PeopleImages

Introduction

As a dividend growth investor, I constantly seek additional investments to enhance my dividend income. Sometimes I add to one of my existing positions. In contrast, other times, I add to new positions to take advantage of the valuation or expand my exposure to different verticals.

In this article, I will look into a company in the consumer staples sector. It is a sector where I lack significant exposure and struggle to find decent options. Investors fled to these safer investments, and now it is more challenging to find a decently valued consumer staples company. In this article, I will analyze The Clorox Company (NYSE:CLX).

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that The Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International. The Clorox Company sells its products primarily through mass retailers, grocery outlets, warehouse clubs, dollar stores, home hardware centers, and third-party and owned e-commerce channels.

Fundamentals

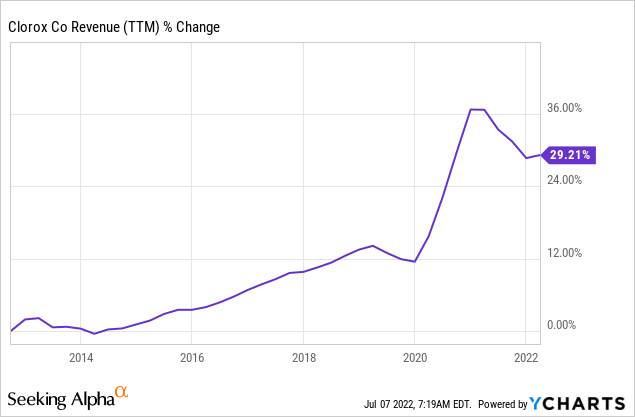

Over the last decade, the company has increased its sales by almost 30%. It is a very modest increase for ten years. The growth was primarily organic, with several small acquisitions that didn’t impact sales. During the pandemic, sales steeply increased as people became more aware of the importance of hygiene in battling the Covid virus. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Clorox to keep growing sales at an annual rate of ~2% in the medium term.

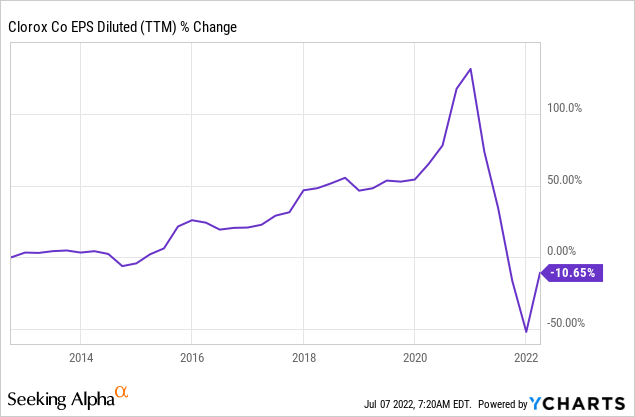

The company’s EPS (earnings per share) has grown much faster. In 2022, the company has a steep decrease in the EPS that, according to the analysts’ consensus as seen by Seeking Alpha, should be followed by increased growth in the next two years. Before 2022, the company reached more than 100% growth in EPS as it improved its margins and squeezed more income from every dollar of sales.

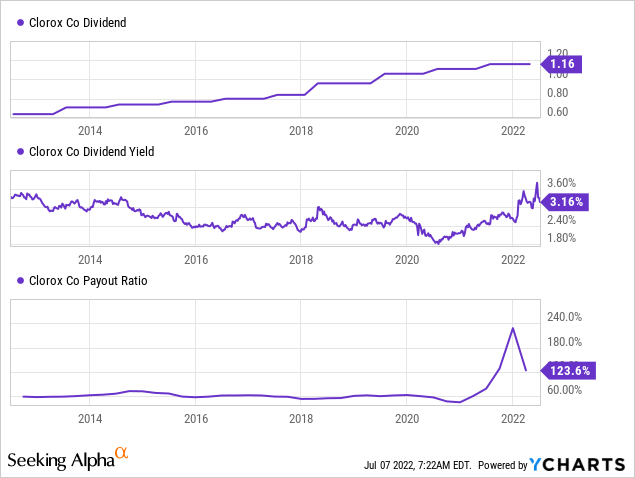

The dividends are the crown jewel for investment in Clorox. The company has been increasing its dividend annually for 44 years. Therefore, the company is almost a dividend king. The dividend is safer than it looks, as the current 123% payout ratio results from a one-time decline in the EPS, and the EPS for next year should offer more than adequate cover. The dividend yield is attractive at above 3%.

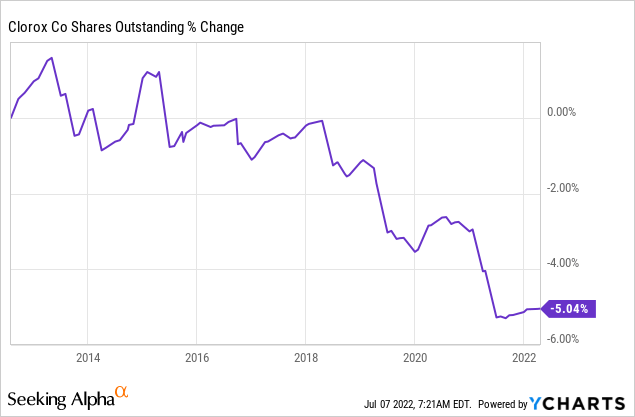

In addition to dividends, the company also invests significant capital in buybacks. Over the last decade, the company decreased the number of shares outstanding by 5%. It happened in the previous five years, as in the first five years, the company focused on not diluting its shareholders. Buybacks for a growing company help boost the EPS and support faster growth.

Valuation

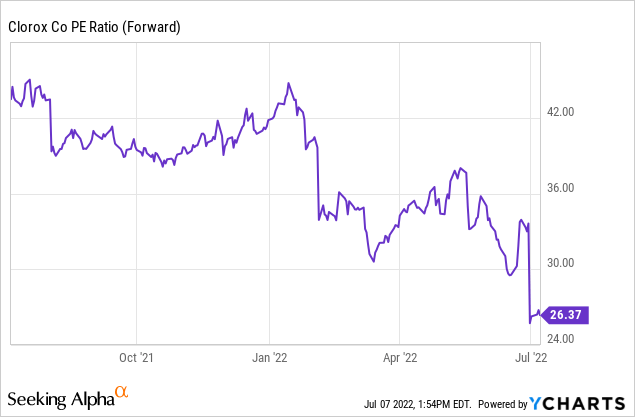

The company’s P/E (price to earnings) ratio is at its lowest point in the last twelve months. The company trades for 26 times the forecasted EPS for June 2023. While this is the lowest valuation we have seen in the previous year, it is still too high for a consumer staples company. The shares are trading for a valuation that we often see with growth stocks such as Alphabet (GOOG) (GOOGL).

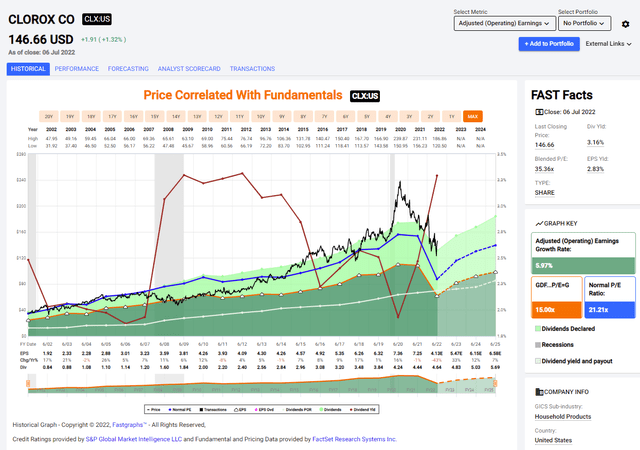

The graph below from Fastgraphs emphasizes how expensive the company is now. The company has historically been trading for 21 times earnings. The current valuation is 25% higher. The forecasted growth rate is also higher than average, yet I don’t believe the mid-teens growth rate is sustainable. Thus I think that the company is expensive at the moment.

To conclude, Clorox enjoys solid fundamentals. Despite limited sales growth, the company grows its EPS by improving margins. It leads to an increase in dividends and buybacks as the company focuses on returning capital to shareholders. That package comes at what I believe to be a high price. The current valuation implies, in my opinion, that Clorox is expensive.

Opportunities

Clorox enjoys excellent loyalty from its consumers. Its brands are loved, and consumers find them effective in cleaning. Therefore, we see that the company controls close to 50% of the cleaning products market. Moreover, we also see that the company has a significant market share in food products, bags, and wraps. The ability to build a brand allows the company to charge higher prices as long as consumers keep finding the products to be effective.

In addition, the company has a great track record of excellent execution. Over the last decade, the company increased its FCF (free cash flow) margin by almost 100%. The management delivered outstanding results as it used its brands to increase sales and gained more cash from the revenues. Competent management is always a great advantage as most companies work in a highly competitive environment.

In addition, Clorox is a company you want to hold if we are to enter a recession as it may outperform. In the financial crisis of 2008, sales of Clorox declined by less than 5%. The company is exceptionally resilient as consumers must eat and clean regardless of the economy. Therefore, investors can expect Clorox to outperform again if we enter a recession.

Risks

The most significant risk, in my opinion, is the lack of margin of safety. Investors flock to safer stocks, and stocks like Clorox are performing well. However, there is also a price for excellent and safe companies. Paying more than 26 times earnings leaves investors with a minimal margin of safety. Every miss or lowered guidance may affect the share price significantly as investors expect higher growth from an expensive stock.

In addition, while Clorox has a strong brand with a significant market share, it also faces competition across the board. The company faces other brands and private labels belonging to large retailers. The first group competes on quality, while the second competes on price. Clorox will have to keep excelling and maintain a competitive price to keep its market share intact.

The competitive risks are going hand in hand with the inflation risk. The current inflation rate in the United States is 8.6%. Clorox has to deal with the price increase of its basic materials and chemicals and higher labor costs. If the company increases prices accordingly, it may lose market share to its cheaper rivals, and failing to raise prices will erode the company’s margins. Therefore, the company has to be very careful when dealing with inflation.

Conclusions

There is no doubt in my mind that Clorox is a great company. You don’t get to the verge of becoming a dividend king by accident. The company has been growing sales and EPS, which led to generous dividends and buybacks. As we advance, the company has significant opportunities due to its brands and strong execution team.

However, there are also risks to the investment thesis. Mainly the lack of margin of safety. I think the current valuation is too rich and may cause significant short-term losses if the sentiment changes again towards growth stocks. Therefore, I believe Clorox is a HOLD at the current valuation.

Be the first to comment