benimage

If there was one thing The Macerich Company (NYSE:MAC) Q3 results showed, it’s that the fundamentals of its business continue to improve despite the tough economic environment. Sales are outpacing last year, and occupancy continues to increase. Leasing spreads are now positive, in the mid-single digits, the strongest they’ve been in three years. Leasing volumes are on pace for a second consecutive record setting year.

The one big concern we still have is with the balance sheet and the debt refinancing. Macerich reported that debt markets remain challenging, but it still managed to make progress addressing near-term maturities of non-recourse mortgage debt. Unfortunately, refinancing is getting more expensive, but that is not really a surprise in the current environment of increasing interest rates.

Funds from operations were $0.46 per share diluted in Q3 2022, compared to $0.45 per share diluted in Q3 2021. Same center net operating income, excluding lease termination income, increased 2.1% in the third quarter of 2022 compared to the third quarter of 2021. We see these results as solid, and are reassured that funds from operation and NOI are moving in the right direction, even if the increase year over year was rather modest.

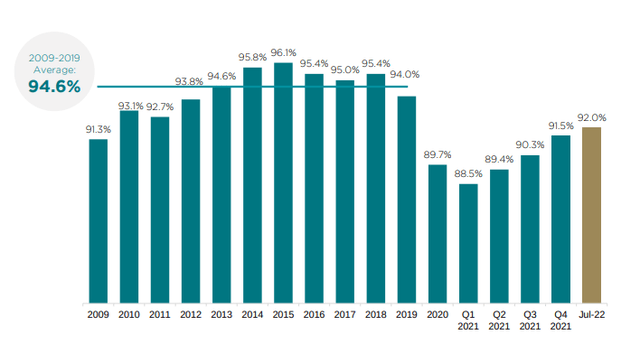

#1 Occupancy is quickly recovering

The company had been pretty clear that coming out of the pandemic the number one priority would be occupancy, occupancy, and occupancy. So far the company is delivering, with portfolio occupancy as of September 30, 2022 at 92.1%, a 1.8% increase compared to the 90.3% occupancy rate at September 30, 2021, and a 0.3% sequential increase compared to the 91.8% occupancy rate at June 30, 2022. For comparison purposes, the 2009-2019 average occupancy was ~94.6%. That means the company is not that far from fully recovering from the pandemic impact.

Macerich Investor Presentation

Additional occupancy tailwinds include the fact that retailer bankruptcies continue to be close to a record low. The company also has a very significant leasing pipeline that gives it confidence that occupancy will continue trending higher. VP of leasing Doug Healey had this to say about the leasing deals in the pipeline during the most recent earnings call:

And to reiterate the continued strength of our deal flow, year-to-date we reviewed and approved 45% more deals for 35% more square footage than we did during the same period in 2021. Once approved these deals moved to documentation and are added to our already very strong leasing pipeline. This strong shadow volume bodes extremely well for continued occupancy and revenue growth for the remainder of this year, next year, and even into 2024.

This has made the company confident that they will very likely reach pre-Covid occupancy by the end of next year. Macerich therefore expects to see occupancy gains continue.

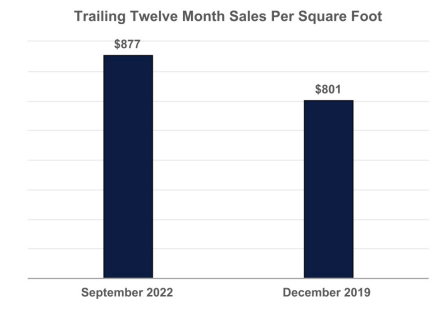

#2 Tenants are healthy and ready to pay more rent

Another big positive from the earnings release is that tenant sales are moving higher, and retailers remain quite healthy. Portfolio tenant sales per square foot for space less than 10,000 square feet for the trailing twelve months ended September 30, 2022 were $877 compared to $801 as of December 31, 2019. That is a very significant increase, which shows that quality malls are not obsolete.

Macerich 8-K

Despite the tough economic conditions, retailers remain quite healthy, according to Doug Healey. As the person responsible for leasing he is in constant contact with retailers, and this is his take on their health:

As I said before, we have a very healthy retailer environment out there. And I talked to the retailers all the time. And, we’re not seeing the fallout that you might think, given what’s going on in the economy.

CFO Scott Kingsmore complemented Doug’s comments by explaining how the increase in occupancy, and healthy retailer demand for space, is now helping push rents higher and giving the company more pricing power:

We’ve been talking about it for a few quarters now that with the pickup and occupancy, we’d start things to think we could start to push on rate. And that seems to be the case. We got to 92% occupancy, which creates that tension between supply and demand. And as we review deals again, every other week, it seems like we’re getting more and more pricing power.

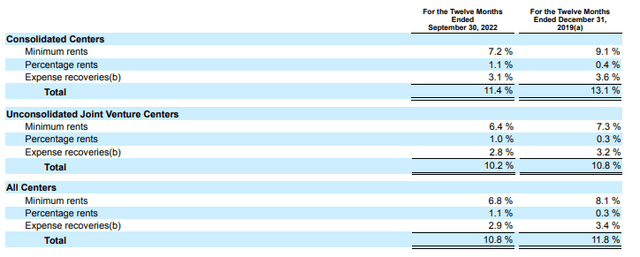

This is effectively reflected in re-leasing spreads that were 6.6% greater than expiring base rent for the twelve months ended September 30, 2022. This is the strongest result since the quarter ended September 30, 2019. The company hopes to be able to maintain a healthy mid-single digit leasing spread going forward.

The company’s ability to push rate, as indicated by spreads, is negatively correlated with cost of occupancy, which is currently at 10.8%. That’s about 100 basis points below where they were at the end of 2019.

Macerich 8-K

Another big tailwind for increasing rents is the reduction of temporary tenancies. The company is still north of 7% in terms of temporary tenancies. When those convert to permanent uses, the company has a rent pickup that’s around 2 to 2.5 times what the temporary tenant was paying. So converting temporary occupancy to permanent occupancy should result in significant revenue growth.

#3 Financing conditions are tough

The one big negative takeaway from the earnings call and quarterly results is that re-financing debt is getting expensive. The company still has good levels of liquidity and has been able to negotiate debt extensions, but the conditions are getting less favorable for the company. Including undrawn capacity in their line of credit, which has about $424 million available, the company has over $615 million of liquidity today. Debt service coverage is at 2.7x. Net debt to forward EBITDA, excluding leasing costs, at the end of the quarter was approximately 9x.

To get an idea of how much the company is having to pay to re-finance debt, year-to-date they have refinanced or extended $580 million of debt at a weighted average closing rate of just over 5%. As a recent example, Macerich closed a one-year extension on July 1st of the $164 million loan on Danbury Fair Mall at a fixed rate of 5.5%. For comparison, Simon Property Group (SPG) completed 16 non-recourse mortgage loans in the first nine months of the year totaling approximately $1.8 billion and the weighted average interest rate on these loans was 4.78%.

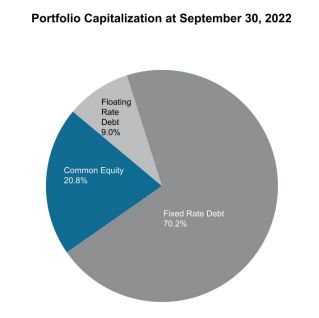

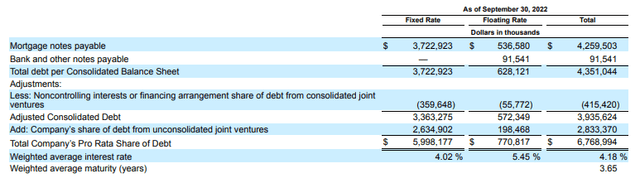

Macerich expects to close multi-year extensions of the loans on Washington Square and Santa Monica Place during November. The $500 million Washington Square loan is expected to extend for four years until late 2026, and the $300 million Santa Monica place loan is expected to extend for three years until late-2025. The company expects the weighted average floating rate on these two extensions to be approximately SOFR plus 2.8%. Both loans will have interest rate caps in place, so they will effectively be hedged as fixed rate loans. As can be seen in the graphs below, floating rate debt is now at ~9% of the portfolio capitalization and has a weighted average interest rate of 5.45%. The weighted average maturity of the total debt is 3.65 years. Hopefully, the company will be able to negotiate multi-year extensions to loans and mortgages that increase this average maturity of debt.

Macerich 8-K

Macerich 8-K

#4 Dividend growth is back

To the delight of income investors, Macerich declared an increased quarterly cash dividend of $0.17 per share of common stock, which represents a 13.3% increase over the prior $0.15 dividend rate. The cash flow on an annual basis after payment of recurring CapEx, but before dividend payments, is approximately $370 million. The company is therefore on firm footing, and management is very confident about the outlook of the business. Importantly, the company hinted that future increase are likely. This is what Scott Kingsmore had to say about it:

So, we do think it’s important to get back into a cadence of increasing our dividend, given the outlook for the business. No guarantees for future increases, but we would certainly hope to be in a position to revisit that down the line as well. So, really it’s a firm vote, in terms of our confidence for the business and the outlook for the business right now.

Valuation

Despite the clear operational improvements, shares remain extremely cheap. They are currently trading at ~6x estimated funds from operation for the year. This is much cheaper than the historical ~14x multiple that investors used to give the company. With fundamentals recovering quickly, and the company almost back to pre-pandemic levels of occupancy, we think that such a big discount is not really justified.

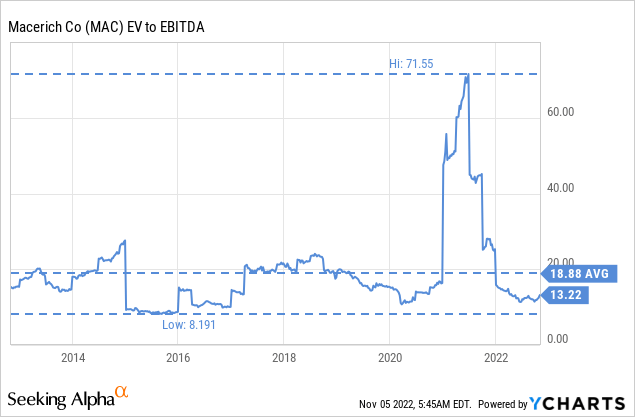

The one remaining concern for us is the balance sheet and debt refinancing, but we don’t think the refinancing risk is significant enough to justify such a large valuation discount. Looking at EV/EBITDA, it is also clear that shares are trading at a significant discount to their ten-year average.

Risks

We believe that the number one risk for Macerich remains the balance sheet, and specifically refinancing risk. So far, the company has continued to be able to negotiate debt extensions, although paying higher interest rates to do so. Should the credit markets freeze, this would pose a serious threat to the company. The balance sheet, liquidity, and leverage ratios have improved, but the company still has further work to do to deleverage more, extend debt duration, and strengthen the balance sheet.

Conclusion

Macerich’s Q3 results reaffirm our view that the company is on the path to full-recovery after the pandemic. Operationally, the company is doing well, the one area of concern for us remains the balance sheet and the refinancing risks. Still, the company is now much healthier, and management’s confidence in the business resulted in a significant increase to the dividend. In our opinion, shares remain very cheap and have room to move much higher. The one big risk to monitor is debt refinancing, but so far the company has proven it can negotiate debt extensions.

Be the first to comment