Edwin Tan

Following a brutal sell-off in 2020 as the pandemic all but halted movie theater attendance, Cinemark (NYSE:CNK) shares staged an impressive recovery during 2021 with shares rebounding 50% in the first half. The rise in the share price was predicated on the hope that theater attendance would revert to pre-pandemic levels and that Cinemark might return to historical profitability levels. However, the reality of big changes in consumer habits has now set in – 2022 moviegoing has been 40% below 2019 levels and Cinemark’s stock has fallen 60% from 2021 highs.

While the death of the movie theater had been heralded many times prior to the pandemic, COVID seems to have brought about the decline in moviegoing that many had been expecting. The proliferation of streaming services and shift to serialized dramatic television series are likely to permanently reduce movie theater attendance and impair Cinemark’s earnings power.

2022 Box Office

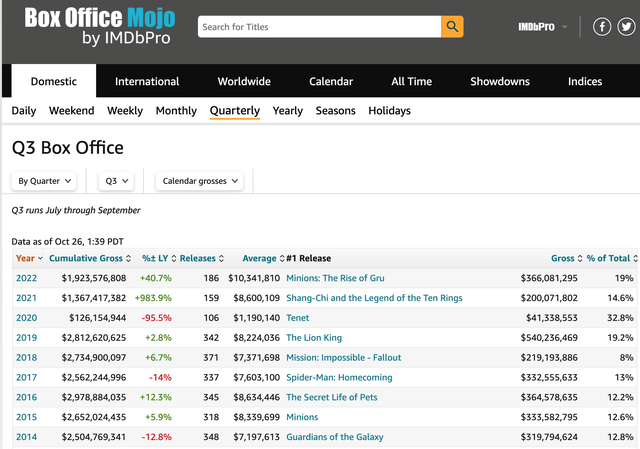

3Q Box Office (Box Office Mojo)

As shown above, 3Q22 movie attendance was down 31% versus 3Q19 (pre-pandemic levels). While variations in attractions have historically caused modest year-to-year fluctuations in attendance, 3Q22 attendance was down 30% from the average attendance from the five-year period from 2015-2019. This stark fall suggests a more permanent change in consumer behavior. Figures for the nine-month period ended September 30 are even worse (closer to 40%), though 1Q22 was likely negatively impacted by lingering Omicron concerns.

The Rise of Streaming

Streaming services have been competing with theater attendance for the past decade. However, the past three years have brought about a proliferation in the number of credible streaming services – beyond the standard competition of Netflix (NFLX), HBO Max (WBD) and Amazon Prime (AMZN), new competition including Disney+ (DIS), Peacock (CMCSA), Discovery+ and Paramount Plus (PARA) have emerged.

In short, consumers have more access to low-cost in-home content than ever before. Recognizing this trend, studios have put more emphasis on creating and releasing content for streaming services than movies for theatrical release. Many non-tent pole productions are now headed straight to streaming rather than first being shown exclusively in theaters.

Cinemark – Feeling the Impact

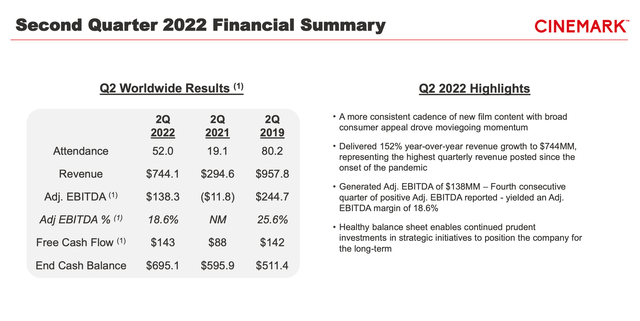

While Cinemark’s 2Q22 figures showed a rebound versus 2Q21 when some states/municipalities still had mask mandates, as shown below, results came in far below 2Q19 levels:

2Q22 Results (Cinemark Investor Presentation)

Worse yet, while Cinemark is generating 43% less EBITDA than it did prior to the pandemic, its debt load has increased from $1.75 billion to nearly $2.5 billion. This has caused its annual debt service burden to jump over 50% to $150-155 million annually.

Valuation & Conclusion

Putting together the combination of lower EBITDA and higher interest expense, I estimate that Cinemark will generate $1.17 of free cash flow per share:

|

2019 |

2022e |

Normal |

|

|

Adjusted EBITDA |

745 |

409.75 |

484.25 |

|

Interest Expense |

100 |

153 |

153 |

|

Capital Expenditures |

303 |

98 |

150 |

|

Taxes |

75 |

0 |

40 |

|

Free Cash Flow |

267 |

158.75 |

141.25 |

|

Shares Outstanding |

121 |

121 |

121 |

|

Free Cash Flow Per Share |

2.21 |

1.31 |

1.17 |

My normalized free cash flow estimate assumes EBITDA 35% below pre-pandemic levels, which is an improvement from what the business has produced year-to-date. At $10/share, Cinemark trades at 7.4x EBITDA and 8.5x free cash flow per share, which seems about fair for a leveraged business operating in a challenged industry. Given my concerns about the long-term sustainability of the movie exhibition business, I recommend investors avoid the stock.

Downside Risks

1. A looming recession could negatively impact Cinemark – with ND of ~5x EBITDA, this would have an outsized impact on equity value.

Upside Risk

1. A runaway blockbuster film or two could make investors enthusiastic about the movie theater business.

2. With ~20% short interest, Cinemark shares are subject to short squeezes.

Be the first to comment