marchmeena29/iStock via Getty Images

Investment Thesis

Chevron Corporation (NYSE:CVX) is one of the top picks in our portfolio, given its upward trend in the past few decades. Despite the short-term volatility ahead, the company will likely emerge victorious over the potential recession, given the insatiable demand for oil and gas for this and the coming decade.

However, CVX’s current metrics still look overvalued, despite the recent correction. Consequently, we advise patience for investors looking to add more, since a short-term retracement may also be looming on the horizon.

CVX’s Operating Metrics Look Exemplary

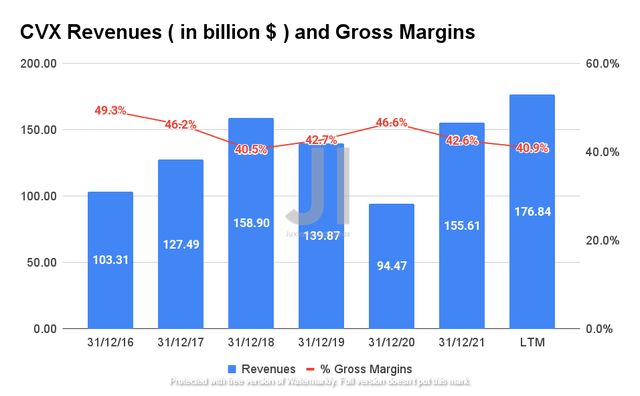

CVX Revenue and Gross Income

In the last twelve months (LTM), CVX reported revenues of $176.84B with gross margins of 40.9%, representing a massive improvement of 26.4% from FY2019 levels.

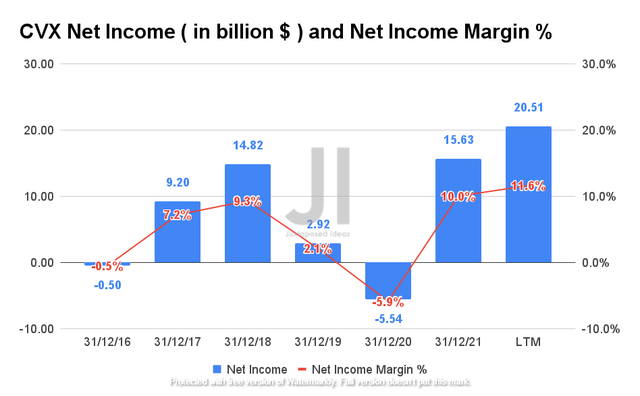

CVX Net Income and Net Income Margin

In addition, CVX’s net income profitability is also notably improved to $20.51B in the LTM with net income margins of 11.6%, representing a gargantuan growth of 702% from FY2019 levels. Therefore, it is evident that CVX is making up for the lost revenue due to the massive throttling back in FY2020, during the height of the COVID-19 pandemic.

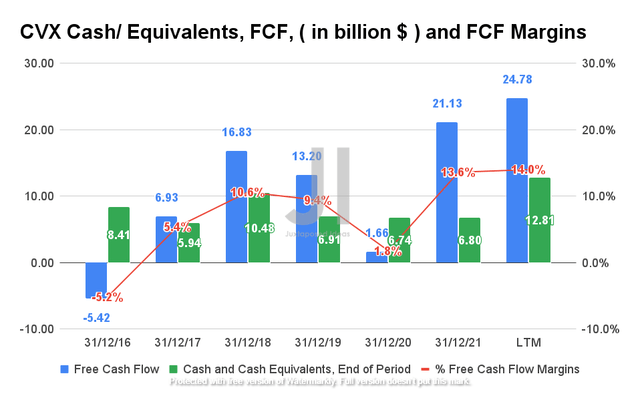

CVX Cash/Equivalents, FCF, and FCF Margins

In addition, CVX also grew its Free Cash Flow (FCF) profitability to $24.78B in the LTM, representing an increase of 87.7% from FY2019 levels, with an improved FCF margin of 14% as well. This has also translated directly to its growing war chest of cash and equivalents of $12.81B in the LTM, which would be massively useful for the expansion of its production capacity in H2’22.

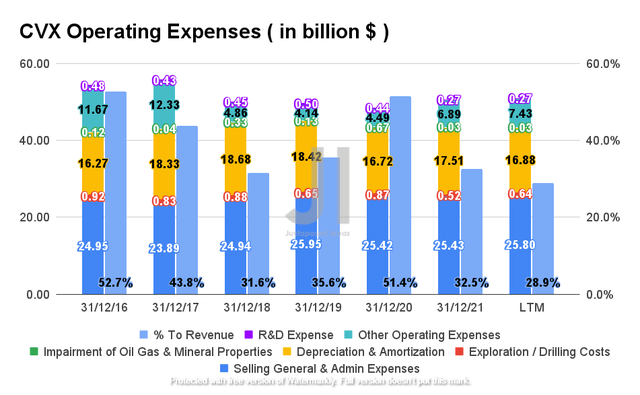

CVX Operating Expense

CVX had also been prudent on its operating expenses, given that it has spent $51.05B in the LTM, representing 28.9% of its revenue then. It is a massive improvement from FY2019, when the company spent an equivalent of 35.6% of its revenue. However, given the potential normalization in revenue growth, we may expect the ratio to jump from FY2023 onwards, thereby impacting its net income generation then.

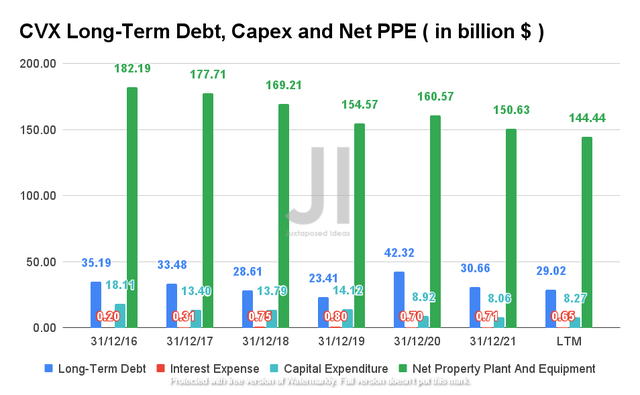

CVX Long-Term Debt, Capex, and Net PPE

It is evident that CVX had been gradually reducing its reliance on debt in the past year, though it is unfortunate that its interest servicing expenses continued to rise over the years. Therefore, it is not surprising that the Fed’s recent hike in interest rates had spooked Mr. Market, triggering a notable plunge for most energy stocks, given the potentially reduced global demand moving forward.

Though CVX had been rather prudent in its capital expenditure in the past two years, we may expect the company to spend up to $17B in FY2022, in order to expand its production capacity moving forward. These are mostly attributed to the Permian production, Bunge JV, and Renewable Energy Group acquisition. However, we are not concerned given the company’s robust net income and FCF profitability, combined with its growing cash and equivalents in the LTM. Nonetheless, assuming that CVX returns to its pre-pandemic Capex from FY2023 onwards, we may expect to see its FCF margin fall accordingly.

Normalization Of Energy Demand Will Happen By FY2024

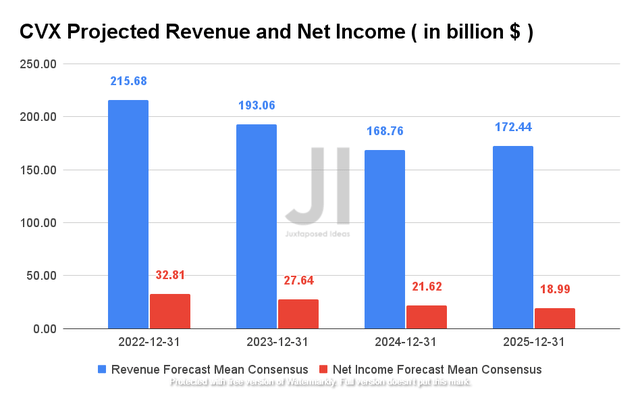

CVX Projected Revenue and Net Income

CVX is expected to report an apparent deceleration of revenue and net income growth at a CAGR of -7.19% and -16.66%, respectively, once the insatiable demand for oil and gas normalizes over the next three years. For FY2022, consensus estimates that the company will report massive revenues of $215.68B and a net income of $32.81B, representing a tremendous increase of 38.6% and 210% YoY.

We will be anticipating CVX’s FQ2’22 earnings call given the consensus revenue estimates of $54B, representing inline sequentially and an increase of 43.6% YoY (total revenue), with an EPS of $4.76. In spite of this, given the management’s guidance for a temporary planned decrease in production for FQ2’22, we might expect the company to report another missed quarter, similar to the one in FQ1’22. Nonetheless, its stock price would also likely hold steady, as it did in FQ1’22. We shall see.

CVX Is An Excellent Dividend Stock For Long-Term Hold

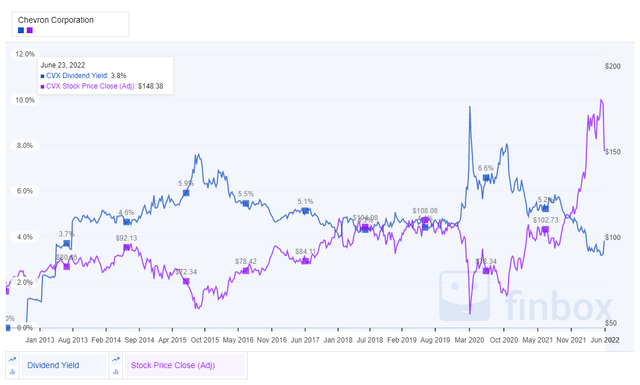

CVX 10Y Share Price (adj) and Dividend Yield

CVX has had a discernible long-term stock price uptrend over the last ten years, discounting the brief dip during the heights of the COVID-19 pandemic in 2020. The stock had also maintained a relatively stable dividend yield of 3.73% over the same period of time. The fact that the company increased its payout by 8.4% during the pandemic highlighted the fact it is a serious dividend stock for a long-term hold. In addition, CVX’s current dividend yield places it comfortably amongst the leaders in the energy sector.

Therefore, CVX remains a solid stock for long-term investors looking for consistent growth, steady dividend payouts, and regular share buyback programs (now for up to $10B), similar to Exxon Mobil Corporation (XOM) which we recently covered as well.

So, Is CVX Stock A Buy, Sell, Or Hold?

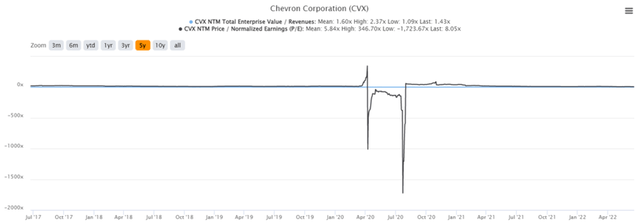

CVX 5Y EV/Revenue and P/E Valuations

CVX is currently trading at an EV/NTM Revenue of 1.43x and NTM P/E of 8.05x, lower than its 5Y EV/Revenue mean of 1.6x though slightly elevated from its 5Y P/E mean of 5.84x. The stock is also trading at $147.87, down 18.9% from its 52-week high of $182.40, though at a premium of 59.2% from its 52-week low of $92.86.

CVX 5Y Stock Price

Long-term CVX investors would be encouraged to know that the stock had a 5Y stock price return of 75.8% and a 10Y return of 122.6%. Therefore, it is apparent that the stock is one of the leading energy stocks to own in the market, given its stellar performance. However, given the clearly elevated trading valuations, we do not advise adding here, despite the recent correction since 8 June 2022.

We reckon that it would be a rough ride ahead as Mr. Market continues to worry about the potential recession. However, we do not anticipate a drastic retracement, given the stock’s apparent uptrend over the last few decades and the obvious need for oil and gas for this and the coming century.

For the long investors, we advise you to hold on and ride the volatility wave in the short term as it is temporal at best. As for those looking for quick gains, you may choose to cash out some of your holdings and come back in during the dips.

Therefore, we rate CVX stock as a Hold for now.

Be the first to comment