Ally Lee/iStock Editorial via Getty Images

Investment thesis:

Many markets have historically been restricted to individuals, be it because of capital requirements or lack of visibility. Private equity (“PE”) and credit markets are two such examples. Our view is that PE and credit markets will outperform both in the short-term and long-term. Currently, high inflation will push up credit earnings, with collateral protecting downside risk. Long-term, the quality of Blackstone’s management team and culture should mean it continues its deal-making track record of strong exit multiples. With BX, you get exposure to some of the profits generated from these markets.

There is a reason that BX is the largest alternative asset manager in the world. If you have a deal to make, call Blackstone. If a mega-cap deal is being made, Blackstone is involved.

Company description:

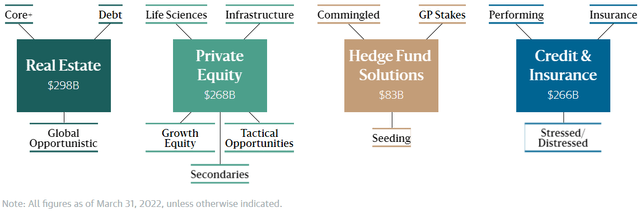

Blackstone Inc. (NYSE:BX) is a multinational asset manager, focused on alternative assets which are not freely traded. This includes real estate, private equity, private credit and hedge fund services. Blackstone current has $915BN of assets under management (“AUM”), as of March 2022.

Blackstone’s largest strategy remains real estate (“RE”), but growth in PE and Credit has been ground-breaking in recent years, resulting in a well-diversified portfolio.

Blackstone Strategies and AUM (Blackstone)

Blackstone’s clientele are predominantly institutional investors, who are allocating stewardship for an extended period of time. In addition to investing services, Blackstone also leverages its expertise to offer investment advice.

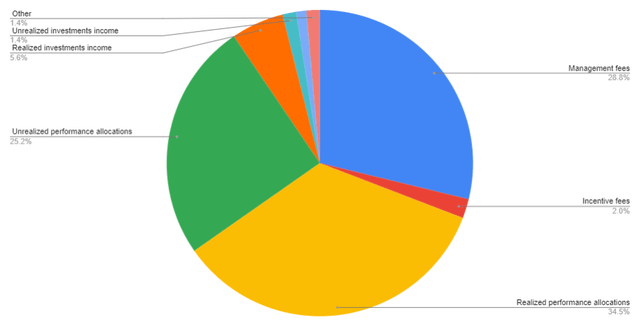

Blackstone earns its revenue through different means. From a high level, they invest their own money, along with providing investment services for individuals and institutions. Q1 2022 revenue breaks down as follows.

Q1 2022 Revenue split (Blackstone)

As we note, the majority of Blackstone’s income is generated from Performance allocations, which are performance-based incomes from their funds. Blackstone’s own investments generate less than 10% of their total revenue and so when we look at Blackstone, we must remember that we are looking at a business which focuses on providing services to others, rather than allocating their shareholders’ money.

Recent news:

Blackstone is always closing deals and raising more money, and so highlighting anything ordinary will add little value. That said, there are two recent developments that are extremely intriguing.

Firstly, Blackstone is attempting to raise $5BN for a new Private Credit business in Asia. For context, Blackstone’s new flagship could be as large as $30BN. Considering the relative risk profiles of the locations and strategies, $5BN represents a huge amount. Asia has always been an attractive investing location in theory but has soured many investors due to currency depreciation and geopolitical issues. Investing through debt is an interesting development as it gives Blackstone contractual protection that equity cannot, while allowing for the returns they expect from a credit fund.

This represents an overarching expansion by Blackstone into private credit. They have also recently announced an expansion into the European Credit market, with their famous “perpetual” funds. I have several years of experience in the Private Debt space and truly believe it to be the future. Some of Europe’s leading credit houses have achieved 8-12% IRR, while losing <1% p.a. With well funded investors increasingly looking for reliable returns with low volatility, Private Debt could certainly be the strategy they have been searching for.

Asset management industry:

There are several leading alts-asset managers globally, so what has led to Blackstone being the cream of the crop? a leading track record, as simple as it is. Blackstone’s funds have performed incredibly well against key market indices and importantly, compared to their competitors. We note two large examples below.

| Fund | Total Asset Value | ITD returns | Type |

| BREIT | $111BN | 13.6% | REIT |

| BCRED | $42.8BN | 9.5% | PC |

The alts-asset market is different to public markets. With a public business, the vast majority of information in the public domain is obtainable. Thus, asset managers compete on information comprehension and interpretation. Conversely, the alts industry is full of potential investment opportunities which have varying degrees of access and information. As a result of this, the management team and market presence is key to success. Blackstone’s senior management are all long standing BX employees, who are well indoctrinated in the Stephen Schwarzman’s (Founder & CEO) (“SS”) culture of risk management, excellence and being experts. This culture focuses on always striving to improve in every aspect of your operations and ensuring everyone is a subject matter expert in their investing practice. (Source: “What It Takes: Lessons in the Pursuit of Excellence”). Although this is easy to replicate in theory, it is clear that SS’s relentless desire for excellence has propelled the business forward, with his lieutenants now encompassing this same approach, as they lead several areas of the business.

On the other hand, we have “market presence.” This encompasses so many things. If a large-cap deal exists, who do the investment bankers call first to pitch the deal? Who can quickly go from a phone call to execution quickly for deals in the billions? Who has the capacity to concurrently execute several billion dollar deals?

The answer for all of these questions is Blackstone. An example of each of the following in the recent year:

- EY announces it plans to spin off its consulting arm – BX linked

- Blackstone approaches KKR to attempt a takeover of Toshiba, the first of its kind in Japan (Large-cap takeovers by foreign firms have restrictions both legally and culturally).

- Blackstone purchased 25 Asda warehouses for £1.7BN, thus allowing the Issa Brothers / TDR Capital to execute their LBO of Asda.

Blackstone is a known quantity in the market, everyone is aware they can close and they have the resources to forage the world for deals.

With the ability to transact any deal and the largest “population” of identified deals, Blackstone is in a position to best choose those with the risk / reward profile which meets their needs.

Private markets will outperform:

Blackstone has 58% of its capital invested in private markets, across debt and equity. This is the real crown jewels and where we believe a large chunk of the future returns will come from.

Increasingly, businesses are choosing to remain private for longer. There are several reasons, but to put simply, markets are a lot more liquid now. As a result of this, businesses can fund growth without needing to IPO. Furthermore, large conglomerates are realizing that public markets are not pricing their business units appropriately, thus are seeking private market carve-outs to unlock value. The vice versa is also the case, where PE firms are identifying value within a business. Also, more simply, there are a lot more private businesses / assets than there are public.

For these reasons and many more, the private equity market represents great growth. These situations are not new, but the private equity markets have historically not had the liquidity to exploit all these deals. This is where Blackstone’s capital might come in. S&P Global is expecting the PE market to remain robust in 2022 and continue its growth.

We are biased towards private debt, given our experience, but evidence suggests this is the next strategy to attract significant inflows. Private debt is simply loans issued by private business to companies who otherwise cannot obtain such favorable rates, such as from a bank. This is because of many factors, usually non-stellar financial performance. In the short-term, this strategy will flourish because the loans are structured as floating (the best funds will have all loans floating). With inflation at the levels it is, many of these assets will yield over 10%.

You might be thinking, will the companies not just default? Not necessarily. If the deals team can source high quality transactions, these businesses usually have enough EBITDA coverage to sustain a couple hundred basis points in additional interest. The downside protection is secured assets (at least 95% of the fund value in my opinion) against these loans which are hopefully all senior in the waterfall (again our view is all debt should be senior), which give the fund the optionality to seize control of the business. In the few cases I have seen of this, it has actually resulted in greater returns than the interest + PIK would have. When I look at Blackstone’s flagship credit fund (BCRED), I see all the hallmarks of a best-in-class fund. ITD returns are 9.5% (JPM report market average as 8.8%), 100% floating rate, 96% senior secured and a range of cash-generative industries invested within.

Blackstone’s potential within this investing strategy comes from this fund. It shows that BX is a serious player, who have the expertise to deal-making in this space and obtain high quality assets. Looking more long-term, we note many businesses were required to obtain financing in recent years and will likely need to if this current economic downturn plays out. This gives BX the ability to deploy more capital and achieve these returns. As mentioned previously, the risk adjusted returns are extremely good, which many investors are looking for. The S&P 500 famous returns c.10% p.a., if that is what you seek, why not invest in credit?

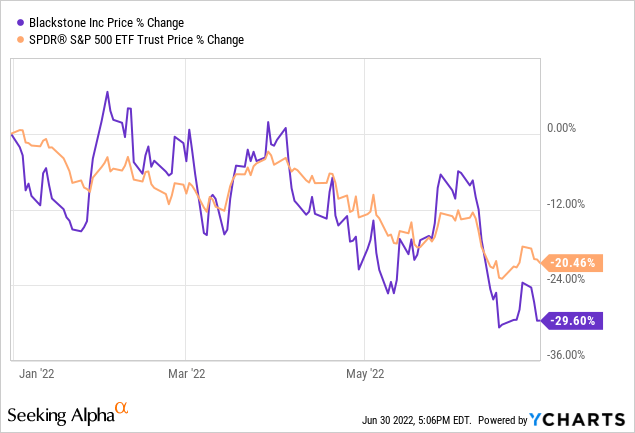

Macro considerations:

GDP growth is aggressively slowing, with many suggesting a recession is impending. This has brought down equity markets, with the S&P down 20% from its all time high. The reason for this is slowing growth means less spending, which means less business growth, which means less wealth and so on. This is clearly not good for any of Blackstone’s strategies and the reason the shares are down as much as they are.

The slight nuance here is that BX deals primarily in alternative assets, as a result of this they are marked-to-market by analysts and external support firms at Blackstone’s chosen valuation interval. As a result of this, there is generally a lag in the fall of alternative asset prices and listed assets. This is one of the key risks I feel with BX, the assets within their funds do not fully reflect the market sentiment we are currently seeing.

We have covered why interest rates are potentially quite good for BX and now will explore the flip-side. Low interest rates are generally good for investors. The reason for this is that companies can borrow money cheaply and fund aggressive growth. Additionally, when analysts try to value the future cash flows of a business, a higher discount needs to be used when interest rates rise. As a result of this, equity markets generally favor lower interest rates. Therefore, we consider the benefits of the private debt business as a hedge against the equity side.

It is clear that tougher times are ahead, BX may face redemptions and some funds will struggle more than others but they are in a position to naturally hedge. There are few investments in the world that can totally eliminate market risk and so when investing in such times, we need to consider what downside protection there is. A genuine risk for asset managers at a time like this is remaining liquid, we have seen many a fund implode due to leverage (which BX utilizes) and poor risk management.

Financial analysis:

Blackstone currently has $139.1BN in dry powder, and $3.8BN of its own cash (almost double that of the year previous). This is extremely good for 2 reasons. Firstly, we believe the liquidity risk is thus low, with enough cash on hand to support the liquidity of the underlying assets (A+ credit rating). Secondly, this will allow BX to grow further by deploying more capital, thus taking advantage of lower asset prices. This is important as at times like this, raising commitments is not easy.

In the last 5 years, BX has grown Revenue and EBITDA at a CAGR of 18.2% and 22.8%, respectively. BX has invested heavily in high quality assets and has ridden the subsequent uptick in valuation. Their opportunistic RE and PE funds both rose 40% in 2021. What we very much like is that investments are consistently being sold and so these are not paper gains.

BX has also exploited their scale to improve operating margins, which currently sit at 57.2%. This is through a mixture of fee increases and economies of scale.

Peer comparison:

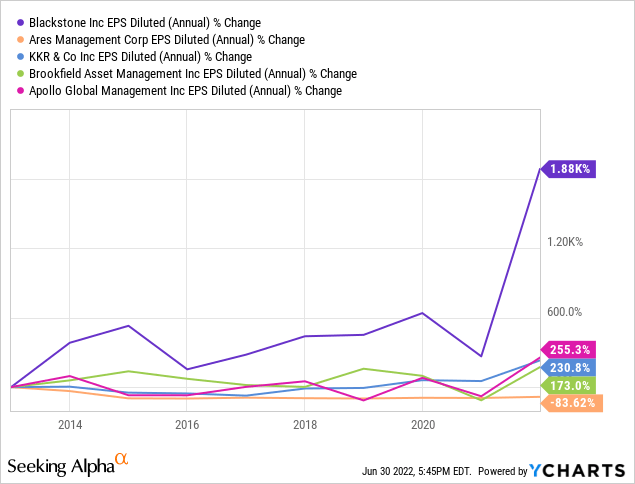

There are few comparable peers, given that BX is a jack-of-all-trades, master of all. We have included those listed below.

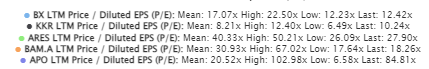

We note that BX performs by the far the best in EPS growth throughout the period, reflecting that they are the premier listed asset manager for investors.

Valuation:

Valuing Blackstone is a fool’s errand as the future is completely unknown, the company obviously does not disclose future potential deals and may sell its current assets at a whim. However, many investors (such as ourselves) like to consider valuation, even if it’s just some additional information.

When looking at comps, BX seems fairly attractive, trading at the lowest of all but one peer, both today and over the life of their listing.

LTM P/E valuation of BX and its peers (Tikr Terminal)

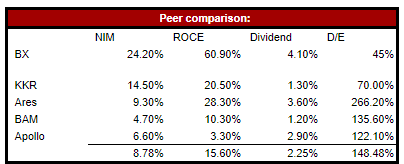

This discount is completely unwarranted, given how superior BX is. There is little more we can say that the numbers below and the analysis above do not already. This is the first time we have done a comparison where a company beats all of its peers individually in every metric.

BX peer comparison (Tikr Terminal)

When looking at Blackstone’s valuation before their crazy growth spurt, we note BX traded at around 10x earnings (Source: Tikr Terminal). We feel a 2x premium is completely worth it, given the much larger asset basis and income generation.

Final Thoughts:

Blackstone is a fantastic business. SS has built a too-big-to-fail empire. Its Credit and real estate investment trust (“REIT”) holdings, which account for c.61% of AUM, will generate consistent returns in excess of inflation. Given Blackstone’s strong risk management, a small uptick in delinquencies should not impact returns.

Our long-term bullish view sits with the PE strategy. Blackstone has a strong deals network and ability to close reliably. Management remains long-standing BX members and so we believe their impressive track record will continue.

We thus rate BX a buy.

Be the first to comment