bondarillia/iStock via Getty Images

Investment Thesis

The Clorox Company (NYSE:CLX) had a rare unicorn moment during the COVID-19 stock market party then. The stock rallied from $146.83 in November 2019 to $227.42 in July 2020. The peak would have been the perfect time for traders to cash in and collect their party goods. For those who had not, it is evident that Mr. Market woke up with a hangover and vengefully reversed all gains to the current levels of $143.41.

Nonetheless, given the relatively sideways price action for the past six months, it is potentially safe to surmise that we are seeing a sustainable support level now. However, since CLX is neither a high growth stock nor an excellent dividend stock, we do not recommend anyone to add this to their portfolio.

Clorox Continues To Underperform Due To Supply Chain And Logistics Issues

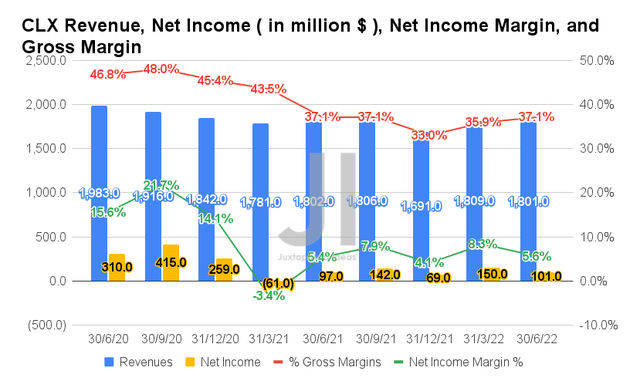

CLX had obviously benefited from the pandemic, given the improvement in its sales and meteoric rise in its stock prices then. However, its margins have also suffered in the past five quarters, given the global supply chain issues impacting the cost of goods sold. By FQ4’22, the company reported revenues of $1.8B and gross margins of 37.1%, representing in-line YoY, respectively. However, it is a massive decline of -9.1% and -9.7 percentage points from FQ4’20 levels. Otherwise, an increase of 10.6% though a decline of -8 percentage points from pre-pandemic levels in FQ4’19.

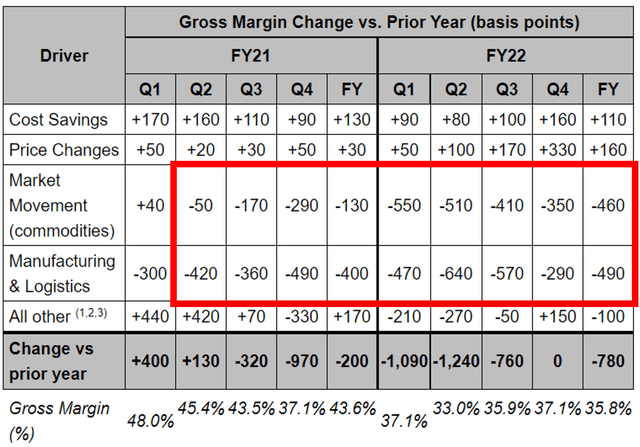

Drivers Affecting CLX’s Gross Margins

These drivers were cleverly addressed in CLX’s financial report thus far, which highlighted the massive increase in costs, especially in the raw materials, manufacturing, and logistics segment. It is no wonder then that CLX reported a lower net income of $101M and net income margins of 5.6% in FQ4’22, representing in-line YoY though a tremendous decline of -67.4% and -10 percentage points from FQ4’20 levels. Otherwise, a decline of -58% and -9.2 percentage points from FQ4’19 levels.

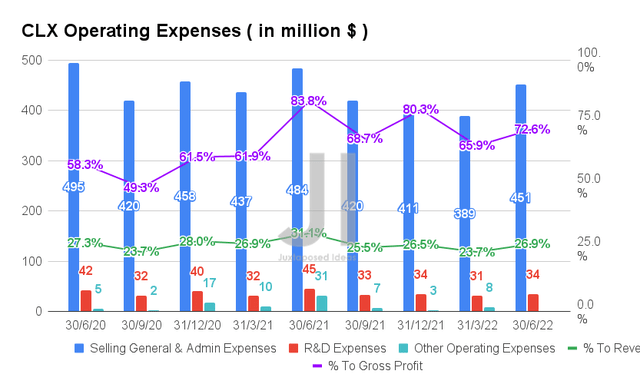

CLX’s management had obviously tried to keep a lid on its operating expenses at $485M in FQ4’22, representing a moderation of -8.3% YoY, -7.4% from FQ’20 levels, and a minimal increase of 13.3% from FQ4’19 levels. Nonetheless, these have directly impacted the ratio to its decelerating revenues at 26.9% and to its gross profits at 72.6% in FQ4’22, compared to 27.3% and 58.3% in FQ4’20, respectively. Thereby, highlighting the other reason for CLX’s lowered profitability.

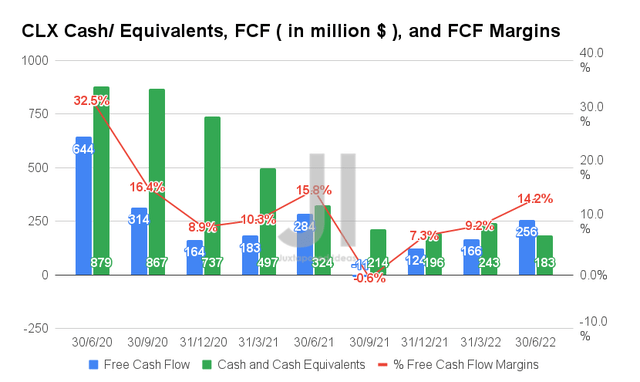

Therefore, it is no wonder that CLX reported a lower Free Cash Flow (FCF) generation thus far, with an FCF of $256M and an FCF margin of 14.2%, representing a decrease of -9.8% and -1.6 percentage points YoY. Otherwise, a decrease of -60.2% and -18.3 percentage points from the peak in FQ4’20. These issues were further exacerbated by CLX’s constantly increasing dividend payouts, which continue to bleed its cash and equivalents on its balance sheet to $183M in FQ4’22, compared to the peak of $879M in FQ4’20.

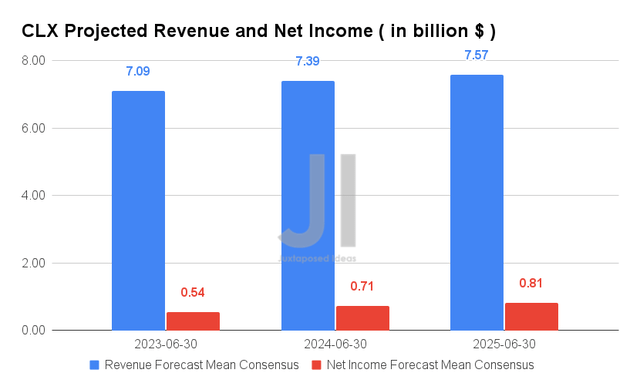

CLX Stock Recovery Is Possible By Mid FY2023

Over the next three years, CLX is expected to report revenue and net income growth at a CAGR of 2.16% and 20.58%, respectively. It is evident that consensus estimates are optimistic about the company’s capability in reversing its profitability to pre-pandemic levels, from net income margins of 13.2% in FY2019, to 6.5% in FY2022, and to a projected 10.7% in FY2025, once the supply chain issues are alleviated then.

In the meantime, consensus estimates that CLX will report revenues of $7.09B and net incomes of $0.54B in FY2023, representing in-line and an increase of 16.8% YoY, respectively. Assuming similar FCF margins of 14.2% then, we expect to see the company maintain its dividend payouts in FY2023, if not a marginal increase. This should alleviate investors’ fears for now. Things will likely normalize over time, with more sideways price action in the short term. Once the market sees improved earnings, we will probably see the stock reverting to its previously slow but steady pace of growth from mid-FY2023 onwards.

So, Is CLX Stock A Buy, Sell, or Hold?

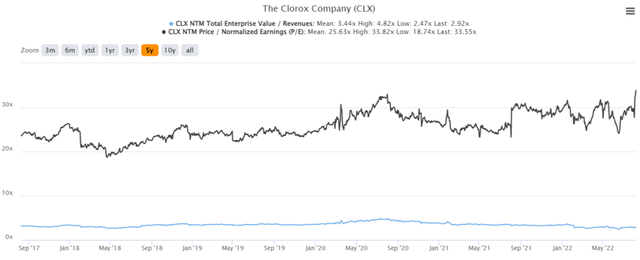

CLX 5Y EV/Revenue and P/E Valuations

CLX is currently trading at an EV/NTM Revenue of 2.92x and NTM P/E of 33.55x, lower than its 5Y EV/Revenue mean of 3.44x though elevated from its 5Y P/E mean of 25.63x. The stock is also trading at $143.41, down 23.2% from its 52 weeks high of $186.86, though at a premium of 19% from its 52 weeks low of $120.50.

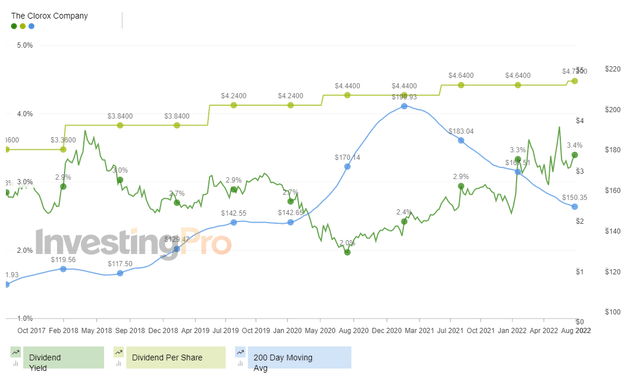

CLX 5Y Dividend Payouts & Yield

In the past five years, CLX has been regularly increasing its dividend payouts, from $3.36 in FY2018 to $4.72 in FY2022, at a CAGR of 8.87%. Thereby, highlighting the stock’s strength as a decent dividend stock. However, it is also evident that the stock has had a rough plunge since hitting the peak in 2021, triggering a temporary weakness in its dividend yields then.

Nonetheless, CLX’s stock performance has remained relatively stable in the past six months, which would paint a rosier picture for its yields ahead, once the company achieves better margins over the next few quarters. In the meantime, investors should not hope for continuous unsustainable dividend growth, given the normalized market condition ahead.

CLX 5Y Stock Price

Despite all of the factors discussed above, consensus estimates still marked CLX as a sell, with a price target of $138 and a -3.77% downside from current prices. This is potentially attributed to its pandemic stock status, as seen from the unsustainable rally witnessed in 2020. Nonetheless, it is also evident that Mr. Market has over-corrected the stock’s valuation, since CLX had drastically normalized to lower than pre-pandemic levels.

Long-term investors who have bought in at lows, may continue holding on for the dividends, though we believe that there are better stocks out there that pay higher dividend yields. In the meantime, we do not encourage any investors to add the stock since CLX is unlikely to rally in the intermediate term, barring another earth-shattering pandemic.

Therefore, we rate CLX stock as a Hold.

Be the first to comment