Gold Price Forecast:

- Gold regains confidence despite bullish NFP report

- Inflation and unemployment to remain at the forefront of risk-sentiment, at least for now

- FOMC Minutes will likely be next risk event consumers will be watching

Gold prices continue to serve as a primary indication of current economic conditions, edging slightly higher as USD donates a portion of its recent gains.

Learn How to Trade Gold with Technical and Fundamental Analysis

With the Federal Reserve facing an immense amount of pressure to tighten monetary policy in an effort to curb rising inflation, Gold prices may be more responsive to major US event risk over the next few weeks as consumers continue to anticipate when the Federal Reserve might begin tapering off on bond purchases.

Despite signs of a swift economic recovery and a better than expected NFP report, an influx of stimulus and soaring prices may continue to support the demand for the safe-haven metal as a hedge against the US Dollar and inflation, impacting the short-term move of Gold price action.

Gold Price Action

Gold prices are attempting to recover from last month’s brutal slide, providing a glimmer of hope to the bulls. Failure to maintain bearish momentum below the 50% Fibonacci support level of the 2020 move at $1,760, enabled bulls to regain temporary control of the imminent move, driving price action higher. With the recent formation of a Golden Cross supporting this bullish narrative, the RSI is pointing towards the upside but remains within range, at least for now.

Gold Daily Chart

Chart prepared by Tammy Da Costa, IG

The next hurdle for the bulls now resides at the key psychological level of $1,800 with the next resistance level coming into play at $1,834, the 38.2% retracement of the 2020 move.

Contrary to this, a break below the 38.2% level of the 2021 move currently holding as support at $1,785 could bring the $1,750 handle back into play, increasing potential for further downside if this level is broken.

Gold Sentiment

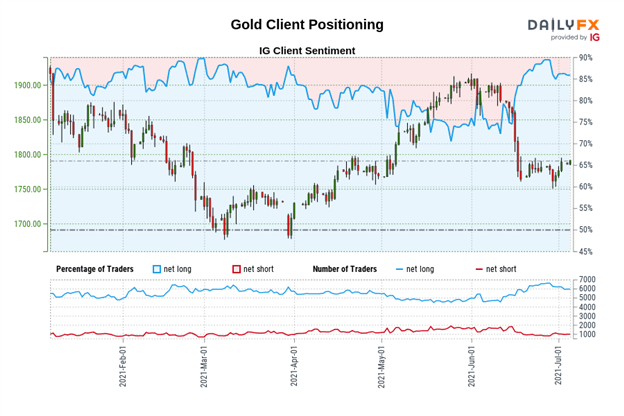

Gold: At the time of writing, Retail trader data shows 85.33% of traders are net-long with the ratio of traders long to short at 5.82 to 1. The number of traders net-long is 1.46% higher than yesterday and 7.91% lower from last week, while the number of traders net-short is 4.63% higher than yesterday and 25.30% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

— Written by Tammy Da Costa on behalf of DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Be the first to comment