Prapat Aowsakorn/iStock via Getty Images

A few years ago we took a look at what is now Frontier Communications Parent, Inc. (NASDAQ:FYBR) and came to the conclusion that the company’s equity was not worth touching unless you were a strategic buyer; someone in the business or who was already a large holder of the company’s debt. At the time, the only way we could envision making money via the name was a play on the high-yield debt…and even then we did not think it was worth the headache one would have to endure.

A lot has changed over the last year, with the company emerging from bankruptcy with a new leadership team and a fresh start. While we like the story and the game-plan moving forward, we do want to stress that Frontier Communications is playing catch-up to competitors and having to fix legacy issues that resulted from prior management teams’ cost-cutting and underinvestment in the business.

The Path Forward

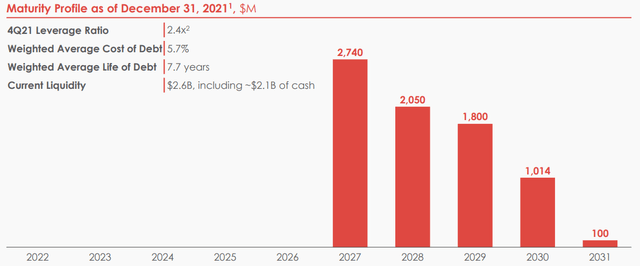

Frontier, like some other competitors, got into trouble via acquisitions of legacy systems that were in small suburban or even rural areas at valuations that turned out to be much too high. Those legacy systems, without capital expenditures to upgrade and expand, saw revenues, cash flow and profits all fall which over time created a death spiral for some of these companies as they had difficulty not only paying their debt off, but servicing it. With the restructuring that occurred via the bankruptcy process, this is no longer an issue and the company currently (as of Q4) has net leverage at 2.4x with their stated long-term target of increasing net leverage to the mid-3s.

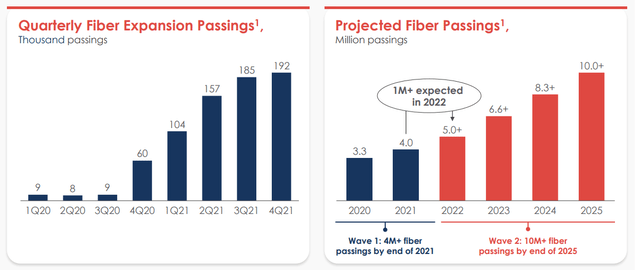

Management has implemented a plan to upgrade their footprint with fiber offerings to sell gigabit (and above) speed broadband and to have 10 million+ fiber passings by the end of 2025. It is an ambitious plan, especially when considering that the company ended 2021 with 4 million+ passings. The good news is that management seems to have the plan in place for a ramping of deployments, by adding roughly 1 million+ by 2022 YE, 1.6 million+ by 2023 YE, and roughly 1.7 million+ in each of 2024 and 2025. The execution risk, as we see it, is from 2022 to 2023 as the buildout will increase by roughly 60% – but management has been pretty adamant in their confidence of reaching the 10 million+ figure by 2025, alluding to multiple avenues to achieving that goal.

Frontier’s management team believes that the company can continue to ramp up their fiber buildout over the next few years. (Frontier Q4 Investor Presentation (Page 12))

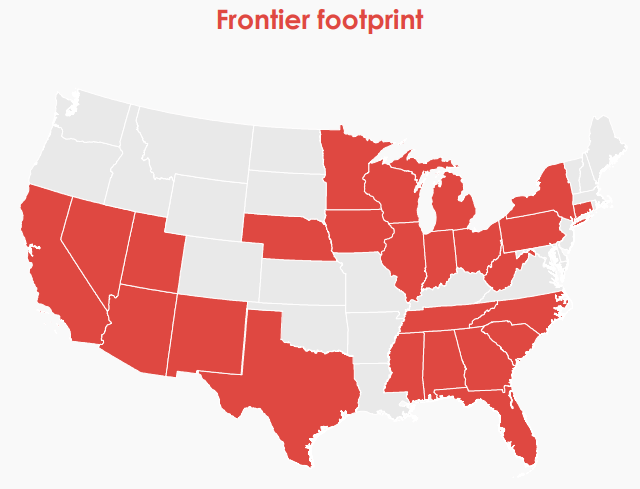

The company’s footprint might be key to enabling this plan to succeed as management can focus on fiber buildouts across the country, instead of being constrained to a certain region or even state. Also, there are a number of markets served where getting new easements and right-of-ways is far easier than some of the large urban markets others have tried to deploy large fiber buildouts in (think Alphabet’s (GOOGL) Google Fiber offering and all of the issues it ran into).

Frontier has many markets it can find available suppliers in, which could ease supply chain and labor constraints during the buildout. (Frontier Investor Presentation)

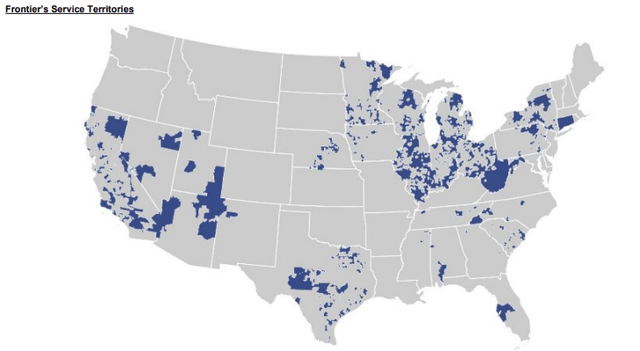

What you cannot see by the map the company includes in most investor presentations are the individual service areas that they serve. Looking in the 10-K, investors can see that while the company has many suburban areas and rural towns that they serve, these are some of the least competitive markets in the country for broadband and usually have 1-2 other competitors (who may or may not offer legitimate broadband) with a high cost to entry for new participants.

Frontier’s service territories, diverse geographies could prevent supply chain issues on the buildout. (Frontier 10-K)

If You Build It, They Will Come

Frontier is finding out that with a new focus on the customer, coupled with a very compelling product offering (the gigabit broadband) can lead to very promising growth. We have been very impressed with the company’s rollout and market penetration which is indicating that not only is Frontier now retaining customers (Q4 of 2020 v Q4 of 2021 saw fiber churn down 24 basis points and copper churn down 27 basis points) and getting them to upgrade but that they are also stealing market share. While ARPU, average revenue per user, is down due to the company focusing less on the low margin video offerings and offering customers a $5 discount on auto-pay, base fiber penetration is up, ending Q4 2021 at 41.9%. In short, Frontier has sacrificed low-margin revenues (video) to focus on high-margin opportunities and retaining customers.

Frontier also reports that their penetration on expansion fiber, at 12 months, is 22% on their 2020 buildout and are guiding towards 15-20% penetration for their Wave 2 buildout (at the 12-month mark). Management stated on their Q4/FY 2021 Conference Call that they expect base fiber penetration to eventually reach 45%, which indicates that there is still subscriber growth to be realized on their current network and potential cash flow and profitability improvement in the years ahead as well.

Moving Forward

Execution is key. We cannot stress that enough here, but this company is in a position to deliver a promising future for investors…something that could not be said not too long ago. The balance sheet is an outlier, as the leverage is currently quite respectable, yet will grow greatly in the next few years which is why this will remain a high yield credit until management delivers on their promises. The leverage expansion is not troubling to us, as the company is offering a compelling product that should over time increase ARPU (even though that has not shown up yet in the numbers), allow the company to consistently add new customers and over time increase profits and free cash flow.

Liquidity is also not an issue, as the company can utilize cost savings, cash on hand, credit lines and property dispositions to fund short-term buildouts (2022 and into the beginning of 2023) but we suspect that a bond offering will be on the table in the second half of 2022 to line up the cash needed for 2023’s capital expenditures related to the Wave 2 buildout. Plus, Frontier is still waiting to get guidance from many states and local governments on their plans for fiber funds that they will be distributing which should only reduce funds needed for any related buildout if the company can smartly weave those projects into its own plans.

With no debt maturities before 2027, Frontier has a clear runway to do their buildout and generate FCF to begin paydowns and refinancing deals. (Frontier Q4 Investor Presentation)

What To Watch For Next

Investors should watch some of the key items that management has discussed and track progress moving forward. For instance, back in August of 2021, management announced at their inaugural Investor Day that they planned to save $250 million by 2023 by cutting expenses and optimizing the business. They are already ahead of this goal and believe that they will exceed their previous guidance for 2022 ($100 million) and 2023 ($250 million), so we think investors can easily track this (via the company’s presentations and quarterly results) and watch for management to possibly adjust their targets higher in the second half of 2022.

We also believe that watching the divestitures that the company plans to do will give a good read on how effective management is at meeting or exceeding their goals. The additional divestitures do not really move the needle, nor are they core to what the company HAS to do in order to move forward, but it is a very easy benchmark to track as well as to grade for what management delivers.

As 2022 will see an increase in the buildout (as measured by fiber passings) over 2021, we would expect that the company will ramp up passings quarter-to-quarter and continue that into 2023. So even if fiber passings look light in Q1 and Q2 results, we believe that the second half of the year will be when the majority of the buildout occurs. This is generally how these plans work.

Conclusion

Broadband providers are all locked in a buildout that reminds us of what cable companies went through last century; years of capital expenditures and expensive mergers to reach economies of scale where they could finally reward shareholders. Many of these companies are now in growth mode and will be ramping up CapEx, even if shareholders do not like it – Altice USA (ATUS) is a prime example. Frontier has done an excellent job explaining to investors the CapEx plans and appears to be running a tight ship focused on the highest margin expansion.

We think that Frontier Communications is a long-term play that could greatly reward shareholders. In the short-term, we think that the stock could trade as high as $35-40/share by delivering on their Wave 2 buildout and penetration expectations, additional cost-cuts and divestitures exceeding the current goal. This could become a volatile stock if management runs into headwinds or the market is caught off guard by how much cash flow the build-out consumes, but we think this is a much better play than some other names in the industry, including Consolidated Communications (CNSL).

We do not see the company paying out a dividend in the near future, and would think that management would wait until after 2025 to even look at that. So, the only other scenarios we see potentially adding value in the near term are some type of tower deal with this new buildout, or acquisitions (bolt-on or tuck-in) that would add scale, cash flow and allow for cost-cutting through synergies.

Be the first to comment