Jakub Laichter /iStock via Getty Images

By Gene Podkaminer, Head of Research, Franklin Templeton Investment Solutions & Miles Sampson, Senior Research Analyst, Franklin Templeton Investment Solutions

Equity markets year-to-date have been marked by volatility. At first, markets fell as inflation forced major central banks to acknowledge the need to raise rates quicker than anticipated. Along with intense human suffering, the Russian invasion of Ukraine also brought heightened uncertainty, major sanctions, and policy shifts, as well as commodity supply shortages. In the past few weeks, markets have partially rebounded, and investors are wondering what comes next.

Key Points

- There is no “one size fits all” geopolitical playbook for asset allocation. While “buy-the-dip” is a popular mantra, we have found equity and commodity performance to be inconsistent following geopolitical events.

- Our framework for thinking through geopolitical events is to consider the potential duration and regional impact. Global and long-lasting events have a higher probability of being disruptive for assets.

- In our view, the Russia/Ukraine war qualifies as a global geopolitical event with long-term implications.

- The macro backdrop is also an important consideration. Today, we see a macro environment that is becoming more precarious for risky assets.

- Our analysis of asset performance following geopolitical events, alongside a deteriorating macro context, lead us to prefer a nimble and cautious approach to risk assets.

What Is The Geopolitical Playbook For Asset Allocators?

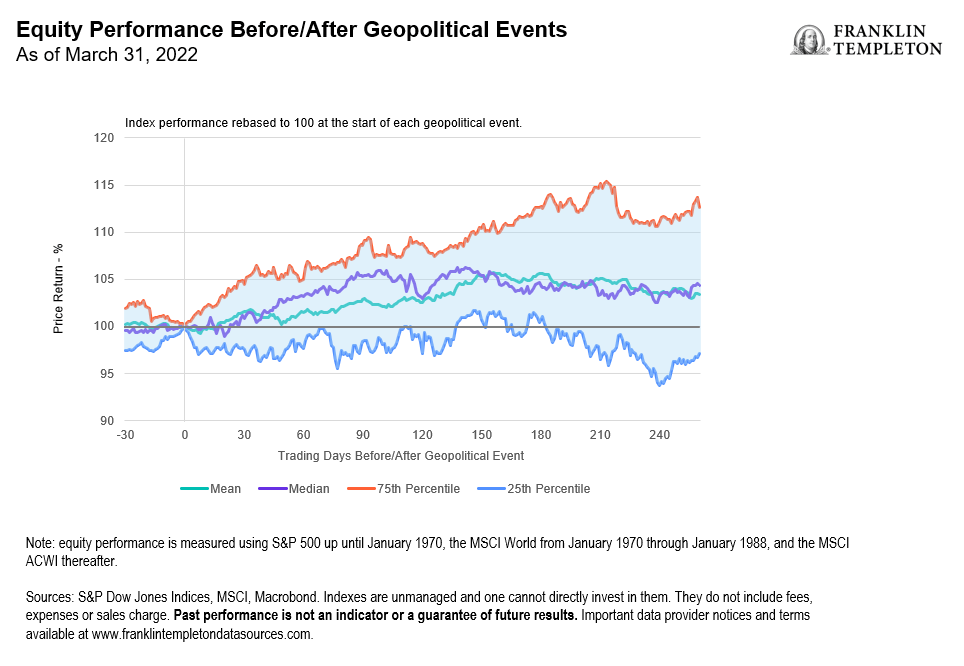

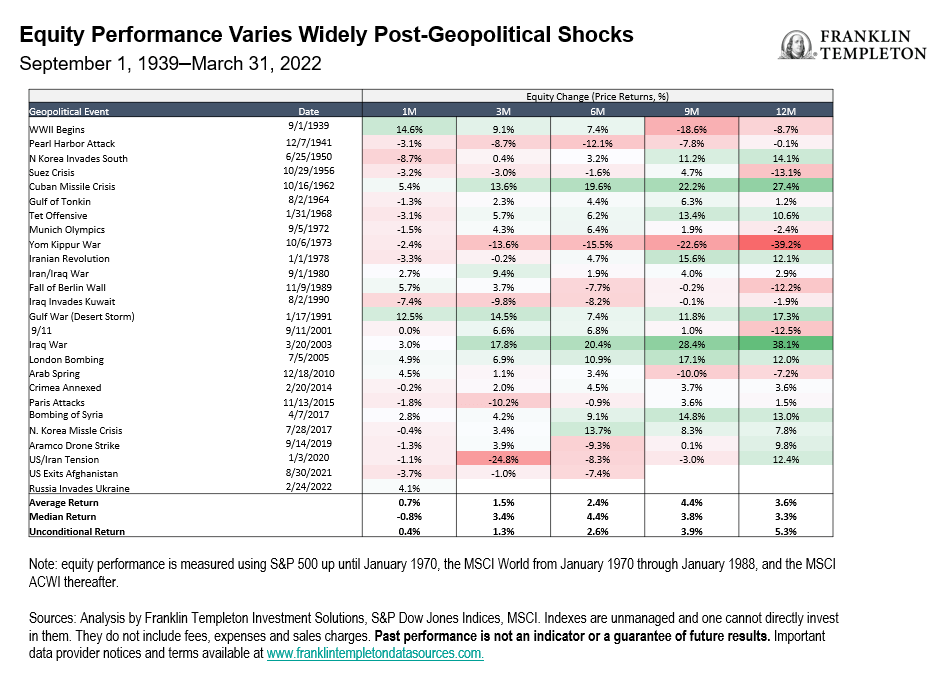

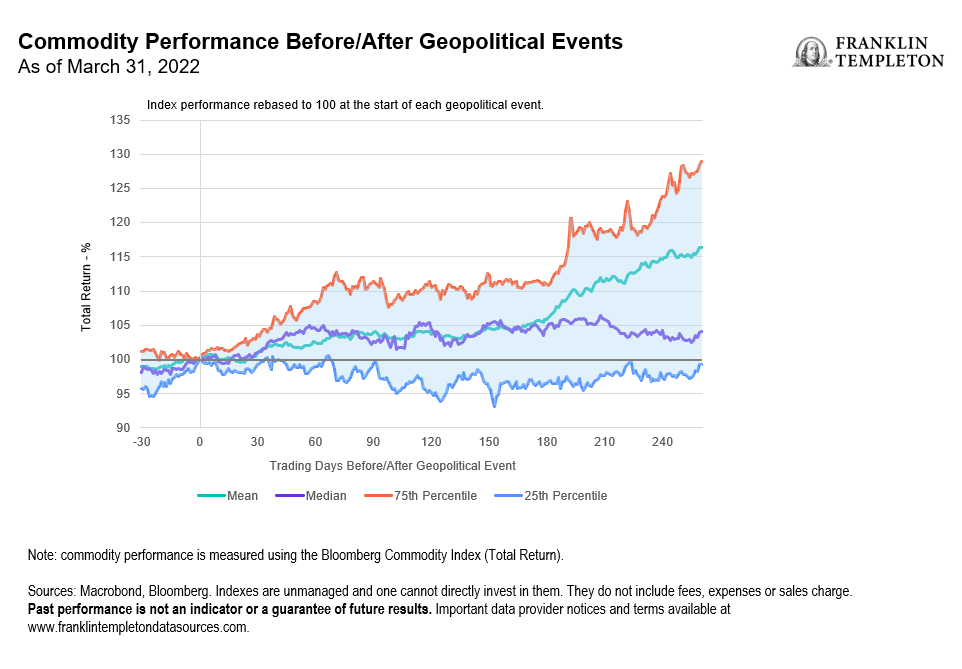

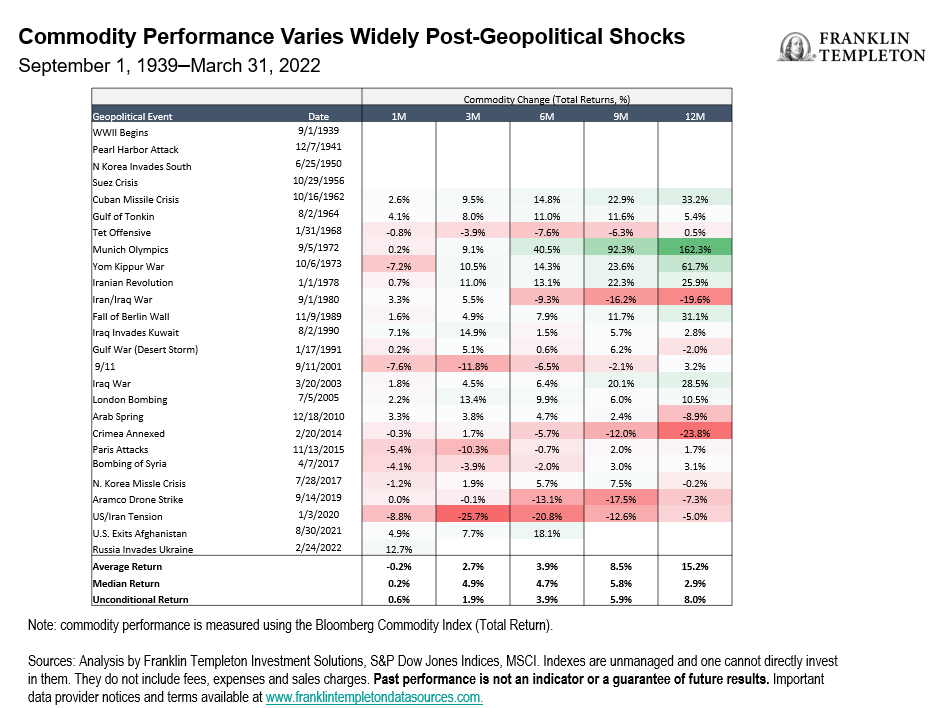

As global developed equity markets have rallied approximately 6% from their lows in early March,1 the popular investment mantra, “buy the dip,” has gained traction, particularly as it relates to investment strategy around geopolitical events. We would caution against celebrating the success of this strategy too soon. When analyzing a broad array of geopolitical events, it’s clear that asset performance can vary significantly in the year following a geopolitical event.

There are several reasons why performance may vary following a geopolitical event. First, many types of events are classified as geopolitical, from unpredictable terrorist attacks to political regime changes, local land disputes, and global wars. Most of these crises have included a horrifying human element but are otherwise distinct, and took place amidst disparate political and macroeconomic contexts.

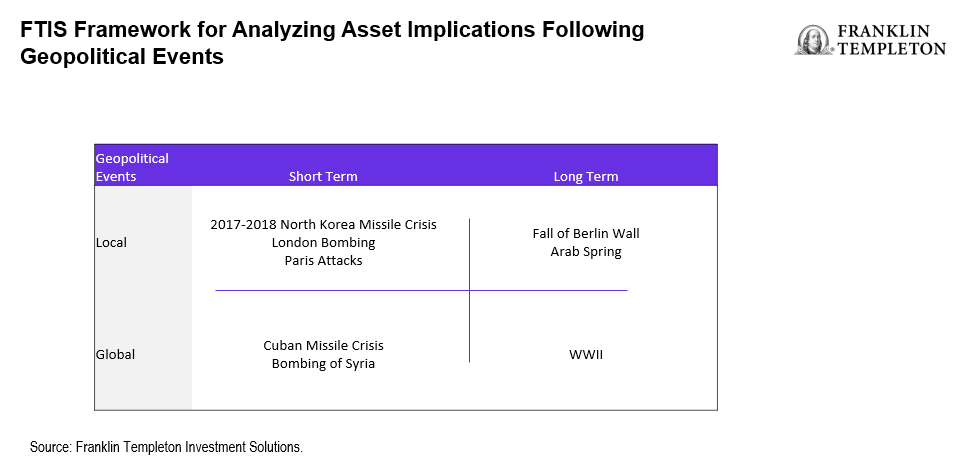

Our asset-allocation framework for thinking through heterogenous geopolitical events is to consider the potential duration and regional impact. Global and long-lasting events have a higher probability of disrupting economic supply and demand, and thus, asset performance. Our analysis suggests that many geopolitical events are local and short-term in nature. Some events have a global or long-term influence, and only a few are both global and long-term in nature. The table below provides a visual example of this framework.

Where does the Ukraine war fit? While the fighting is currently confined to the territory between Russia and Ukraine, the reach of the war is global. Coordinated sanctions from Western economies, including the United States and Europe, have broadened the repercussions of this war. The rise in commodity prices, affecting many different sectors, also has a global reach.

While the duration of the war is uncertain, it has already lasted longer than many observers expected. And we believe there are many long-term implications, which will continue to play out well after the violence subsides. This war has exposed Europe’s energy dependence on Russia and has accelerated its shift away from Russian energy. Investments into alternative forms of energy, especially green energy, are being accelerated as a result. Geopolitically, the war has further unified NATO countries and increased the divide between Russia and its allies. Secularly, the reorientation of globalization is likely to accelerate. For instance, the steady mantra of just-in-time inventories may be recast as just-in-case.

The Macro Backdrop

Another reason for performance dispersion is that the macro backdrop varies substantially across historic geopolitical events. Our analysis suggests that the macro starting point matters (a lot)— geopolitics can often accelerate macro trends that were already underway.

This is an important consideration today, where we are expecting growth to slow to trend levels amidst a challenging inflationary environment. The Ukraine war has intensified both trends. Inflation pressures are not only increasing from higher energy prices, but Russia and Ukraine also play an important role in global supply chains that will impact production of food, semiconductors, autos, and more. Higher inflation is stunting consumer confidence across the world and lowering real purchasing power. Ultimately, this should amplify the slowdown in growth.

Alongside the challenging growth and inflation mix, we believe the monetary policy outlook is becoming more precarious. Outside of China and Japan, nearly every major central bank is expected to tighten policy rates by year-end—in many places significantly. The recent Federal Reserve communications continue to support a more hawkish future stance.

Implications For Multi-Asset Portfolios

Our analysis of asset returns following geopolitical events, along with the deteriorating macro backdrop, has led our team to reduce our bullishness over the past month. We continue to disfavor European equities relative to their North American counterparts, where energy exposure is more positive and trade less disrupted by the war. Emerging market equities remain vulnerable, in our opinion, as they bear the brunt of many supply chain shocks alongside weak growth dynamics in China.

In fixed income, we prefer less duration exposure in developed government bonds. Similarly in credit, we prefer asset classes with less duration, such as high yield and bank loans. We find some value in hard-currency emerging market debt and still favor exposure to Chinese government bonds, where policy easing remains out of sync with other major regions. Moving forward, the uncertainty surrounding the Ukraine war and its aftershocks, coupled with a challenging inflationary background, leaves us carefully assessing where we take risks in our portfolios.

What Are The Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds adjust to a rise in interest rates, the share price may decline. Investments in lower-rated bonds include higher risk of default and loss of principal. Floating-rate loans and debt securities tend to be rated below investment grade. Investing in higher-yielding, lower-rated, floating-rate loans and debt securities involves a greater risk of default, which could result in loss of principal—a risk that may be heightened in a slowing economy. Interest earned on floating-rate loans varies with changes in prevailing interest rates. Therefore, while floating-rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Investments in foreign securities involve special risks including currency fluctuations, economic instability, and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity, and lack of established legal, political, business, and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers, and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

1. Source: MSCI World Index, as of April 12, 2022. The MSCI World Index captures large- and mid-cap performance across 23 developed markets. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses, or sales charges. Past performance is not an indicator or guarantee of future results. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MSCI. Important data provider notices and terms available at www.franklintempletondatasources.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment