Marco VDM/E+ via Getty Images

Investment Thesis

When I last covered Clever Leaves (NASDAQ:CLVR), a “multi-national operator in the botanical cannabinoid and nutraceutical industries, with operations and investments in Colombia, Portugal, Germany, the United States and Canada” (source: company 10K submission 2021), in June last year, I gave the company a “buy” rating when shares traded at ~$10.75 based on its ability to disrupt the industry by producing cannabis flower at a much lower cost than its rivals.

After a tricky 2021 – not just for Clever Leaves, but for all publicly traded cannabis growing and distribution enterprises, Clever stock now trades at a value of $3.84, down ~64% since my last post. For context, over the same period, Aurora Cannabis (ACB) stock is -46%, Village Farms (VFF) is down 46%, Hydrofarm Holdings Group (HYFM) is -73%, and GrowGenerationCorp (GRWG) is -79%.

Things could have been worse for Clever Leaves – the share price had fallen <$1 in early March, before an upbeat Q421 and FY21 results presentation and earnings call with investors last week on March 24 sent the share price soaring last week, reaching $3.55 by COB Friday.

Clever leaves is a grower of cannabis flower, not a distributor – it relies on third parties to purchase its products and distribute them – and its key point of difference is where it produces its product – in Colombia, and Portugal, where the climate is ideal for cultivation, labour costs are cheaper, and where Clever currently enjoys a first mover advantage.

This underlying thesis is proving to be correct – in 2021, Clever Leaves’ cost per gram of cannabis flower produced was $0.22 (according to the its Q421/FY21 earnings presentation) which is significantly cheaper than e.g. Tilray’s (TLRY), $0.72 per gram, Sundial’s $1.86, and Aurora Cannabis’ $2.34, according to management’s data at least. All 3 rivals produce their cannabis in Canada, with a less favourable climate and higher costs of labour.

The main problems Clever has are a lack of growth – revenues grew by 27% year-on-year in 2021, but were still only $15.4m, and a high cash burn – loss from operations in 2021 was $57.2m, following a loss of $36m in 2020. Clever’s cash position has fallen from $79m in 2021, to $37.2m as of Q421, and on its Q421 earnings call, management all but confirmed that further fundraisings were inevitable, which will dilute the value of existing shares.

Clever Leaves has solved one element of a complex puzzle – producing pharmaceutical grade cannabis cheaply – but management still has to prove that it can find commercial partners, obtain the right licenses, certificates, and permissions to ship its product worldwide, and start to increase its revenues and narrow its losses.

In this article I will discuss how realistic a prospect that is, or whether things may get worse for Clever Leaves in 2022. The company – under a new CEO, after existing CEO and Chairman Kyle Detwiler announced his departure, replaced by Andres Fajardo, who has been with Clever Leaves since 2016, having formerly been Founding Partner of Mojo Ventures, a venture capital incubator in Colombia.

Fajardo may be something of an unknown quantity as a CEO, but he clearly impressed analysts last week on the earnings call. Frankly, however, Clever Leaves’ stated ambition, to become “a hub in the global cannabinoid chain” looks to be a tough one to achieve, given its dwindling cash resources, low market valuation, regulatory issues around the cannabis industry, and intense competition.

As such, I would expect the recent share price surge to be short lived, and I would not buy at current price personally, but if the market cap valuation were to return to lows of ~$50m, then I may be tempted to open a position and benefit from market volatility – each time Clever Leaves achieves a milestone, or the legal cannabis industry makes a regulatory stride forward, Clever Leaves stock is likely to reward investors, as it did last week, with some triple-digit upside.

Longer term, if Clever Leaves can weather the storm and locate good partners, its first mover advantage as a producer in Portugal and Colombia could yet see it succeed as more and more international markets open up, whether recreational or medicinal. The company does seem to have built some impressive infrastructure, now it needs legislation etc to go in its favour, before its resources give out.

Company Overview, Recent Results and Forecasts

I covered Clever Leaves and its business model in some detail in my previous note, but just to recap on its listing, Clever Leaves utilized a Special Purpose Acquisition Company (“SPAC”) in order to join the Nasdaq, completing the acquisition of Schulze Special Purpose Acquisition Corporation and Clever Leaves International in a $205m deal in December 2020, which left the company with a funding war chest of $80m.

In Colombia, according to Clever Leaves 2021 10K submission, the company has:

18 greenhouses creating 1.8 million square feet of cultivation space. With 6 million square feet of leased or owned land, our greenhouse cultivation can be expanded to approximately 2.5 million square feet at our existing operating site. We also have an option to acquire approximately 73 million additional square feet of agricultural land for open field cannabis production.

Clever’s greenhouses, propagation area, and post-harvest facility in Colombia have been received Good Agricultural and Collection Practices (“GACP”) certification by Control Union Medical Cannabis Standard (“CUMCS”), as well as GMP certification from Colombia’s equivalent of the FDA (“INVIMA”), and EU GMP certification, apparently by the Croatian Agency for Medicinal Products and Medical Devices (“HALMED”).

In Portugal, Clever Leaves owns:

approximately 9 million square feet of agricultural and agro-industrial land, approximately 260,000 square feet of licensed and operational greenhouse facilities, and an EU GMP-compliant post-harvest facility which we intend to obtain EU GMP certification.

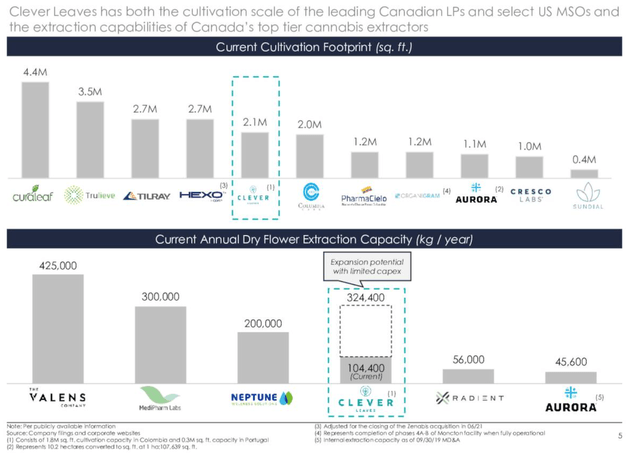

As we can see below, Clever Leaves has relatively competitive cultivation and extraction capacity.

Clever Leaves is globally competitive in terms of cultivation and extraction. Source: Q421 earnings presentation.

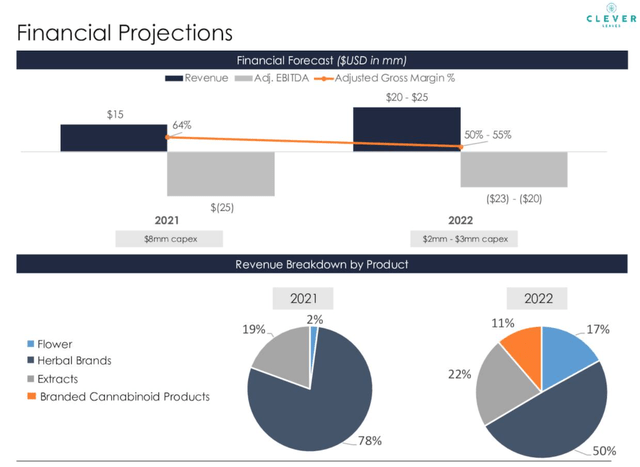

It also generates industry leading gross margins of ~64%, management says. With that said, however, while gross margins are impressive, when you have General and Administrative expenses of $38.4m, or 2.5x sales, as Clever Leaves does, your gross margins are more or less irrelevant.

It’s also important to note that of Clever Leaves’ $15.4m of revenues earned in 2021, $12.1m came from a non-cannabinoid source, namely, its wholly owned subsidiary, Herbal Brands, based in Arizona, which is a national distributor of nutraceutical products.

Clever Leaves did launch Herbal Brands’ first cannabinoid based product, JoySol, last year – a 3-part CBD care system for use throughout the day – and the sales and marketing infrastructure may become more valuable to the company if the US government were to make cannabis legal at the federal level, so the business is complementary to Clever Leaves long term goals in some ways, as well as providing some much needed income, although it is unclear if the business is profitable or not.

It would be interesting to see if Clever Leaves would consider a sale of Herbal Brands, in order to increase its cash position, pay off some of its $25m debt (a significant portion of which is related to a loan taken out by Herbal Brands, and laser focus on its Colombia and Portugal sites.

That does seem unlikely, however, as we can see below, Herbal Brands is still expected to make up 50% of management’s projected $20 – $25m of revenues in 2022.

Source: Q421 earnings presentation.

Markets and Partners

Clever Leaves says it will shortly complete construction of a post-harvest facility in Portugal, for which it has obtained a license from INFARMED, the Portuguese pharmaceutical regulator, to cultivate, import and export GACP quality dried flower.

Importantly, management says this work will mark the end of its capex cycle, which ought to reduce costs in 2022 and narrow the company’s losses. The next step is to find partners and markets, and Clever Leaves has identified Germany, the US, Brazil, Australia and Israel as its key target markets for the time being.

In Israel, a partnership has been initiated with Intercure, a “leader in the cannabis industry in the country,” according to CEO Fajardo. Intercure will have “access to Clever Leaves’ high THC medical cannabis flower to serve several medical cannabis markets”, and Fajardo believes this relationship can be used to help both companies target other markets “within the EU, U.K. and South American markets as regulation evolves.”

Some analysts on the earnings call queried the volumes Clever Leaves could do with Intercure, given the company works with rival suppliers of cannabis, but nevertheless, this is at least an intriguing partnership.

Meanwhile, in Germany, Europe’s biggest market for medicinal cannabis with $260m of sales in FY20, estimated (perhaps optimistically) to grow >$8bn by 2028, Clever Leaves has established its own IQANNA flower brand, while on the B2B side, another partner is Ethypharm, the pharmaceutical chain, which will aid distribution, and another is Cansativa, a cannabis distributor and wholesaler in which Clever Leaves holds a minority stake, who have agreed to purchase ~$2m of cannabis slower product per annum for a three-year period.

There are other partners in Germany besides, so it certainly seems as though progress is being made in these two markets. In the US, Herbal Brands aside, legislation means that Clever Leaves’ hands are effectively tied until something changes – potentially a huge upside opportunity, although it’s questionable if there’s genuine enthusiasm to legalize cannabis in the US. Decriminalization is more likely, which may not help companies like Clever Leaves.

In Brazil, CEO Fajardo told analysts that “2 of our products have already been approved by Anvisa, the National Regulatory Agency under RDC 327, the local regulatory framework for cannabis products,” and that he sees the country as a major growth driver going forward, which is understandable, given its size, adding that “we are navigating through the final process of actually exporting some of that product and getting it to the market in Q2, as I mentioned.”

Given that Mexico has recently legalized cannabis, personally this strikes me as an obvious target, but it doesn’t appear to be on Clever Leaves’ radar, again, most likely for legal reasons I assume.

In Australia, Clever Leaves has a “two-year, $3.6 million take-or-pay basis supply agreement” with Cannatrek around CBD oils, and there’s now a similar deal in place with Australian Natural Therapeutics Group, which is positive news.

Conclusion – Difficult To Separate Hype From Genuine Momentum – Keep A Close Eye On Results

Clever Leaves is exactly the kind of investment that the market has fallen out of love within a climate where headwinds from the pandemic are still strong, interest rates and inflation are rising, and investors want to buy profitable companies, but with that said, as debt becomes less attractive as an investment, due to falling yields, equities are becoming more popular again.

That may make Clever Leaves a little more popular with more risk-on investors, since Clever Leaves is undoubtedly a very high risk investment, even if equities are back in fashion.

Clever Leaves’ first mover advantage is obvious – its land grabs in Colombia and Portugal may well prove to be inspired, and even if the company cannot make them succeed on its own, another cannabis firm – most of whom have vast amounts of cash to deploy – may wish to buy them out.

The issue with Clever Leaves is that, because the industry is still nascent, it’s difficult to assess the value of e.g. accreditations, licenses, and permissions to export flower, since the regulatory environment is in constant flux, and it’s also difficult to assess the value of partnerships.

Could, for example, the Intercure partnership develop into a double-digit million opportunity, perhaps even a triple-digit-million one, or is it a token agreement that’s not legally binding and one where the commitment is all on Clever Leaves side? The same goes for partnerships in Germany, Brazil, and Australia – do they have long-term potential?

Only Clever Leaves insiders will truly know what they may be worth in the long term, and therefore it may not be a good sign that the long-term CEO and chairman just unceremoniously quit the company.

The only way to know for sure is to watch and wait, which is why I would certainly not recommend investing immediately after a share price spurt. If you do believe that the low costs of production in Colombia and Portugal compared to e.g. Canada will eventually translate into global sales or $50m – $100m, for example, then Clever, at a forward P/S of ~1x, may well look attractive.

It’s a tricky judgment call to make – my advice would be to watch the losses in 2022 – if they narrow, it will be a sign of good financial stewardship, but if they widen, you have to wonder if Clever Leaves management views its investors as a cash cow, and whether they may have bitten off more than they can chew in Portugal and Colombia.

I hope it’s the former scenario, as there could be a massive market here in the making, and it would be rewarding to see Clever Leaves’ bold initial moves pay off. I would also like to see the company ramp up its marketing operations with some new hires, and to begin building a brand with global recognition in mind.

Be the first to comment