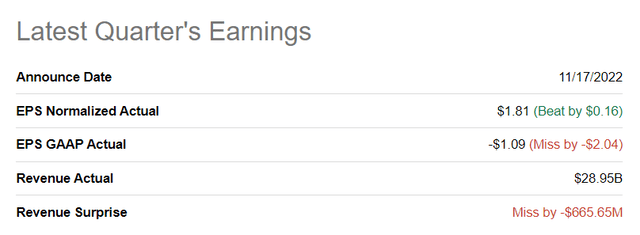

The Chinese e-Commerce firm generated revenues of $28.95B in the September quarter, which was $667M below expectations. Regarding earnings, however, Alibaba squeezed out an EPS beat with adjusted earnings per-share of $1.81, surpassing the average estimate by $0.16.

Seeking Alpha: Alibaba FQ2’23 Results

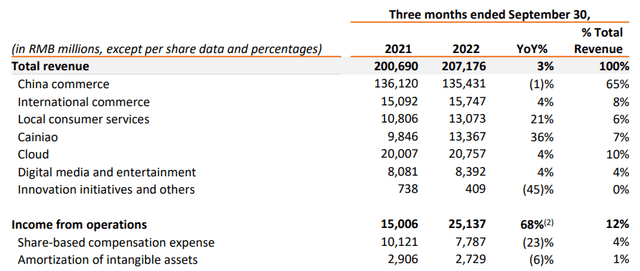

The biggest story in the September quarter, I believe, was that Alibaba avoided revenue growth going negative. Alibaba’s revenues in the September-quarter were 207.2B Chinese Yuan which translates to $29.1B, showing a year over year growth rate of 3%. Before the earnings release, given the slowdown in the Chinese economy and crushing COVID-19 lockdowns, it was entirely possible for Alibaba to have seen negative revenue growth. That Alibaba didn’t see its first-ever negative revenue growth was partly attributable to Alibaba’s Local Consumer Services and Cainiao — Alibaba’s logistics enterprise — which continue to benefit from strong business momentum.

China commerce, Alibaba’s biggest segment regarding revenue contribution, however, saw its second straight quarter of negative revenue growth: the segment’s top line declined 1% year-over-year to 135.4B Chinese Yuan, and China commerce now accounts for 65% of all revenues, down from 69% in the June-quarter.

Two core businesses are emerging as drivers of Alibaba’s growth

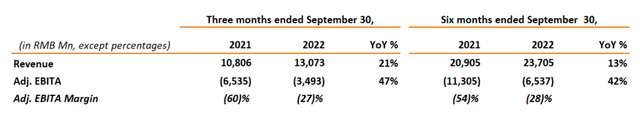

Two businesses are set to drive Alibaba’s growth going forward: Local Consumer Services and Logistics. Local Consumer Services includes Ele.me, as an example, which is a food delivery platform whose business thrived this year due to widespread COVID-19 lockdowns. The segment generated 13.1B Chinese Yuan or $1.8B in revenues, showing an increase of 21% year over year. Local Consumer Services grew its top line at the second-fastest rate after Alibaba’s Logistics business, but the segment is not yet profitable.

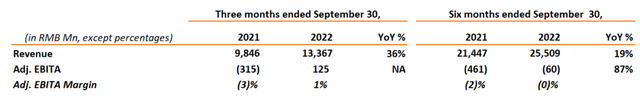

Alibaba’s Cainiao-branded logistics enterprise is also doing extremely well and the company benefits from increased shipments of parcels. Cainiao is building an international logistics business that provides one-stop-solutions and supply chain management. The segment generated 13.4B Chinese Yuan ($1.9B) in revenues in the September-quarter, showing an increase of 36% year over year. Cainiao was the fastest-growing business for Alibaba in the last quarter and considering that shipment volumes are growing — chiefly due to deliveries originating from Alibaba-owned Tmall and Taobao — the segment will likely continue to be a growth engine in Alibaba’s business portfolio.

I specifically like these two segments because growth in these parts of Alibaba’s business is set to reduce the company’s reliance on the Chinese commerce market over the long term. Alibaba generated 65% of all revenues from commerce revenues in China in the September-quarter and an internationally integrated smart logistics platform could help the company reduce its reliance on the Chinese market going forward. In the longer term, I believe Alibaba could achieve 50% or less of its revenues from the China commerce segment and a growing percentage of revenues could come from Cainiao’s external customers, Local Consumer Services, international commerce and Alibaba’s Cloud segment.

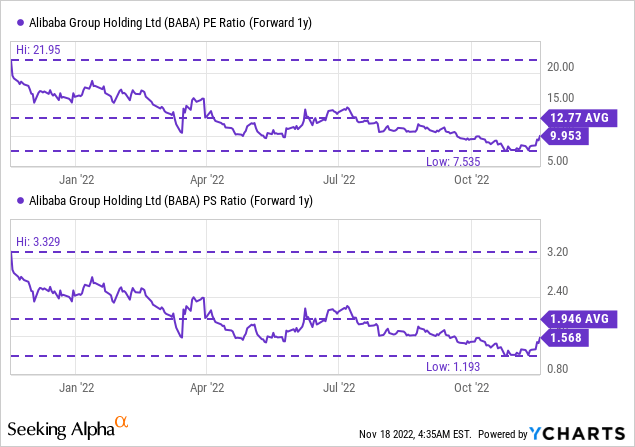

Alibaba’s valuation remains irrational

I have recommended Alibaba before and was clearly wrong about that. Significant negative sentiment overhang has been created for Alibaba in the last two years due to slowing top line growth, political and delisting risks and a more aggressive regulatory environment. However, on a fundamental operating level, I believe Alibaba still represents deep value… the market may just need more time to recognize this.

Shares of Alibaba are currently valued at a P/E ratio of 9.9 X and they are trading below the 1-year average P/E ratio of 12.8 X. The same is true for Alibaba’s P/S ratio, which can be used to value the company based off of its revenue prospects. Alibaba’s P/S ratio is 1.6 X, which is about 20% lower than the average P/S ratio in the last year.

Risks with Alibaba

The single biggest short term risk I see is that a global economic slowdown will hurt Alibaba’s top line growth and the Cainiao-branded logistics enterprise which depends on robust growth in parcel shipments. I also see continual risks that Alibaba’s top line, at least in the near term, could see negative growth, especially if the global economy was headed for a more severe down-turn.

Final thoughts

Political risks and negative sentiment overhang for Alibaba’s shares aside, I believe Alibaba is running a fundamentally sound and growing e-Commerce enterprise that has a lot of potential long term… and for those reasons I believe that fortunes could be made here.

Two of Alibaba’s segments have especially strong growth potential going forward: Local Consumer Services, which benefited from COVID-19 lockdowns, and Cainiao, which is building an internationally integrated logistics platform. Given Alibaba’s irrationally low valuation, I believe there is a case to be made for a strong upside revaluation of Alibaba’s shares over the longer term!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment