Sundry Photography/iStock Editorial via Getty Images

Thesis

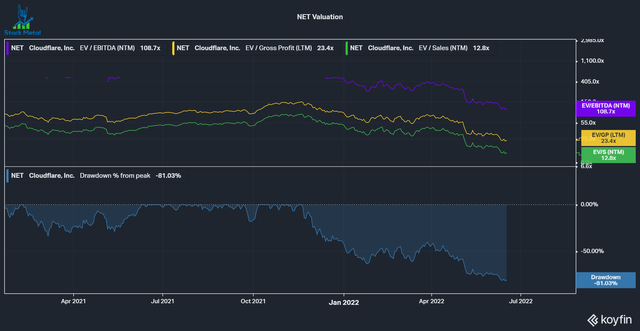

Cloudflare (NYSE:NET) was one of the hottest stocks in the 2020/2021 growth stock frenzy, trading at 114 times trailing EV/Sales at the peak. In the last 7 months, the company fell 81%, as most high-fliers did. Cloudflare still has a high valuation though, considering the market we are in, and is a HOLD for me.

Macro tailwinds

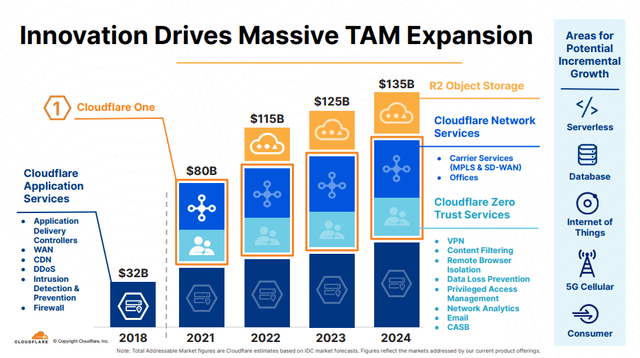

Cloudflare estimates it can grow its TAM from $80 billion in 2021 to $135 billion in 2024 by continuously adding new services and products to its portfolio. They also expect the individual segments of the offering to continue growing. The newest addition to the offering is R2 Object storage, an attempt to attack the dominant S3 object storage solution from the Cloud computing giant Amazon Web Services (AMZN). Cloud object storage is expected to grow to $13.65 billion by 2028, according to Enterprise Storage Forum. The global economy continues to migrate online and Cloudflare is well-positioned to benefit from these macro tailwinds. Another macro tailwind is the acceleration in the customer need for security with all the macro uncertainties with the Ukraine Crisis and the general backward trend towards nationalization. I wrote more about this tailwind in my recent CrowdStrike (CRWD) article.

Cloudflare TAM (Cloudflare investor day)

Running Cloudflare through My SaaS Checklist

I have a checklist of factors to look at for SaaS companies, so let’s take a look at the last earnings report and see how Cloudflare is performing regarding:

- Retention rates

- Multi-product customers/number of modules

- Number of big customers

- Gartner Magic Quadrant positioning

- Margins

- Rule of 40

Retention rates are expanding

Software as a Service or SaaS has been one of the hottest markets in recent years. The companies appeal to investors due to their easy scalability and potential for high profitability down the road. One key part of any successful SaaS company is to retain its customers. Customer acquisition costs are high (S&M spend for Cloudflare was 42% of revenue in Q1 22, down from 46% YoY), so you better be able to keep those customers and ideally charge them more money every year.

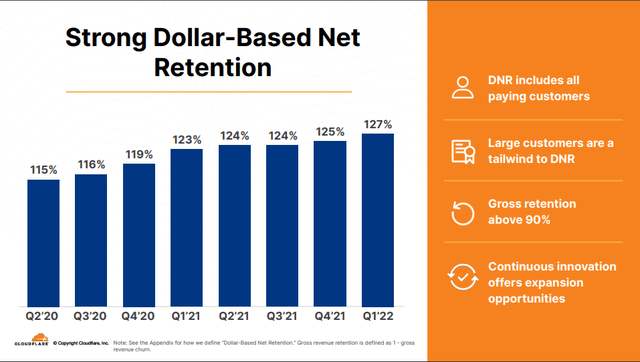

Cloudflare has impressive net dollar retention (NDR). So basically, at an NDR of 127% in Q1 22, the average customer spent 127% of their Q1 21 spending. We can observe that this number has been increasing over the last two years sequentially in 6/7 quarters from 115% to 127%. I regard an NDR over 110% as an okay value and upwards of 120% as a good value.

Gross retention is also important to look at, which basically means how many of our customers keep using our services. Sadly, the company doesn’t give us concrete numbers here, they just indicate that it’s above 90%. At a company conference presentation in June 2021, CFO Thomas Seifert said the following:

And we had this threshold of once we get to 4 customers — 4 products per customer, then churn rates are coming down significantly.

We know that the amount of products customers use is increasing, so we can conclude that gross retention is rising as well for Cloudflare.

Cloudflare NDR (Cloudflare investor day 22)

Multi-product customers/number of modules

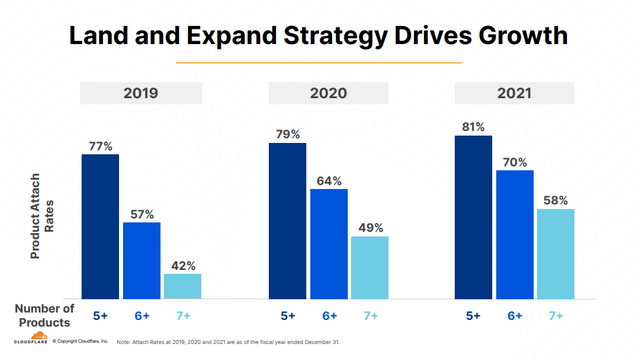

As I alluded to in the last section, multi-product customers are an essential part of a successful SaaS company. Not only does it increase spending per buyer, but it also is a great tool to keep the buyer on YOUR platform and works like a moat. We can see that in the last 3 years, the number of users choosing at least 5 products increased incrementally from 77% to 81%. The 6+ and 7+ customers on the other hand saw strong growth from 57% to 70% (6+ products) and from 42% to 58% (7+ products). Cloudflare mentions that customers with at least 4 products have a significantly lower churn rate, so we can assume that at least 81%, most likely around 90%, of customers are not likely to leave the platform anymore. This lock-in effect should be able to help Cloudflare scale its operations for many years into the future and take more share in their 100+ billion-dollar market opportunity. Adding new products, for this reason, is very important and with the addition of the R2 Object Storage Cloudflare has a new module that might find wide adoption across its customer base.

Cloudflare multi-product customer growth (Cloudflare investor day)

The number of big customers is growing fast

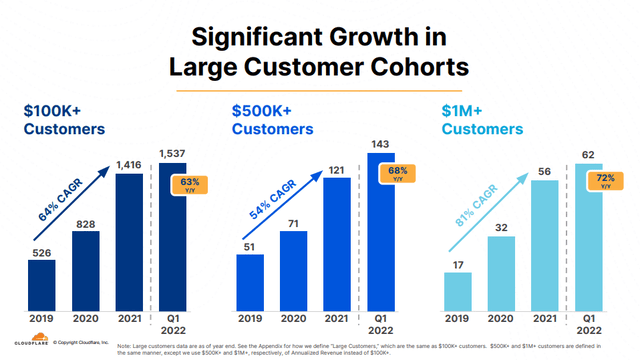

A result of the continued upselling of existing customers is that large customers tend to grow bigger than the small customers for a SaaS business. Cloudflare is no exception here. The company states that 54% of its revenue comes from large corporations, with the top 100 customers accounting for just 29% of revenue. This is a good sign and shows a broad diversification of over 154 thousand paying customers and no real reliance on any single customer. We can see that $100k+ customers saw a growth rate much higher than the growth rate for the entire business (63% YoY growth versus total revenue growth of 54% YoY). $500k+ customers are even more impressive with 68% YoY growth, only topped by $1m+ customers with a 72% growth rate. Everything points in the right direction here.

Cloudflare large customers (Cloudflare investor relations)

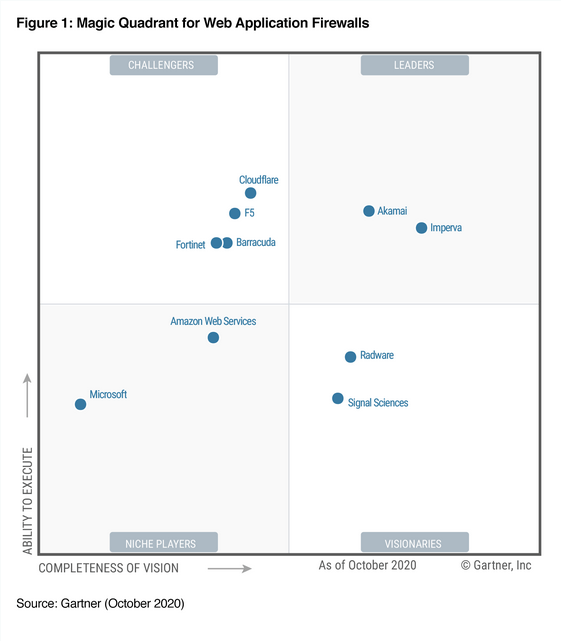

Gartner Magic Quadrant positioning

Gartner is a great resource to get an overview of a competitive landscape. In the October 2020 version of their Magic Quadrant for Web Application Firewalls, Gartner ranked Cloudflare as a challenger, pushing towards the leader quadrant. Compared to the 2018 placement, Cloudflare managed to move from the middle of the challenger’s quadrant to the edge, showing visible improvement in its positioning. The leaders, Akamai (AKAM) and Imperva (IMPV) haven’t changed from 2018 to 2020. It will be interesting to observe if Cloudflare can finally break into the leader’s quadrant in the next iteration of Gartner’s report on this industry.

Gartner magic quadrant for web application firewalls (Gartner)

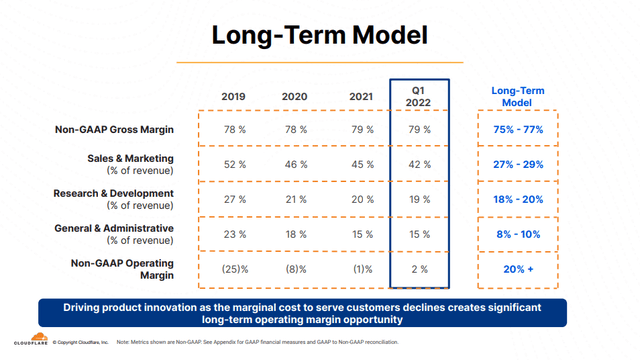

Margins aren’t as good as they seem

The beauty of SaaS businesses is the ability to rapidly scale up and leverage the market position to drive high profitability. Cloudflare showcases its margins as Non-GAAP operating margins as you can see below. Costs have improved nicely over the last 3 years, with the largest expense S&M dropping from 52% to 42% last quarter. Eventually, S&M should fall to 27%-29% of revenue. Efficiencies in G&A and R&D should drive further margin expansion with a long-term goal of 20%+ operating margins. Like most SaaS companies, Cloudflare doesn’t talk about stock-based compensation. It sadly is the industry standard to hide a lot of the operating costs in stock-based compensation to come up with nice operating margins quicker.

| Quarter | Q1 21 | Q2 21 | Q3 21 | Q4 21 | Q1 22 |

| Revenue | $138 | $152 | $172 | $193 | $212 |

| Stock-based compensation | $18 | $22 | $23 | $28.5 | $34 |

| SBC as a % of revenue | 13% | 14.5% | 13.4% | 14.8% | 16% |

| Capital Expenditures | $22 | $13.5 | $28.8 | $28.3 | $24.5 |

| CapEx as a % of revenue | 16% | 8.9% | 16.7% | 14.5% | 11.5% |

As you can see in the table above, stock-based compensation is a massive expense and even though it doesn’t come up in the P&L, the shareholders do pay these costs in the form of dilution. In the last 5 quarters, stock-based compensation trended upwards from 13% to 16% of revenue. I hope that this trend reverses because especially at a depressed share price, these stock options hurt a lot more. I’d subtract these expenses from the operating margin, which would leave us with a negative operating margin of 14% for Q1 22 and a long-term operating margin goal of around 10%+ with the assumption that SBC can get under control and drop to 10% of revenue or less long term. Something else that I’d consider with the long-term margin potential for Cloudflare is the need for Capital Expenditures. Building up server infrastructure is costly and has maintenance costs. This will always be a drag on margins.

Cloudflare margins (Cloudflare investor day)

Rule of 40

The Rule of 40 is a metric to see if a SaaS company is growing healthily. The rule is calculated by adding the growth rate to the profit margin. There are different versions of the Rule of 40, depending on the type of profit margin used. If we use the Non-GAAP operating margin that Cloudflare prefers, we get to 2% margin + 54% revenue growth = 56, which passes the Rule of 40.

As I explained in the previous section, this leaves out a lot of the costs, so I will do the same calculation excluding SBC. -14% margin + 54% revenue growth = 40. Regardless of how you calculate it, Cloudflare passes the Rule of 40, which shows that the company is growing healthily.

A hold at these levels

Even after falling 81%, Cloudflare is still a highly valued company. Forward EV/EBITDA of 108 times, EV/Sales of 12 times, and trailing EV/Gross Profit of 23 times all are still expensive. After growing by over 50% for several quarters, Cloudflare is guiding for a slowdown in growth of 49% in Q2 and 45-46% for the full year. The company has to maintain very high growth rates to justify this high valuation in this market environment and is still not a bargain. I consider Cloudflare a hold here.

Be the first to comment