marchmeena29/iStock via Getty Images

By Scott Glasser | Michael Kagan | Stephen Rigo

Too Early to Call a Bottom

Market Overview

What a difference a year makes. At year-end 2021, the S&P 500 Index completed three consecutive years of double-digit returns, including seven consecutive quarters of positive results. The cumulative three year (2019 21) total return of 100.4% (a +26% compound annual growth rate) fell within the top decile of any rolling three-year period over the past 95 years. By contrast, in 2022 the S&P 500 failed to post a quarter of positive returns until the fourth quarter’s +7.6% rally off the September lows, which left the index down only 18% for the calendar year. Market declines in the first three quarters were the first time since the global financial crisis (GFC) where the S&P 500 posted three consecutive quarters of negative returns (it fell in six consecutive quarters between 2007 and 2009). 2022’s decline was the S&P 500’s worst annual performance since 2008.

Market performance in the fourth quarter started strong as the S&P 500 rallied 14% in the first two months of the quarter. Oversold conditions off the September low met softer-than-expected inflation data, driving optimism that the Fed’s path on interest rates could be less steep than previously expected. However, Fed Chairman Jerome Powell dashed hopes for a year-end rally post the December Fed meeting by stating the committee’s inflation fighting is far from complete and monetary policy will remain restrictive “for some time.”

“The S&P 500’s three-year total return of 93% fell within the top decile of any rolling three-year period over the past 95 years.”

Energy led the index in the fourth quarter, capping off a second consecutive year of massive outperformance. The sector returned a whopping 66% in 2022 and was one of only two sectors with positive calendar year returns (utilities returned +1.5%). Consumer discretionary was the quarter’s notable laggard, largely the result of declines in Amazon.com (AMZN) and Tesla (TSLA), which dropped 26% and 54%, respectively. For the calendar year 2022, communication services and consumer discretionary stocks were notable laggards as high-profile tech stocks such as Meta Platforms (META) and Netflix (NFLX, in communication services) and Amazon and Tesla fell out of favor. Notably, the IT sector underperformed in 2022, the sector’s first year of underperformance since 2013.

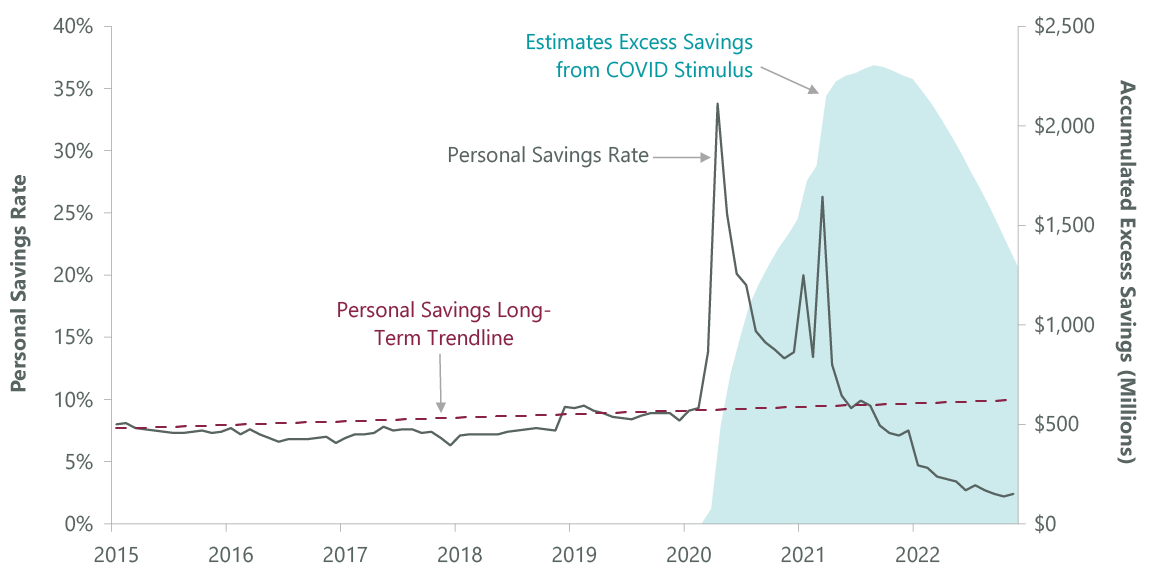

The Federal Reserve has been successful in creating more restrictive financial conditions. Money supply is not growing for the first time in over 25 years (Exhibit 1); the Fed balance sheet is shrinking after doubling in size post COVID-19; and consumer savings are being spent down after the COVID-19 stimulus-driven surge (Exhibit 2).

Exhibit 1: Money Supply Not Growing

As of Nov. 30, 2022. Source: ClearBridge Investments, Federal Reserve.

Exhibit 2: Personal Savings Falling Post-COVID-19

As of Nov. 30, 2022. Source: ClearBridge Investments, Bureau of Economic Analysis, Bloomberg Finance.

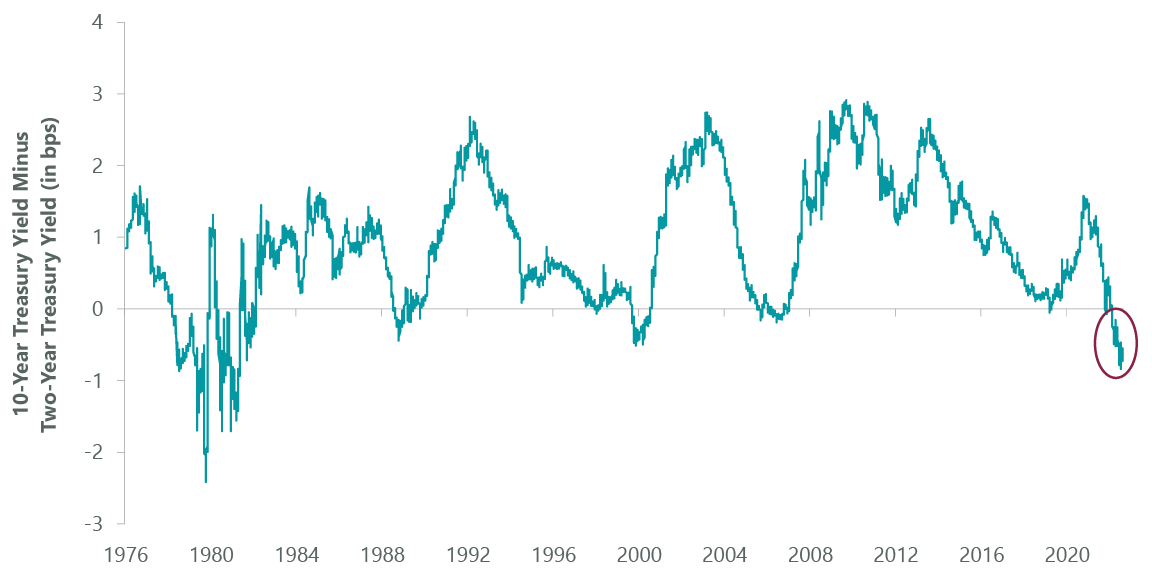

Although tighter financial conditions have yet to bleed into traditional measures of growth such as GDP, Fed actions are having the desired effect, namely, to reduce aggregate demand and weaken the red-hot employment market. Most measures we follow as a gauge of future economic activity point toward an impending recession. The Conference Board’s Index of Leading Economic Indicators is at its lowest level in over 40 years (at that time inflation was also front and center); the Purchasing Managers’ Index (PMI) — a good measure of future profits — continues to decline; and bank loan officers continue to tighten lending standards. Finally, the steep inversion of the Treasury yield curve, which has an excellent track record forecasting recession, continues to suggest recession is a matter of “when,” not “if” (Exhibit 3).

Exhibit 3: Treasury Yield Curve in Steep Inversion

As of Jan. 5, 2023. Source: ClearBridge Investments, Bloomberg Finance.

It’s not all doom and gloom. Investors have begun adjusting to the current investment backdrop, recognizing that a recession is a base case probability. At 16.6x 12-month forward EPS, the S&P 500 is now trading roughly in line with its historic average (Exhibit 4). This is a meaningful adjustment from the ~22x P/E multiple at year-end 2021, which was two standard deviations above historic average. However, just as positive EPS revisions and low interest rates supported an expensive market in 2021, we remain concerned equities in 2023 are at risk for negative EPS revision and higher interest rates, which could further impact the market multiple. Said another way, although the market is cheaper today, it is not cheap, especially given the current backdrop.

Exhibit 4: Market is Cheaper Today, but More Downside Is Possible

Chart depicts quarterly data prior to Dec. 31, 2009; weekly data subsequently. Data as of Jan. 3, 2023. Source: ClearBridge Investments, Bloomberg Finance.

Outlook

The market decline to this point largely reflects higher interest rates but not yet the lower earnings from a likely recession, in our view. Although we continue to favor more defensive industries such as pharmaceuticals and insurance, the current decline has created some idiosyncratic opportunities to add exposure to growth stocks.

At this point, we estimate 75% of the multiple compression from higher rates is reflected in stock prices. The remaining 25% is likely a function of how long the Fed keeps rates elevated to counter base inflation. Market consensus expects the Fed to transition to a more dovish stance and perhaps cut rates as early as the second half of 2023. However, we believe that assumption is too hopeful and believe the central bank will hold rates higher for longer as both service and wage disinflation occur more slowly than investors expect. Moreover, Fed Chairman Powell is mindful of the decade-long battle against inflation between 1972 and 1982 and is likely to maintain a restrictive policy stance longer than market participants expect (Fed easing is considered the cause of a second bout of inflation in the late 1970s). Current stock multiples remain higher than the trough levels witnessed during the last three bear markets, creating some future risk.

We remain concerned investors are too sanguine about the outlook for corporate earnings. While 2023 S&P 500 earnings expectations have started to decline, consensus still expects 10% earnings per share growth in 2023. Given mounting demand headwinds and record-high corporate margins, we believe 2023 earnings will struggle for growth, on average. As such, we believe estimates have ~10% downside and expect negative revision to 2023 estimates early in the year. Simply put, we will be much more comfortable should EPS expectations reset to a more subdued earnings growth rate year over year in 2023.

However, there remains reasonable debate about the depth of a future recession. While we do expect a recession in 2023, we are not ready to opine on the severity. The unique circumstances surrounding COVID-19 (as well as further implications from the Russia-Ukraine war) and its global effect on inflation, labor, supply chains and supply/demand dynamics make forecasting a challenge. Given this uncertainty, we intend to prudently and methodically add to our highest-conviction ideas as market expectations adjust.

Conclusion

Throughout 2022 we asserted investor total return expectations should be muted near term, a stance we maintain at 2023’s outset. We see market performance in 2023 shaping up as a tale of two halves. Today, we continue to lean defensively and favor companies with durable cash flows, dividends and clean balance sheets. Many of these companies reside in traditional value-oriented sectors. However, when market participants become convinced the bear market is over, market leadership will rotate toward small-cap and more aggressive, higher-risk stocks. The current selloff has begun to provide us opportunity to acquire higher-growth names at attractive risk/reward.

It’s important to remember that the market is a discounting mechanism and will make its bottom before earnings and the economy trough. Encouragingly, the market has begun to price in a more subdued outlook and certain companies are beginning to discount earnings growth. Anecdotally, companies that missed second-quarter 2022 earnings almost uniformly saw stock price declines, while third-quarter misses resulted in more mixed or muted reactions. Rather than trying to project near-term earnings trends, we believe it is better to look out two to three years and make investment decisions based on the longer-term, sustainable growth rates of companies.

As active managers and fundamental stock pickers, we embrace the current volatility as an opportunity to differentiate while the bear market grinds to a durable bottom. The timing of a market bottom and absolute depth of the market decline will be a function of how quickly the Fed gets inflation under control and the depth of a likely recession. In the meantime, we are building lists of stocks to own for the long term and stand ready to take advantage of the temporary price dislocations that volatility and bear markets create.

Portfolio Highlights

The ClearBridge Appreciation Strategy outperformed the benchmark S&P 500 Index in the fourth quarter. On an absolute basis, the Strategy had positive contributions from nine of 11 sectors. The financials, health care, industrials and IT sectors were the main positive contributors to performance, while the real estate and communication services sectors were detractors.

In relative terms, stock selection and sector allocation contributed to outperformance. In particular, stock selection in the consumer discretionary and financials sectors boosted relative returns. An underweight to the consumer discretionary sector and overweights to the energy and materials sectors also proved beneficial. Conversely, stock selection in the energy and industrials sectors detracted.

On an individual stock basis, the biggest contributors to absolute performance during the quarter were JPMorgan Chase (JPM), Merck (MRK), Honeywell International (HON), Chevron (CVX) and TJX Companies (TJX). The biggest detractors were Amazon.com, Apple (AAPL), Alphabet (GOOG, GOOGL) , Meta Platforms and EQT.

During the quarter, we initiated new positions in Nvidia (NVDA), PayPal (PYPL) and Palo Alto Networks (PANW) in the IT sector, Tesla in the consumer discretionary sector and Emerson Electric (EMR) in the industrials sector. We closed positions in Medtronic (MDT) in the health care sector, Truist Financial (TFC) in the financials sector and Fidelity National Information Services (FIS) in the IT sector.

Scott Glasser, Chief Investment Officer, Portfolio Manager

Michael Kagan, Managing Director, Portfolio Manager

Stephen Rigo, CFA, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment