Dilok Klaisataporn

A Quick Take On Paycor HCM

Paycor HCM (NASDAQ:PYCR) went public in July 2021, raising approximately $426 million in gross proceeds from an IPO that priced at $23.00 per share.

The firm provides a SaaS-based platform for human capital management purposes for small and medium businesses worldwide.

The market is valuing PYCR well above the average of SaaS companies for only moderate growth while the firm still generates significant operating losses.

Given these factors, I’m on Hold for PYCR in the near term as the company may be forced to deal with a tougher sales environment as the U.S. economy slows in the quarters ahead.

Paycor HCM Overview

Cincinnati, Ohio-based Paycor was founded to create an integrated SaaS platform for various human capital management functions for organizations of all sizes.

Management is headed by Chief Executive Officer Raul Villar Jr., who has been with the firm since July 2019 and was previously CEO of AdvancedMD and has held numerous senior roles at Automatic Data Processing.

The company’s primary offerings include:

-

Core HCM and Payroll

-

Workforce Management

-

Benefits Administration

-

Talent Management

-

Employee Engagement

The company pursues new clients via both a direct and indirect sales approach.

It segments its client base by company size, from 1-9 employees, 10-49, 50-250 and 251+ employees.

Paycor HCM’s Market & Competition

According to a 2017 market research report by Markets and Markets, the total human capital management market was valued at $14.5 billion in 2017 and is projected to reach $22.5 billion by 2022.

This represents a forecast CAGR of 9.2% from 2017 to 2022.

The main drivers for this expected growth are the need for standardization of the processes of main HR activities, talent, and workforce management, advancements in cloud technologies as well as the adoption of mobile technologies.

Also, the North America region has led the globe in adoption of HCM software and most major vendors are located in the same region.

Major competitive or other industry participants include:

-

Workday

-

Ceridian HCM

-

Oracle

-

SAP

-

Kronos

-

Automatic Data Processing

-

Ultimate Software Group

-

IBM

-

SumTotal

-

EmployWise

Paycor HCM’s Recent Financial Performance

-

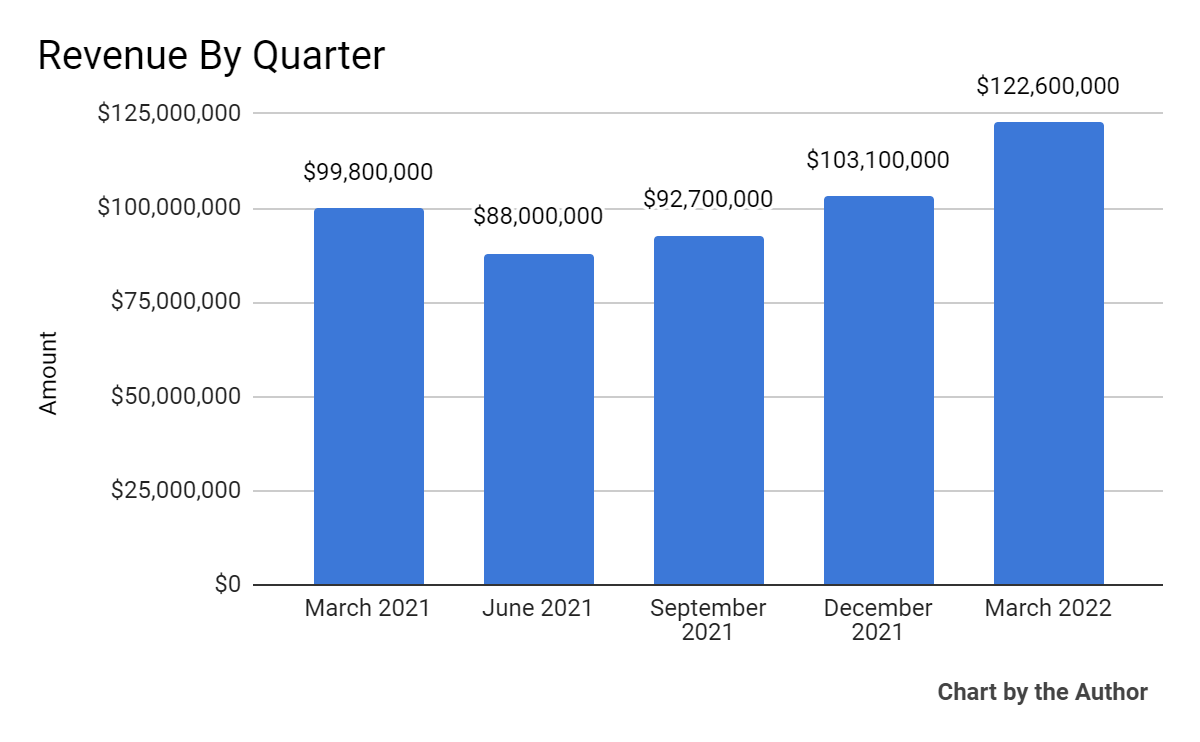

Total revenue by quarter result over the past 5 quarters have been as follows:

5 Quarter Total Revenue (Seeking Alpha)

-

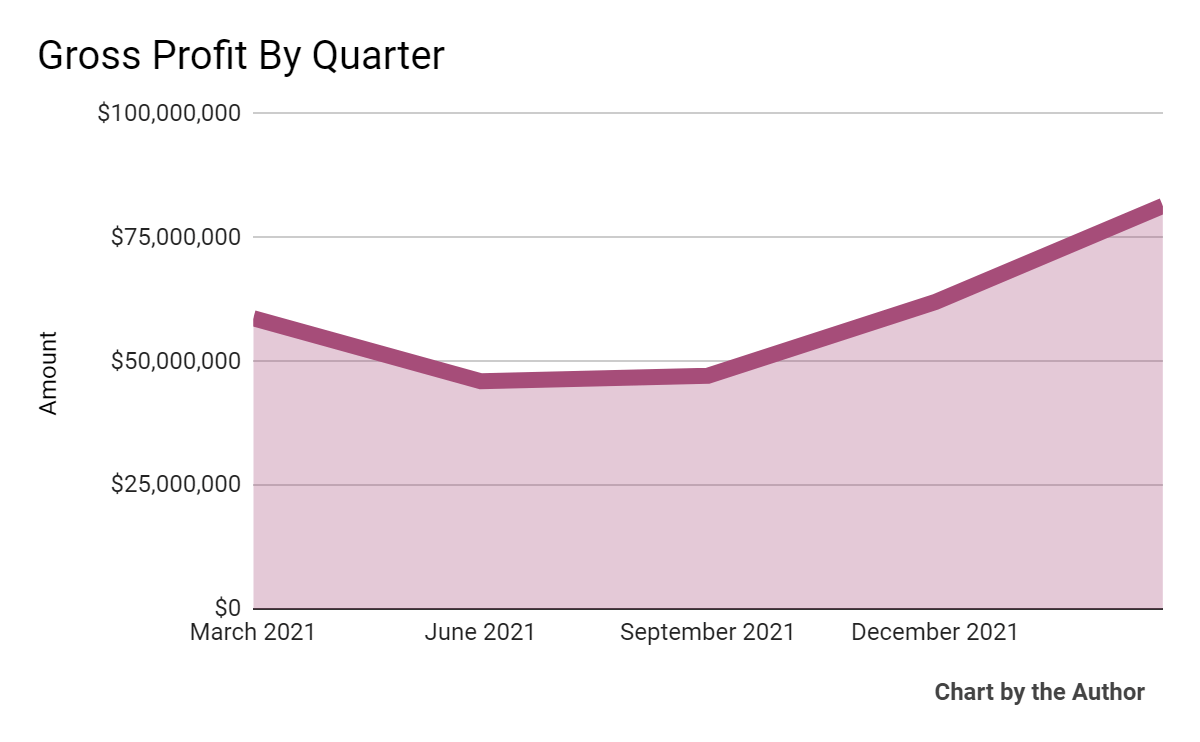

Gross profit by quarter has followed a similar trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

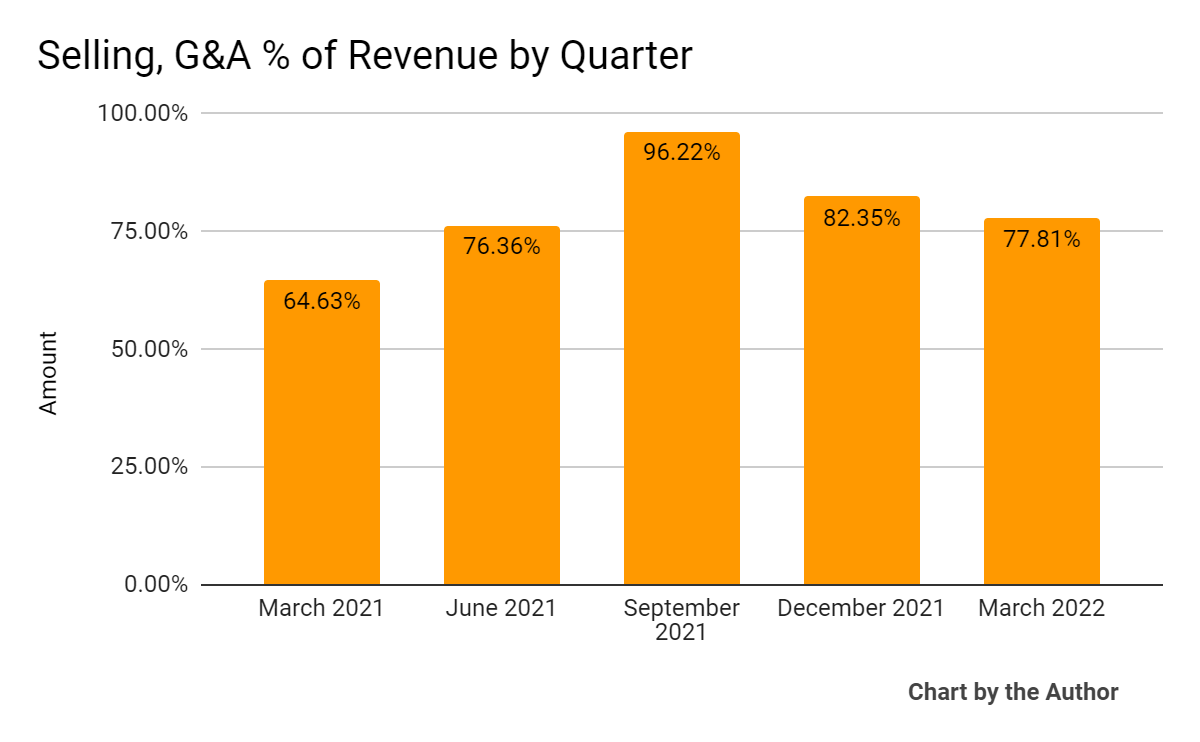

Selling, G&A expenses as a percentage of total revenue by quarter have come down from their Q3 high over the past 5 quarter period:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

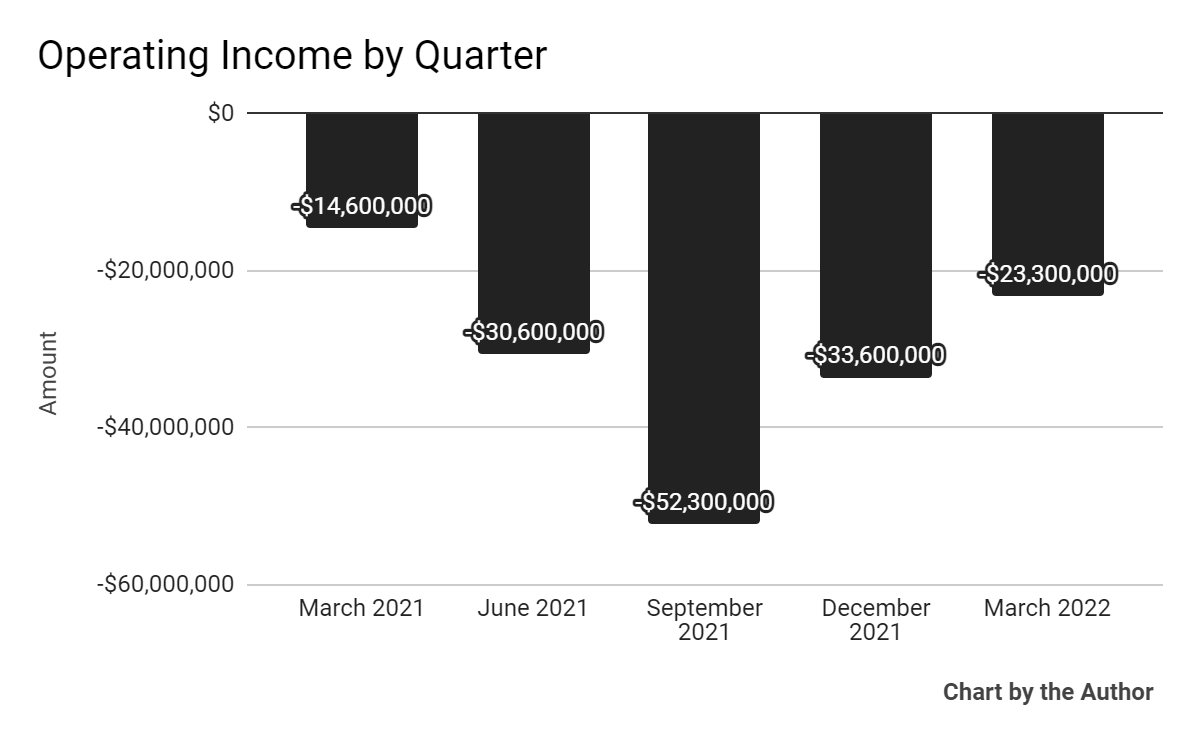

Operating losses by quarter have remained substantially negative:

5 Quarter Operating Income (Seeking Alpha)

-

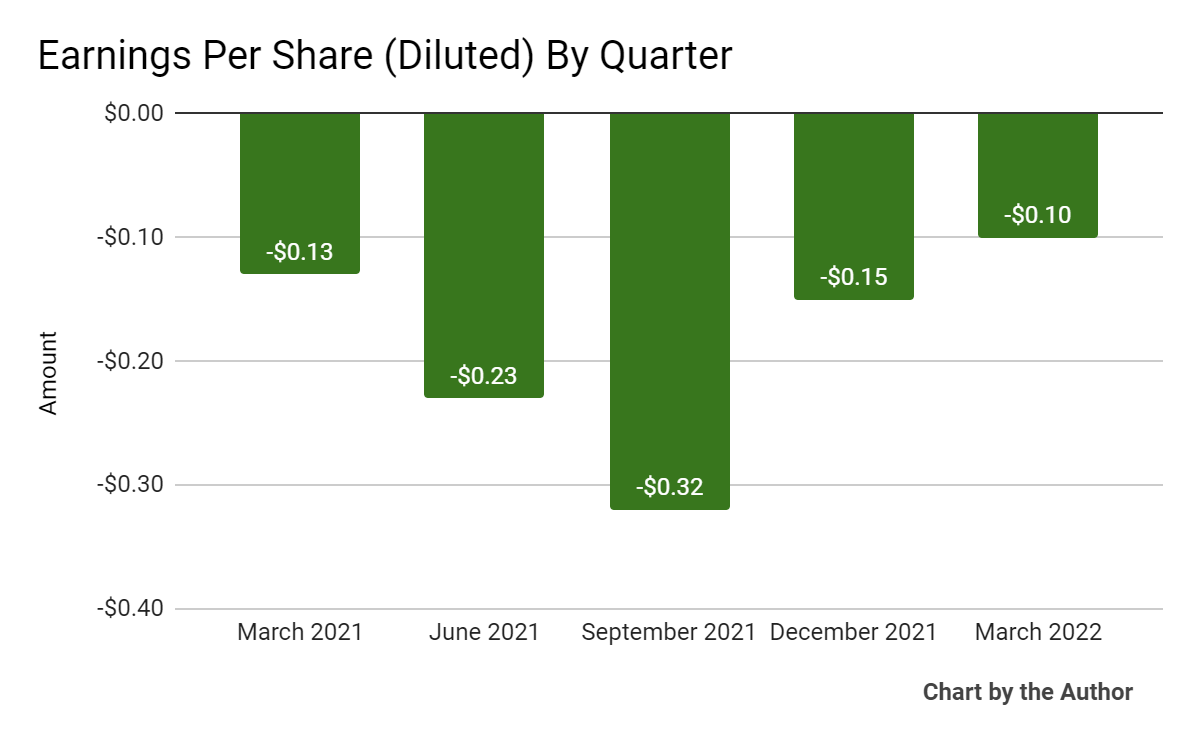

Earnings per share (Diluted) have also remained considerably negative:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

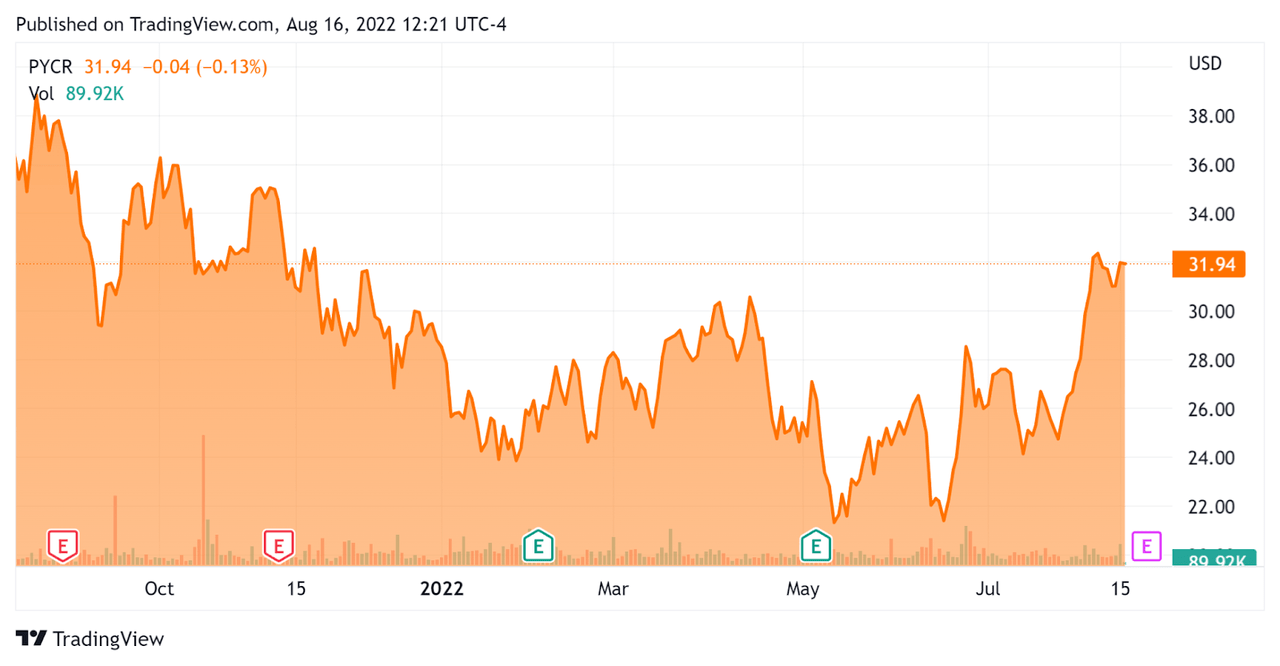

In the past 12 months, PYCR’s stock price has fallen 12.1% vs. the U.S. S&P 500 index’ drop of around 4.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Paycor HCM

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$5,460,000,000 |

|

Market Capitalization |

$5,590,000,000 |

|

Enterprise Value / Sales |

13.43 |

|

Revenue Growth Rate |

20.2% |

|

Operating Cash Flow |

-$3,780,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.80 |

|

Net Income Margin |

-31.7% |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Ceridian HCM (CDAY); shown below is a comparison of their primary valuation metrics:

|

Metric |

Ceridian HCM |

Paycor HCM |

Variance |

|

Enterprise Value / Sales |

10.26 |

13.43 |

30.9% |

|

Operating Cash Flow |

$64,400,000 |

-$3,780,000 |

-105.9% |

|

Revenue Growth Rate |

24.3% |

20.2% |

-16.9% |

|

Net Income Margin |

-6.8% |

-31.7% |

362.7% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PYCR’s most recent GAAP Rule of 40 calculation was 15% as of FQ3 2022, so the firm need improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

20% |

|

GAAP EBITDA % |

-5% |

|

Total |

15% |

(Source – Seeking Alpha)

Commentary On Paycor HCM

In its last earnings call (Source – Seeking Alpha), covering FQ3 2022’s results, management highlighted the demand its products are seeing due to the ‘Great Resignation’ and growing regulatory compliance complexity.

Additionally, more companies are transitioning from legacy, on-premises systems to more modern, cloud-based platforms such as PYCR’s.

CEO Villar also noted the firm’s sales penetration efforts into Tier 1 cities which are the 15 largest metropolitan areas in the U.S., both through its in-house teams as well as through partnership channels.

As to its financial results, recurring revenue grew by 23% year-over-year, the company’s ‘fastest recurring revenue growth in more than five years.’

This was partially fueled by an increase in per employee per month [PEPM] revenue and by employee processing growth at client firms.

However, while management referred to growing net retention rate, they did not share what that all-important subscription model metric was.

For the balance sheet, the company ended the quarter with $134 million in cash and no long-term debt. Over the trailing twelve-month period, PYCR has used only $6.9 million in free cash flow.

Looking ahead, for the full year, management raised its revenue guidance to about 20% growth at the top end of its new range; adjusted operating income is forecast to be around $42.3 million at the midpoint.

Regarding valuation, the market is valuing PYCR at an EV/Sales multiple of around 13.4x.

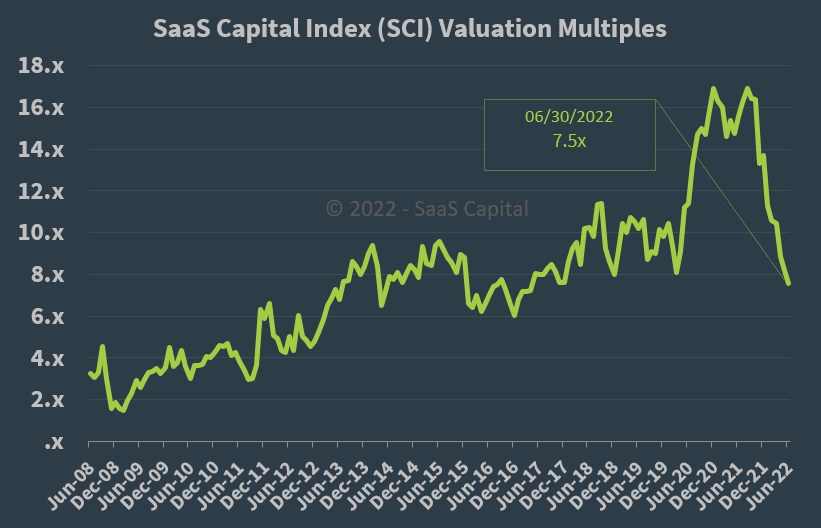

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, PYCR is currently valued by the market at a significant premium to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow prospective customer sales cycles and reduce its revenue growth potential.

A potential upside catalyst to the stock could include a slowdown in interest rate hikes, lowering the forecasted cost of capital growth and increasing the firm’s valuation multiple.

The firm is scheduled to report its next quarterly financial results on Tuesday, August 23, 2022, so interested investors should track that announcement.

My belief is that the U.S. is entering a recession (or significant slowdown) as the number of unfilled advertised employee positions has dropped and signs abound as to deteriorating conditions in various industries.

The market is valuing PYCR well above the average of SaaS companies for only moderate growth while the firm still generates significant operating losses.

Given these factors, I’m on Hold for PYCR in the near term as the company may be forced to deal with a tougher sales environment as the U.S. economy slows in the quarters ahead.

Be the first to comment