Brandon Bell/Getty Images News

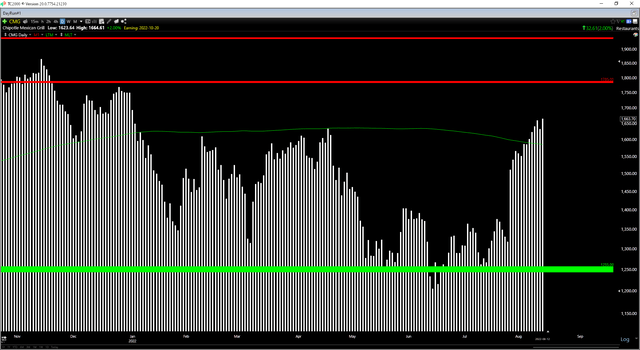

Just over six months ago, I wrote on Chipotle Mexican Grill (NYSE:CMG), noting that while I was neutral on the stock at $1,400, I would view any pullbacks below $1,255 as low-risk buying opportunities given the meaningful support in this area. Since dipping below $1,255, Chipotle has enjoyed a strong rally, up nearly 35% from this buy point and massively outperforming the S&P 500 (SPY). While this can be attributed to its resilience in this difficult environment for restaurants and industry-leading same-restaurant sales growth, the stock isn’t nearly as attractive after this rally, suggesting that if this rally continues above $1,780 before October, booking some profits would be wise.

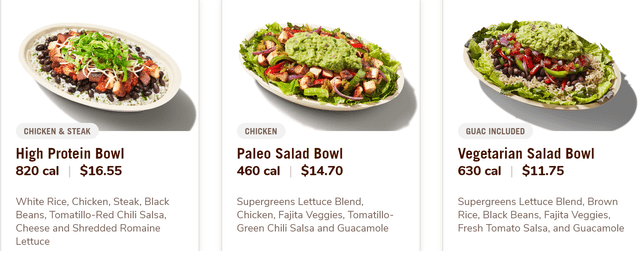

Chipotle Quesadillas (Company Website)

Q2 Sales Performance

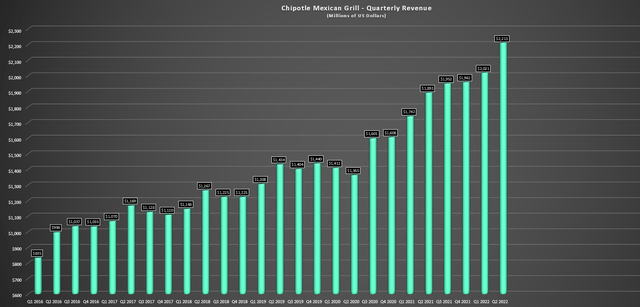

Last month, Chipotle released its Q2 results, reporting quarterly revenue of $2,213 million, a 17% increase from the year-ago period. This was especially impressive given that it lapped 39% revenue growth in the year-ago period, driven by industry-leading unit growth relative to other large-cap brands and a 10.1% increase in same-restaurant sales. Notably, digital came in at 39% of total revenue despite higher in-store sales, and the company opened 42 new restaurants, including 32 with Chipotlanes.

Chipotle – Quarterly Revenue (Company Filings, Author’s Chart)

While these are strong results, Chipotle noted that comparable sales were tracking towards the top end of guidance in the quarter but decelerated in late May. The company is now anticipating mid to high single-digit comp sales for Q3, though this will be with the benefit of yet another menu price increase in August. For those unfamiliar, Chipotle raised prices by 4% in the middle of December 2021 and another 4% at the end of Q1 2022. While the same-restaurant sales performance in Q2 outperformed its peers, the double-digit year-over-year price increases were certainly a meaningful tailwind.

To put this in perspective, First Watch (FWRG) took only mid-single-digit pricing in Q2 and reported a massive same-restaurant sales number of 13.4%, with this being a much higher-quality beat (led by 8.1% traffic growth).

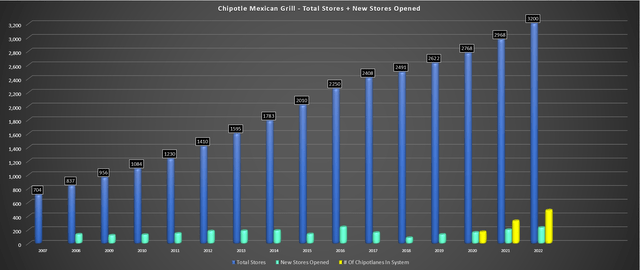

Chipotle – Total Stores, New Stores Opened & Chipotlane Mix (Company Filings, Author’s Chart)

Moving over to unit growth and development, Chipotle opened 42 new restaurants in the period, saw its average unit volumes improve to $2.8 million, and is confident in its ability to push AUVs above $3.0+ million medium term. The company also reiterated its guidance for 235-250 new openings this year (10-15 relocations), with 80% having Chipotlanes. As shown above, its Chipotlane mix (yellow bar vs. blue bars) continues to grow steadily. This is great news from a sales and margin standpoint, with restaurants with Chipotlanes exceeding expectations and enjoying higher AUVs and restaurant-level operating margins vs. the system.

Assuming Chipotle meets its guidance, the company will end the year with ~3,200 restaurants, but there’s still a path to considerably more earnings power long term. This is because Chipotle believes it has room for 7,000 restaurants in the United States and Canada combined, and its Canada footprint sits at just 29 restaurants currently. Meanwhile, the company hasn’t even scratched the surface outside North America.

Chipotle Digital Kitchen (Company Presentation)

So, with the potential to more than double its North American footprint and expand further internationally (Europe), this may be a much more mature growth story than where it was a decade ago. However, there’s still considerable growth left in the tank, and it’s growing at an incredible clip (8-10%) for the juggernaut that it is from a scale standpoint relative to most brands. Most importantly, its margin performance and staffing levels support this expansion, unlike Shake Shack (SHAK) which may be growing units at a torrid pace but with a weakening margin profile.

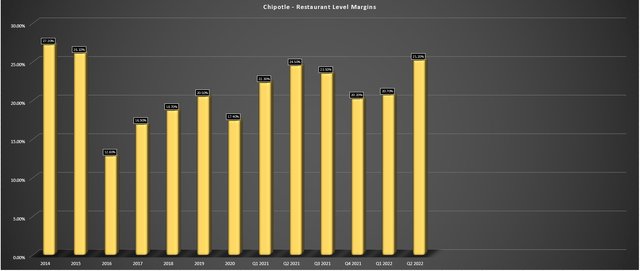

Margins & Industry Trends

Most restaurants put together mediocre to satisfactory Q2 sales numbers to eke out a same-restaurant sales increase. Still, it was overshadowed by margin erosion due to commodity price and wage inflation. While Chipotle wasn’t immune here, calling out higher costs for avocadoes, packing, dairy, and chicken, it managed to increase margins, reporting 25.2% restaurant-level operating margins, a 70 basis point improvement year-over-year. This was related to menu price increases and lower delivery costs and is actually up meaningfully vs. pre-COVID-19 levels.

Chipotle – Restaurant Level Margins (Company Filings, Author’s Chart)

However, while Chipotle is one of the proverbial better houses in a bad neighborhood given its sales/margin performance, the restaurant industry is in a tough position. This is because labor continues to be tight, and inflationary pressures appear stickier than anticipated, putting downward pressure on margins. Worse, the American consumer does not appear as strong as hoped, at least not in the lower end, impacted by rising mortgage costs, elevated gas prices (even if off their highs), and rising grocery costs. These headwinds are impacting discretionary budgets, which has shown up in restaurant traffic, as highlighted by many brands in their Q2 calls.

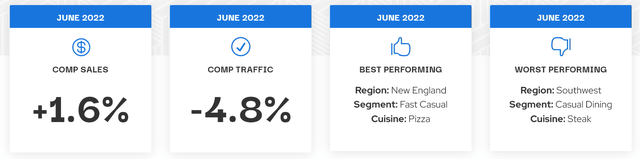

While the May numbers from Black Box Intelligence for restaurant traffic were disappointing already, marking twelve consecutive weeks of negative traffic, the June numbers were even more concerning. This was evidenced by comparable traffic down 4.8% for the month, decelerating from (-) 2.9% in May. Meanwhile, same-store sales growth came in at the lowest levels since February 2021, an alarming statistic given that this was despite meaningful menu price increases for all brands across the board. However, the worst revelation was that there appears to be bad news for brands raising prices aggressively to combat inflationary pressures.

June Restaurant Statistics (BlackBoxIntelligence.com)

According to Black Box’s June report, higher average checks were linked to a lower intent to return and decreased traffic. In fact, Black Box analysts noticed that companies reporting the lowest increase in guest checks (lowest quartile of check growth) saw increased guest counts, but the other 75% of restaurant companies all reported negative traffic growth (Q2-22 vs. Q2-19). Additionally, guests at low check growth restaurants saw improved guest sentiment. This shouldn’t be a huge surprise given that consumers are getting nailed from every angle with rising grocery prices, fuel prices, and mortgage costs in some cases. So, those brands offering value are seen more positively than those where checks are constantly creeping up.

For a company like Chipotle, that’s done a great job holding the line on margins (helping by its steady price increases, Chipotlane rollout & digital footprint), taking the step to raise prices an additional ~4.0% this month might end up being a mistake. In fact, it could end up affecting sales and reducing transactions if we see this increase tip a little over the affordability scale for some consumers that were able to stomach the previous menu price increases. It’s already clear from some brands that we’re seeing a sharp decline in incidence from less affluent customers, and while Chipotle over-indexes on higher-income consumers, there could come a point where guests feel they’re being taken advantage of a little.

Chipotle Canada Menu (Toronto Prices) (Company Website)

Obviously, there’s no question that Chipotle’s differentiator vs. some brands is real food and ingredients, and with grocery costs continuing to increase, this does fall in Chipotle’s favor. This could lead to fewer visits per guest if the average check continues to climb at high double-digit levels for the same offering vs. what guests have become accustomed to over the past two years. Plus, while migration to other brands may be less likely vs. a healthy convenient option like Chipotle, it doesn’t help that at the same time Chipotle is aggressively raising prices, weaker brands are promoting value, like Red Robin (RRGB) has with its recent $10 gourmet value meal.

Red Robin – $10 Combo (Company Website)

To summarize, the decision to increase prices again in May to protect what are already solid margins could end up being a misstep. If Black Box research proves correct, it could lead to weaker guest sentiment and a decline in traffic. I believe this decision to take ~10% total pricing is bolder given that Chipotle appears to have a path to clawing back some of these losses long term. This is made possible through automation with its Hyphen investment (automates the assembly of meals on make-line) and Chippy – the autonomous robot being tested that can make tortilla chips. So, Chipotle appears focused on margins short term at the possible expense of guest satisfaction despite long-term opportunities to boost productivity.

Chippy Robot (Chipotle – Yahoo Finance)

Valuation & Technical Picture

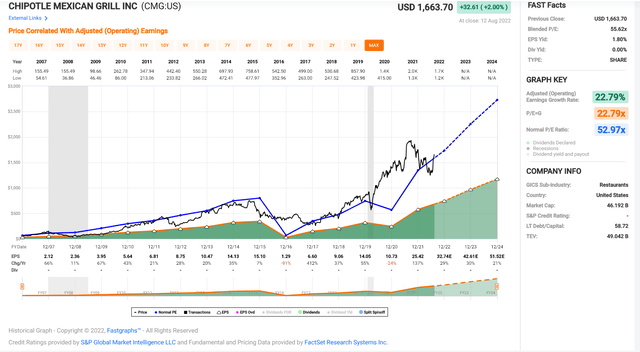

Based on ~27.7 million shares and a share price of $1,662, Chipotle trades at a market cap of $46.0 billion, dwarfing some of the largest operators in the restaurant space like Darden (DRI) and Yum Brands (YUM). This premium multiple can be explained by the company’s consistently industry-leading unit growth and incredible earnings growth, with Chipotle on track to maintain a 35% plus compound annual earnings growth rate since FY2017 ($32.90 vs. $6.60) with minimal deceleration based on FY2023 estimates ($42.18 in annual EPS).

CMG – Historical Earnings Multiple (FASTGraphs.com)

Historically, Chipotle has traded at ~53x earnings, a massive premium to its peers. Still, I believe a more conservative multiple for the stock is 40, given the challenging environment for restaurants and higher rates. Based on this, I see a fair value for the stock of $1,687 (40x FY2023 earnings estimates), leaving the stock fully valued at current levels. This doesn’t mean that the stock can’t go higher, and we’ve seen stocks levitate when momentum is at their back regardless of valuation, like Dutch Bros (BROS) post-IPO debut. That said, the elevated valuation suggests that any misses could have a more pronounced effect on the downside. Therefore, I don’t see any way to justify chasing the stock above $1,700.

Meanwhile, from a technical standpoint, I don’t see Chipotle as anywhere near a low-risk buy point either. This is because the stock is trading in the upper portion of its expected trading range, with potential resistance at $1,775 and no strong support until $1,255. From a current share price of $1,662, this translates to a reward/risk ratio of 0.30 to 1.0, well below the 5 to 1 reward/risk ratio I prefer to justify entering new positions. Based on this unfavorable reward/risk ratio, I expect any rallies above $1,780 before October to be profit-taking opportunities.

Summary

Chipotle had a solid Q2 performance and has continued to lead its peer group from a comp sales, margin, and unit growth standpoint. That said, the recent menu price increase could be a little more difficult for guests to swallow in a difficult economic environment and could also lead to a temporary dip in guest satisfaction if loyal customers feel they’re being gouged with considerable pricing taken since 2019. This pricing action could prove even more poorly timed with the potential that weaker operators in all categories resort to discounting to boost traffic.

To summarize, while Chipotle was a buy below $1,255 with some investors panicking near a major support level, I don’t see it as nearly as attractive despite the solid Q2 results. Therefore, I would view any rallies above $1,780 before October as profit-taking opportunities.

Be the first to comment