sandsun/iStock via Getty Images

Introduction

Until a couple of years ago, Cleveland-Cliffs (NYSE:CLF) was a mining firm, supplying raw material to the steel industry out of three mines in Michigan and Minnesota. This all changed in 2020 when they acquired two steelmakers: AK Steel and ArcelorMittal USA, transforming them into the largest flat-rolled steel producer and the largest supplier of steel to the automotive industry in North America. Not content to stop there, in 2021, Cliffs’ CEO Lourenco Goncalves appointed his son Celso as CEO, and the pair completed the further acquisition of Ferrous Processing and Trading (FPT) one of the largest processors of prime scrap steel in the US. And just to keep the ball rolling, the company recently also announced its intention to acquire U.S. Steel (X) which, if the deal were to come to fruition, would catapult the company into the big leagues as one of the top ten steel producers in the world. This is something of a meteoric rise for a company that a few years ago was a relatively small mining operation. Despite there being some logic behind their vertical integration strategy, the profitability numbers are not impressive so far, and the U.S. Steel deal appears to be a stretch financially. The hype around the current acquisition also looks like an unwelcome distraction when there is still work to do to make the previous deals a success, and I would rate the stock as a sell until they have proven that they can deliver on their current strategy.

ArcelorMittal US Acquisition

The ArcelorMittal acquisition in 2020 turned Cliffs into a major steel producer, at the time bringing $10.4 billion in revenues and $700 million of EBITDA. Cliffs paid $2.5 billion for AMUS using a combination of common and preferred stock and $630 million in cash. As part of the deal, Cliffs agreed to assume responsibility for $3.3 billion of pension and OPEB liabilities, with the purchase price also including $1.2 billion in goodwill. With the AK Steel acquisition also bringing $975 million in similar liabilities, these jumped from $316 million to $4.2 billion on the Cliffs’ 2020 balance sheet.

The current rising interest rate environment, however, has improved discount rates and reduced the value of this liability substantially. In a move that would be admired by stakeholder theorists, Cliffs has also worked with the United Steelworkers Union (USW) to renegotiate the retiree medical coverage plans under the current VEBA enabling them to provide the same service at a substantially lower cost. The net result of this is that both the pension scheme and the VEBA are currently overfunded, and the company has been able to remove $3 billion in liabilities from its books. Taking a large chunk of the legacy pension and OPEB liability out of the equation makes the purchase of AMUS look like a bargain, with Cliffs effectively paying substantially less than book value for the net assets.

The rationale behind the expansion into the steel industry is aptly described in the strategy section of Cliffs’ last annual report:

We are a fully integrated steel enterprise with the size and scale to achieve margins above industry averages for flat-rolled steel. The combination of our ferrous raw materials, including iron ore, scrap and HBI, allows us to do so relative to peers who must rely on more unpredictable and unreliable raw material sourcing strategies.

We have an industry-leading market share in the automotive sector, where our portfolio of high-end products delivers a broad range of differentiated solutions for this highly sought after customer base. As a result of our exposure to these high-end markets, we have the highest fixed price contractual volumes in our industry. Approximately 45% of our volumes are sold under these contracts. These contracts reduce volatility and allow for more predictable through-the-cycle margins.

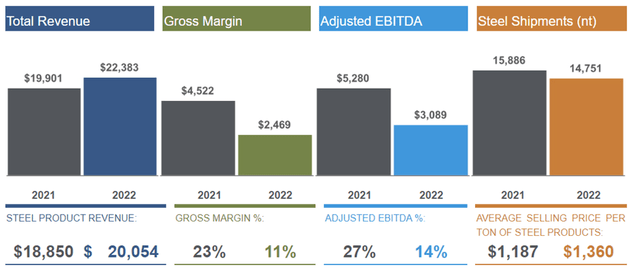

On the face of it, Cliffs’ strategy would appear to be a smart one; by owning the raw material supply as well as producing the final product, they should be able to better shelter themselves from volatility in commodity prices. With its main customers in the automotive industry, the company negotiates yearly fixed-price contracts, and by vertically integrating the business, it should be able to keep a larger percentage of the overall margin in-house or be in a better position to pass some of this back to the customer if in a tight competitive bid. We only have a couple of years figures to go on; however, the strategy doesn’t seem to be reaping rewards as yet. As the below figures show, 2021 was a reasonably good year; however, in 2022, net income dropped by 54%, adjusted EBITDA fell by 40%, and EPS reduced from $5.36 to $2.55. The company attributed this drop in performance to reduced gross margins related to higher raw material and utility costs as well as increases in both maintenance and labor costs.

Cliffs Recent Performance (Cleveland-Cliffs 2022 Annual Report)

The most worrying part about these results is that the average selling price of steel increased in 2022, which provided a boost to revenue and should have helped gross margin. There are also another couple of points that are worth noting. Firstly, gross margins were affected adversely by raw material costs, which doesn’t bode well for the vertical integration strategy. Secondly, they were also affected by increasing labor costs. The cozy relationship with USW may have been good for the balance sheet; however, it has come at a cost, with the company agreeing to increase wages by 8% in 2022 and a further 4% each year until 2025. This will, therefore, continue to put pressure on GM in the near term.

Proposed Takeover of U.S. Steel

In August of this year, Cliffs announced that it had submitted a formal offer to acquire U.S. Steel. The offer was for $17.50 plus 1.023 shares of Cliffs stock per share, which at the time would have made the deal worth $7.8 billion. The first point that jumps out from the offer is the $17.50 per share which would have required about $3.9 billion in cash (at the time). Cliffs, however, doesn’t have $3.9 billion in cash, in fact, its cash balance was only $34 million in the Q2 report, up from $26 million in 2022 and it hasn’t been over $100 million since 2020. In fact, if you took a walk down to your local country club, I’m pretty sure you’d find a couple of members in the bar with a higher cash balance.

Since the AMUS takeover, Cliffs has generated $2.8 billion of operating cash flow in 2021 and $2.4 billion in 2022. From this, an average of $800 million per year has gone on CAPEX with the majority of the rest going to pay down debt and to repurchase stock. The company has committed to reducing total debt to $3 billion and is making good progress in this regard with this currently sitting at $3.9 billion, down from $5.3 billion two years ago. They have also stated that they will continue to allocate all free cash flow to debt repayment and share repurchases going forward and as they don’t pay a dividend, the repurchases are the only way that cash is distributed to shareholders.

To manage operations without cash, the company has been using an ABL facility, with current net borrowing sitting at $833 million, down from $1.8 billion at the end of 2022. Looking at the cash flow statement, the company is using this facility like a bank account, borrowing $5.75 billion and repaying $5.5 billion in 2022 (with similar figures in 2021). With the interest rate currently at 7.091%, this is an expensive way to fund operations and it can’t help the gross margin number. Operating cash flow has also tanked in the first half of this year, reducing to $848 million from $1,398 in the first half of 2022. At that level, there isn’t a lot left over to meet current commitments with any leftover for acquisitions.

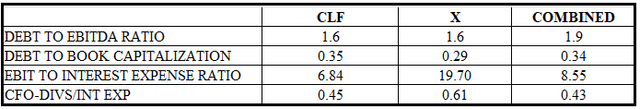

Without any cash, the question of where they are going to get $3.9 billion to acquire U.S. Steel comes to mind. Fortunately, for Cliffs, U.S. Steel has about $3 billion in cash and equivalents, and assuming they need 5% of sales as cash for operations, there is about $2 billion spare that Cliffs could use. That still leaves Cliffs about $1.9 billion short; however, according to recent reports, there is a group of banks willing to provide the necessary financing. Following Moody’s methodology for the steel industry, I have put the below leverage and coverage figures together for the combined company. This assumes $1.9 billion more in debt, $2 billion less in cash, and interest costs at around today’s level.

CLF, X and Combined Leverage and Coverage Metrics (Authors own Calculations)

Moody’s currently rates Cliffs as Ba2 and U.S. Steel as Ba3 and although there is a deterioration in the scorecard, the combined company would still be in that range with no immediate threat of a downgrade. Steel prices are notoriously volatile, however, and with more debt and less cash, the combined firm could be exposed if market prices moved against them over a prolonged period. Post-acquisition revenues would be in the $40 billion range and with a scant amount of cash on hand, they may also need to make increased use of the ABL facility. With $4.5 billion available, it would be possible, though as discussed earlier, this is an expensive way to do business and would affect margins.

Value

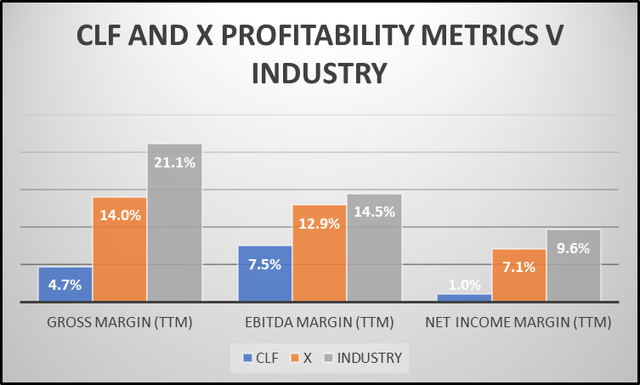

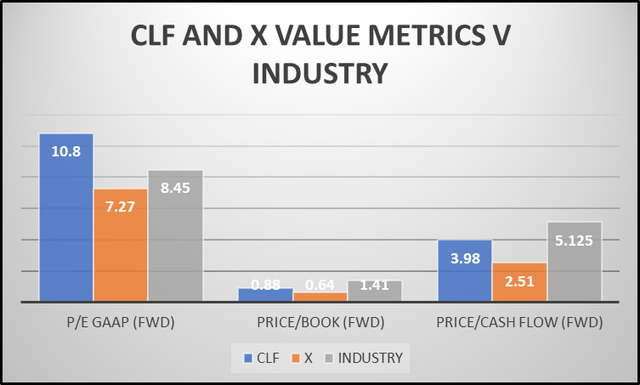

With reference to the below figures, it can be observed that both Cliffs and U.S. Steel are currently underperforming their peers in terms of profitability. U.S. Steel, however, is faring better than Cliffs, posting better numbers for gross, EBITDA, and net income margins. The market appears to have taken a dim view of these numbers and both stocks are relatively undervalued, with forward price to book and price to cash flow ratios for both companies currently less than the industry median. Interestingly, however, despite its poor profitability metrics, Cliffs stock is trading at a forward P/E of 10.8 as compared to the industry median of 8.4, making it look expensive in this respect. U.S. Steel on the other hand is relatively cheap, trading at a forward P/E of 7.3, despite it being more profitable than Cliffs and the stock recently benefiting from a 40% hike in price when news of the acquisition interest broke.

According to a Cliffs press release, there would be $500 million in synergies when combining the two companies; however, that doesn’t really help profitability. Going on the TTM figures and taking $500 million out of the costs of the two firms combined, gross margin would be 11.6%. This is still a lot less than the industry median of 21% and less than the current figure for U.S. Steel of 14%. If I were the CEO of U.S. Steel, the Cliffs bid would look a lot like an offer to swap one share of my undervalued stock for one and a bit shares of their (relatively) overvalued stock plus $17.50 in mostly my own cash. I also wouldn’t be sure if the stock my shareholders ended up owning would be a better investment than the one they already had. Notably, U.S. Steel declined to accept the offer, stating at the time they could not accept Cliffs’ requirement for them to accept the price prior to entering an NDA to conduct due diligence (a statement which Cliffs has since disputed). It should be noted, however, that U.S. Steel has since initiated a formal review process in which Cliffs has been invited to participate.

Reproduced from Seeking Alpha Data Reproduced from Seeking Alpha Data

Notes:

1. The tickers included in the industry figures are: NUE, STLD, RS, CMC, TMST, CLF, and X.

Recommendation

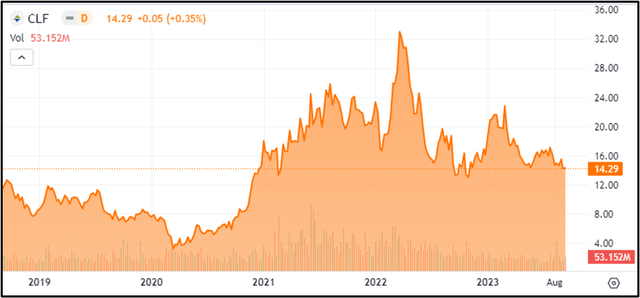

As the below plot shows, if I had bought Cliffs at the end of 2020 after the purchase of ArcelorMittal US and AK Steel, currently my stock would be worth about the same as I had paid for it. In that time, the company hasn’t paid a dividend and with the rate of inflation being high, I’d be out of pocket in real terms when the return on the S&P 500 has been 20% over the same period. Cliffs has only been running a steel-making operation for a couple of years and they have yet to prove that they can do this profitably with recent figures being rather underwhelming and there likely to be headwinds with respect to labour and financing costs going forward. For the U.S. Steel deal to make sense, then the combination of the two companies should be greater than the sum of the parts and with both companies underperforming the industry in profitability metrics, there should be some potential upside. Based on performance so far, I’m not sure if Cliffs management, with a couple of years’ experience in the industry is best placed to do this however, and it is also questionable if they are in a strong enough position financially to make the deal work.

In a recent news article, it was revealed that Cliffs had refused to sign a standstill agreement with U.S. Steel, reasoning that it would like to keep its options open when pursuing the company. U.S. Steel has stated this as a pre-requisite to participate in the sale process which on the face of it would bar Cliffs from being involved. Cliffs, however, has an ace up its sleeve as the USW Union has the option to make a counteroffer to any bid and they have stated that they are willing to sign this over to Cliffs (and only Cliffs). Their refusal to sign the standstill agreement could be a tactic to let them play this chip. At $7.8 billion, however, the deal is already a stretch and with multiple bidders in the sales process, this could go higher still. Should Cliffs attempt to shoehorn themselves in at a higher price, the deal would be a step too far and they could struggle to absorb the expense at current profitability levels.

I can’t see the acquisition process ending well for Cliffs; either they will buy U.S. Steel and struggle to make it work, or they won’t buy them and have wasted a lot of time and effort. It all looks to be an unwelcome distraction when they are still in the process of integrating two previous acquisitions and recent results have not been good. If there is no improvement in results in the second half of the year, the stock will come under pressure and it is, therefore, a sell for me until such time as the management has proven that they can deliver on their current strategy.

Cliffs Historical Stock Price (Seeking Alpha)

Risks

Cliffs’ CEO Lourenco Goncalves recently appeared in a Fortune article that declared him as the Elon Musk of the steel industry. I could, of course, be wrong, and he could achieve his aim of making the company the most profitable in the industry, and as the AMUS deal proved he has the ability to find value in the balance sheet of an acquisition target. It should be noted that making steel is a volatile business and an easing of energy prices or a tightness in supply could give a boost to profitability and help their stock price. There are also the upcoming negotiations over the EU steel tariffs that may work out in their favor. As always, we should consider this alternative thesis as there is no limit to how high a stock price can go (within reason) but the short side has a bottom limit.

Conclusion

You have to admire Cliffs for where they have come from and what they have done in a short period. The U.S. Steel deal, however, is a step too far, in my opinion, with a high potential for downside. Without the acquisition, an improvement in results is required or the stock price may come under pressure, and the acquisition is a distraction from this more pressing task. For these reasons, it is a sell for me until management can prove that they can deliver on their current strategy.

Be the first to comment