shisheng ling

Introduction

The China Fund (NYSE:CHN) has a mandate to invest at least 80% of its assets in China companies. This mandate includes HK and Taiwan, as well as the flexibility to invest in companies outside of China if they have certain Chinese characteristics. This refers to cases where the company may have more than 50% of their revenues from China, or greater than 50% of their assets in China.

Whilst the fund’s inception was way back in 1992, we did see a shareholder activism battle around 2018. Eventually a new investment manager was running the fund by the start of 2019.

Are Chinese stocks “uninvestable”?

There was recently panic in Chinese stocks throughout September and October. Most comments threads I observed suggested Chinese stocks were “uninvestable”. Before such large falls we witnessed, in August the well-respected Howard Marks was discussing China in the context of how we should search for bargains in the “uninvestable” pile.

China is not “uninvestable”, it is just that uncertainty is very high, and we need to take that into account. I liken the potential opportunity to how one might view assembling a portfolio of “net net” stocks. Screening for “net nets” would likely produce many stocks with high levels of uncertainty and the possibility of large losses on individual stocks. However, assembling a large number of positions with low weightings can make sense with such a strategy. That tends to mean any large individual stock losses can be offset by outsized gains in others to produce good returns overall.

Chinese stocks are “investable”, it is simply a question of price and investing a relatively small position according to one’s risk tolerance.

For sure the China we know in recent years is far less business friendly and interfering way too much. At the same time, however, (obviously to a far less extent), the pandemic has highlighted this is also somewhat of a worrying trend in the west.

I also have in the back of my mind another group of stocks, the coal sector, that were similarly shunned not that long ago. Where I am old enough to remember a couple of years ago were labeled by many as “uninvestable”. In hindsight, an amazing buying opportunity.

Is Michael Burry also searching to buy Chinese stocks?

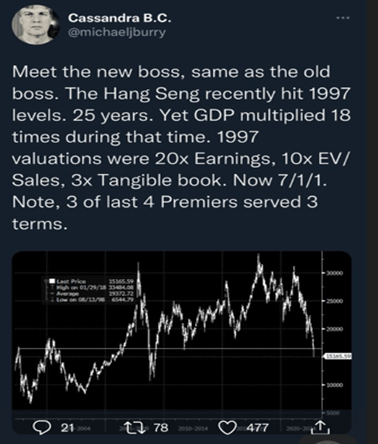

I don’t know the answer to the above, however, it was interesting to observe his tweet on October 25th, the day in which HK stocks suffered their largest daily fall since 2008.

However you try to interpret Dr. Burry’s tweets, most would probably suspect he might be doing what Howard Mark’s suggested, i.e., searching for opportunities where the investing crowd are labelling them as “uninvestable”.

Why then examine the China Fund?

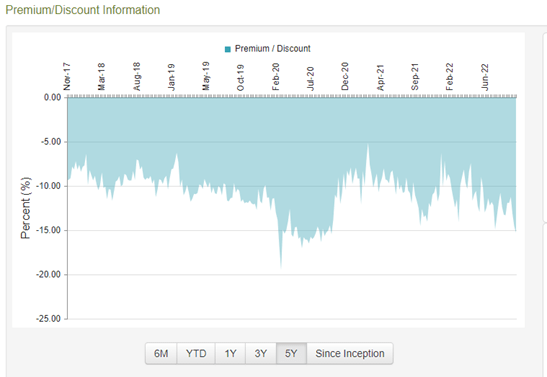

I could recall the activism battle in 2018 and change of investment manager that took place. There were a large number of investors keeping the board of directors accountable. I also observed during the October panic the discount to NAV being the largest I could remember at near 20%.

Closed End Fund Connect CHN discount

City of London was the key shareholder to stand up to the board in 2018. I note their ownership stake is significantly higher now compared to back then. One notable event that did occur around then was a large tender offer of 30% of the shares outstanding at 99% of the NAV. This was quite attractive for shareholders at the time. Due to some shareholders not tendering, the final result was that you could have tendered more than 40% of your holding at very close to NAV.

Whilst not necessarily my base case here in the short term, we have a situation where there might be more ways to win here. Aside from a bounce back in Chinese stocks, the possibility remains of some further action to address the large discount to NAV. The regular buyback as part of the “discount management program” has been very small and disappointing in recent years.

China Fund characteristics

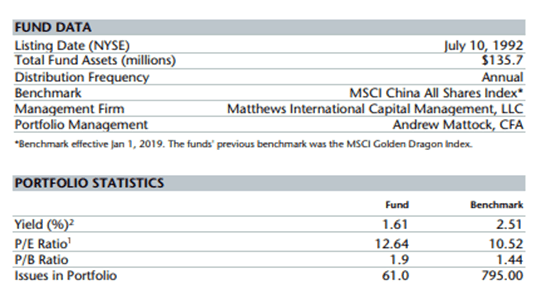

Before we look at the fund characteristics, please bear in mind that the data below is from the September 30th factsheet, and that markets were very weak in October.

A problematic issue the fund now faces is how it shrunk so much in 2022 from poor underlying performance. As we can see below, the fund size is now under $150 million. This means if they decided on a similar tender offer like in 2019, it would leave a very small fund.

Since the fund manager change in 2019, they have tried to keep the expense ratio lower at 1% now.

CHN Monthly Factsheet September 2022

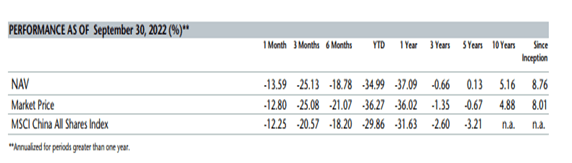

The performance of the fund in a relative sense hasn’t necessarily been a failure. However, in the last year, they are doing even worse than the steeply declining MSCI China All Shares Index. The 3-year number is becoming more increasingly important to observe. This timeframe is getting close to the period of the appointment of new manager, Matthews International Capital management.

CHN Monthly Factsheet September 2022

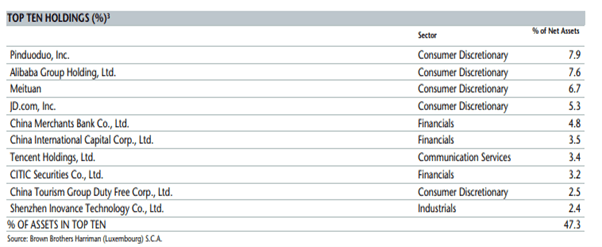

Below are the latest top ten holdings and they are currently most overweight in the consumer discretionary sector.

CHN Monthly Factsheet September 2022

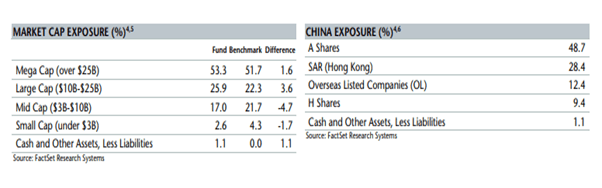

The fund’s exposure to A shares are running below that of their benchmark, probably due to my point earlier that the A shares premium to H shares is at historic highs.

CHN Monthly Factsheet September 2022

Why are Chinese stocks down? The risks of the China Fund

Chinese stocks have suffered headwinds from a wide array of events in recent years. Falling home prices, trade wars and tensions with the US and other parts of the globe. Then there are fears of a Taiwan invasion, China’s internal crackdown on certain industries, zero Covid polices, we could go on.

In October the catalyst for further panic seemed to be Chinese president Xi Jinping’s consolidation of power. This has heightened fears in particular that it is difficult to see an end anytime soon to China’s zero Covid policy. It also has risen concerns that the possibility of China invading Taiwan might be a major risk for even the shorter-term outlook.

What struck me as odd though, was risk factors that drove HK stocks to fall around 15% in October, were factors that US stocks pushed aside to gain around 8% for the month.

Aside from all the political risks, it could simply be a case of China having their own housing market crisis that is comparable to the US housing crisis. One point I would like to make in that context at least with the HK stock market, is that the losses already suffered there are already comparable to the US bear market around 2008.

What happens to US stocks if China invades Taiwan?

Such risk factors like China invading Taiwan or continuing their zero Covid policy for another year, according to many make Chinese stocks “uninvestable”. There is the fear around that trying to pick a bottom here could even mean your China investments result in a zero. That you may not be able to access them to sell them in a crisis.

Whilst not ruling that out entirely, I must wonder where the S&P500 is headed if things get that bad? Sure, in a more “investable” US stock market you will still have access and liquidity in a crisis. However if things get as bad as predicted by the China bears, there could still be huge downside to US stocks.

What appears safe and comfortable as an investment is not always so obvious. Those at the beginning of 2022 with a portfolio of Facebook, Google and Amazon shares may attest to that now.

Will Chinese stocks recover?

Now I shall come back to my earlier point, that a highly uncertain situation may warrant an investment as a relatively small position size. Even if you do fear a small chance of a zero outcome in Chinese stocks, perhaps a chance of your investment doubling or tripling in a few years compensates you for such risks. Having said that though, does China’s record really warrant us fearing investments being cut off like we saw with Russia?

I realize that a boom in Chinese stocks might seem farfetched to many investors amidst the current negative sentiment. The below chart however gives perspective about how much panic we witnessed in the HK market in recent months.

Bloomberg

It also offers food for thought what any type of rebound to even the lower part of historical valuation ranges may mean for potential returns. How about a scenario where China plays a patient strategy with Taiwan, and where it decides to emerge from its zero Covid policy early next year? Does that sound all that far-fetched? Perhaps add to the equation some significant Chinese monetary and fiscal policy stimulus. China is one of the few parts of the world where this looks possible right now.

Whatever your opinion on Chinese president Xi Jinping is, one must acknowledge that the end goal may well be very long term. It is quite possible it may also involve in the shorter term first seeing China emerge strongly from the recent economic slump. Thereby it can exert its power from more of a position of economic strength.

Conclusion

In summary, whilst I do not have a position in CHN at the present time, the panic we saw in late October spiked my interest. The widespread labeling of Chinese stocks as “uninvestable” has prompted me to take a closer look.

I am leaning towards a bullish opinion and that the sharp selloff throughout September and October, particularly in HK stocks, is finally looking like a bottoming out phase.

As I have discussed however, uncertainty is extremely high, and it only interests me from the angle of taking a relatively small bet. With such a volatile market, it is extremely challenging to get the timing right.

After examining CHN, the discount to NAV it has hit lately of circa 18% does look appealing. From the prospects of any certainty of closing such a gap in the shorter term though, I have more of a preference for an Asian focused CEF listed on the ASX, ticker is EAI. That is where I am currently looking right now to put my toes in the water as a stock that offers plenty of exposure in this region.

At the time of writing this in early November, rumors of China backing away from their zero Covid policy has led to a bit of a bounce from oversold conditions. Perhaps it is a bullish sign seeing such a bounce even during sessions where US stocks have been weak.

As I am a bit skeptical about the rise in US stocks during October however, I wish to also leave some dry powder. I would plan to add a bit more to Chinese stock exposures in the case we revisit recent lows. Hence whilst I am coming at this from a bullish perspective, I acknowledge the uncertainty and will resist to go all in right now with significant exposures to my portfolio.

Be the first to comment