Sundry Photography

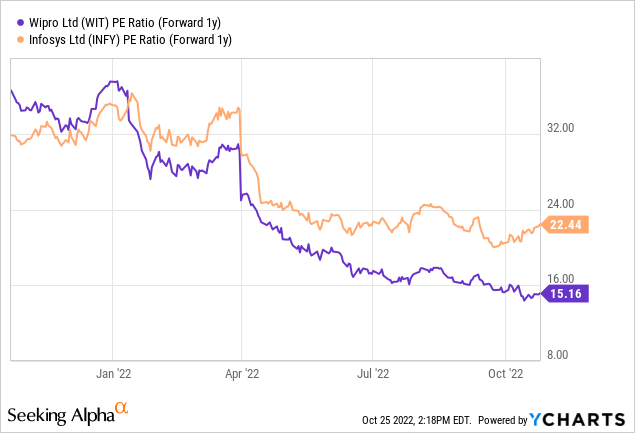

Leading Bangalore-based IT services company Wipro (NYSE:WIT) remains poised for long-term growth, supported by the secular growth in demand for offshore IT services globally. The near-term outlook is cloudy, however, with a combination of headwinds, including supply side challenges along with higher labor and travel expenses post-COVID-19, likely to weigh on margins. The latest guidance disappointment was, therefore, unsurprising as projected Q3 ’23 growth fell short of expectations once again. Compounding Wipro’s issues is the fact that its recent consulting-focused acquisitions are early cycle and will be impacted, to a greater extent, by the ongoing macro challenges. With Wipro likely to underperform its Indian IT services peers, the wider P/E valuation discount to Infosys (INFY) and Tata Consulting Services (“TCS”) seems warranted at this juncture.

Resilient Deal Activity Props Up Q2 ’23 Growth

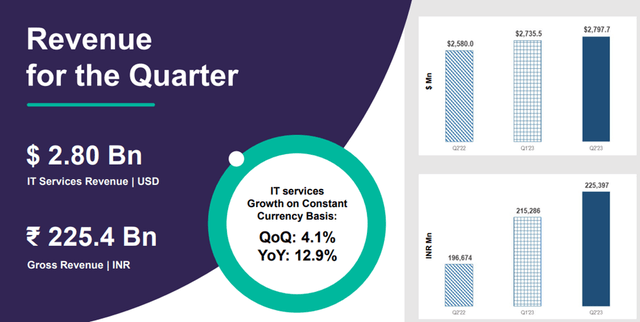

Considering the backdrop, Wipro’s reported +24% Y/Y growth in deal wins for its latest quarter was impressive, comprising eleven large deals worth $725 million. On a half-year basis, Wipro’s TCV (“total contract value”) of large deals was up an even more impressive c. 42% Y/Y. As a result, the company posted positive growth on a sequential (+4.1% Q/Q) and yearly (+12.9% Y/Y) basis in constant currency terms. On another positive note, the growth was also broad-based across Wipro’s key verticals – APMEA (“Asia Pacific, Middle East, and Africa”) led the way at +6.7% Q/Q, followed by Energy, Natural Resources, & Utilities and Ideas at +6.6% Q/Q and +4.9% Q/Q, respectively.

A closer look at the underlying numbers, however, suggests that without the inorganic growth contribution from Rizing (approximately six months’ worth), organic growth was slower at +3.1% Q/Q. With management also pointing to an unfavorable mix shift in the future away from the current balance of growth, transformation, and cost cutting projects, the sustainability of this quarter’s growth is in question. Considering the company’s exposure to retail and tech clients, both of which will see an outsized impact from a pending slowdown, the early cycle nature of Wipro’s consulting revenue base leaves the company especially at risk.

Margin Pressures Remain the Key Concern

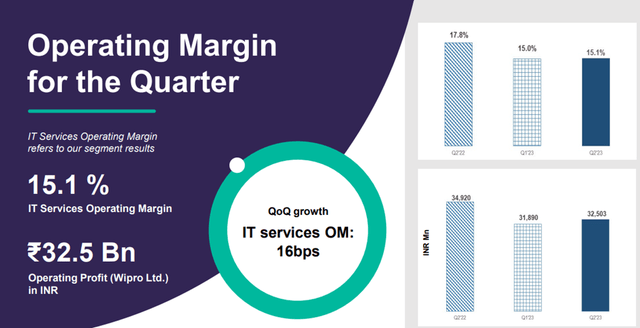

Wipro’s operating margins expanded c. 20bps Q/Q, as the company successfully offset c. 110bps of pressure from wage hikes via increased utilization and SG&A cuts, both of which contributed c. 40bps each. FX tailwinds of c. 30bps also helped but is likely to be temporary. The main surprise this quarter was the divergence between revenue growth and (+4.1% Q/Q) and hiring (net unchanged Q/Q), as the company focused on reducing attrition instead. Per management, the moderation in attrition numbers will also be sustainable into the upcoming quarters, providing some support to near-term earnings. Despite a significant one-off restructuring charge to support more cost cuts ahead, consolidated net profit still rose a solid c. 4% Q/Q. Relative to its main peers (Infosys and TCL), however, Wipro’s margin recovery has been muted. And while the c. $2.3 billion net cash position helps, margins will likely underperform amid more wage hikes and promotion-related expenses, along with continued supply side headwinds.

Guidance Update Signals a Challenging Outlook

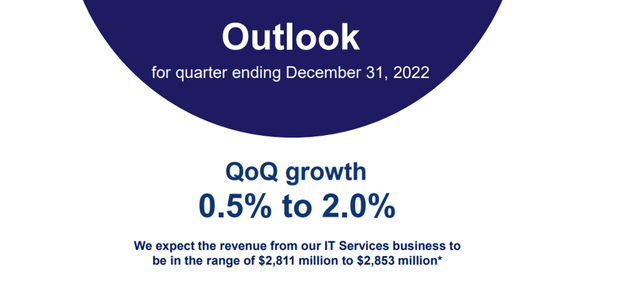

For this fiscal year, Wipro sees its deal pipeline remaining intact, as it further taps into its partner ecosystem to gain share. For fiscal 2023, management guidance stands at double-digit top-line growth in constant currency terms, although Q3 ’23 will see a slower +0.5-2.0% Q/Q growth. On the one hand, the upcoming quarter’s slowdown could reflect some conservatism from management to account for seasonality (mainly furlough-related). However, the fact that Wipro also noted client uncertainty on tech spending, especially for clients in the tech and retail verticals, is worrying. Also, considering the worsening macro environment and slowdown in net hiring this quarter, I would stay cautious on the demand outlook for H2 ’23.

Profitability is guided to be surprisingly resilient, however, led by a Q/Q margin improvement in H2 ’23. The main hurdle will be offsetting the annual wage hikes, having added c. 14k campus hires in the first half of the year. Utilization will also be important, as Wipro brings its new crop of trainees into production. All in all, the company has attractive margin levers, from lower sub-contracting costs as utilization rises to price increases in-line with inflation, along with a further moderation of group-wide attrition levels. Depending on execution, this could mean upside to the projected EBIT margin recovery through H2 ’23, although Wipro’s relative lack of pricing power (vs Infosys/TCL) remains a concern.

Final Take

Overall, Wipro’s latest quarterly update offered little new insight, with macro-driven client uncertainty continuing to weigh on the tech spending outlook in Q3 ’23 and beyond. Wipro’s relatively higher early-cycle consulting exposure (exacerbated by recent acquisitions like Capco) is a concern, likely placing it at a major disadvantage in a pending macro slowdown or recession. In the likely scenario that large deal wins dry up amid a pullback in the broader economy, the sustainability of its growth outperformance is also in question. Management deserves a lot of credit for its work on margins thus far, but with future supply side headwinds compounding pressure from wage hikes and promotions, a sustained margin recovery will be challenging. Thus, I see the current valuation discount to TCL/Infosys as justified and remain neutral on the shares.

Be the first to comment