Lemon_tm

By Evan Bauman | Peter Bourbeau | Aram Green | Margaret Vitrano

Cash Flow Compounders Show Their Strength

Market Overview

Equities ended a tumultuous year on a positive note, grinding higher in the fourth quarter on better-than-expected corporate earnings and signs that inflation may have peaked. The S&P 500 Index rose 7.56% for the quarter but finished down 18.11% in a year marked by a historic tightening of financial conditions. With the Federal Reserve raising interest rates by 425 basis points, its most aggressive campaign since the 1980s, long-duration growth stocks felt the most pain. The benchmark Russell 3000 Growth Index gained 2.31% for the quarter but underperformed the Russell 3000 Value Index (+12.18%), extending a streak that saw growth stocks fall 28.97% for the year, trailing value by 2,100 basis points.

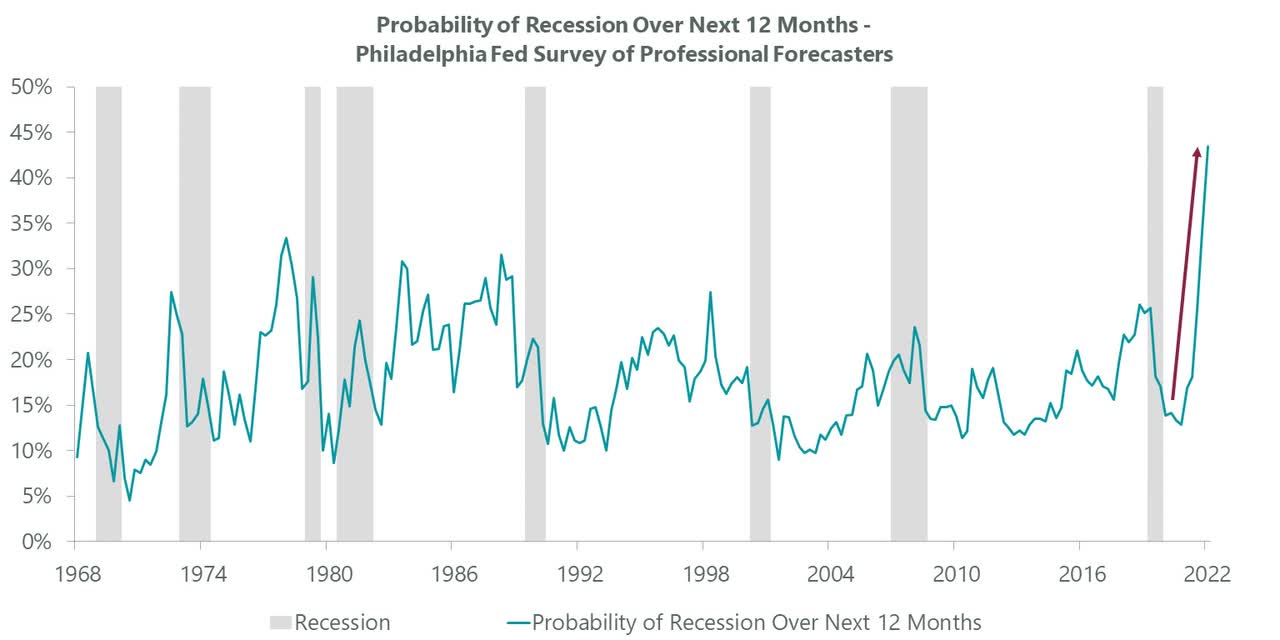

Better than expected corporate earnings and initial signs that inflation may have peaked supported stocks during the quarter, leading to double-digit gains across the market in October and November. But gains were pared in December as the Fed pushed through a 50 bps rate hike on top of a 75 bps move the previous month and indicated that it would keep rates higher for longer to ensure structural inflation does not take hold. Such rhetoric confirmed the views of many pundits that the U.S. economy will fall into recession in 2023 (Exhibit 1).

Exhibit 1: Recession a High Probability in 2023

Data as of Dec. 31, 2022. Source: Federal Reserve Bank of Philadelphia, FactSet.

We have been cautious on the economy and markets for some time, positioning the ClearBridge All Cap Growth Strategy accordingly for the current environment and what will likely be another unsettled year ahead. As a result of moves solidified during the year, the Strategy outperformed the benchmark in the fourth quarter.

Results in the last three months were driven by stable compounders as well as growth companies that have already suffered losses and seen their earnings outlook reset lower. Among our compounding contributors were communications chipmaker Broadcom (AVGO), which has managed inventory better than peers and continues to generate healthy levels of free cash. Broadcom should benefit from a more balanced revenue mix between semiconductors and software upon the expected closing of its acquisition of VMware (VMW) in 2023. Long-time media position Comcast (CMCSA) saw a snapback after a difficult first half of the year caused by cord cutting in its cable business and slowing subscriber growth in its broadband business. A flexible balance sheet and strong cash generation enabled the company to repurchase shares during the selloff earlier in the year.

Nike (NKE) has been pressured by an uneven global recovery that led to surplus inventory. We added to the position earlier in the year with the view that its inventory write-down should not derail the company’s long-term high-single-digit revenue growth or the margin expansion from its enhanced focus on the direct-to-consumer business. While near-term earnings estimates may have some risk, much of the multiple contraction is in the current value of Nike shares and sentiment has shifted, with the shares bouncing 40% higher during the quarter. Netflix is another earnings reset name that has taken decisive actions, developing an ad-supported subscription tier and cracking down on password sharing, that have helped its shares rerate strongly.

More restrictive financial conditions weighed on several disruptors and companies that are not yet profitable. Wolfspeed (WOLF), a leader in the emerging market for chips from silicon carbide ((SiC)) for power management applications, was a primary detractor in the fourth quarter after strong performance earlier in the year. The company has suffered from short-term execution issues at its Durham, N.C. plant as it ramps up capacity in its newer fab to meet the significant long-term demands for SiC technology. The company raised $1.5 billion in a convertible offering that improves its cash position, but it will have ongoing financing needs in the years ahead.

More discretionary IT spending is beginning to create headwinds for software makers, even in areas deemed recession proof like information security. This demand uncertainty, coupled with the vulnerability of higher valuation of growth companies to a higher for longer interest rate regime, pressured security holdings CrowdStrike (CRWD) and Palo Alto Networks (PANW) as well as workflow software maker Atlassian (TEAM).

Portfolio Positioning

Expanding diversification to a greater range of growth companies and improving risk management have guided repositioning over the last year. We remained active in the fourth quarter, adding five positions while exiting three others. The outcome of these efforts is a more balanced and diversified portfolio with the potential to provide resilience during downturns and keep pace during momentum-driven upswings.

We added Zoetis (ZTS) to the portfolio due to its improving ESG characteristics. The world’s largest animal health company provides medicines, vaccines, diagnostics, and other products for companion animals (dogs, cats, horses) and livestock (cattle, swine, poultry, fish). The company has been steadily improving its ESG performance under the leadership of CEO Kristin Peck, who took over the role in 2020 and has brought new rigor to its ESG policies. The company indexes particularly well on diversity, equity and inclusion and sustainability progress. On the sustainability front, the company has begun major initiatives to improve its environmental efficiency, including moving up its target to source 100% renewable energy in its operations to 2030, which is a 20-year acceleration from the initial goal, and is moving towards becoming carbon neutral in its own operations by 2030. The area of greatest historical concern from an ESG perspective related to its in-feed antibiotic products, which were used in some parts of the world to stimulate animal growth. However, this portfolio has been declining at double digits over time, driven by the company’s decision to pivot away from these products.

We increased our financials exposure with Marsh & McLennan (MMC), which is the world’s largest insurance broker and operates two consulting businesses, Mercer and Oliver Wyman. The company benefits from attractive insurance industry dynamics, durable underlying revenue drivers and a strong margin/free cash flow profile. MMC has demonstrated the ability to grow revenue in excess of GDP growth, particularly during periods of strong property & casualty commercial industry pricing like the current environment, while experiencing more modest revenue declines than overall GDP during past recessions. The insurance brokerage segment does not take underwriting risk but instead earns fees and commissions based on services provided, resulting in low capital intensity and strong free cash flow generation. In aggregate, we believe MMC’s business will be durable during recessionary periods. Risks include a valuation on the higher end of the stock’s historical range, limited exposure to changes in GDP growth and the likelihood that shares would lag balance sheet intensive financials in a rebound.

Estee Lauder (EL), which manufactures and markets cosmetics, fragrances, skin and hair care products across a number of well-known global brands including Clinique, MAC and Bobbi Brown, adds to our group of secular growers. Estee Lauder is a global leader in the prestige beauty space, which has outgrown the broader home and personal care category since 2010 and has historically been recession resilient. The company has substantial brand and pricing power and is overindexed to the highly profitable prestige skin care category. We believe the company’s most recent earnings report and 2023 guidance update, which was cut significantly due to uncertainty over China’s zero-COVID policy (China and travel retail are key growth drivers), provided an attractive entry point. At this point, we believe the stock has been significantly derisked and could see potential upside from a China recovery.

Market volatility provided a rare entry point into disruptive grower Snowflake (SNOW). The operator of a cloud-based data warehousing platform for SMB and enterprise customers, Snowflake is a key beneficiary of software spend moving to the cloud as well as the increasing strategic importance of data. With the potential to address the large and growing market opportunity for data cloud, which represents a $90 billion plus market today, we see a long runway for growth ahead. Although the company is already profitable, we believe Snowflake still has significant room for free cash flow margin expansion over time.

We exited Walt Disney (DIS) to focus on areas of the media industry with better risk/reward. Disney has significant exposure to consumer spending that is showing early signs of weakening. We decided to move on from the name as its traditional linear programming business is dissolving more quickly than expected, while its Disney+ streaming business cannot offset the affiliate fees and advertising revenue that the company has relied on for years. Disney’s parks business has done well recently due to strong pricing power but we have concerns that consumers will continue to spend on such discretionary purchases in a recessionary environment. At this point in the cycle, we believe Netflix has more ways to innovate and improve profitability.

We also sold a position in ImmunoGen (IMGN), a biotechnology company developing antibody-drug conjugate therapies to treat cancer. ImmunoGen received FDA approval for Elahere for ovarian cancer, however it is a relatively modest opportunity and the company still faces a long road to reach meaningful profitability. The sale is also part of our effort to consolidate the portfolio in our highest conviction ideas.

Outlook

Corporate earnings expectations retreated during the fourth quarter, declining 2.8%, the first year-over-year earnings decline since the third quarter of 2020, according to FactSet. As of mid-December, 63 S&P 500 companies had issued negative forward guidance compared to 34 reporting positive projections. We think these trends underestimate the downward earnings revisions still to come and will be closely monitoring the guidance provided by portfolio companies during the upcoming quarterly reporting period.

We see the economic environment as weak and getting weaker, with pain still to be felt on both the corporate and consumer side as the hammer of monetary policy, which acts with a lag, begins to be felt. Led by IT and shadow tech, companies are looking for any way to cut costs, with layoffs increasing among the largest growth companies. The pandemic savings accumulated by households are eroding, with retail sales likely to struggle in the year ahead. While the consumer remains in good fiscal shape, credit is starting to worsen and it’s totally normal to expect a credit cycle to take hold at this stage of an economic contraction. Paradoxically, a slowdown in inflation could also create headwinds: retailers no longer able to lean on price as a revenue driver may see margins contract.

Mega cap growth companies are struggling as much as other businesses due to downstream weakness of their clients. Cloud spending is being hurt by budget constraints of buyers, the advertising business is slowing and management confidence is being challenged by increasingly negative data prints. In short, all signs point to a challenging earnings year. Despite so much uncertainty, we maintain confidence in our portfolio as the active positioning we have put in place is enabling leadership franchises to flex their advantages.

Portfolio Highlights

The ClearBridge All Cap Growth Strategy outperformed its Russell 3000 Growth Index benchmark in the fourth quarter. On an absolute basis, the Strategy had gains in seven of the nine sectors in which it was invested (out of 11 sectors total). The primary contributors were in the health care and industrials sectors while the lone detractor was the consumer discretionary sector.

Relative to the benchmark, overall sector allocation contributed to performance. In particular, an overweight to health care, an underweight to consumer discretionary and stock selection in the communication services, consumer discretionary and consumer staples sectors drove results. Conversely, stock selection in the health care and IT sectors, an overweight to communication services and an underweight to consumer staples weighed on performance.

On an individual stock basis, positions in Broadcom, Visa (V), Netflix (NFLX), Nike and Comcast were the leading contributors to absolute returns during the period. The primary detractors were Amazon.com (AMZN), CrowdStrike Holdings, Atlassian, Wolfspeed and Palo Alto Networks.

In addition to the transactions mentioned above, we initiated a position in Freeport-McMoRan (FCX) in the materials sector and closed a position in Twitter in the communication services sector.

Evan Bauman, Managing Director, Portfolio Manager

Peter Bourbeau, Managing Director, Portfolio Manager

Aram Green, Managing Director, Portfolio Manager

Margaret Vitrano, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment