Petra Richli

Analyzing the prospects for Chewy, Inc. (NYSE:CHWY) last September, I wrote good things are not cheap, meaning that Chewy, in my opinion, was attractively valued back then despite elevated valuation multiples. Since then, CHWY stock has gained nearly 22% against the S&P 500’s 0.2% decline. The market recovery in the last 30 days has certainly helped Chewy’s gains and the cooler-than-expected CPI print for October boosted e-commerce stocks too, paving the way for Chewy to come back strongly after a forgettable few quarters. As we approach Chewy’s fiscal third-quarter earnings (the company is set to report earnings on December 8 after the market closing bell), the time is right for investors to assess whether earnings will have a positive or negative effect on Chewy stock at a time when Mr. Market seems to be punishing companies that guide for lackluster growth for the next few quarters.

3 Q&As To Evaluate Chewy’s Prospects

Chewy competes with pet care retailers such as PetSmart and e-commerce giants such as Amazon.com, Inc. (AMZN). The industry is moving toward a digital future, which is evident from how established pet care retailers with a massive brick-and-mortar presence such as PetSmart (1,650 stores) and PETCO (1,500 stores) are aggressively investing in improving their online presence. The pandemic tilted the odds in favor of e-commerce pet stores because of mobility restrictions that limited movement, and not surprisingly, Chewy made the most of this favorable development by capturing and retaining thousands of new customers. With the online pet care industry already getting crowded, Chewy has its work cut out in the coming years to maintain its market leadership in this segment.

To assess Chewy’s future, investors need to evaluate Chewy’s competitive positioning in the pet care industry from a few different angles.

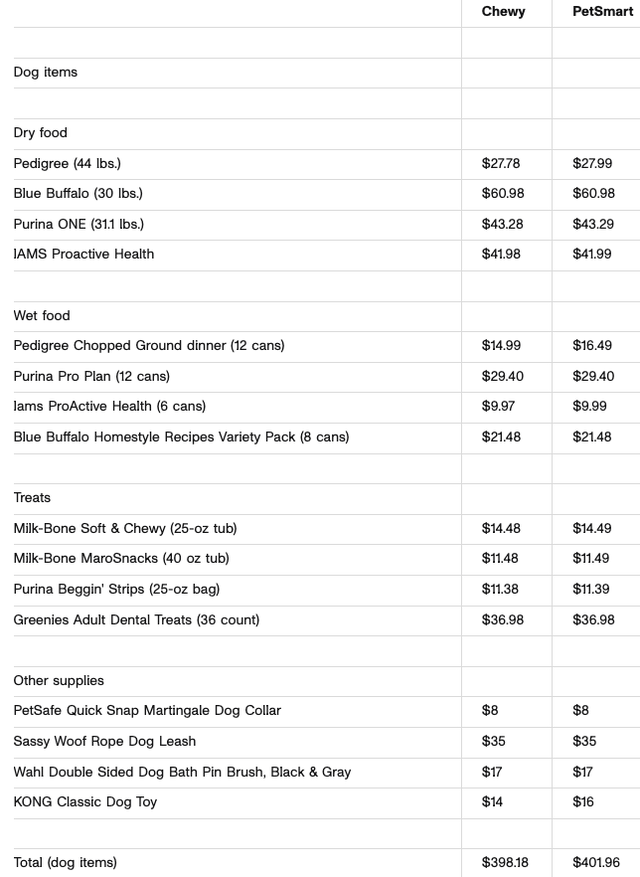

First, are Chewy’s prices on par with industry averages? We are living in an era where convenience offered to customers plays a key role in determining the winners and losers of any business sector. However, with inflation eating into the wallets of many pet owners, the price of products will, in my opinion, play a key role in determining which companies will thrive in the next few quarters. For Chewy, losing customers is not an option as lost customers are highly unlikely to be enticed back into Chewy in the next business cycle when things normalize. Data collected by Zachary McAuliffe for his recent article for CNET shows that Chewy is winning on this front against arch-rival PetSmart.

Exhibit 1: Chewy vs PetSmart (price comparison for dog items)

CNET

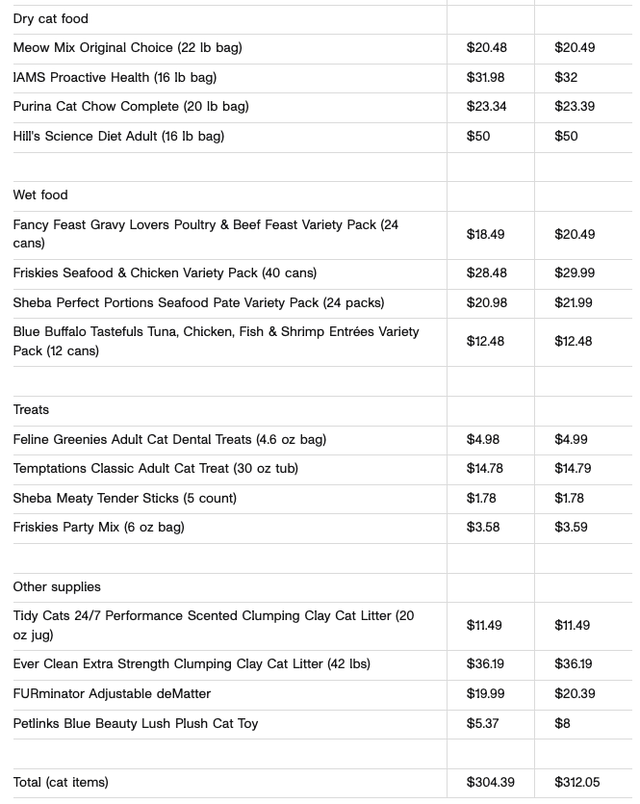

Exhibit 2: Chewy vs PetSmart (price comparison for cat items)

CNET

Source: CNET

The difference might not be eye-popping but it would have been irrational to expect massive differences in prices for pet products given that the market is fragmented. Although these differences are little, I believe Chewy stands to attract more customers in the coming quarters as consumers are likely to look for ways to save as much money as possible on pet care products in this inflationary environment. What’s more, Chewy offers a better selection of products compared to PetSmart, which should be another good-enough reason for pet owners to prefer Chewy over PetSmart. According to data from CNET, Chewy offers a massive 172-brand selection of dog food in comparison to just 41 brands available on PetSmart. Chewy’s prices are on par – or at times better – than the industry averages and the company offers a better selection of products than many of its competitors. These characteristics should bode well for Chewy to gain market share in the long run.

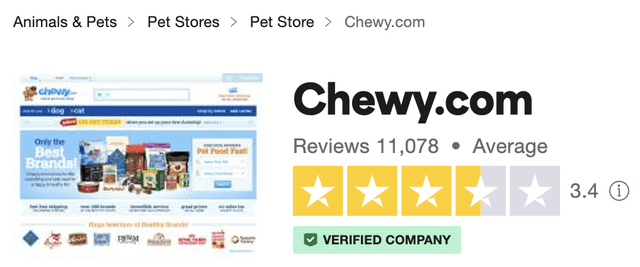

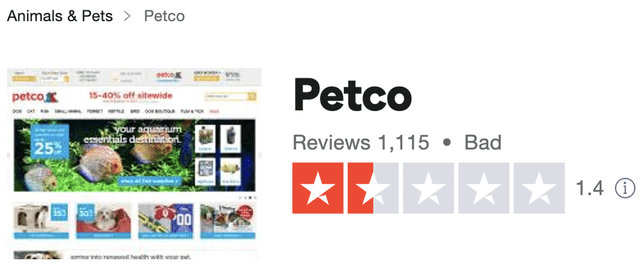

Second, how does Chewy differentiate itself from the competition? In a competitive market segment, it would be impossible to survive let alone thrive without offering a unique product/service that continues to lure customers. For Chewy, the differentiator is the high-quality, personalized, and industry-leading customer service offered to its customers. As investors, we cannot rely on hearsay to make investment decisions. To understand what customers think of a company and its products, one of the best places on the Internet is Trustpilot. The platform does a commendable job of publishing verified reviews by requesting reviewers to verify their identity in certain instances and also by allowing businesses to reply to these reviews publicly, for free. Trustpilot, according to its website, employs trained staff to monitor platform activity to remove fraudulent reviews as well. This is something that I have experienced first-hand while dealing with financial advisory companies in Dubai. As illustrated below, Chewy’s customer support rating on Trustpilot is substantially better than its closest rivals.

Exhibit 3: Trustpilot rating comparison of Chewy and its competitors

Trustpilot

Trustpilot

Trustpilot

Trustpilot

Source: Trustpilot

Chewy offers 24/7 customer service as well, and the company, according to recent job adverts posted on its website, prioritizes pet lovers when hiring customer support staff. If you want some examples of how Chewy is going above and beyond with its customer servicing, have a look at this Forbes article which highlights how Chewy sent a customer flowers to congratulate them on a wedding which was mentioned over the phone while another staff member sent an unused keyboard to a customer who mentioned having a broken keyboard. The company is already yielding positive results through its focus on offering unmatched customer servicing, which could continue to be a value driver in the coming years.

Third, can Chewy convert customer loyalty into more revenue? Through high-quality customer service, Chewy believes it can build a loyal customer base that will stick with Chewy in the long run. For investors, the more important consideration is whether loyalty will trickle down into the financial statements of the company in the form of revenue and earnings. The only reliable way to evaluate this is to look at Chewy’s customer retention rates along with the spending patterns of customers. Chewy is focused on retaining high-value customers, which seems to be working well for the company. The management, in many instances, has highlighted how the company focuses on certain customer cohorts to drive spending in the long run. Although Chewy has come under scrutiny in the past for low customer retention rates, according to data revealed by the management in the Fiscal Q1 earnings call, net revenue retention for each of its customer cohorts going back to 2011 is over 100%. This confirms that Chewy is not losing revenue although the company sees a high degree of customer churn. This is only possible because retained customers tend to increase their spending on Chewy as they stay loyal to Chewy for a few years. Last June, Chewy CEO Sumit Singh explained these spending patterns of customers and said:

Overlaying this tenure data with a consistent lifetime spending curves our customers demonstrate over time, spending less than $200 their first year, over $400 by their second year, approximately $700 by their fifth year, with our oldest cohorts spending nearly $1,000 per year.

These numbers illustrate how Chewy is well-positioned to benefit in the long run by retaining new customers for at least a few years. Net sales per active customer reported by Chewy have been trending higher consistently and hit a record high of $462 in the last quarter. This positive trend is a testament to how Chewy is converting customer loyalty into higher revenue and eventually profits. Although the company might initially incur costs to acquire and retain customers, Chewy stands to benefit from its efforts in the long run, which is confirmed by empirical evidence. Not to forget, the bulk of Chewy’s active customers were attracted in 2020 at the height of the pandemic, so this customer cohort is still very new. Therefore, Chewy still could be a few years away from making the most of this customer cohort.

The findings discussed in this segment of the analysis suggest Chewy is well-positioned to grow in the next decade.

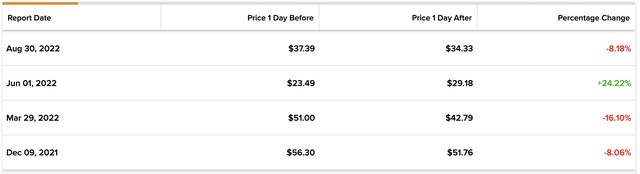

How Will CHWY Stock React To Earnings?

Over the last few quarters, earnings have triggered wild moves in CHWY stock. With the company likely to discuss its prospects for a challenging few quarters this earnings call, investors should expect heightened volatility yet again.

Exhibit 4: Earnings-related price changes of CHWY stock

TipRanks

Source: TipRanks

Instead of trying to profit from short-lived market moves triggered by the upcoming earnings report, as a long-term focused investor, I will be looking for answers to the below questions.

- How is the company dealing with supply-chain challenges?

- How is rising inflation affecting customer spending on both essential and discretionary pet care spending?

- How is Chewy holding up against the competition from brick-and-mortar stores for wet food items that are difficult to be delivered?

- How is Chewy dealing with regulatory challenges as the company expands its pet healthcare services across the nation?

Finding answers to these questions, in my opinion, will be key to understanding Chewy’s long-term prospects.

Takeaway

Chewy is proving to be a wonderful business as the company continues to thrive in a fragmented market. The company, arguably, is still in the very early stages of its growth story but investors need to be cautious of the changing competitive landscape. Although the short-term future will be challenging for Chewy, the company seems well-positioned to grow in the long run.

Be the first to comment