Matze Fotograf_Bln/iStock via Getty Images

Company Overview

Clearwater Paper (NYSE:CLW) makes toilet paper and paperboard. Yes, it’s a boring business, but that’s precisely why the market is overlooking this gem. The company’s Consumer segment provides high-end private-label toilet paper and tissue to major grocery chains and membership clubs. Its paperboard segment produces foldable packaging for fast food, microwave-ready food, and over-the-counter medicine. Its products also include disposable coffee cups. It’s not a glitzy business, but it’s a sturdy one.

After beating the market year-to-date, this year’s bear market has pulled the stock down over the last month. Now the stock trades at an incredibly cheap valuation.

Investment Thesis

Fortunately, it’s not glamour that makes the stock attractive. Over the last two years, the company has implemented meaningful changes in how it allocates capital. Combine the changes with a reliable consumer staple product, and the stock has incredible potential.

When Clearwater’s board promoted Arsen Kitch to CEO in April of 2020, what he had was a durable business that, with a little TLC, had a massive upside. The company’s value was masked by the prior management team that allocated capital destructively by squandering cash flow and borrowing to fund low and negative-return investments.

For instance, in 2010, Clearwater acquired Cellu Tissue Holdings for $243.8 million, which it exited in 2018. In 2017, Clearwater spent another $139.7 million on a continuous pulp digestor meant to provide the company with low-cost material to make its Consumer and Paperboard products. But gross margin fell from 11% to 9% in the first two full years of operations. Keep in mind that between 2007 and 2017, the company averaged only $64.3 million in annual earnings.

The company invested over $400 million to build a state-of-the-art facility in Shelby, NC. The idea behind the investment was to create additional capacity to ready Clearwater for overly optimistic sales growth forecasts. Previous management’s sales forecasts proved too ambitious, but Kitch nonetheless used the asset. With excess capacity, he kept the Shelby expansion, closed older mills, and sold its owned and unionized plant in Neenah, WI.

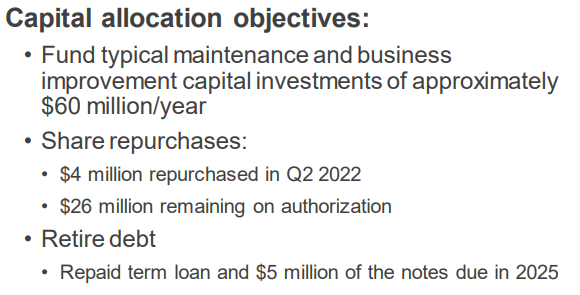

After averaging $139 million in capital expenditures during the previous ten years, the company’s plan would slash capex by more than half to a normalized $60 million per year in maintenance capex. Now the company stands ready to deploy its cash flow in a more shareholder-friendly manner.

Clearwater Paper Q2 Investor Presentation

Minor changes have had a major impact on the company’s future

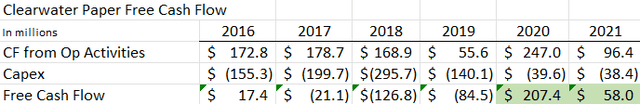

Let’s put Clearwater’s cash flow improvements in perspective. From 2016 to 2019, the company’s annual free cash flow varied widely but averaged $(53.75) million. The impact of Kitch’s allocation strategy was immediate. In 2020, Clearwater generated $207.4 million in free cash flow. In fairness, 2020 was a banner year for the company, marked by toilet paper hoarding due to COVID-19 lockdowns. But in 2021, while Clearwater experienced significant destocking, it still produced $58 million of cash flow.

Clearwater Paper Annual Free Cash Flow (Company Annual Reports)

Since Kitch implemented his capital allocation strategy, the company has reduced long-term debt from $884.5 million at the end of 2019 to $598.5 last quarter. Speaking of last quarter, Clearwater also announced that it had reached its target net debt to adjusted EBITDA ratio of 2.5x. In addition, it bought back $4 million of its stock, leaving $26 million left on its current buyback authorization (on a market cap of $654 million).

Going forward, Clearwater plans to continue returning dramatically increased cash flow to shareholders by deleveraging and focusing more on share buybacks. Kitch also hinted at the possibility of M&A:

As Mike noted, we intend to discuss our capital allocation plan and priorities during our third-quarter earnings call. These priorities will be anchored by continued performance improvement and capital expenditures and will likely include a balanced and opportunistic approach to return capital to shareholders, further deleveraging, and possible M&A.

This situation is not at all flashy. There are no disruptive technology or head-turning growth projections. It’s an easy-to-understand, rock-solid business, unmasking its value by making better decisions regarding its capital. The little work, the company, needed to put itself on track to create value for shareholders is behind it and is now generating prodigious amounts of cash.

Risks

Clearwater has a similar risk to many small-cap stocks. Its top 10 customers represent 46% of its 2021 revenue. Though many of its customers have been with the company for many years, that doesn’t mean they won’t bolt for a competitor. In 2017, Kroger took a multi-supplier approach and cut its purchases from Clearwater.

The materials used to make Clearwater’s products, like wood pulp from lumber and energy used to run plants are commodities subject to wild cost swings. These input costs affect all market participants, and prices are typically adjusted accordingly. But due to price increases (and operating efficiencies), Clearwater’s gross margin in the first two inflation-plagued quarters of this year stood at 13.5%, compared to 9.5% last year.

Of course, Clearwater could do an about-face and spend capital irresponsibly or flub an M&A deal. Given Kitch’s history, I place a small probability of that happening. The bear market could also hammer shares until a recovery. But a depressed stock price makes buybacks a much more attractive long-term use of capital.

Valuation

Considering the company’s focus is now on maintenance capex, there is a noticeable difference between non-cash depreciation on previously acquired assets and lower future cash capex. For instance, Clearwater expects between $101 million and $104 million of depreciation and amortization this year. And the company projects normalized capital expenditures of ~$60 million annually. By taking out non-cash depreciation and replacing it with cash capex, the ~$40 million difference is additional cash coming into the company above accounting earnings.

Since the company has a stable ~16.7 million share count, the additional annual cash flow adds about $2.39 per share ($40m cash flow / 16.7m shares) to earnings per share. When added to Wall Street’s earnings per share estimate of $3.98 for this year, we reach roughly $6.37 in free cash flow per share this year. That implies a mouth-watering 5.9 times forward P/CF valuation.

Even a routine 16 times multiple puts the stock at $102 or 167% from today’s price. In a best-case scenario where the current bear market gives way to a bull market, the stock could fetch 20 times (similar to competitor Kimberly-Clark (KMB), today) multiple or $127 per share – a 234% return. However, neither of these scenarios fully showcases the long-term effect of intelligent capital allocation.

For perspective, let’s say Clearwater generates $100 million in free cash flow (less than the average of the last two years) per year. It could use the cash to eliminate its debt in less than six years. That would save the company ~$34 million per year in cash interest payments, which adds another $2.03 per share ($34m / 16.7m shares). If the company repurchased shares at an average price of $60 (up 50% from today) with $100 million in cash flow over six years, it would extinguish 10 million shares, leaving 6.5 million outstanding. That would boost $6.37 in cash flow per share to $15.38 ($100m CF / 6.5m shares). The company will likely deploy a combination of the two or M&A, but all these scenarios are incredibly favorable for shareholders.

Though Clearwater stock has outperformed the market this year, it’s not too late to buy the stock. As the company continues to create value by investing its newfound free cash flow to benefit shareholders, the multiple should vault to a much more respectable valuation over time. Though their friends might not be impressed when they tell them they bought a toilet paper stock, buy-and-hold value investors should see the stock as a slam dunk.

Be the first to comment