EUR/USD TALKING POINTS

- Q1 eurozone GDP smashes forecasts.

- Focus shifts to tomorrow’s ECB rate decision.

- IG client sentiment: Bearish.

EURO FUNDAMENTAL BACKDROP

Money markets are becoming increasingly optimistic about a more aggressive European Central Bank (ECB) tomorrow after adding a few extra basis points yearly forecast. There has been much talk around a 50bps rate hike in July and rumors of a surprise hike tomorrow, I believe this to be premature and is highly unlikely to materialize. What we could see is a change in tone from the ECB post-announcement which has allowed the euro to remain relatively resilient against the U.S. dollar this week.

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

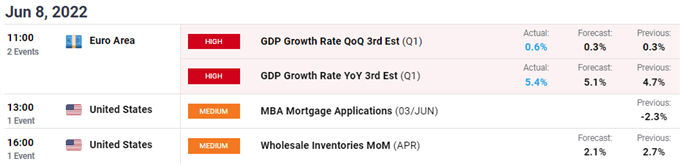

The economic calendar today opened up with strong eurozone GDP data for Q1. Although the print exceeded expectations, the lag in data release did not have much impact on EUR/USD. In actuality, the immediate reaction sent the euro lower showing the markets disregard for the data.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

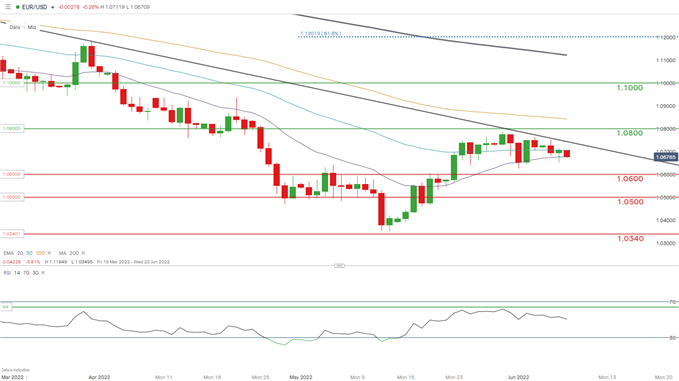

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/USD price action keeps the euro elevated heading into the rate announcement tomorrow. While there is uncertainty around the outcome of the ECB meeting, both immediate support (1.0600) and resistance zones (trendline) could be under threat. That is, a hawkish result could see the euro above 1.0700 and trendline resistance respectively while an ECB that remains on it’s previous narrative could see the euro pushing the 1.0600 support level once more.

Resistance levels:

Support levels:

- 20-day EMA (purple)

- 1.0600

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on EUR/USD, with 60% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term upside bias.

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment