jetcityimage

Operationally speaking, one of the most unique companies on the market today is Cintas Corporation (NASDAQ:CTAS). Given its large market capitalization of $40.06 billion as of this writing, you might never imagine that the firm generates most of its revenue from renting out uniforms to other businesses and selling other products and services like restroom supplies, mops, shop towels, and more. It also sells first aid and safety services to its customers. But this represents a far smaller piece of the pie, while the company does also have some other miscellaneous activities that generate revenue as well. Despite concerns about the economy more broadly, business has been quite solid. Revenue, profits, and cash flows continue to rise at a nice clip. And when it comes to the 2023 fiscal year as a whole, management is incredibly optimistic. Unfortunately, this kind of quality does not come cheap. But the upside to paying a premium for a high-quality operator is that it does bring with it limited downside so long as business continues to perform nicely. Personally, I do think that actual upside for the company is limited from here. So even though management is forecasting continued growth, I do believe that a ‘hold’ rating is more appropriate for the company at this time.

Better than expected

The last time I wrote an article about Cintas was a little over a year ago in August of 2021. In that article, I discussed how impressed I was by the consistent revenue and profitability growth that the company had exhibited in prior years. I concluded that it was a quality prospect for investors. But at the same time, I also recognized that shares were looking rather pricey. Long term, I concluded that the company would do quite well. But given how pricey shares were, I had no choice but to rate it a ‘hold’, reflecting my belief that it would likely perform along the lines of the broader market for the foreseeable future. So far, the business has far exceeded my own expectations. While the S&P 500 is down by 19.7%, shares of Cintas have actually increased by 1%.

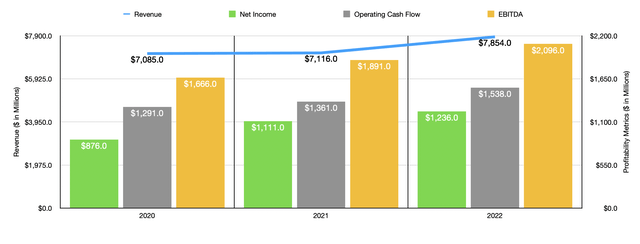

To be clear, this increase has not been without cause. To see what I mean, we should first touch on how the business finished its 2022 fiscal year. During that year, revenue came in at $7.85 billion. That’s 10.4% above the $7.12 billion generated in the 2021 fiscal year. Most of this expansion came from organic means, with organic revenue growing by 10.2%. What’s really interesting is that growth strengthened from quarter-to-quarter. In the first quarter of the year, organic growth was just 8.6%. This rose to 9.3% in the second quarter before hitting 10% in the third quarter. In the final quarter of the year, organic growth was a robust 12.7%. Unfortunately, we don’t know much more about growth besides this. What I mean by this is that management attributed growth broadly to a variety of factors, without giving a breakdown of how much was driven by price increases, how much was driven by the introduction of new products, how much was driven by increased volume, etc. On the bottom line, performance was robust as well. Net income increased from $1.11 billion to $1.24 billion. Operating cash flow increased from $1.36 billion to $1.54 billion. Meanwhile, EBITDA for the company also expanded, growing from $1.89 billion to nearly $2.10 billion.

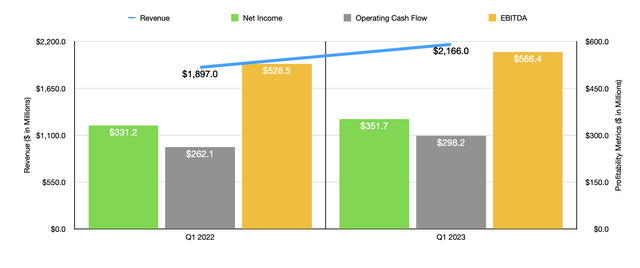

This strong performance has continued into the 2023 fiscal year. In the first quarter, revenue came in at $2.17 billion. This represents an increase of 14.2% over the $1.90 billion generated the same time one year earlier. Actual organic revenue growth for the company was 13.9%. The greatest expansion here came from the Other operations of the company, with revenue skyrocketing by 20.6% from $388.77 million to $468.68 million. This growth was fairly evenly split between the First Aid and Safety Services segment of the company and the ‘All Other’ portion of it. The Uniform Rental and Facility Services segment of the company, meanwhile, grew a more modest but still impressive 12.6%.

On the bottom line, performance continued to come in strong as well. Although the company did experience some margin compression, largely as a result of higher interest expense and a rise in selling and administrative costs, net income still managed to grow by 6.2%, climbing from $331.2 million to $351.7 million. This was instrumental in pushing operating cash flow from $262.1 million to $298.2 million. And over that same timeframe, the company also saw its EBITDA increase, climbing from $528.5 million to $566.4 million.

When it comes to the 2023 fiscal year as a whole, management has high expectations. They currently think that revenue will come in at between $8.58 billion and $8.67 billion. This would translate to a year-over-year increase of between 9.2% and 10.4%. In addition to posting nice growth, it’s worth noting that the revenue figures for the company should be higher than what the company previously anticipated. Their initial guidance was for revenue of between $8.47 billion and $8.58 billion. From a profitability perspective, earnings per share should be between $12.30 and $12.65. That’s between 9% and 12.1% above what the company generated during its 2022 fiscal year. By comparison, prior expectations had this figure coming in at between $11.90 and $12.30. This guidance has left the company so confident in the future, that management recently announced a $1 billion share buyback program on top of the $500 million plan the company already has. Rewarding shareholders when times are good is not necessarily the worst idea in the world. But in general, especially given how shares are priced, I do think that there are better ways to do it.

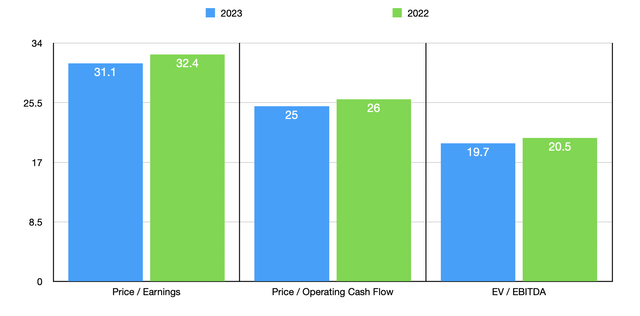

If the company can hit the midpoint of expectations for earnings, that would translate to net income of $1.29 billion. No guidance was given when it came to other profitability metrics. But based on current trends, I could see operating cash flow hitting around $1.60 billion and EBITDA totaling $2.19 billion. Using these figures, we can see how shares are currently valued. On a price-to-earnings basis, the forward multiple for the company is 31.1. The price to operating cash flow multiple should be 25, while the EV to EBITDA multiple should come in at around 19.7. These numbers stack up favorably against the results we get using data from 2022. These multiples would be 32.4, 26, and 20.5, respectively. Finding perfect comparables to look at is rather complicated. The three best companies that I identified were two firms that provide uniforms and other related services, while the third business manufactures building products and systems, including integrated fire detection and suppression systems, fire protection and security products, and more. Using the 2021 data for these firms, I calculated a price-to-earnings multiple range of between 28.9 and 51.8. In this case, Cintas was cheaper than two of the three firms. Using the price to operating cash flow approach, the range was between 26.5 and 29, with our prospect being the cheapest of the group. And when it comes to the EV to EBITDA approach, the range was between 10.8 and 14.2, with Cintas being the most expensive of the players.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Cintas Corporation | 32.4 | 26.0 | 20.5 |

| UniFirst Corporation (UNF) | 28.9 | 28.4 | 10.8 |

| Aramark (ARMK) | 51.8 | 29.0 | 14.2 |

| Johnson Controls International (JCI) | 33.4 | 26.5 | 14.5 |

Takeaway

The data shown right now suggests to me that Cintas continues to perform well for itself and its shareholders. I see no reason why this picture shouldn’t change for the long haul, even though we might be up for some pain in the near term. However, even management doesn’t seem to be concerned about that risk. So it is possible the company might weather this current market volatility mostly unscathed. Regardless of the outcome, shares do look a bit lofty right now, even though they are cheap in two out of the three ways compared to similar firms. All things considered, the pricing of the company does lead me to approach it cautiously, resulting in my decision to keep the ‘hold’ rating I had on it previously.

Be the first to comment