dan_prat

Introduction and Overview

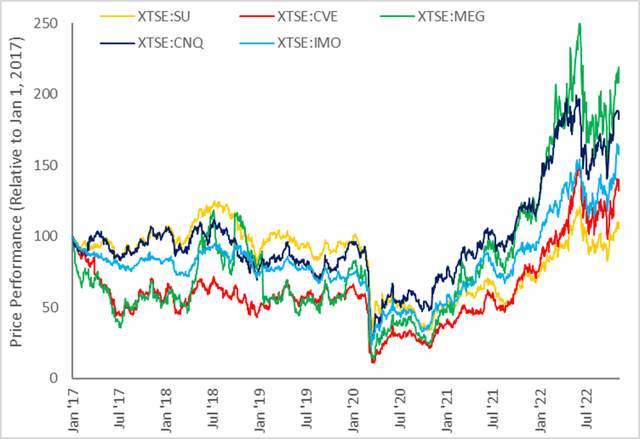

Suncor Energy (NYSE:SU) is one of the largest integrated senior Canadian producers, with production almost entirely concentrated in the Alberta oil sands. In recent years, the company has been plagued with a multitude of health, safety and reliability issues at its various sites leading to higher operating costs and unexpected downtimes which have ultimately resulted in the company drastically underperforming its peers, as illustrated by the figure below. Relative to January 2017 (used as a reference starting point in the chart below), Suncor’s price performance (excluding dividends and share buybacks) has returned a measly 10% to date. Meaningfully underperforming other senior Canadian oil sands peers like Cenovus (CVE) returning 40%, Imperial (IMO) returning 63%, Canadian Natural (CNQ) returning 88%, and MEG (OTCPK:MEGEF) returning over 115% over that same time period. Separately, we have previously broken down why MEG continues to remain one of the most attractive names in the space.

Despite the troublesome tailwinds, we are cautiously optimistic on the company given the following:

- In the near-term Suncor is limited in its exposure to sustained widened WCS differentials, which we believe poses material pricing risk over the next 6 to 12 months to many Canadian names. Relative to other oil sands peers and given its heavier SCO / diesel weighting, Suncor is uniquely positioned to limit its exposure to widening differentials in the near term.

- Over the long-term, Suncor (as the largest oil sands producer, and third largest producer in Canada) is positioned to play a meaningful role in fulfilling the growing demand for Canadian production. This comes in light of the growing importance of energy security, as many countries have more closely become interested in Canadian production. Moreover, by the end of 2023 with the completion of the TransMountain Pipeline Expansion, oil sand producers will have meaningfully higher exposure to Asia-Pacific refining markets in addition to the existing Gulf Coast markets.

- The existing interim leadership has wasted no time on focusing on its core business, enhancing its operations, and deleveraging its balance sheet. The company has been extremely active with several dispositions of its non-core assets, in order to focus on its oil sands operations while utilizing proceeds towards debt reduction. While shareholder returns are far from materializing, we see this as a constructive step in the right direction both in terms of enhancing the company’s operations and balance sheet.

- Operationally, the company has already implemented a series of programs in order to boost its reliability at its various sites. Furthermore, the company will begin trialing a shorter turnaround schedule at its Syncrude Mine in 2023 which will be a meaningful catalyst towards reducing operating costs. Lastly, the company plans to reduce its contractor workforce by 20% by H1 2023, in order to enhance its health and safety record while further reducing operating costs.

- The latest earning’s results (first quarter under the new leadership) were promising as both capital and operating costs fell below expectation, while funds flow and production were above expectations. An early but promising result, reflective of the enhanced focus from the company’s interim leadership.

We believe the several catalysts that will guide towards meaningful share appreciation are only beginning to materialize. Many investors have not been persuaded by the latest quarter and as such, the company continues to trade at a meaningful discount to peers. Given the strengthening backdrop, we have shifted to a bullish outlook on Suncor.

Figure 1: Relative Price Performance of Canadian Oil Sands Seniors (Source: Google Finance)

Asset Overview

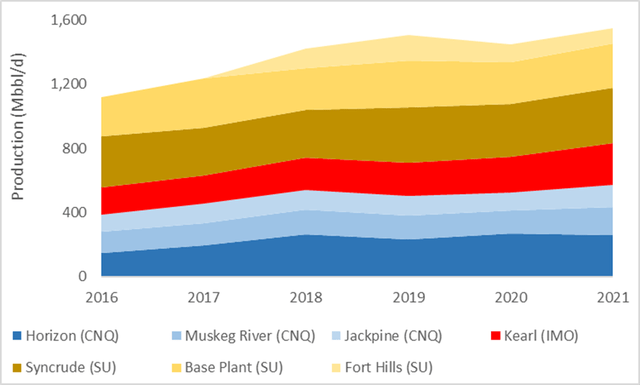

Suncor is Canada’s largest oil sands mining operator, producing ~560 Mbbl/d from its three mining assets: Base Plant (wholly owned and operated), Fort Hills (75.4% working interest), and Syncrude (58.9% working interest). Although greenfield expansion of new oil sands mining facilities is unlikely in the near-term, given the current market volatility, the company continues to focus on debottlenecking projects and brownfield development. The company has received approval from the Alberta Energy Regulator and is at various stages of implementing up to an additional 627 Mbbl/d of processing capacity (gross). Namely through its Aurora Phase 1 & 2 Expansion (Syncrude Mine), its Mildred Lake Expansion (Syncrude Mine) and its Base Plant Expansion. In contrast, the other mining operators (CNQ and IMO) have a combined total of an additional 610 Mbbl/d across their four mines.

Figure 2: Oil Sands Mining Production by Operator (Source: Alberta Energy Regulator)

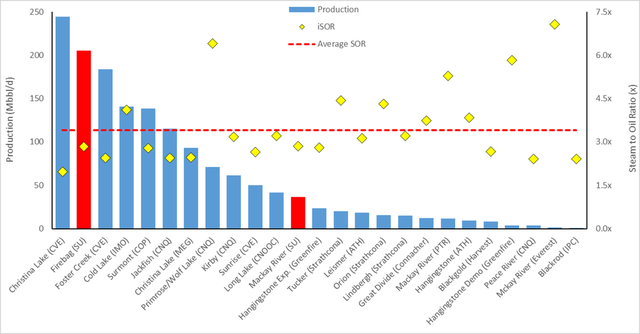

Within its thermal operations, Suncor owns two in-situ facilities, Firebag (~205 Mbbl/d) and MacKay River (~35 Mbbl), placing the company as the third largest thermal producer behind Cenovus and Canadian Natural. Despite the company’s relatively smaller in-situ thermal footprint, the company assets rank in the top quartile in terms of Steam-to-Oil ratio which serves as the primary catalyst for lower operating costs across thermal operators.

Figure 3: Oil Sands In-Situ Thermal Production and SOR (Source: Alberta Energy Regulator)

Despite the company’s coveted assets and dominant oil sands market share, Suncor has meaningfully underperformed other oil sands peers (CNQ, IMO, CVE, MEGEF) given a multitude of health, safety and reliability incidents (driving to more downtime and higher operating costs) which ultimately led to a leadership change in Q2 2022.

Under its interim CEO Kris Smith, the company has already implemented substantial enhancements aimed at meaningfully improving safety and reliability across the company. Understandably, the company’s operational results remain the biggest wildcard for shareholders to digest. Moreover and as explained below, several factors are already in motion which underpin our bullish thesis. Given the size and scale of Suncor’s existing assets, any enhancement to management’s execution, operating costs, and asset reliability will meaningfully affect returns to the upside.

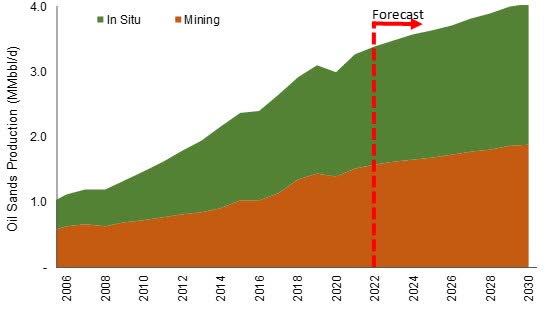

Constructive Market Pricing Backdrop

Canadian oil sands production has increasingly become dominated by senior producers, with the top five producers controlling over 80% of total production. Oil sands production is set to play a meaningfully more important role over the next decade, primarily driven by two fundamental factors. Firstly, ESG headwinds have calmed in recent quarters as focus has shifted to energy security, which has driven many countries to reassess their sources of energy supply in favor of more politically stable countries. Secondly, Canadian egress capacity is expected to increase materially (~890,000 bbl/d by Q3 2023) with the completion of TransMountain Pipeline Expansion (TMX), which serves to both reduce transportation-driven costs and provide exposure to Asia-Pacific refining markets. As illustrated by the Canadian Energy Regulator’s forecast below, oil sands production is expected to grow to 4.0 million barrels per day by 2030. Given’s Suncor’s position as the largest oil sands producer (currently making up over ~25% of total production), the company is sure to benefit from the expected demand growth and increased egress capacity.

Figure 4: Oil Sands Production Growth Forecast (Source: Canada Energy Regulator)

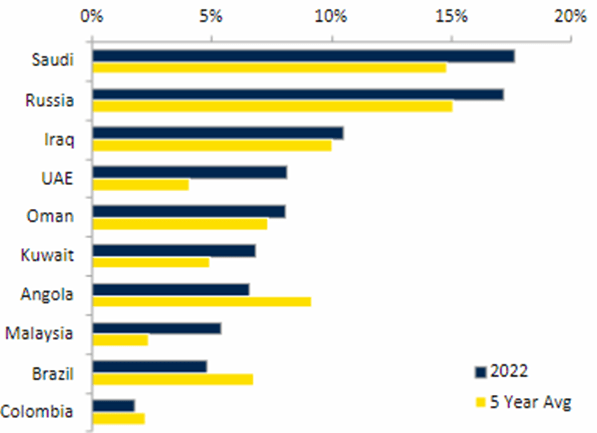

Despite the recessionary backdrop, oil and gas fundamentals remain constructive and supported by a tight supply and demand balance, decreasing inventories and limited production growth year to date. Furthermore, in recent months, WCS differentials have widened significantly driven by short-term impacts, which have negatively impacted many Canadian oil sand names. The US Administration’s SPR releases, BP’s Toledo unexpected refinery outage, and the Mississippi river drought have all played a role in widening WCS differentials over recent quarters. Moreover, we think there may be a risk of prolonged short-to-medium term sustained wider WCS differentials. In light of the imposed sanctions, the deeply discounted Russian Ural production has been largely absorbed by China. As illustrated in the chart below, Chinese imports of Russian and Saudi production have increased nearly 5% in 2022 compared to the previous 5-year average. The risk materializes as more Russian production is absorbed by China, less Brazilian and Colombian production will be received instead. Meaning the excess South American production will compete for refining capacity in the US Gulf Coast which in turn would further widen WCS differentials.

Figure 5: Market share of Chinese Oil Imports, by Country (Source: RBC Capital Markets, China Customs)

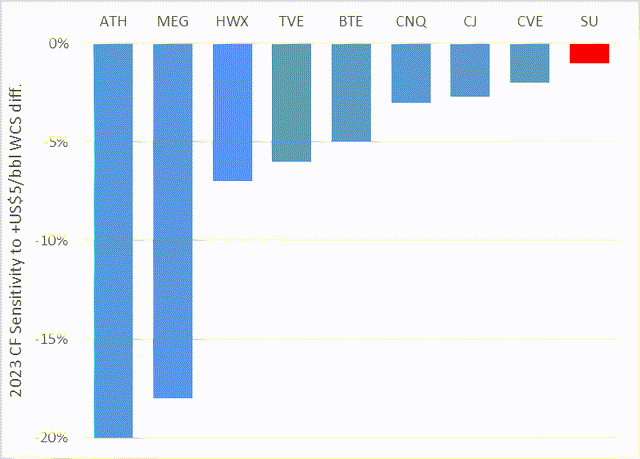

Given its downstream operations and production weighting towards upgraded streams (SCO and diesel), Suncor (SU) maintains limited exposure to widened WCS differentials and is uniquely positioned relative to its peers to weather short-to-medium term pricing risks. Moreover, given its dominance as the largest oil sand producer, the company is also poised to benefit from longer term oil sands demand and increased egress capacity.

Figure 6: 2023E Cash Flow Sensitivity to Widening WCS Differential (Source: RBC Capital Markets)

Sharpened Focus on Core Assets

Suncor is expected to announce its new CEO by year end, with the new leadership expected to execute on the company’s newly defined strategy of enhancing safety and reliability, decarbonizing operations, reducing debt and boosting shareholder returns. In recent quarters, the company has been engaged in several A&D processes in order to divest of its non-core assets, grow its working interest in its Canadian oil and gas core assets while using proceeds to reduce debt to bolster shareholder returns.

Under its interim leadership, Suncor has entered into a definitive agreement to dispose of its Norway E&P assets (~10,000 boe/d). Furthermore, the company noted that the disposition of its North Sea E&P assets (~19,000 boe/d) is ongoing. These divestitures are part of a broader effort to concentrate the company’s operations in the Canadian oil sands, while utilizing proceeds to reduce debt. Moreover, the company is undertaking a review for a strategic divestiture of its downstream retail business, with a decision expected on December 1st. Estimates of after-tax proceeds from a potential divesture range from C$3.6 to C$4.5 billion. This serves as part of the company’s broader effort to decarbonize its operations while utilizing proceeds to reduce debt.

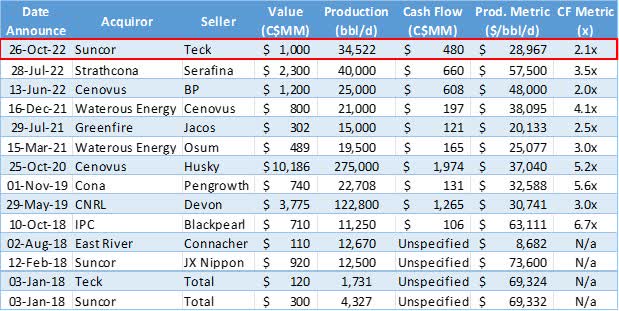

At the beginning of October, the company announced that it reached an agreement to sell its wind and solar assets to Canadian Utilities Limited (OTCPK:CDUAF) for C$730 million. With management iterating that the company will focus its ESG efforts towards advancing initiatives directly optimizing its core assets such as replacing coke-fired boilers at Base Plant with lower emission cogeneration units, investing in biofuel and renewable chemical productions (through its investment in Enerkem Inc.), and investing in carbon-capture technologies (through its investment in Svante Inc.). Most recently, the company has entered into definitive agreement to acquire 21.3% working interest in the Fort Hills oil sands mine from Teck (TECK) for C$1.0 billion. Suncor was able to purchase the remaining working interest at some of the lowest historical precedent multiples (as illustrated by the table below), demonstrating prudent capital discipline from the interim management.

Figure 7: Precedent Oil Sands MD&A Transactions (Source: Corporate Disclosure, Company Press Release)

This last acquisition is especially important as it sets a price precedent in light of TotalEnergies’ (TTE) announcement that it would spin off its Canadian oil sands assets, on September 28th. Total owns the remaining 24.6% working interest in the Fort Hills project, and this announcement coupled with Teck’s divestment point to Suncor as a likely acquiror of the remaining working interest (pegged at C$1.1 – C$1.2 billion).

We see these series of transactions as a testament to management’s acute focus on cleaning up their portfolio, concentrating their operations in their core competencies, and deleveraging their balance sheet.

Valuation

Pricing

The majority of Suncor’s operations are from oil sands assets, of which roughly 62% is upgraded to Synthetic Crude Oil (SCO) and Diesel which realizes a 3-4% premium to Edmonton Light, while the balance (38%) is sold as non-upgraded bitumen and realizes a slight 1-2% discount to Bow River Heavy. Furthermore, the company holds roughly 10% of its production in offshore assets in the North Sea and Eastern Canada which realize Brent pricing.

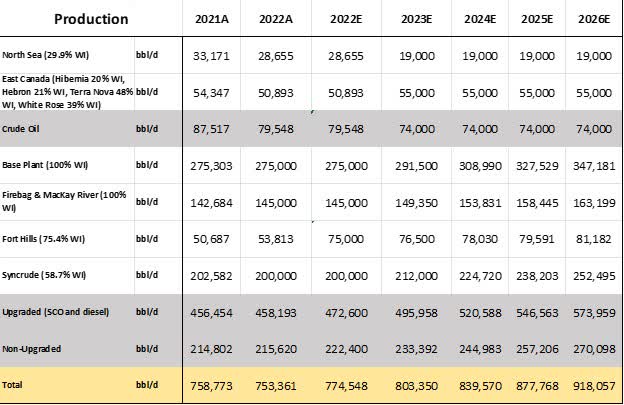

Figure 8: Benchmark Pricing (Source: 3 Consultant’s Average (October 2022))

We have reduced North Sea production by ~10,000 boe/d given the company has entered into definitive agreements to sell its Norway E&P assets. Lastly, we have updated Fort Hills production as of Q4 2022 to reflect the purchased working interest from Teck. We have remained conservative relative to the Canadian Energy Regulator’s forecast of 4.0 million barrels of oil sands production by 2030, and have therefore incorporated a 6% growth rate to Suncor’s Base Plant and Syncrude production (given current production still fall well below of their respective nameplate capacity), and a more conservative 3% production growth rate at Fort Hills, Firebag and MacKay River.

Figure 9: Production Forecast (Source: Company Disclosure, Internal Estimates)

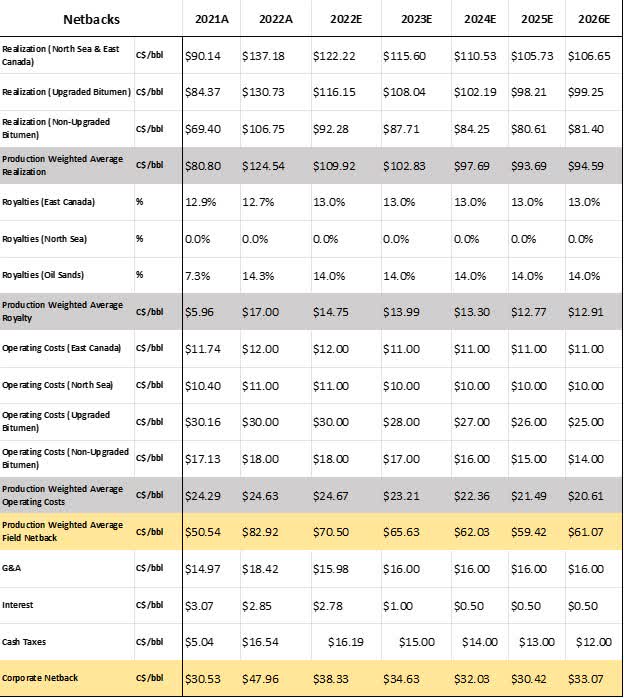

To remain conservative, despite the lower operating costs reported in Q3 2022, we have incorporated higher costs which gradually taper by 2026. Furthermore, given the company’s focus towards debt reduction we anticipate interest payments to decrease meaningfully by 2026. Despite the conservative assumptions, the company is able to generate over C$60/bbl operating netbacks and over $30/bbl corporate netbacks.

Figure 10: Operating and Corporate Netbacks (Source: Company Disclosure, Internal Estimates)

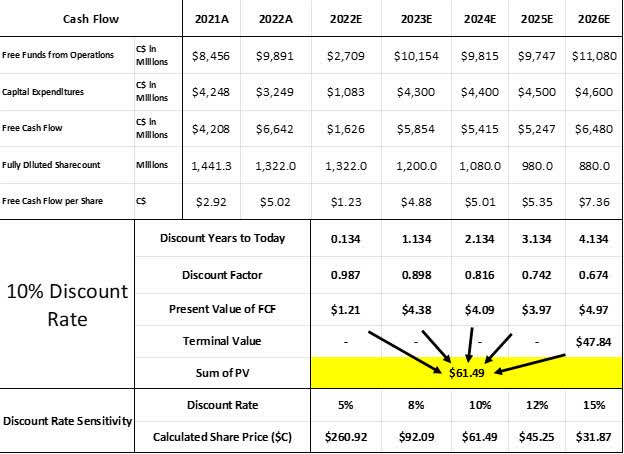

In 2022 the company is poised to generate over $8 billion in free cash flow, while continuing to contribute up to its maximum NCIB capacity as disclosed by the company’s return of capital guidance. At a 10% discount rate, Suncor’s intrinsic valuation falls around $C61 per share implying a 27% upside from current pricing.

Figure 11: Valuation (Source: Company Disclosure, Internal Estimates)

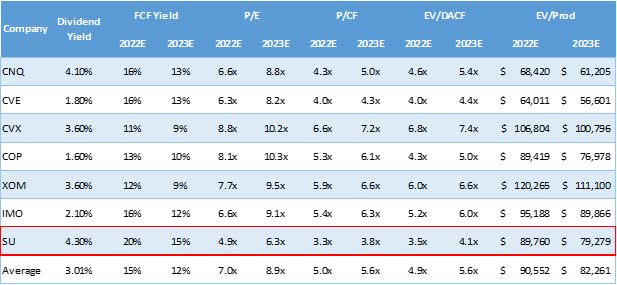

In terms of relative valuation, the company continues to trade at incredibly attractive multiples compared to other integrated North American oil and gas peers. As illustrated by the table below, Suncor remains undervalued in almost all trading multiples relative to peers.

Figure 12: Trading Multiples (Source: Company Disclosure, Internal Estimates)

Near Term Results and Return of Capital Strategy

Suncor’s third quarter earnings came in above Wall Street consensus on operating EPS (C$1.88 vs C$1.76 from the Street), AFFO per share (C$3.28 vs C$2.95 from the Street), production (724.1 Mbbl/d vs 721 Mbbl/d from the Street and below Wall Street consensus on capital spending (C$1.34 billion vs C$1.37 billion from the Street). Operationally, the company was able to come in below consensus estimates on operating costs at Base Plant (C$29.65/bbl vs C$30.28/bbl from the Street), Fort Hills (C$25.65/bbl vs C$27.03/bbl from the Street), and its Syncrude operations (C$42.40/bbl vs C$34.28/bbl from the Street). On its downstream front, Suncor’s refineries processed 466,600 bbl/d of crude which equates to 100% utilization rate with no maintenance anticipated in the last quarter of the year.

Directionally, it appears that the company has begun to execute on its new strategy with a focus on health, safety, and reliability at its operations. Although many shareholders will need to witness several more quarters of good results, we see this last quarter’s results as a first step in the right direction. As part of its focused strategy to improve reliability and operating costs at its facilities, the company will trial 60-day turnaround schedule in 2023 at its Syncrude operations down from its existing 90-day turnaround schedule. Lastly, in effort to reduce costs and more closely enforce health and safety standards, the company has reduced its contractor workforce by 10% with an additional 10% reduction earmarked for the first half of 2023.

Over the quarter, the company has repurchased C$1.0 billion worth of stock, in addition to returning C$638 million in dividends to shareholders. Suncor’s net debt stood at C$14.6 billion, which drives excess free cash flow being equally split between share repurchases and debt repayment. Once the company reaches C$12 billion of net debt, 75% of free cash flow will be earmarked for share repurchases which then increases to 100% once the company reaches its net debt floor of C$9.0 billion. The company expects to reach C$12 billion of net debt by Q1 2023. Lastly, on November 15th the company increased its base dividend 11%, which serves as a testament to management’s confidence in sustained improvements to its operational performance.

Conclusion

We are optimistic that Suncor’s operational challenges are behind them, as the interim leadership has quickly taken action to streamline the company strategy towards enhancing operational reliability, deleveraging its balance sheet, and enhancing shareholder returns. In terms of fundamentals, we see the company well positioned to weather volatile pricing dynamics in the short-term, while also benefitting in the long-term from its dominance as one of Canada’s largest producers. Despite the positive results from the latest quarter, the company continues to trade at a deep discount relative to peers. In terms of intrinsic valuation we see Suncor fairly valued at ~C$61.50/share, implying an attractive 27% upside from its current valuation.

Be the first to comment