Alexis Gonzalez/E+ via Getty Images

Overview

Chile is a stand-out country in Latam and other emerging market economies because of the relative quality and stability of its banks. NPLs are low relative to other regional and emerging market peers, and Chile’s economy is also relatively open to the rest of the world. Banco de Chile (NYSE:BCH) is the leading bank in the country and is one of the simplest ways to gain exposure to Chile’s economy. I am continuing to monitor Banco de Chile as a way to gain exposure to Chile, and will particularly be monitoring political developments and the bank’s asset quality during Q2-Q4 2022.

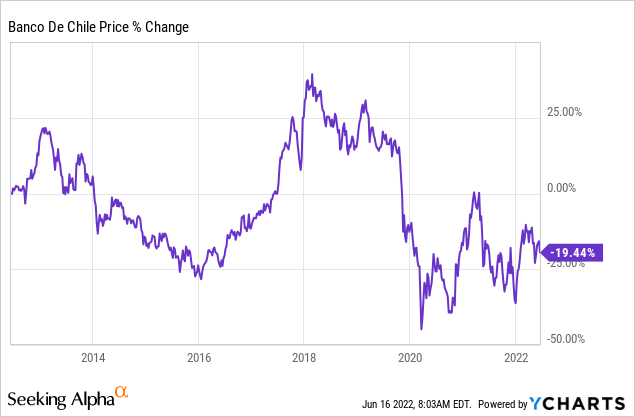

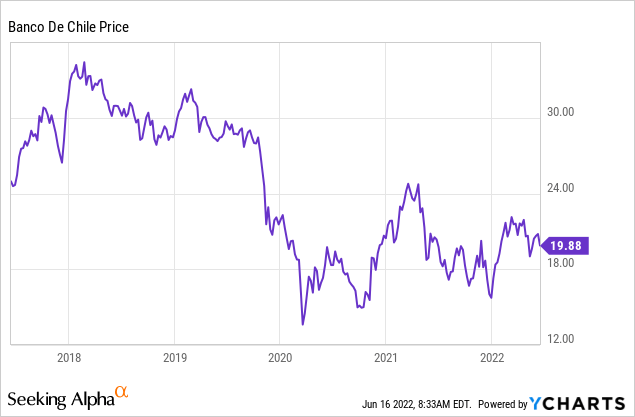

Banco de Chile has already bounced back to its 2016 lows and may pull back further if conditions in various emerging markets continue to deteriorate.

FDI and Commodities

Chile’s economic growth largely hinges upon copper (its top export) and China is one of its top export destinations. Unfortunately, this current cycle is less appealing, relative to 2011-2012, as global growth is declining and commodity price movements are being driven by supply issues. Global growth projections, as well as growth projections for Asia, have been continuously declining. However, the price of copper has nearly doubled from the lows of Q1 2020.

|

Region |

% of Exports |

|

China |

37% |

|

Rest of Asia |

20% |

|

US |

14% |

|

EU |

13% |

|

Latam |

13% |

Source: OEC/BCH

Copper is Chile’s main export (52% of total exports), and it is heavily dependent on exporting to China and other countries in Asia. China’s copper consumption has nearly doubled since 2009 but has experienced setbacks in growth since 2020.

Chile has free trade agreements with multiple countries, equivalent to 85% of GDP. FDI has also recovered slightly from the 2017 lows and has been targeting other industries outside of mining, including financial services (23%) and electricity/gas/water (13%). However, this figure was more than double these levels during previous commodity booms, when FDI as a % of GDP exceeded 10%. Additional political clarity by the end of 2022 is necessary to restore investor confidence and potentially bring FDI back to these historic levels.

Economic Outlook

Chile’s economy has been facing a variety of new challenges since 2019, and multiple economic indicators are approaching multi-decade highs.

Rising Unemployment and Inflation Exacerbate Political Risk

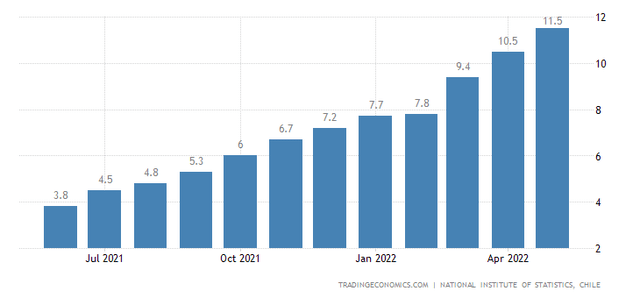

Chile’s inflation rate has been increasing substantially since the beginning of 2022. Chile’s annual inflation rate recently rose even further to 11.5% in May 2022, compared to only 10.5% in the previous month.

Local prices in Chile are sensitive to global inflation, as 60% of Chile’s CPI basket is composed of tradable goods.

Chile’s Unemployment Rate

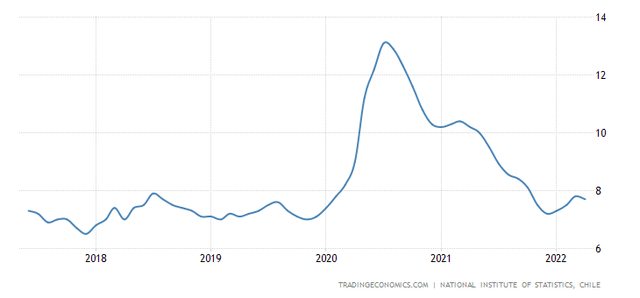

However, unemployment in Chile peaked in 2020 and has since recovered somewhat. Chile’s unemployment rate fell to 7.7% in April 2022, compared to 10.2% in the same period last year. Most notably, youth unemployment in Chile is on the rise and has been on an uptrend since 2016. Youth unemployment rose all the way to 19.1% during January 2020, which was not far from its record high of 26.61% in 2009. The youth unemployment rate has also historically exceeded the national average unemployment rate.

The risk of political protests, similar to 2019, is rising, especially as the population will be voting for a new constitution this September. Higher inflation and unemployment could exacerbate these risks.

Growth Outlook: Chile’s Finance Ministry recently lowered its growth target for 2022 to 1-2%, compared to its previous target of 2-3%. The Central bank also increased its inflation target to 10.8% for this year, lower than its initial target of 8.2%. Since growth targets have been adjusted downward in recent months, it would not be surprising to see Chile begin to experience negative economic growth coupled with continued inflation. Chile previously had one of the strongest global economic recoveries in 2021, as its economy grew by over 11%.

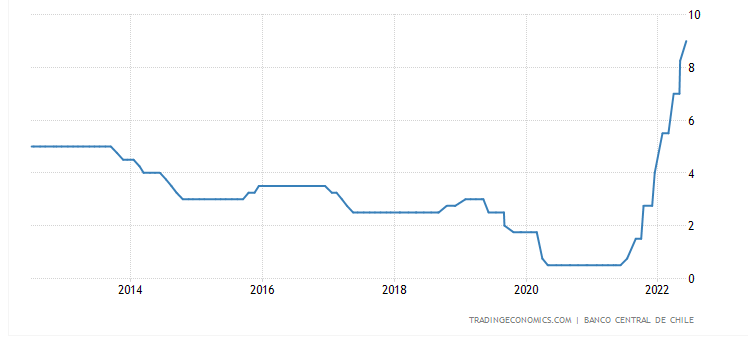

Rising Rates: Chile’s benchmark interest rate recently rose by 75bps to 9% this June. There may be room for additional rate hikes if inflation rises above 10%. This is relatively new territory for banks, as rates have been below 4% for the better part of the past 10 years.

Trading Economics

Banking Asset Quality Health: As of April 2022, Chile’s NPLs stood at 1.4%, well below its 2009 high of 3.3%. I am monitoring this closely this year, as Chile’s household debt levels are well above regional peers, and a lot of banks are heavily exposed to retail. However, Chile’s foundation is certainly more solid, and Chile is one of the few emerging markets where I would be willing to invest in a bank.

Banks in Chile

Banks in Chile have bounced back following Covid, and have so far maintained low NPLs and attractive profitability. The average ROAE of Chile’s banking sector was 15.5% last year. The ROAE dropped to 11.2% during 2020 as a result of Covid and later rebounded to 16% during Q1 2021. Credit growth will inevitably decline during the next 1-2 years, and banks will have to be sensitive to the increased risk profile of retail customers. Most of the population is banked, but there is still room for banks to grow by targeting SMEs or offering retail clients new products such as credit cards. The number of people in Chile with a bank account rose from 42.2% of the population in 2011 to around 82% of the population in 2021. Most individuals have debit cards, and around 14 million individuals in Chile have credit cards.

BCH

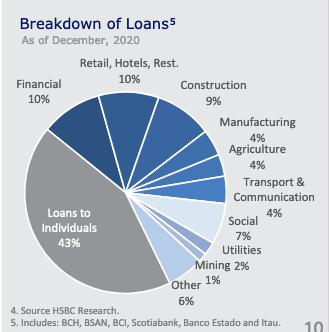

SMEs only receive around 20% of the total commercial loans in the country, while retail customers account for around 43% of total loans. A large % of the banking sector loans include loans to individuals for mortgages. SME-focused strategies may help banks succeed in capturing additional growth this decade.

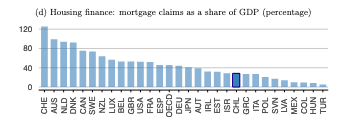

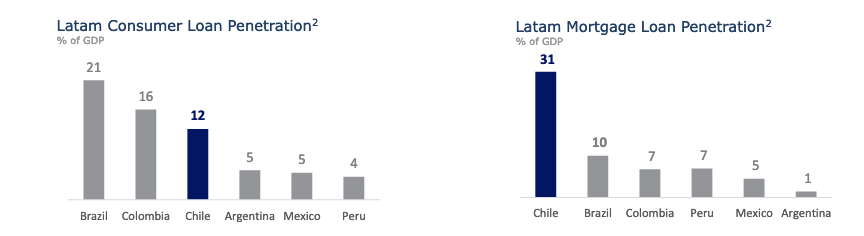

Chile’s mortgage loan penetration ratio is extremely high relative to its peers.

Housing Policy Tool Kit

Although mortgage claims relative to GDP may be attractive by global standards, they are still high relative to other countries in Latin America. Greater long-term growth opportunities may lie within consumer and SME loans, especially since Chile’s consumer loan penetration is lower than regional peers such as Colombia and Brazil.

BCH

Household Debt

|

Country |

Household Debt/GDP |

|

Argentina |

7% |

|

Brazil |

36.6% |

|

Chile |

44.7% |

|

Colombia |

32.4% |

|

Mexico |

16.4% |

|

India |

34.7% |

|

Indonesia |

17.2% |

|

Malaysia |

73.6% |

|

Thailand |

90.2% |

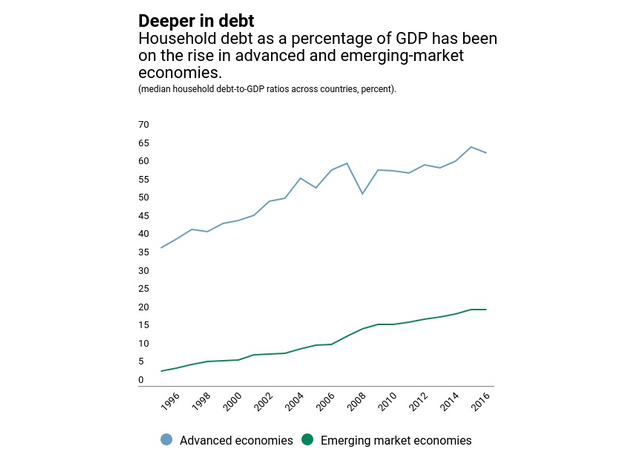

The CMF indebtedness report noted that as of June 2020 16% of debtors had a high financial burden, as defined by over half of their monthly income. Meanwhile, 23.4% had a debt payment that exceeded 40% of their income. Notably, the 35-40 age group, primary home buyers, had the strongest debt burden. These trends could likely accelerate in the coming years due to rising interest rates and slower economic growth.

This has been a rising trend in not only emerging market economies but also developed economies.

IMF

Banco de Chile

Banco de Chile is one of the largest publicly listed companies in Chile and has a very strong presence in Chile. It is ranked 1st in terms of net income, 2nd in terms of total loans, and 1st in terms of assets under management. I think the bank is approaching a bottoming out phase, similar to what occurred during 2015-2016 before commodities took off. As macroeconomic conditions become riskier, I am focusing on Banco de Chile, relative to other smaller banks in Chile.

|

Loan Market Share |

17% |

|

Demand Deposits Market Share |

21% |

|

Customers |

2 million |

|

AUM |

$17.7 billion |

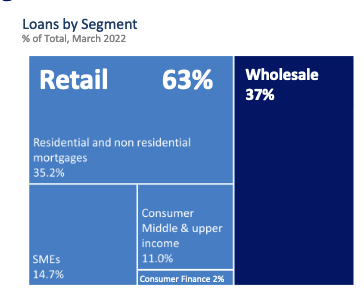

Banco de Chile has a comparatively stronger focus on retail loans, most notably residential and non-residential mortgages. This is a slight area of concern, given that household debt in Chile has been rising. However, Banco de Chile has ample room to focus on SMEs and consumers, as it continues to expand its digital offerings to consumers. SMEs represent around 80% of Chile’s total employment, and will therefore be a key driver of growth.

BCH

Banco de Chile recently launched a Fogape Reactiva Program, which helped to attract 28,000 SMEs. Notably, Banco de Chile now has an additional $10 billion in credit facilities (FCIC) to help support SMEs.

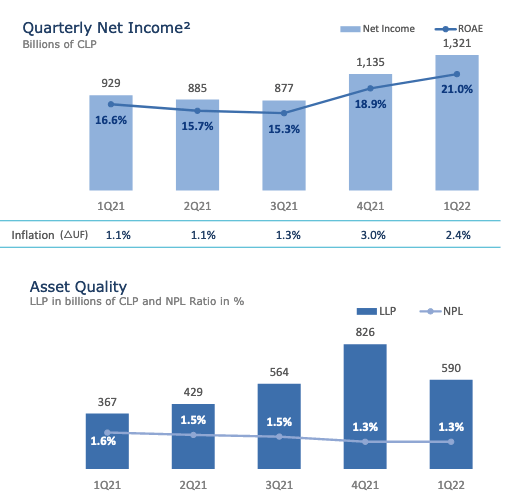

Banco Chile’s ROAE rose from 16.6% in Q1 2021 to 21.0% in Q1 2022. The bank has also been able to keep its NPLs well below 2% and has not experienced a noticeable rise in NPLs due to the higher interest rate environment. I will continue to monitor NPLs in the coming quarters, although NPLs would still be attractive relative to EM peers if they doubled from the current levels. Banco de Chile’s NPLs were slightly below the sector average of 1.4%.

BCH

Banco de Chile appears positioned to exploit interest rate movements to improve profitability while keeping NPLs under control. I am planning to wait for two more quarterly earnings reports before making a significant investment, but the initial trends are favorable.

Growth in different areas: Banco de Chile experienced rapid growth in all of its segments. The total number of accounts at the bank rose considerably for personal banking (7.9%), SME banking (6.1%), and wholesale banking (10.0%) during Q1 2022. 50% of people who received a consumer loan applied through a digital channel. The bank’s new payment solutions company, Getnet, has particularly been well received among SMEs, who accounted for 90% of its customer base as of last quarter.

Risks Moving Forward

Rising household debt: Chile’s relatively higher level of household debt is a key area of concern, especially since banks like Banco de Chile rely heavily on retail consumers/real estate mortgages. During Banco de Chile’s last earnings call, management noted that it expected a slowdown in mortgage loan growth as interest rates continue to rise. Consumers are beginning to deal with historically high inflation levels and rising interest rates, which could further exacerbate this issue and result in higher NPLs. This is one of the main reasons why I currently have a hold rating on Banco de Chile.

Economy: Even though copper is in a bull market, Chile’s economic growth is still relatively slow and is heading towards negative growth. The 2011-2013 bull run scenario is therefore not relevant in this case, as it is not being driven by rapid economic growth from China and other emerging markets. While Chile’s public debt is well contained at around 33% of GDP, other emerging markets are struggling with sovereign debt, and could potentially default. This could result in negative sentiment for all emerging markets, which would be bearish for Chilean equities. Banco de Chile’s loan growth was 11% last year, but this will be hard to replicate in 2022-2023 due to the higher base of 2021. As the economy comes under pressure and political risks rise leading up to September, increased tensions could result in tensions similar to 2019, which had a negative impact on the equities market.

Higher rates are new: Interest rates in Chile have already risen above the rates seen during 2008. Banks and consumers have adjusted to rates being below 4% since 2016, and rates are beginning to rise at a very inconvenient time. Banco de Chile has fared well so far but may experience an uptick in NPLs during subsequent quarters as rates continue to rise and Chile’s economic growth rate declines.

Chile’s banking industry still has a pretty solid foundation, and Banco de Chile is likely the best option to gain exposure to Chile. I may begin accumulating during Q4 2022 unless there is a significant pullback (below $15/share) due to general market turmoil. I think it is appropriate to accumulate near the lows experienced after the political protests of 2019/Covid, as the risk/reward profile is not very attractive at the moment.

Be the first to comment