Tasos Katopodis/Getty Images Entertainment

Dear reader/followers,

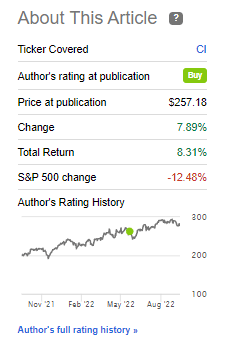

We’ll now revisit Cigna (NYSE:CI) and see how the company’s performance has impacted my long-term thesis for one of the world’s more significant healthcare businesses. In my last article, I established my thesis at a “BUY”, which I viewed as justified due to the company’s fundamentals and upside.

This call has worked out fairly well – because Cigna has actually been one of the few positive performers on the market and in my portfolio since June.

Cigna Article (Seeking Alpha)

In this article, we’ll look at whether it still “pays” to pay a premium for Cigna.

Revisiting Cigna Corporation and the “BUY”

Before selling off what was essentially one of the industry-leading P&C businesses, Cigna was one of the largest general insurance businesses on the planet, rivaling even Allianz (OTCPK:ALIZY) operations. The choice to focus on its core business – healthcare – was a controversial one for many investors at the time, but for Cigna, it seems to have turned out very well.

A quick reminder that the company was actually almost bought up by Anthem (ANTM) in 2015 for close-on to $50B in cash and stock, which might have been an excellent deal by today’s standards but was blocked by the DOJ. Instead Cigna acquired Express scripts for an even bigger sum.

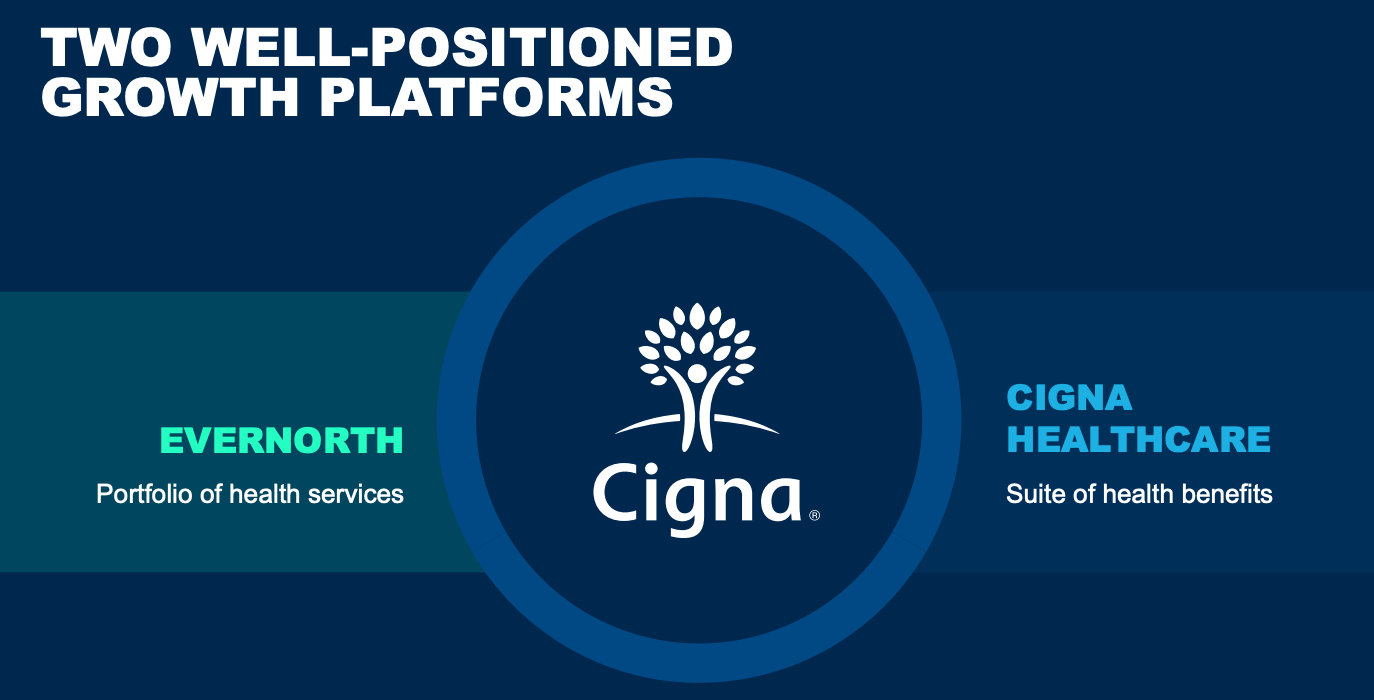

Cigna IR (Cigna IR)

This transaction and the results mean that the company’s current operations are centered around what we can call global health services – with the mission goal of being affordable and qualitative for everyone. The company has a two-sector portfolio, with Evernorth (the service portfolio such as analytics, management solutions, and care delivery) and legacy Cigna healthcare, focusing on healthcare solutions for employers and individuals.

So, the question becomes, just how has the company’s business model and sales held up in this current market environment, with the mission statement and growth strategy in mind?

It’s not exactly a surprise that Cigna is doing well -because that is what it has been doing for going on over 12 years now, with a near-constant growing EPS trajectory of around 15% adj. EPS CAGR since 2010, looking at FY21 results of $20.47 on an adjusted EPS basis.

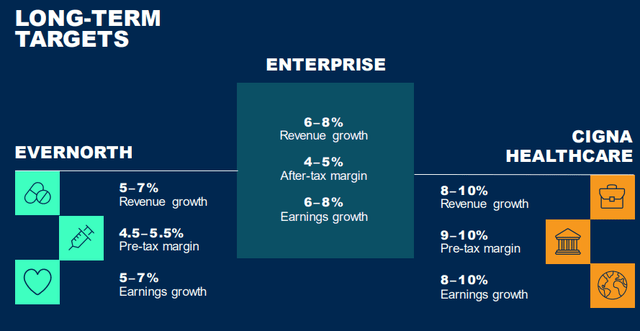

Cigna is targeting growth on the basis of its foundational segment, the pharmacy benefit services, US commercial, and International health segment. The company has high growth ambitions, around 40% of revenue (with a 50% forward target) coming from the Specialty pharmacy, Evernorth Care, and government service expansion. The company is targeting a mix shift here, with 2026E seeing a 50/50 split between growth and stability, as opposed to a 60/40 In favor of stability as it is currently. Investors and Cigna bulls can therefore expect Cigna to grow faster in the future if these are realized.

Cigna is also further, a play on deepening enterprise relationships to drive long-term growth. Cigna believes thee to be an opportunity to create an additional $10-$20B worth of Evernorth revenue by using and expanding its current relationships. These factors come to the 2Q22-updated long-term targets for the company, with these two segments coming together at a high-single digit revenue and EPS growth.

The company’s capital allocation strategies remain focused as well. Out of the expected $40B worth of 2022-2026E non-CapEx cash flows, 10% is going to debt, 20% is going to dividends, and the lion’s share is being allocated to buybacks and strategic M&A. The company is mostly in-line with its current debt/leverage, and I consider these growth trajectories based on both historical numbers, and likely growth, to be realistic.

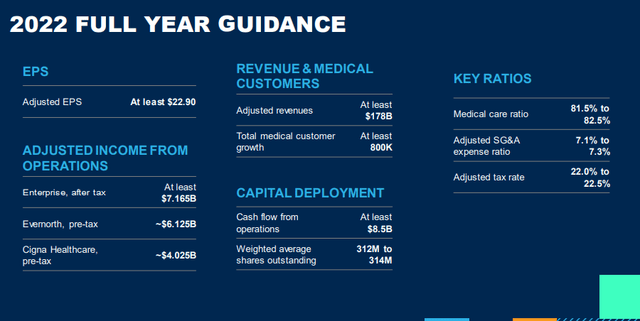

2Q22 results confirm these, with the company generating around $6.22 in adjusted EPS, and around $1.24B worth of operational cash flows. The company has been growing further, and now has 17.8M medical customers, a growth of 725,000 YTD so far. The full-year guidance for the company is very much intact, and the company is targeting at least $8.5B worth of operational cash flow, and EPS of at least $22.9, which would imply a slight growth from 2021 numbers.

Remember also that Cigna isn’t just a US-based shop. The company also boasts international healthcare operations, both for ex-pats and others – and Cigna, as an example, offers coverage for Expats living in Sweden. The company covers globally mobile individuals and employees of multinational companies and organizations. The aforementioned 17.8M medical customers are just a drop in the bucket. Cigna serves over 180 million customers worldwide, making it one of the largest healthcare organizations on the planet. The company works with a total addressable market of $900B, and 60% of all of the health plans in the US use one or more of the company’s Evernorth services. Express scripts alone impact 33% of the US population.

There is much to consider here, but scale and size are really one of the primary arguments for this company.

I made my stance clear in my last article, and this stance has not changed.

On a high level, Cigna is one of the most conservative plays on the future need of quality, affordable healthcare in the US. No matter what happens with this market, it’s my stance that Cigna will be a core part of this, and the company’s services and driving of expenses will be an important part of making this affordable for individuals and organizations.

2Q22 only confirms the validity of my thesis to me.

In a bout of constructive criticism aimed at myself, I need to – to a far larger extent than I currently am – take aim at such investments when they are cheap, even if their yields are closer to 1.5% than I would like.

it’s my argument and my stance that the higher your portfolio value goes, the more conservative your investments should become – and this is not a mantra I’ve followed as closely as I would like for the past year or so. Provided a certain amount of capital, dividends even at 1-2% will yield you enough income to live on while providing you with a far lower beta than a typical, the more income-oriented portfolio would. My current portfolio yield is around 4.6% – I would like to reduce that, through diversification and focus on Cigna-like investments, to around 3.5% or even 3% in the longer term.

That is why I say that Cigna is a core part of my consideration here.

Let me show you the updated valuation for the company.

Cigna – Valuation update

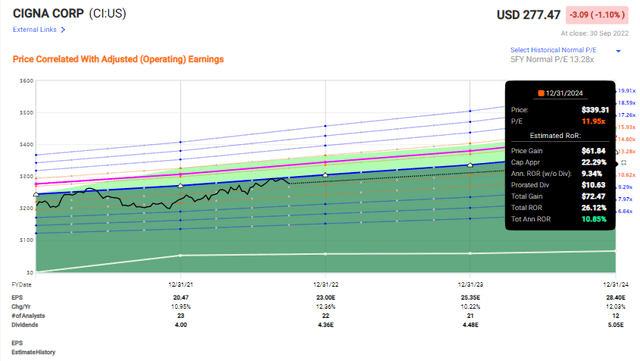

You might expect Cigna to be a massively expensive business in terms of its multiples, but this is not the case. Cigna trades at a 5-year average of around 12.5x, and currently to around 12.4x P/E, which makes a positive stance quite easy to defend for me.

The company is an A-rated health care service provider – and it’s one of the largest on the planet. Its yield is sub-par, but its growth is stellar. The company is expected to grow EPS by double digits on an adjusted basis for the next 3 fiscals, which to my mind calls for a far higher average multiple than the company is currently trading at. Even if we only forecast the company at 11-13x P/E multiples on a forward basis, the annualized RoR beats inflation and goes above low double digits.

Cigna Upside (F.A.S.T. Graphs)

These forecasts come in at a near-perfect accuracy score with only one miss in over 10 years with a 10% margin of error. That gives these forecasts a very high conviction to me.

Still, it’s important to point out that Cigna is subject to some high volatility at times. It’s not unlikely for the business to drop below 10X P/E, at which point investors can expect significant outperformance when the company reverts to above-average valuations.

While there have been times the company was overvalued to its P/E, even bought at close to 20X P/E back in 2018, you still would have made around 4% per year, which is impressive given the degree of overvaluation you would have been ignoring.

S&P Global would still agree with a positive assessment for the company. The average target for the company is now almost $20 higher than it was when I previously reviewed Cigna. It’s now at close to $311/share, which comes to an upside of around 11% upside to the current share price. 14 out of 24 analysts consider the company a “BUY” or equivalent at this time. Many analysts are currently in a holding pattern due to market macro. I cannot fault them for this conservative stance given where the market currently seems to be moving, but I would still argue that there is merit to investing in Cigna at this time.

My previous target for Cigna was $300/share. On the back of improved earnings, I’m bumping this slightly to $305/share, which reflects an average 13x forward P/E, which I also mentioned in my last piece.

Under this valuation, I believe that investors can expect alpha when investing in Cigna.

I, therefore, consider Cigna to still be a “BUY” here and bought 2 shares at market close yesterday.

Thesis

Cigna has the following upside:

- Cigna is a fundamentally appealing healthcare company, active in several crucial segments. There are significant short-term and long-term upsides to the business based on current and future trends in the business.

- Given its size and market position, I view very few companies, perhaps with the exception of Anthem, as being better positioned than Cigna.

- I view Cigna as having an upside of 15-20% until 2024E based on current forecasts, which I view as valid.

With that, I see it as a “BUY”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment