_ultraforma_/iStock Unreleased via Getty Images

It is always tempting to buy brand name companies trading at what look like cheap valuations. Most investors remember times when these companies and their share prices were at high levels, and value investors like to find well- known companies trading at what often looks like big discounts.

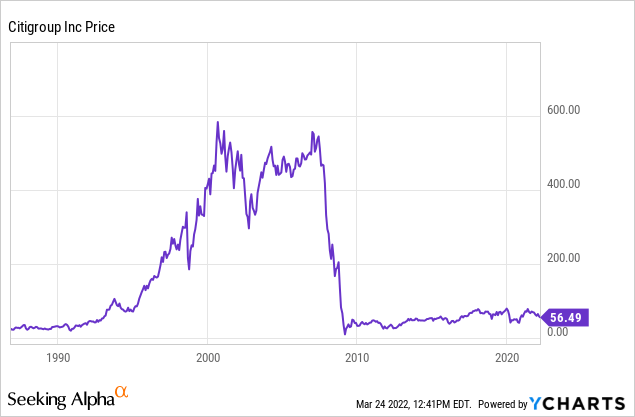

There are a number of well-known leading financial companies that have consistently underperformed the S&P 500 (SPY) for a while. Citigroup is one of them. Citigroup Inc. (NYSE:C) was one of the best performing stocks in the market just over a decade ago, before the financial collapse in 2008.

The stock had a big run from the early 1990s until the financial collapse in 2008, but Citigroup has significantly and consistently underperformed both the major indexes and much of the financial sector since 2008.

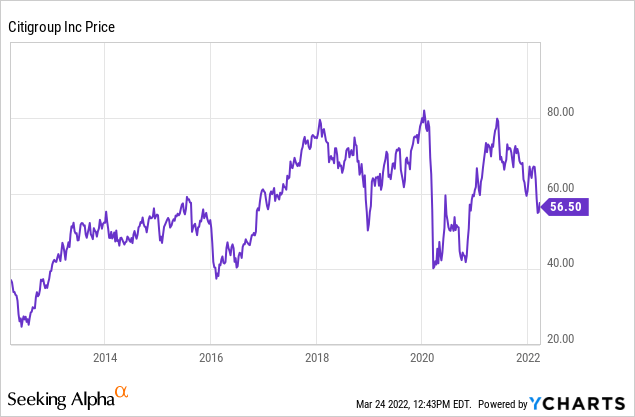

Citigroup’s stock has gone nowhere since 2018, even well the major indexes have risen significantly.

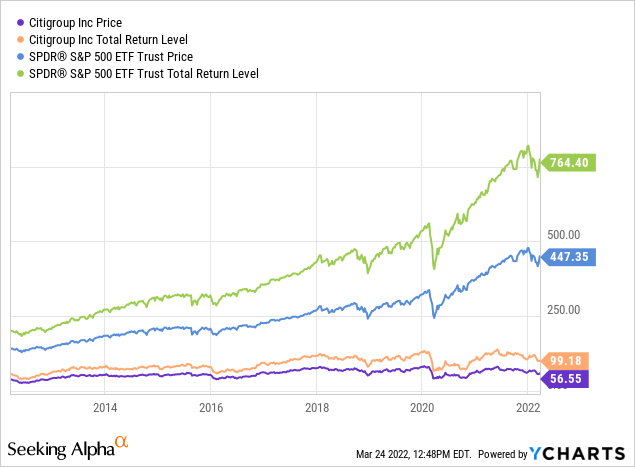

Citigroup has significantly underperformed major indexes such as S&P 500 for some time, and the company’s costly turnaround plan face a number of difficult near-term and long-term challenges.

When Jane Fraser took over in 2021 she immediately announced the closing of 13 large consumer banking franchises across a number of markets. These closing were part of Fraser’s broader plan to achieve two main goals. First, refocus the company’s consumer banking operations to higher margin markets such as Asia, the Middle East, Europe, and Africa. Second, she wants to shift the company’s business operations away from consumer banking into higher margin financial fields such as wealth management and investment banking.

The problem is that Citigroup is trying to enter field where competitors such as Bank of America (BAC) and JPMorgan (JPM) have a significant head start. Citigroup has around $250 billion in assets under management, Bank of America has closer to $1.5 trillion in assets under management, and JPMorgan has over $2.8 trillion in assets under management. Well Citigroup did recently report nearly 25% growth in assets under management, the company’s costs have also risen dramatically, and the situation in Russia is a significant issue for Citigroup as well.

Citigroup’s recent earnings report was concerning for several reasons. Skinner said that she expects costs to again rise this year, this time by about 5-6%, and this after a dramatic 20% rise in operating costs last year. Most concerning was that net income dropped 26% on a year-to-year basis, and expenses increased dramatically and a year-to-year basis by 18%. The company’s withdrawal from Russian has been an issue as well. Citigroup is planning a three-part plan to transform the company’s business over a number of years that will include investing in technology, target a return on equity of 11-12%, and then returning to a more normalized period of operating expenses as the company is smaller after much of the lower margin consumer banking division is spun off. Citigroup has needed to upgrade technologically for a while, as the company’s mistaken $900 million dollar transfer to creditors on a Revlon loan in 2016 showed some of these issues.

Even though Citigroup reported $5.4 billion in asset exposure in Russia and $8.2 billion in third party risk exposure to Russia, which is less than 2% of Citi’s overall assets, the company has been significantly drawing down assets and closing operations in Russia for several months. Citigroup had the most exposure in Russia of any of the major US banks, and even though management was already planning to eliminate the company’s consumer banking business in Russia, the bank also had to give up its institutional and wealth management clients in Russia as well. Analysts are expecting a big hit to Citi’s first quarter earnings in 2022 as assets in Russia are written down, and one analyst has already lowered first quarter estimates from $1.60 a share, to $1.10 a share, since the company is expected to write-off nearly $1.5 billion in assets. This write-off could also impact the company’s buyback plan and current dividend payouts.

Citigroup’s plan is not growing the company’s revenues, and the company’s costs have risen dramatically in the short-term, showing that the cost of Skinner’s plan is not cheap. Citigroup’s exposure to Russia is also significant. Even though Citigroup trades at nearly 7x forward earnings estimates, the company isn’t expected to grow revenues this year after the write-offs in Russia, and the company’s need to invest heavily in areas such as technology show how far behind its competitors this bank is. Citigroup also has more exposure to Asia than most of the company’s competitors, and there have been significant recent downgrades to growth expectations in both China and India. China is already seeing growth slow from just over 8% last quarter, to under 5% this quarter. Growth estimates for 2022 in India have recently fallen significantly from 6.7% to 4.6% as well on inflationary concerns and the likelihood of more restrictive monetary policies in that country.

Citigroup is behind the company’s competitors, and the company’s significant consumer banking divisions aren’t producing the kinds of profits the company needs to consistently grow revenues. Fraser has some bold plans for transforming Citigroup, but she is dealing with a company that is significantly behind competitors on a number of levels, and these costly plans will take time to implement. Even though Citigroup’s valuation may look appealing to some value investors, this company is facing a number short-term and long-term headwinds.

Be the first to comment