Funtap/iStock via Getty Images

Investment Thesis

Cloudflare (NYSE:NET), the content delivery network company, has seen its share price implode and is down approximately 75% from its highs.

Right now, we are about 1 week away before Cloudflare reports its Q3 2022 results.

I make the argument that even if the stock appears expensive on an earnings multiple, this is not the right way to think about Cloudflare.

I make the case that if Cloudflare can reassure investors that it can continue growing at 50% for a few more quarters, and into 2023, then the stock has a lot more upside and could see its multiple expand.

If, on the other hand, Cloudflare does not upwards revise its Q4 guidance, then, investors will come to question whether it’s possible at all for Cloudflare to grow at 50% CAGR or whether there are just too many headwinds preventing it from staying at hypergrowth.

What’s Happening Right Now?

Investors are fixated on one thing only right now, when will the Fed stop raising rates? The moment that it’s clear to all participants that the pace of rate growth will moderate, there’s a very strong appetite to get back into high-growth stocks.

On the other hand, after that initial rally, investors will start to rethink about their portfolios and see what they actually own, and what they want to get rid of in the portfolio.

Simply put, investors with significant tech exposure, just want to put this period in the rearview and get constructive on 2023.

And herein lies our opportunity, in Cloudflare.

What Everyone is Focus On

This is what we know about Cloudflare. For all intents and purposes, I believe that when Cloudflare reports next week, its Q3 2022 revenue growth rates will reach 50% CAGR. That’s not what’s at stake here!

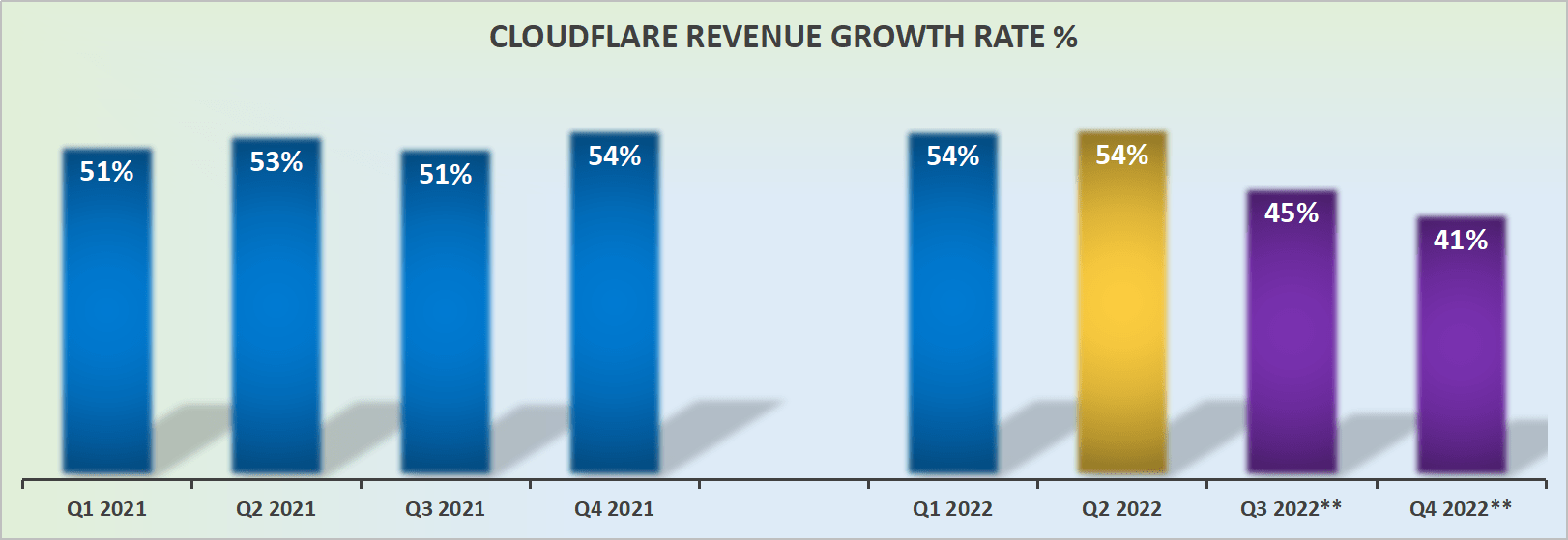

Cloudflare’s revenue growth rates

What we are trying to get some semblance of visibility into is 2023. Put simply, investors will be eyeing up Cloudflare’s guidance, to see exactly how much confidence management has over its ability to make strong revenue growth numbers in 2023.

Now, let’s take a step back. Yes, management will always attempt to be conservative with its Q4 guidance, to allow room to positively surprise investors.

- But investors want to understand how big an impact has inflation had on Cloudflare’s sales cycle.

- What proportion of Cloudflare’s monthly pay-as-you-go customers will decide to set back from using Cloudflare’s products?

- Can Cloudflare still grow at 50% CAGR?

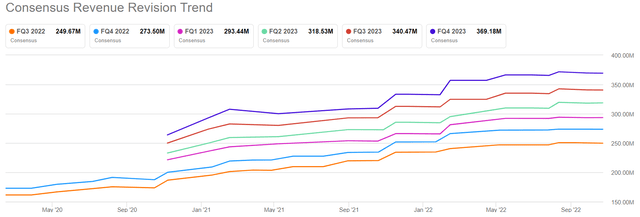

One aspect to consider is that analysts following Cloudflare haven’t downwards revised its revenue estimates at all:

NET analysts’ revenue consensus

From the Street’s perspective, it’s nearly as if the economic turmoil affecting all companies, of all shapes and sizes, has not affected Cloudflare in the slightest. Realistically, this strikes me as odd.

There’s no doubt that Cloudflare’s full potential has been in someway been impaired, given everything that’s happened in the past couple of months.

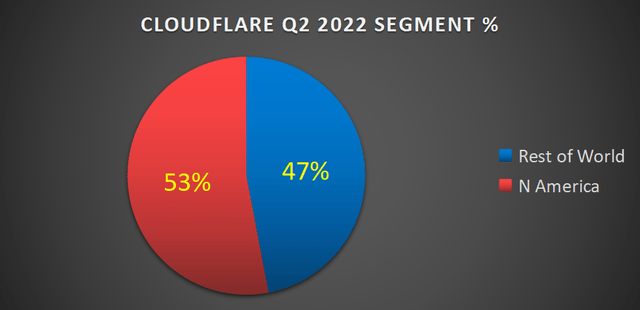

Cloudflare revenue disaggregation

As you know, high inflation and slowing economies have been seen across the board.

On the other hand, we know that North America is where Cloudflare’s growth engine finds itself, so it may be immune up to a certain point from USD headwinds.

On, yet, the other hand, in the same way, as we’ve seen reported by Netflix (NFLX), I suspect that currency headwinds will to a certain extent dampen Cloudflare’s profitability. Why?

Because nearly 50% of its revenues are in currencies outside of the USD. Indeed, in Cloudflare’s SEC filings, Cloudflare highlights as a risk factor,

Fluctuations in exchange rates between the U.S. dollar and foreign currencies in markets where we do business, particularly the United Kingdom and Singapore where we have large offices and pay employees in local currency.

This is clearly not a thesis breaker, as Cloudflare will continue to report currency-adjusted results, but it’s something to keep in mind if the dollar was to continue to be very strong relative to other currencies.

NET Stock Valuation — Cheap If Growth Rates Continue

Here’s the reality of the situation. Cloudflare is being priced at an astronomic P/E multiple. But as I stated throughout, as long as Cloudflare can continue convincingly lay down a path where it still has a few quarters left of high 40s% to low 50s% CAGR, investors will not be too perturbed by its earnings valuation.

After all, unlike countless other SaaS companies, Cloudflare is already profitable.

And if its growth rates were to slow down, I’m confident that Cloudflare could expand its profit margins.

That being said, keep in mind what Cloudflare has stated on several occasions. That if the business had a quarter where it was too profitable, that would mean that they didn’t invest enough in that quarter. And left future revenue on the table.

The Bottom Line

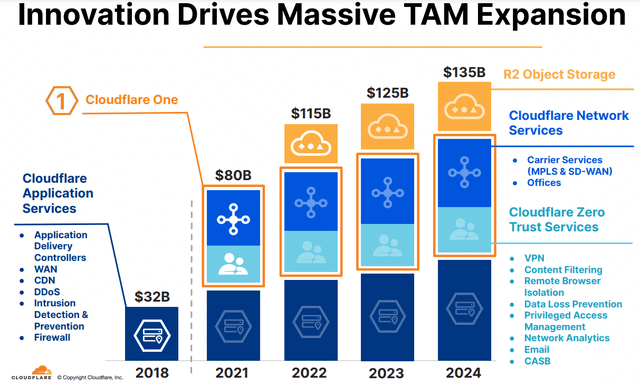

The one aspect that Cloudflare has always been extremely focused on and has executed really well since its IPO is on figuring out the next wave of product innovation, that would have a massive total addressable market.

And that’s exactly what we see above. Cloudflare’s focus started with firewall and application delivery controls, before moving on to Zero Trust services.

Now, it’s moved onto Object Storage, sometimes referred to as blob storage. This allows users to store large and unstructured files. This is at the core of what Cloudflare is focused on, speed and security.

This is the one-line summary. Cloudflare is already down more than 75% from its highs. Yes, it could move down a further 10% to 20%, but I believe that the vast majority of the risk is already priced in.

Be the first to comment