imaginima

(Note: This article was in the newsletter on August 29, 2022, and has been updated as needed.)

Every now and then one sees execution as though management read a book on the subject and then tried to go straight from that book to actual implementation. No experience needed. Chesapeake Energy Corporation (NASDAQ:CHK) management recently announced that they will focus on basically natural gas basins while much of the industry is moving towards diversification.

The last few years, since the better days of the years ending around 2015, have been a real challenge. Natural gas has had the worst of the challenges because the growth of the unconventional business caused a long price downturn (from a persistent oversupply of natural gas) that hurt the industry for years.

The current management is betting that normal industry cyclicality will return to the natural gas industry. Therefore, management wants to focus upon the natural gas area while getting rid of anything not natural gas. In fact, management appears to be emphasizing dry natural gas.

The problem with this emphasis is that the United States generally is not the low-cost natural gas producer. The Canadian competitors have a natural advantage because the Canadian dollar is usually weaker than the United States dollar. Therefore, the Canadian companies can produce with Canadian dollar costs while using available takeaway capacity to receive revenue that is attached to the United States dollar.

The other issue is management needs to state that they will be a low-cost leader along with exactly how the company will get there. Specialists, which in this case is a natural gas focus, generally need a competitive advantage. That competitive advantage can be geology of the leases, or operating superiority, or sometimes vertical diversification (for example). Here there just seems to be a migration towards a goal without “filling in the blanks” for shareholders. When that happens, the risk of a strategy backfire tends to rise in the long term.

As is typical of any cyclical industry, the latest outlook for natural gas appears to be bright. But, then again, cyclical downturns rarely advertise themselves well in advance. This last industry downturn that just ended a few years back saw all kinds of opinions all the way down about how the industry turnaround was “just around the corner.”

Therefore, the announcement about selling the Eagle Ford properties appears to be ditching some safety at a time when management should be looking to minimize a second future bankruptcy filing. One thing that characterizes this industry is that financial ratios are conservative until they are not in a cyclical downturn. Similarly, the profit outlook of any one line of commodities can rapidly change.

What should have happened instead, was an emphasis on cost reduction and efficiency improvement. Chesapeake Energy is large enough that diversification should be a necessary strategy consideration along with leadership in all the areas in which the company operates.

Management Cost Discussion

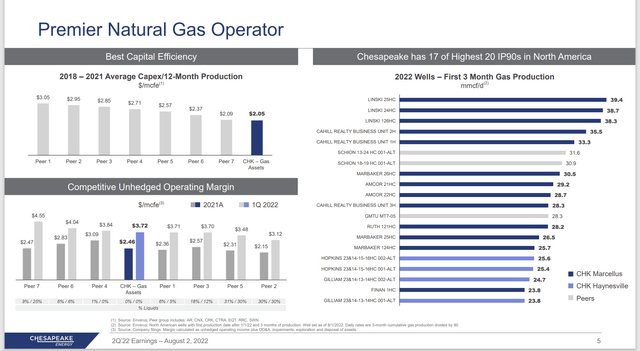

The latest management shareholder presentation has some vague details about costs. The problem with that is a lack of specifics usually signifies operational challenges and possibly a lack of will to tackle cost issues. Managements that are specific and blunt about their objectives generally will resolve profitability issues.

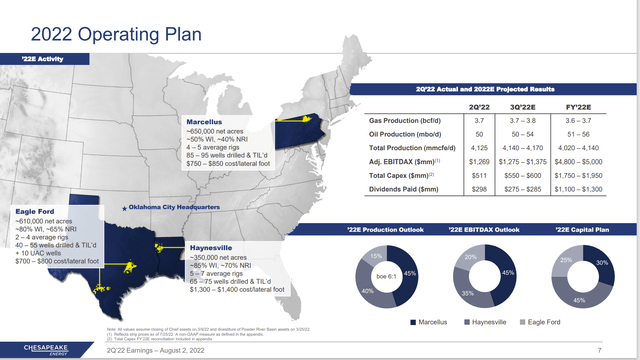

Chesapeake Energy Map Of Operating Basins With Corresponding Drilling Costs (Chesapeake Energy Second Quarter 2022, Conference Call Slides)

Some of the costs that management does show are actually among the highest costs of the companies I follow. All three of the drilling costs per foot are sky high compared to many competitors these days. High drilling costs can be made up either through some kind of production mix advantage or a cost advantage elsewhere. But the slide above does not show any offsetting costs to bring overall costs “in line.” That can signal trouble during the next inevitable industry downturn.

Chesapeake Energy Capital Costs Per Well. (Chesapeake Energy Second Quarter 2022, Earnings Conference Call Slides)

Similarly, with the emphasis shown above to the right on natural gas production, the corresponding costs to the left appear to be pretty high. Several of the comparisons are known rich gas producers. Those producers will have a higher revenue value of production to justify higher costs. This company appears to be focusing the future on dryer gas. Then, the costs need to be rock-bottom to assure long-term survival. The scary part of this for shareholders is that management may be heading back to ways in the “good old days” that really were not so good.

Similarly, the earnings press release avoids a discussion of costs that used to be routine before the bankruptcy filing. Management does discuss the debt ratio. But the key discussion of the debt ratio needs to be that it is conservative at specific lower prices so that the company is ready for the next downturn. This discussion has been completely omitted from the latest quarterly earnings material.

Comparison To EQT

EQT Corporation (EQT) management will discuss in depth all the competitive costs that investors need to know. Management further discusses upcoming challenges and necessary improvements that leave little to the imagination. This is a management that does not hesitate to call things as they see it. That includes mistakes made. This type of management will get investors industry-leading costs and profitability even if it takes time to get there.

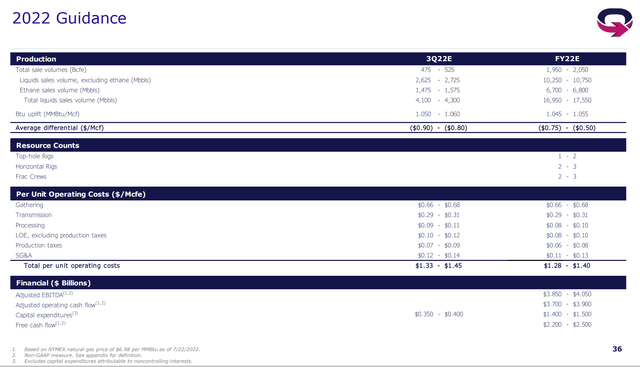

EQT Operating Cost Guidance And Capital Budget Guidance Fiscal Year 2022. (EQT Second Quarter 2022, Earnings Presentation Slides)

This is the kind of detail that an industry cost leader provides. It is also the kind of detail that was lacking from the second quarter Chesapeake management presentation. Clearly, EQT likely has lower costs than Chesapeake Energy. That can be a real issue when the next inevitable cyclical downturn occurs.

Generally, managements that disclose more will resolve more issues. Managements that do not disclose similarly seem to allow challenges to “pile-up.” Before the bankruptcy filing, Chesapeake management had a pretty long list of challenges. Now the remaining challenges are not discussed.

A lack of disclosure is one of the things that can materially increase the risk of an investment because it makes quite a challenge for an investor to come up with an investment strategy when key information is lacking.

Competitors like EQT and Antero Resources (AR) also discuss prices received relative to a benchmark as well as before and after hedging. Here, you do not see a single discussion about relative pricing and pricing challenges. The Marcellus, in particular is known for some poor pricing of production for a number of reasons. Therefore, having the transportation necessary to get the natural gas to a stronger pricing market is essential.

Summary

Management appears to be mechanically executing a well-trod execution strategy of focusing on two well-known natural gas producing basins. But that same Chesapeake management is not giving shareholders enough revenue and cost information to evaluate the strategy. The lack of information could result in a long-term drop in profitability if the non-core asset sales are extremely profitable.

The two basins in which the company will operate do have some superior geology that should lead to decent profitability. The problem is that good enough management often is not good enough in a downturn. Generally, the long-term survivors of the industry are very detailed oriented and hard-driving managers. Average margins tend to be so low that every last opportunity needs to be taken advantage of. Here that kind of indication that management is aware of these needs is lacking.

In this case, the Eagle Ford leases are likely to be the most profitable leases in the portfolio. They would also provide some badly needed diversification away from dry gas production. Chesapeake Energy company is a large enough company where some diversification would make sense.

The lack of a lot of routine numbers that many competitors provide should raise questions in the mind of any potential investor. Managements that disclose often resolve problems. Managements that do not disclose often have unpleasant surprises in the future. Nondisclosure also raises the risk of the investment in ways that ratings companies do not measure. Right now, this management feels like it is making adequate disclosure. Time will tell if this serves investors well.

For the reasons discussed, an investment in Chesapeake common remains a very speculative venture that is probably best avoided by any but the most knowledgeable investors. The previous bankruptcy filing alone raises the investment risk considerably. The non-disclosure of a lot of standard information disclosed by many competitors raises the investment risk a lot more. There are far easier ways to profit from the natural gas industry without running the risk of an unpleasant surprise in the future.

Be the first to comment