Photography By Tonelson/iStock via Getty Images

Although the paper industry may not seem all that exciting, it does offer some interesting opportunities in the current investing environment. The fact of the matter is that there are a number of players in this space that are trading at fundamentally attractive levels. On top of this, the fundamental condition of these firms continues to improve. But it is truly uncertain exactly how long that will last. Even in the event, however, that financial performance for the companies in this space does pull back some, it does stand to reason that there could be additional upside for investors from here. One such prospect that warrants consideration is Clearwater Paper (NYSE:CLW). Its latest performance, in particular, has been very appealing. And absent a significant change in the economics of the space, I have a difficult time believing that there could be more downside for shareholders moving forward.

A disconnect between value and price

Back in September of 2021, I wrote an article about Clearwater Paper wherein I said that the company offers some nice upside potential for investors. This was based on my conclusion that the company’s recurring cash flow was bullish, despite some rather lackluster recent performance by the business. Overall, I concluded that shares were attractively priced and that the risk-to-reward ratio was favorable for investors. Even a return to results achieved in 2019 would likely offer some upside for investors. At the end of the day, this led me to rate the business a ‘buy’, reflecting my belief at the time that it would probably outperform the market from a share price perspective for the foreseeable future. So far, that call has not played out exactly as I would have hoped. While the S&P 500 has dropped by 6.4%, shares of Clearwater Paper have generated a loss for investors of 9.6%.

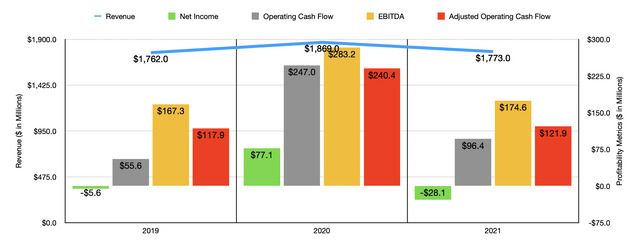

Given this outsized drop, you might think that the fundamental condition of the company was deteriorating. But that’s actually not the case, despite some rather disappointing results for its 2021 fiscal year. For that year as a whole, revenue came in at $1.77 billion. That was 5.1% below the $1.87 billion generated in 2020. The company went from generating a net profit of $77.1 million in 2020 to a net loss of $28.1 million in 2021. Operating cash flow declined from $247 million to $96.4 million. And EBITDA dropped from $283.2 million to $174.6 million.

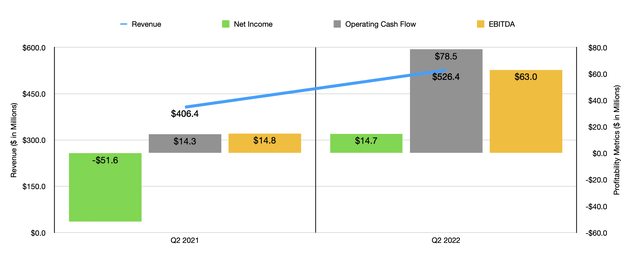

No doubt, these numbers could have been better. But if you look at more recent data, the picture is looking up. Revenue in the second quarter of the company’s 2022 fiscal year, which management just reported on, came in at $526.4 million. That represents an increase of 29.5% over the $406.4 million generated just one year earlier. Even though the sale of pulp plunged by 52.9% year over year, the sale of paperboard skyrocketed by 35.5%. This was driven by two key factors. First and foremost, the volume of paperboard shipments, as measured in short tons, grew by 7.7% from the second quarter of 2021 to the second quarter of this year. Second, paperboard sales prices per short ton rose by 25.9% from $1,058 to $1,332. The company also benefited from its consumer products sales jumping by 28.5%, with retail tissue sales climbing by 34.9% from $169.4 million to $228.6 million. Overall shipments here grew by 14.9%, while retail pricing jumped by 8.3%.

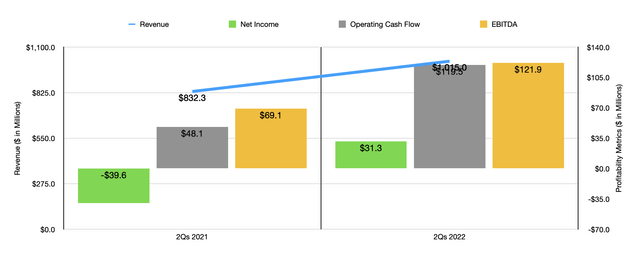

This was not a one quarter thing, however. Overall results for the first half of the year still came in strong, with revenue climbing from $832.3 million in the first half of 2021 to $1.02 billion in the first half of this year. The company saw paperboard sales grow by 27.6%, driven by a 2.5% rise in shipment volume and by a 24.5% increase in paperboard sales per ton. In addition, retail tissue sales grew by 22.1%, with shipments climbing by 7.1% as sales prices grew by 6.2%. Clearly, the top line for the company is healthy thanks to strong demand and the company’s ability to push its cost increases onto its customers.

During this timeframe, the company also saw profitability improve. In the latest quarter, net profits of $14.7 million dwarfed the $51.6 million loss achieved the same time last year. This brought total profitability for the first half of the year up to $31.3 million. That compares favorably to the $39.6 million loss achieved one year earlier. Operating cash flow surged from $14.3 million to $78.5 million, while EBITDA grew from $14.8 million to $63 million. Naturally, this all had a positive impact on results for the first half of the year as a whole, with operating cash flow nearly tripling and EBITDA almost doubling. If this seems improbable, it’s worth noting that any low-margin company can see a significant impact to its bottom line, for better or worse, caused by even small changes in pricing. This is the exact kind of impact that we are seeing here today.

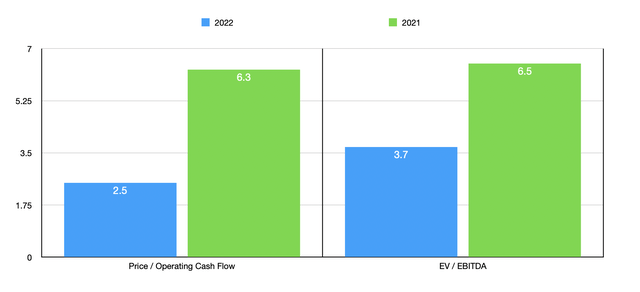

When it comes to the 2022 fiscal year as a whole, management has not really provided any guidance. But if we annualize results experienced so far for the year, then we should anticipate adjusted operating cash flow of $239.5 million and EBITDA of roughly $308 million. On a forward basis, this would imply a price to operating cash flow multiple of 2.5 and an EV to EBITDA multiple of 3.7. These numbers are incredibly low on an absolute basis. But even if we assume that financial performance will revert back to 2021 levels, these multiples would be low still at 6.3 and 6.5, respectively. To put this all in perspective, I compared the company’s valuation using its 2021 results to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 2.2 to a high of 26.3. And using the EV to EBITDA approach, the range was from 1.8 to 14.7. In both cases, three of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Clearwater Paper | 6.3 | 6.5 |

| Mondi plc (OTCPK:MONDY) | 7.1 | 6.7 |

| Mercer International (MERC) | 3.6 | 3.0 |

| Resolute Forest Products (RFP) | 2.2 | 1.8 |

| Suzano S.A. (SUZ) | 3.3 | 5.2 |

| Glatfelter Corporation (GLT) | 26.3 | 14.7 |

Takeaway

All the data is shown right now suggests to me that there is something of a disconnect between fundamental performance and the company’s share price action. The market is clearly concerned, and rightfully so, that current strong performance will not continue. But given how cheap the stock is even if we see results match what 2021 brought, the stock does look cheap on an absolute basis and it’s probably more or less fairly valued compared to similar firms. For those who really like this space, this may well be a decent opportunity to consider buying in. Although I personally have no intention to buy because I feel like there are better prospects on the market at this moment, I could understand why somebody might pull the trigger on this firm right now.

Be the first to comment