SasinParaksa/iStock via Getty Images

Alteryx (NYSE:AYX) went through a seemingly definitive inflection point towards high growth and renewed momentum last quarter. Patient investors holding on since the start of this year would have been rewarded, but there’s more to come at these valuations in my view.

Premise

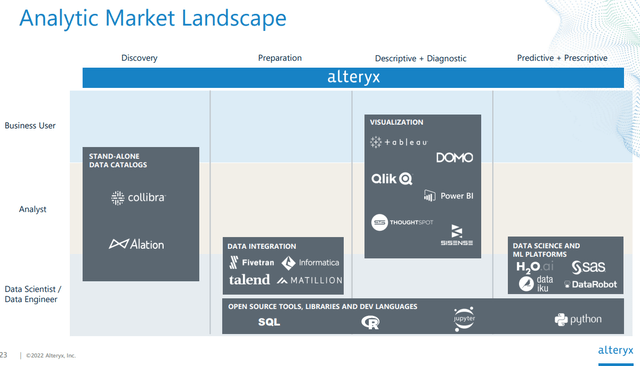

Alteryx is a software company that provides a data-analytics platform, bridging the gap from raw data and sources to insights that can influence decisions. That gap is a wide one, and most of the energy expended in filling that gap has historically been in data preparation (Extract Load Transfer, or Extract Transfer Load) – where data analysts have had to collect and synthesize the data from a variety of sources in a useful format before effective analysis can be carried out.

Alteryx, with their first cohesive product, Alteryx Designer, tackled this issue by automating the most significant pain points in the data preparation funnel. The platform automated large parts of ETL/ELT, increasing efficiency and saving considerable user time by an order of magnitude. The company gained prominence pre-pandemic for its brilliant tool and expanded by evolving its ecosystem with ancillary functionality. The product development resulted in an end-to-end analytics platform.

Alteryx functionality (Investor Presentation Slide 2022)

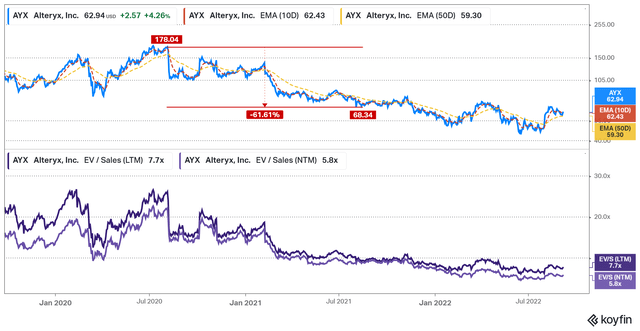

While on a trajectory of high growth, the business however faltered in mid-2020. When the pandemic hit, Alteryx was relying on a licensing model and didn’t have a cloud-based offering. Their approach didn’t sync with the calls for rapid digital transformation where other software businesses arose to the challenges.

Ultimately the deceleration in sales in 2020 was drastic and stood starkly in contrast to a time period that was marked by accelerated cloud transformation and adoption across most software companies.

Price action and multiple compression (Koyfin)

With a re-adjustment in expectations, the stock price was punished appropriately. Founder CEO Dan Stoecker eventually stepped down and a new CEO came on board.

What Changed?

It has been well over a year since the new CEO, Mark Anderson took over. 2021 was a year of a lot of transitions, from getting to cloud-based offerings, and refocusing on key strategic areas for both product and sales. As of this year, AYX has regained its mojo, outperforming most software companies on a YTD basis.

To me, the more intriguing story and perhaps the leading root of the resurgence is the new CEO. Mark Anderson’s past experiences point to a robust collection of skills: President of Palo Alto Networks (from pre-IPO to post), Chief of Growth at Anaplan, Board Member for Cloudflare & Alteryx, Advisor at TPG, Venture Partner at Lightspeed Ventures. One might infer a combination of a growth specialty, investment aptitude, and cross-industry software knowledge acquired over decades. It is perhaps interesting to note that he spent most of the last quarter traveling to three geographical theatres to meet with partners, customers, and other stakeholders to understand their analytics needs first-hand. While the previous CEO’s vision was to produce “citizen data-scientists”, the adjusted perspective calls for “democratizing access to data-driven insights”. It isn’t about making everyone technical in any form, but bridging the gap of friction between raw data and intelligence for use cases that commanded a sophisticated platform like Alteryx. The company has since gone from eccentric vision to confidence in knowing who its products are for and focusing sales efforts on high-value use cases within the broader analytics space. Pricing also seems to be adjusted with a full cloud offering called “Alteryx Analytics Cloud” now seeing rapid adoption, while ecosystem staples such as Alteryx Designer, and the more recent APA (Analytics Platform Automation) are doing well enough.

Perhaps it’s an adjustment in the target go-to-market strategy, the cloud transition, or a more effective way of communicating the Alteryx product line-up to potential clients. Going by the past four earnings reports it looks like the combination of these factors, but whatever they’re doing, it’s working. The company signed the two largest ACV (Annual Contract Value) deals in company history last quarter. The financials are accelerating once again, and there’s renewed momentum on market capture. Such trends, even if not fully understood, are enough to warrant an investigation from an investment standpoint.

The Growth Track – Deciphering Key Metrics

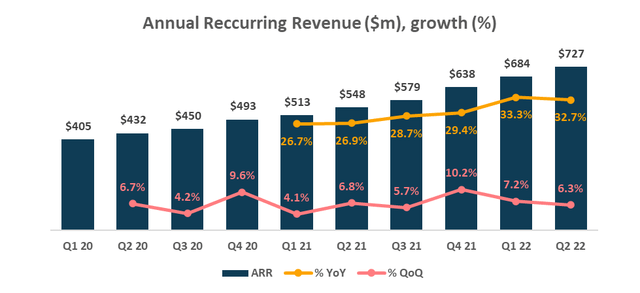

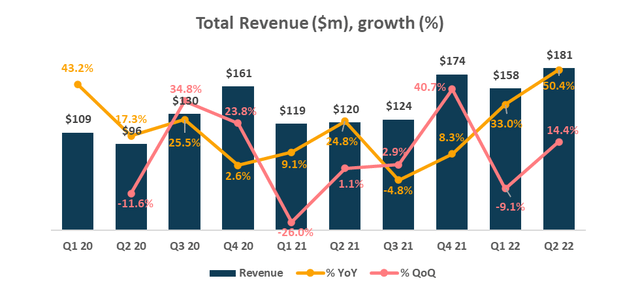

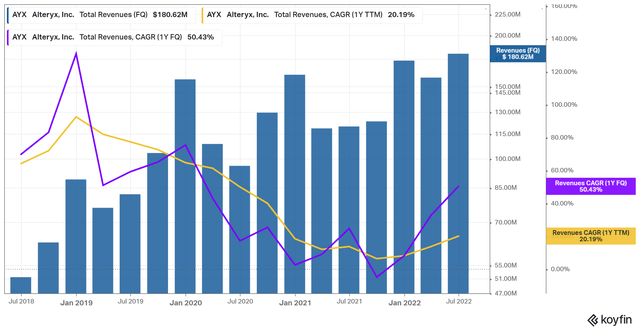

The top-line isn’t the whole story with Alteryx. GAAP Revenues are not a measure of organic growth since they recognize the value of a contract in inconsistent pieces. This has led to a large deviation between Revenue and Annual Recurring Revenue. The following charts show trends across both metrics:

ARR (Author, data from Quarterly Filings) Revenues & Growth (Author, data from Koyfin)

To judge organic growth health, ARR is more appropriate as it excludes upfronts and contract one-offs. Investors should therefore note that this is not a hyper-growth company like it used to be (yet). Q4 21, Q1 22, and Q2 22 have lapped the QoQ and YoY growth of the previous years with accelerated growth in ARR. Even with a focus on ARR, one should still consider GAAP Revenue as an optimistic indicator as firstly, it corresponds with cash inflows that improve the financial condition, and secondly, for what it represents. Renewals, upfronts, and longer contract durations were cited as reasons for the revenue beat. Overall, the numbers represent significant business momentum with the operational execution changes leading to results that are working well.

As a cherry on the cake, the dollar-based net retention rate inched above 120% last quarter from 119%, signifying some minor re-acceleration against their historical customer cohorts too. Q2’s surprising results were eventually rewarded with a 30%+ share price reaction. That said, there remain reasons to be optimistic about this business and it is back on a strong growth track. The excerpt below sums it up:

Business leaders are prioritizing analytics and embracing democratization of data to scale their analytics and upskill their workforces. And with the macro environment serving as a forcing function for businesses to optimize and automate analytics, the market is coming to us with greater urgency and demanding solutions that Alteryx is uniquely positioned to provide.

– CEO, Q2 Earnings Transcript

A Reasonable Business For A Reasonable Price

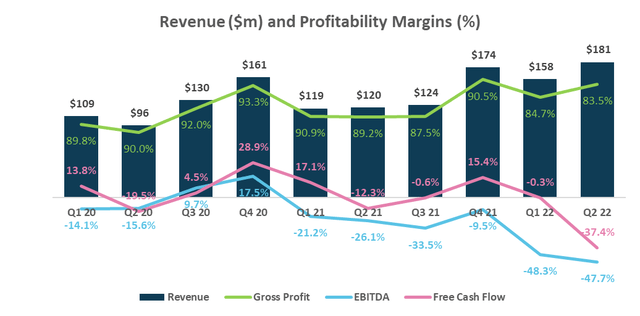

Financials – Income Metrics (Author, Data from Koyfin)

The gross margin has dipped as a result of the cloudification of the Alteryx ecosystem. Instead of the clients bearing the infrastructure costs, Alteryx has to, for this particular vertical. This feature is not a negative in my book, as it strategically aligns with the market’s needs and will eventually serve to reduce deployment costs below the gross margin. EBITDA margins have dipped substantially as a result of Alteryx allocating more income to personnel expenses – stock-based compensation, merit-based grants etc. Considering the turnaround, and a large shake-up of the organization, it might be somewhat understandable though I’m not particularly happy as a shareholder. For the current fiscal year, management guided 68.6m shares outstanding as opposed to 68.5m last quarter. That said with historical trends, 2-3% dilution every year seems to be in line so one should factor in this drag on compounding.

On Free Cash Flow, the last quarter saw prominent negative adjustments on Accounts Receivable and Prepaid Expenses so it’s fair to expect the trend to revert to a flat margin. It’s important to note that the balance sheet holds $400m in liquidity and $790m in long-term debt. That said, if the business continues on its current trajectory of market capture, I don’t see the cash conditions as a significant deterrent to growth. Alteryx should have limited cash burn against this and can still invest substantially in market capture.

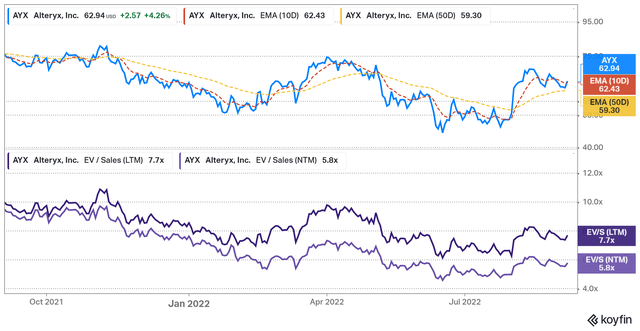

As for valuations, the EV/S multiples are shown below:

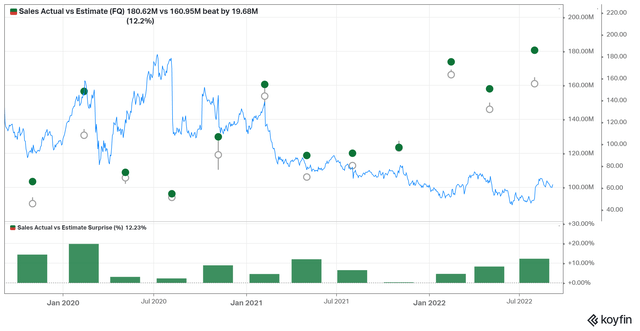

The NTM EV/S of 5.8x for this mid-growth software company is a very reasonable ask in my opinion. As mentioned, the business has gone through a mild renaissance and it’s worth holding on to the higher than usual probability of outperformance in coming quarters. The sales beat trend is in our favor for now

Quarterly Sales Beats (Koyfin)

The company forecasts sustained strength at 57% YoY rev. growth and 30% ARR YoY growth for Q3. While some of the guide and sales trends might be priced into expectations, the valuations have room to expand if Alteryx keeps its head over the 30% ARR range for more than a few quarters. Once again, business momentum is a tailwind for good financials by itself as analyst consensus often sticks to declining trends in their forecasts.

In the long-term, the need for data analytics is ever-growing, to the tune of a $60B and counting market opportunity. So there’s a long way to go for Alteryx as an early player.

Risks

- Macro: Software names have been remarkably macro resilient thus far but I won’t discount a turn in trends should more economic pain manifest.

- Competition: Alteryx has been lauded for its sophistication and end-to-end nature for complete analytics. However, Tableau Desktop from Salesforce (CRM), Dataiku, and SAS may build broad functionality to compete for more head-on.

- Financial: Cash at $400m and debt at $900m isn’t the best for a flat FCF generative company of this size. Bad macro and competition could influence the financials leading to a slowing of the growth machine.

- Dilution: SBC is substantial and dilution could eat away at long-term compounding potential. All expense items saw increased margins last quarter on a YoY basis as a result of the turnaround. Management is executing well but they’re not shy about spending for it too.

- Systemic: Volatility and drawdowns should be expected for an unprofitable and growth-oriented name like Alteryx.

Conclusion

Alteryx is back on track for growth, demonstrating macro resilience as a result of its excellent product value proposition for both good times and bad. Data analytics remains a priority for most of the company’s target market, and the last two quarters have shown that the software adoption trend should sail smoother through a recession when compared to most other industries. A lot of Alteryx’s recent turnaround can be attributed to the new management and shift in focus enacted in 2021, which is now paying off with business momentum. Accelerating financials, faster customer count growth, strong retention, and big customer wins. At a NTM EV/S multiple of 5.8x, there’s room for valuation expansion should the company deliver on its current trajectory of 30%+ YoY ARR growth. I’m long AYX.

Be the first to comment