Sundry Photography

Thesis

Leading disruptive technology company Cloudflare, Inc. (NYSE:NET) remains a highly volatile play. There’s little doubt that Cloudflare has grown rapidly over the past two years. However, it has also come at the expense of significant OpEx, resulting in an operating model that’s very light on profitability.

Therefore, investors in NET need to assess whether the company can continue to execute well toward its long-term model of garnering 20%+ in adjusted operating margin at its current valuation. Given its negative free cash flow (FCF) profitability, we have found it highly challenging to model its valuation. Hence, we believe investors should remain nimble with Cloudflare, as the company is still miles away from reaching its long-term model.

Notwithstanding, the company is confident it could post FCF profitability in H2 even though the enterprise sales cycle remains elongated and measured. Coupled with an increasingly harsh environment portending a recession, we believe that NET could continue to face significant headwinds even at its current valuation. Therefore, we urge investors to apply a generous margin of safety to account for heightened execution risks in increasingly challenging macroeconomic conditions.

We gleaned that NET appears at a near-term bottom and, therefore, could stage a short-term rally. Despite that, we urge investors not to chase the rally as it’s susceptible to momentum spikes used by the market to ensnare investors. Hence, we encourage investors to let NET’s price action form its bottoming process and assess whether it’s likely to re-test its June lows.

We reiterate our Hold rating on NET.

Cloudflare’s Q2 Earnings Were Robust, But H2 Could Be Challenging

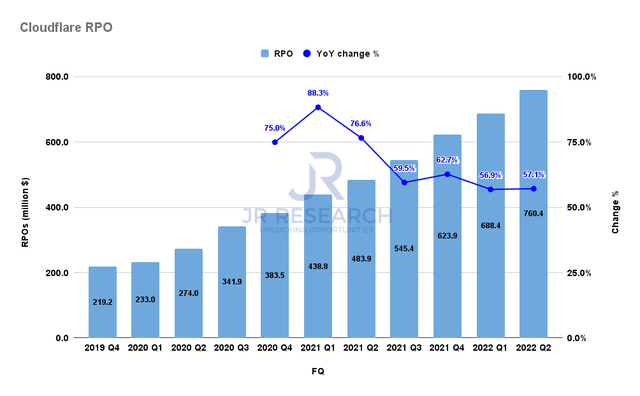

Cloudflare remaining purchase obligations (Company filings)

Cloudflare’s Q2 was better than expected, with its raised guidance a pleasant surprise. We gleaned that its remaining purchase obligations were robust, as it posted an increase of 57.1%, in line with Q1’s 56.9%.

Therefore, we urge investors to assess its cadence in H2 on whether it can sustain its momentum, given worsening macros that could likely impact its enterprise and non-enterprise customers. Given Cloudflare’s aggressive growth rates, it could also lead to unforeseen execution issues to meet its guidance.

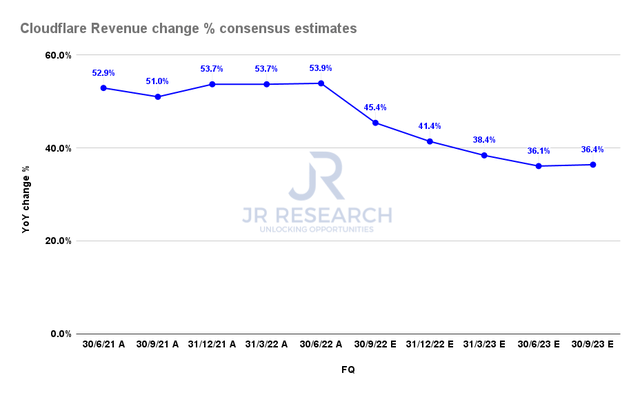

Cloudflare Revenue change % consensus estimates (S&P Cap IQ)

Notwithstanding, we believe the company has likely de-risked its guidance in Q2, given the challenges with its enterprise sales cycle. Therefore, investors should continue to expect Cloudflare’s revenue growth to slow further in H2. The consensus estimates (bullish) suggest that Cloudflare could exit FY22 with revenue growth of 41.4% in Q4, in line with management’s guidance.

However, we are concerned about whether these estimates are still reasonable as we move closer to a recession. We believe NET’s well-battered valuation likely reflects the market’s anticipation of its challenges in 2022. Hence, we believe Q3’s earnings will be critical to offer clues on Cloudflare’s recovery and whether the company expects unforeseen revisions to its guidance.

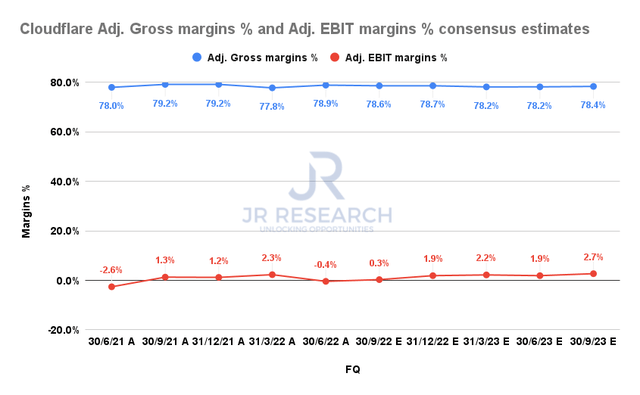

Cloudflare Adjusted Gross margins % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Also, its weak profitability could continue to hamper the recovery of NET’s upward momentum in H2. We urged investors to consider the quality of its revenue growth in our previous articles.

Despite its reasonably high gross margins of nearly 80%, Cloudflare has been unable to post sustainable EBIT profitability. Therefore, investors need to ask whether they are confident in its ability to drive OpEx leverage moving ahead.

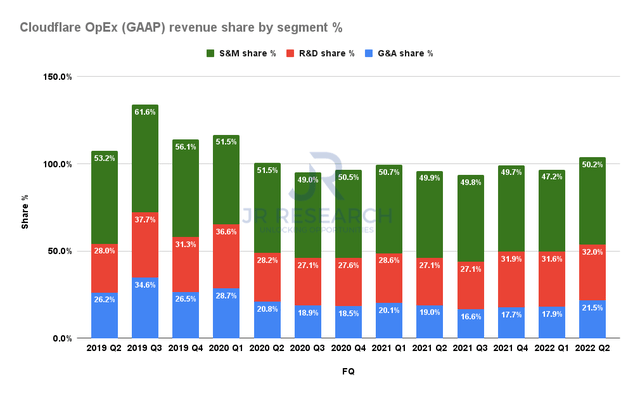

Cloudflare OpEx (GAAP) revenue share % (Company filings)

On a GAAP basis, its sales and marketing (S&M) share of revenue has consistently averaged nearly 50% over the past three years. Therefore, investors need to be confident that Cloudflare can continue to deliver its aggressive growth estimates even if its S&M spend (as a % of revenue) is reined in.

The potential for Cloudflare to gain operating leverage is significant, given its long-term model target of 20%+ in non-GAAP operating margin. However, Cloudflare’s model remains unproven. In addition, we believe it’s operating in segments that are likely highly competitive, which necessitates the company to invest aggressively to compete. Therefore, we would continue to classify NET as a speculative opportunity.

Is NET Stock A Buy, Sell, Or Hold?

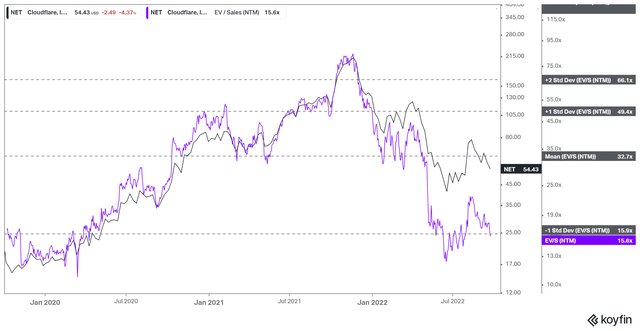

NET NTM Revenue multiples valuation trend (koyfin)

NET’s valuation has been battered, as it fell below the one standard deviation zone under its mean in June. However, the de-rating is justified, given its unprofitable model and aggressive growth rates.

Therefore, investors need to assess whether its current NTM revenue multiple of 15.6x makes sense to justify its operating model.

Our assessment suggests investors should be patient in letting NET form its bottom and assess whether its June lows could hold, as we postulate that it’s unlikely to be re-rated significantly in the near term.

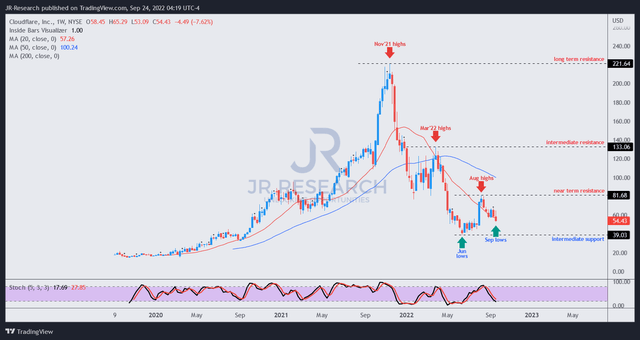

NET price chart (weekly) (TradingView)

We believe the substantial volatility in NET results from the uncertainties over its unprofitable model and aggressive growth rates.

Its post-earnings momentum spike has been digested meaningfully, with NET falling nearly 35% from its August highs. So, we urge investors not to chase momentum surges in NET, given its high volatility. Therefore, we believe it’s essential for investors to be patient and let NET form a bottoming process before considering pulling the buy trigger.

As such, we reiterate our Hold rating on NET stock.

Be the first to comment